In a recent movie, there is an interesting sequence involving a little kid.

The kid plants a mango seed and comes back the next day to see if it has grown. When there are no signs, the little one, now confused, digs up the seed and plants it back again.

He repeats the same thing the next day and every day after that…

Before you think this blog got taken over by some ardent movie buff, let me quickly come to the point.

If you had started your SIP in the last one or two years, odds are you are as confused as the boy.

A Rs.10,000 Monthly SIP started in a Nifty 50 index fund on 01-Jan-2022 would have been roughly Rs 1.26 lakhs by the end of the year. You would have invested Rs 1.2 lakhs in aggregate and made gains of Rs 6,000.

While the returns are not bad (XIRR of ~10%), the portfolio has hardly moved.

But if you were feeling you got the raw end of the deal, here comes the shocker – this has always been the case!

If we look at history, over 1-year periods, the portfolio value of a ten-thousand rupees monthly SIP made in Nifty 50 TRI has been Rs 1.3 lakhs on average.

The meagre gain of Rs. 10,000 doesn’t really give us any sort of comfort in terms of achieving our goals.

This brings us to the question…

Where is this ‘Magic of SIP’ that everyone keeps talking about?

In the initial years of your Equity SIP investment journey, the returns occasionally turn subpar (albeit temporarily) due to the three phases of temporary underperformance.

And even when the returns are good, the gains are mostly insignificant.

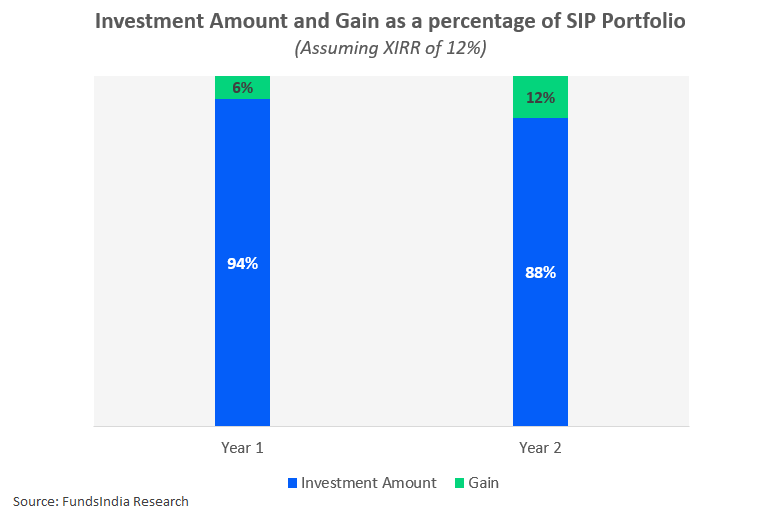

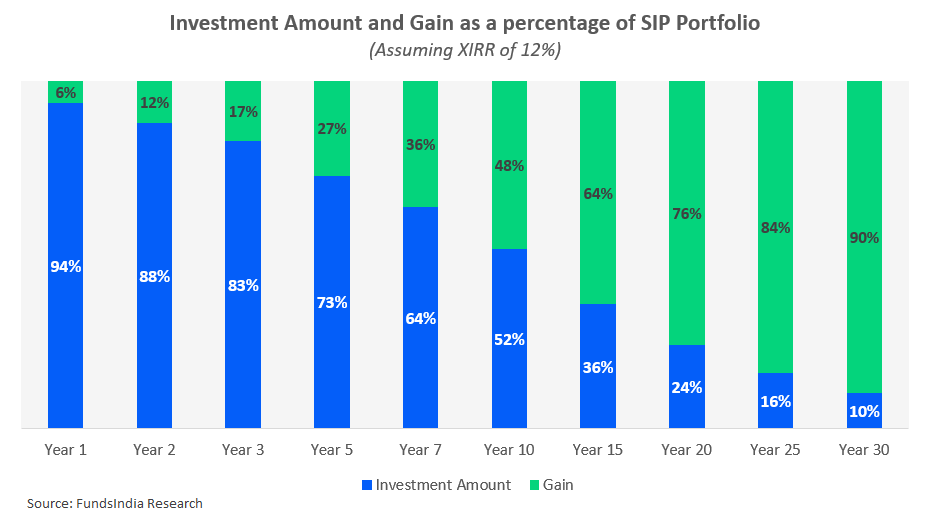

Assuming returns of 12%, at the end of the first year, the Equity SIP gains are just 6% of your portfolio. At the end of the second year, the gains are just 12% of your investment portfolio.

While these numbers are nothing exciting, something magical happens as you cross Year 5.

The compounding effect kicks in and by the end of the fifth year, the gains become one-fourth of your portfolio.

This percentage becomes 36% by the end of Year 7 and 48% by Year 10.

When you extend the time frames even further, the real magic happens!

The gains account for a whopping three-fourths of your portfolio for a 20-Year SIP and a massive 90% for a 30-Year SIP.

As you can clearly see, the magic lies in the long term!

Parting thoughts

In SIP investing, investing every month in a disciplined manner is just one-half of the equation.

Only when discipline meets time, magic happens!

PS: If you are wondering about the movie, it’s a Tamil movie titled Love Today 🙂