Clean Science & Technology Ltd. – Green Future Ahead

Clean Science & Technology (Clean Science) was launched in 2003 and is one of the few chemical companies to have developed novel technologies via the use of in-house catalytic processes. Indeed, some of the company’s approaches are firsts in the globe. Cleaner (fewer effluents) and more cost-effective procedures have helped the company to attain market leadership in each of the recent products it has introduced. The company’s success is based on its ability to maintain a continuous focus on product discovery, process innovation, catalyst development, large-scale operations (for each product), and backward integration, where necessary.

The company has 3 plants in Kurkumbh, Maharashtra with a total installed capacity of 44,000 MTPA and manufactures specialty chemicals such as MEHQ (Monomethyl ether of hydroquinone), guaiacol, 4-methoxy acetophenone (4-MAP) and BHA (Butylated hydroxyl anisole). The company has 500+ global and domestic customers across 30+ countries with over 70+ scientists and 4 R&D facilities.

Products & Services:

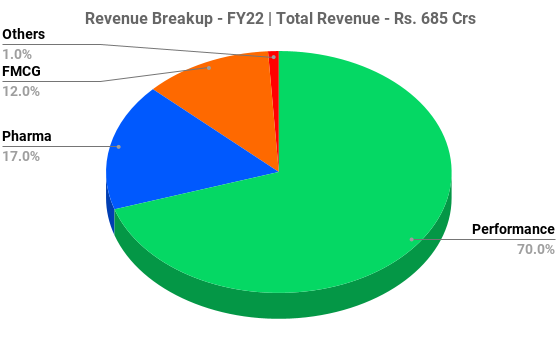

The company produces various products under three segments namely Performance chemicals, FMCG Chemicals and Pharmaceutical Intermediates.

Performance Chemicals – MEHQ, BHA and AP (Ascorbyl Palmitate) are the three major performance chemicals which caters to the end industries as a Polymerization inhibitor in acrylic acids, acrylic esters, Anti-oxidants, Infant food formulations, liquid detergents, etc.

FMCG Chemicals – Anisole and 4-MAP are the two major FMCG chemicals which caters to the end industries such as Cosmetics, pharmaceutical & agrochemicals, UV blocker in Sunscreens, etc.

Pharmaceutical Intermediaries – Guaiacol and DCC (Dicyclohexyl Carbodimide) are the two major pharmaceutical intermediates which caters to the end industries as a Pre-cursor to manufacture APIs for cough syrup, Raw material to produce Vanillin and Reagent in anti-retroviral.

Subsidiaries: As on March 31, 2022, the Company has four wholly owned subsidiaries.

Key Rationale:

- Largest Player – Clean Science is the largest producer of Monomethyl ether of hydroquinone (MEHQ), Butylated Hydroxy Anisole (BHA), and 4-Methoxy Acetophenone (4-MAP) globally. It is the number 1 player in the World as well as in India for the above products. Furthermore, it has backward integrated into producing Anisole, a key raw material, and has even become the largest producer of Anisole globally. Particularly, it is the largest manufacturer of MEHQ in the world, accounting for more than 50% of worldwide capacity. MEHQ is also used as an intermediate to manufacture BHA (Butylated Hydroxy Anisole), for which the company has already undertaken forward integration.

- Client Relationship – The company’s customers comprise direct end-use manufacturers as well as institutional distributors. A majority of revenues is generated from direct sales to customers. Certain key customers include Bayer AG and SRF for agro-chemical products, Gennex Laboratories for pharmaceutical intermediates, Vinati Organics for specialty monomer products and Nutriad International NV for animal nutrition. Some of customers have also been associated with the company for over 10 years. Its products are used as key starting level materials, as inhibitors, or additives by customers for their finished products, for sale in regulated markets. The customer engagements are therefore dependent on delivering quality products consistently. It could take potential customers a few years to approve as suppliers, based on quality control systems and product approvals across jurisdictions by multiple regulators.

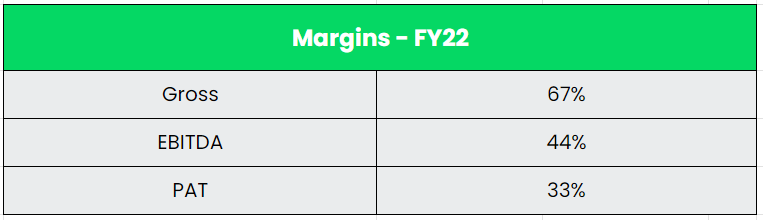

- Q3FY23 – The company’s Q3FY23 revenue grew 31% YoY at Rs.237 crs, EBIDTA grew 42% YoY at Rs.108 crs and PAT grew 45% YoY at Rs.84 crs. This was driven by the performance in chemicals segment wherein revenue grew 47.6% YoY to Rs.170 crs which benefited from 50% increase in capacity for MEHQ and BHA. Pharmaceutical intermediates revenue grew 9.1% YoY to Rs.40 crs and FMCG chemicals’ revenue grew 12.9% YoY. The company’s Gross margin improved 270 bps YoY and 470 bps QoQ to 67.2% in Q3FY23. Likewise the EBITDA Margin increased to 46% in Q3FY23 from 42% in Q3FY22.

