A version of this article was originally published in Mint Genie. Click here to read it.

We carefully select good funds and build a portfolio around them. But sometimes, some of these funds end up underperforming the benchmark.

And this underperformance worries us every time we check our portfolio.

But should we be really worried?

Before we attempt to answer this, here is a quick question…

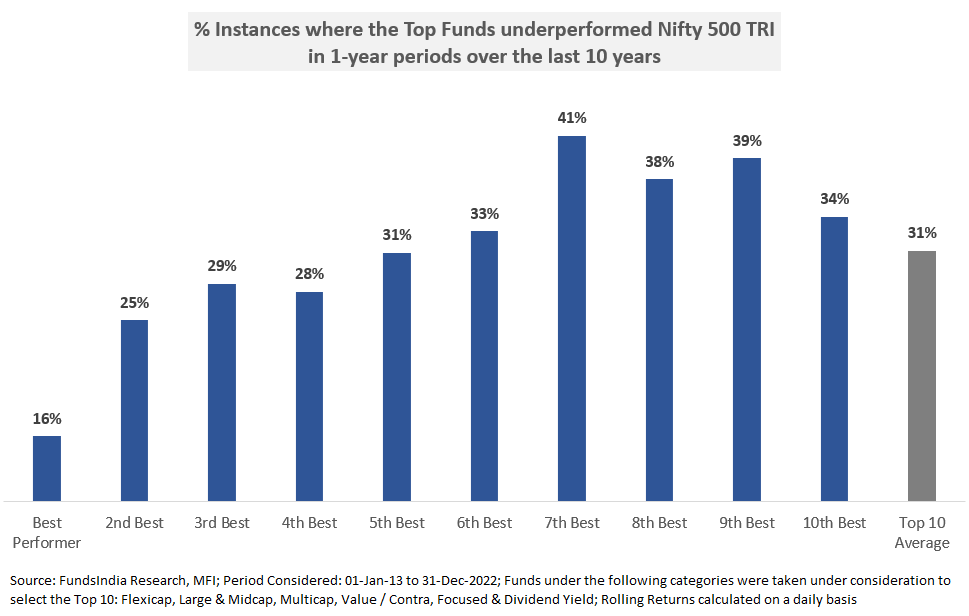

There are two equity fund portfolios of Rs 10 lakhs each as on 01-Jan-2013. Here is how they have performed in the next ten years…

Portfolio A: Gave returns lower than the benchmark in 31% of 1-year periods

Portfolio B: Gave Rs 18 lakhs more than the benchmark over the decade

Which of the two would you prefer?

If you are like the rest of us, you would have picked Portfolio B.

Clearly none of us would want to miss out on an extra Rs 18 lakhs!

And as you might have expected, Portfolio B comprises the best performers. To be more precise, this portfolio includes the top 10 funds with the highest returns between 01-Jan-2013 and 31-Dec-2022.

But here is something you might not have expected…

Both Portfolios A and B are the same!

Yes, the ten best performers of the last decade (which delivered an average outperformance of 180% versus the benchmark Nifty 500 TRI) also underperformed in 31% of 1-year instances.

Surely, this must have been an anomaly specific to the last 10 years?

