We read in our earlier blog here that it’s best to set a SIP date within 2-3 days of your salary credit. This makes it simple, and automatic and ensures you save first before you spend.

But won’t it be smarter to manually decide your SIP date of investment every month based on how the market conditions are?

Would this improve your Equity SIP returns?

Let’s find out…

Putting manual SIP investing to the test

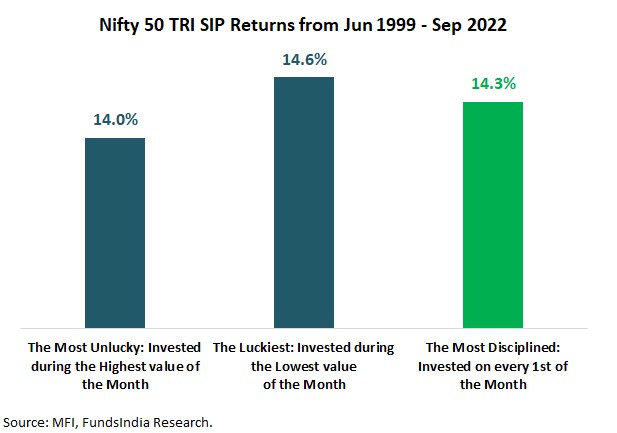

We checked for Equity SIP returns in Nifty 50 TRI (since Jun-99).

If you had manually selected and invested on the best dates every month (read as the day with the lowest index value every month) then your SIP returns (% XIRR) were 14.6%.

If you had manually selected and invested on the worst dates every month (read as the day with the highest index value every month) then your SIP returns (% XIRR) were 14.0%.

As we can see the returns are almost similar with no major difference.

Now, let’s see what the returns would have been had you set a date (in this case 1st of every month) and let it invest automatically every month on the same date.

The SIP returns (% XIRR) were 14.3%. Yet again we see the returns are almost similar.

What did we find?

- Even if you get the timing right each and every month (which is next to impossible), over long time frames you still end up with returns almost similar to a simple SIP return.

- There is no significant advantage to manually trying to time your monthly Equity SIPs.

How to use this Insight?

- There is no advantage gained by timing your SIPs. The returns over long time frames are almost similar even if you invest on the best days or worst days.

- When you manually time your SIP every month, you make more decisions, increasing the chances of behavioral errors.

- Also, you may keep pushing off investing if there is some big expense or a major change in the market conditions.

- So, to help you stay consistent and disciplined with investing, it is best to automate your SIP such that it invests every month on the same date.