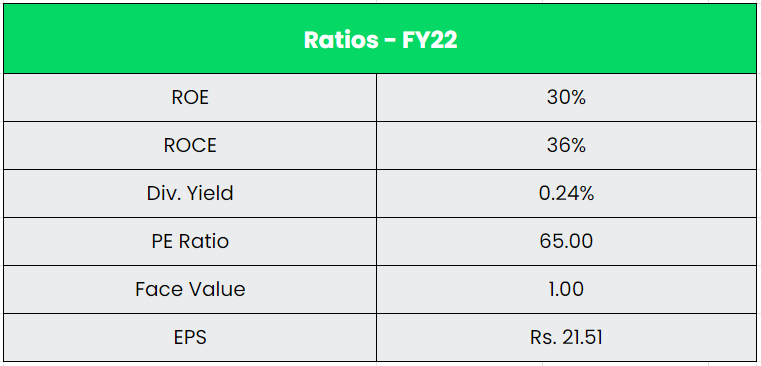

- Financial Performance – The company’s Revenue and PAT CAGR made a 30% and 47% growth between FY18-22. EBITDA Margin has been improved from 31% in FY18 to 44% in FY22. The company has a strong balance sheet with zero debt and a cash balance of ~Rs.280 crs at the end of Q3FY23. The Free Cash Flow (FCF) of the company has been positive from FY18 to FY21 with a cumulative amount of Rs.278 crs and FY22 had a negative FCF due to huge capex. The FCF CAGR between FY18-21 stands at a humongous 146%.

Industry:

Chemicals industry in India is highly diversified, covering more than 80,000 commercial products. The Indian chemicals industry stood at US$ 178 billion in 2019 and is expected to reach US$ 304 billion by 2025 registering a CAGR of 9.3%. The demand for chemicals is expected to expand by 9% per annum by 2025. The chemical industry is expected to contribute US$ 300 billion to India’s GDP by 2025. The specialty chemicals constitute 22% of the total chemicals and petrochemicals market in India and is expected to continue the impressive growth rate. Increasing demand from various end markets like construction, automotive, packaging, water treatment, home care, personal care, food processing, nutraceuticals and other demand-driven sectors will continue to drive growth. India exports just around ~3% of the global market for specialty chemicals and is expected to double its share of the global market to ~6% by 2026. Indian Specialty Chemicals market is valued at $33 Billion and is poised to reach $52 Billion by 2026 – registering an impressive of CAGR 9%. It accounts for the third-largest speciality market in the APAC region.

Growth Drivers:

- 100% FDI is allowed under the automatic route in the chemicals sector with few exceptions that include hazardous chemicals. Total FDI inflow in the chemicals (other than fertilisers) sector reached US$ 20.96 billion between April 2000 and December 2022.

- Growing disposable incomes and rapidly increasing urbanization are fuelling growth in various end user segments, which in turn is expected to improve domestic consumption outlook of the specialty chemicals industry.

- The Government of India is considering launching a production linked incentive (PLI) scheme in the chemical sector to boost domestic manufacturing and exports.

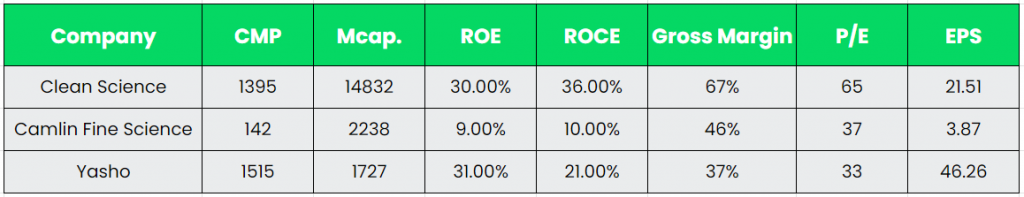

Competitors: Camlin Fine Sciences, Yasho Industries, etc.

Peer Analysis:

Camlin Fine Sciences and Yasho Industries are like-to-like peers of Clean Science, considering the product portfolio in the listed space. Margin profile of Clean Science is far superior than the other two companies and the incremental part is a function of higher gross margin as well as lower cost structure on account of efficiency related measures.

