Company Overview:

Avalon Technologies Limited (“Avalon Technologies”) was incorporated on November 3, 1999. Avalon Technologies is one of the leading fully integrated Electronic Manufacturing Services (“EMS”) companies with end-to-end capabilities in delivering box build solutions in India, with a focus on high value precision engineered products. They provide a full stack product and solution suite, right from printed circuit board (“PCB”) design and assembly to the manufacture of complete electronic systems (“Box Build”), to certain global original equipment manufacturers (“OEMs”), including OEMs located in the United States, China, Netherlands, and Japan.

Objects of the Offer:

- Prepayment or repayment of all or a portion of certain outstanding borrowings availed by the company and one of its Material Subsidiaries, i.e., Avalon Technology and Services Private Limited.

- Funding the working capital requirements.

- To carry out the Offer for Sale of Equity Shares by the Selling Shareholders.

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

Investment Rationale:

- Unique Position: Avalon Technologies has a unique global delivery model, comprising design and manufacturing capabilities across both India and the United States. Avalon Technologies is the only Indian EMS company with full-fledged manufacturing facilities in the United States, which gives them a unique competitive advantage in the North American markets. The company has 12 manufacturing units located across the United States and India: one unit in Atlanta, Georgia, one unit in Fremont, California, seven units in Chennai, one unit in Kanchipuram and two units in Bengaluru. The electronics manufacturing services (EMS) market in India was valued at Rs.1.5 trillion (trn) in FY2022 and is expected to grow at a CAGR of 32.3% to reach a value of Rs.4.5 trn by FY2026. This will create a chance to drive the revenue growth of the company.

- High Entry Barriers: Avalon Technologies has built long term relationships with its clients and as of November 30, 2022, they had an average relationship of 8 years, with clients who accounted for 80% of their revenue. Their experience in offering EMS services across product and industry verticals for customers globally for several years serves as an entry barrier in the industry for any new entrants. Given the depth and nature of the engagement with longstanding customers, their customers would not find it easy to switchover to alternative EMS providers as the cost, time and effort for such transitions is high. Most of their customer engagements are with the long lifecycle industries such as power, railways, aerospace, medical, etc.

- Financial Track Record: The consolidated revenue from operations have increased at a CAGR of 14% between FY20-FY22 from Rs.642 crs in FY20 to Rs.841 crs in FY22. The PAT margin posted a strong growth of just 1.9% in FY20 to 8% in FY22. The company has a diversified revenue base with 20% of the overall revenue caters to clean energy, 27% to mobility, 30% to Industrial, 7% to communication and 8% each to Medical and others. Their order book (open order) has stood at Rs.1190 crs (1.4x of FY22 Revenue) as of November 30, 2022. Most of their open orders will be fulfilled within one year to 18 months.

Key Risks:

- OFS – The IPO is a mix of offer for sale (OFS) and Fresh issue with OFS being 63% of the overall issue size. In the offer for sale (OFS), existing promoters and shareholders will offload shares worth of Rs.545 crs. Promoter & Promoter group selling shareholders will offload shares worth Rs.329 crs and other selling shareholders will offload shares worth Rs.216 crs. The company will not receive the proceeds worth Rs.545 crs from the OFS part.

- Client concentration Risk – More than 50% of the revenue comes from Top 5 clients of the company. A loss of relationship with any of these customers can have a huge impact on the profitability of the business.

Outlook:

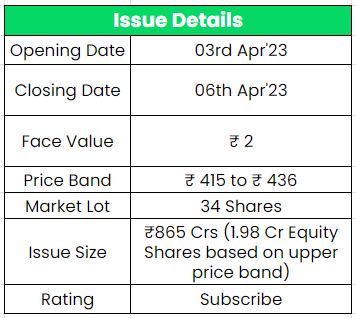

Avalon is one of the leading integrated electronic manufacturing services companies in India with well diversified business leading to strong growth. Its revenues and margins improved significantly in the last few years. The company’s listed peers according to the RHP are Dixon Technologies, Amber Enterprises, Kaynes Technology India, Syrma SGS Technology and Elin Electronics. Comparing to its peers, Avalon is a pure B2B player with the most diversified end user Industries and only Kaynes and Avalon have a 10%+ EBITDA Margin when compared to others. At higher price band, the listing market cap will be around ~Rs.2847 crs and Avalon Tech is demanding a P/E multiple of 42x based on FY22 EPS. While comparing with the Industry P/E of 76x, the company seems to be placed between undervalued to Fairly valued category. Based on the above views, we provide a ‘Subscribe’ rating for this IPO.

If you are new to FundsIndia, open your FREE investment account with us and enjoy lifelong research-backed investment guidance.