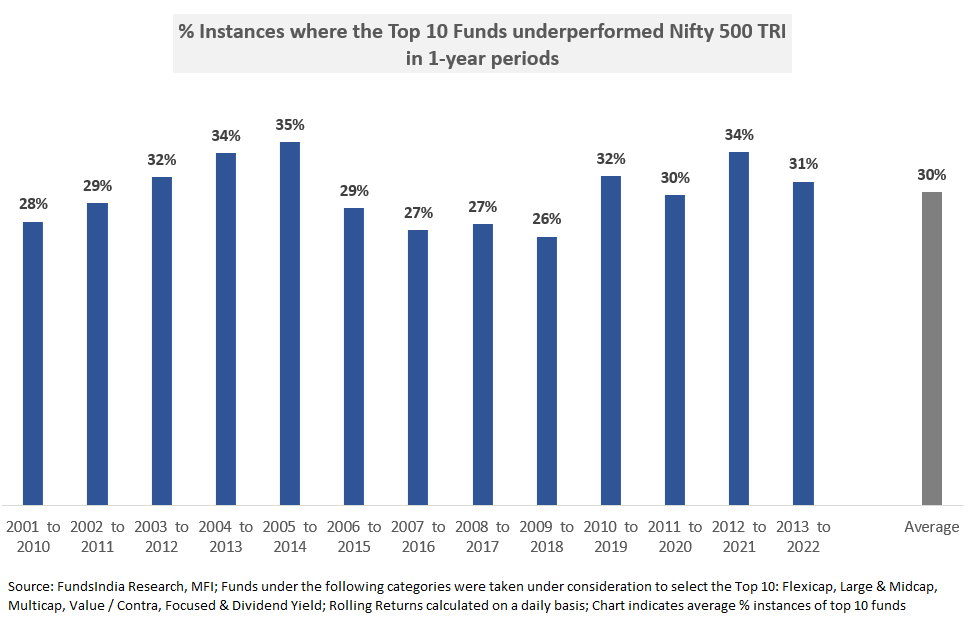

To understand whether the above underperformance was a one-off, let’s check the 1-year consistency of the long-term best performers across different periods.

The results are as below,

- The top 10 funds show significant short-term underperformance across different 10-year timeframes.

- On average, the top funds underperformed in roughly 30% of all 1-year periods.

This makes it pretty clear that the short-term underperformance of the best performers is no anomaly.

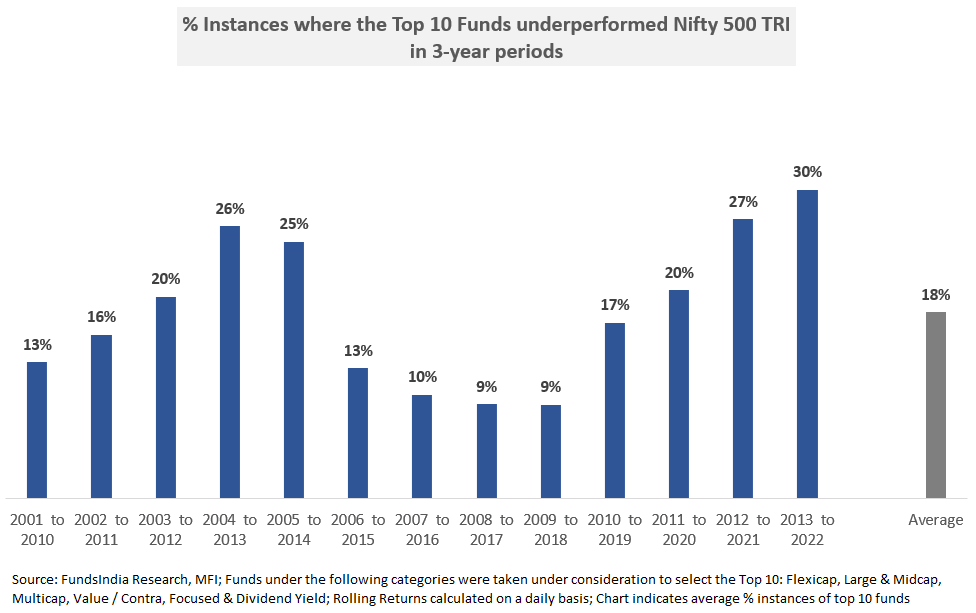

Do these results improve when the short-term threshold is increased to 3 years?

Let us find out!

While there is some improvement, the long-term top performers still continue to show meaningful underperformance in the short-term.

The best performing funds have underperformed Nifty 500 TRI in 18% of all 3 year periods on average.

But why does this happen?

As we had previously discussed (here and here), the performance of equity funds goes through cycles. A phase of good returns will likely be followed by a phase of subpar returns and the same repeats.

The ‘performance-shifts’ occur due to rotation in Investment Styles (Quality, Growth, Value etc), Market Cap Segments (Large, Mid Cap & Small Cap), Sectors and Geographies / Countries.

When cycles change, almost all equity funds go through phases of short-term underperformance.

So what should we do?

Investing is easy, but staying invested is not.

No investment strategy works all the time. Even the best of funds that outperform in the long term generally underperform in the short-term.

The key to long-term investment success is to include this as part of our base expectations and to diversify our equity fund investments (across styles, market caps, sectors, regions).

Getting these two right will help us remain invested for the long term! 🙂