Outlook:

Clean Science is the world’s biggest manufacturer of five of the ten items it produces, making it a market leader. The company is adding incremental capacities in the Hindered Amine Light Stabilizer (HALS) series. It added its first line of HALS series (701 and 770) at Unit 3 (2ktpa). The rest of the capacities in the HALS series will be set up in the Unit 4 (10ktpa) under its wholly owned subsidiary Clean Fino-Chem Limited, which is expected to be fully commissioned by FY25. The total capex for the HALS series is Rs.300 crs in the subsidiary, with another Rs.200 crs for other new products. With this, Clean Science is the first company to develop HALS series in India. According to the Management, the revenue from HALS segment is expected to rise around Rs.700 crs by FY27-28, assuming a 10% market share of the 1 Bn USD global market for the whole range of products. Revenue from the already existing products is expected to be ~Rs.1200 crs in FY25, with increasing demand for its products being seen. The company also plans to expand its R&D team to ~100 scientists from ~75-80 scientists currently.

Valuation:

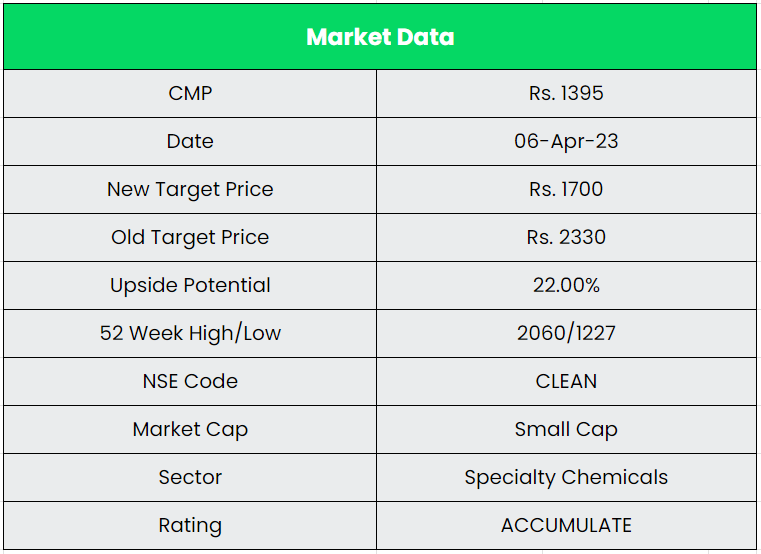

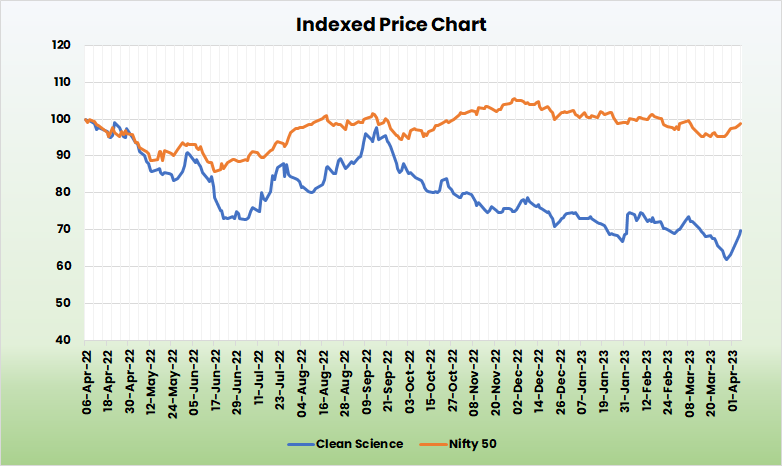

Clean Science is an integrated player for its key products and is likely to grow at a faster rate than the industry due to its cost advantage as well as introduction of new products. Hence, we recommend an ACCUMULATE rating in the stock with the target price (TP) of Rs.1700, 50x FY25E EPS.

Risks:

- Growth related Risk – MEHQ accounts for the major part of the revenue and is used as a polymerisation inhibitor in acrylic acids. Any decrease in end-user industry demand or an increase in competition might be detrimental to the business’s overall growth.

- Raw Material Risk – Prices of key raw materials, which are crude oil derivatives, tend to fluctuate constantly and thus, keep the operating margin under pressure.

- Competitive Risk – Historically, it generated a significant amount of revenue from a few numbers of markets, including China, India, Europe, and the Americas. Due to the scarcity of rivals in the same industry segment in China, any technical advancements there might reduce the growth prospects and have an adverse effect on corporate performance.