A version of this article was originally published in Live Mint. Click here to read it.

When equity markets fall, there is always a temptation to exit equities for the time being and enter back later at lower levels.

To be fair, intuitively it does make sense.

The thinking usually goes along the lines of..

There is some bad news (think covid, war, inflation, sub prime, bank crisis etc). The market has fallen due to the bad news. It looks like the news will only get worse from here. This should logically lead to a further fall in equity markets.

Going by the above intuition, why should someone stay invested in equities?

Isn’t it better to take out your money from equities and re-enter back when things start getting better. This way you can avoid the remaining fall and make a killing by entering back at the bottom levels.

This attempt is also fancily referred to as ’trying to time the markets’.

But at the same time, we also hear from the greatest investors such as Warren Buffet, Peter Lynch, Bejamin Graham, John Templeton, Jack Bogle etc that market timing is almost impossible to pull off on a consistent basis.

Where is the disconnect? What are we missing?

Welcome to the “5 Counter-Intuitive Patterns of a Bear Market”.

In every bear market (read as equity market fall > 20%), there are 5 counter-intuitive patterns that play out exactly opposite to what you would typically expect to happen. These unexpected patterns make it really hard to get back into the equity markets if you’ve already exited.

1. Counter-Intuitive Pattern 1: Equity market recoveries usually happen in the middle of bad news – much ahead of earnings/economic recovery

2. Counter-Intuitive Pattern 2: Market decline has several false upside rallies and the actual recovery also has several false declines

3. Counter-Intuitive Pattern 3: Recovery is usually extremely fast – the first few months capture most of the rally.

4. Counter-Intuitive Pattern 4: We get psychologically anchored to the bottom levels

5. Counter-Intuitive Pattern 5: Even experts can’t predict the market bottom

If interested you can read a detailed explanation of all the 5 counter-intuitive patterns here

Applying the 5 counter-intuitive patterns to the current US Bear Market

Now comes the interesting part. While all this is good in hindsight, what if we had the chance to apply all the above 5 lenses in real time and truly understand how this works.

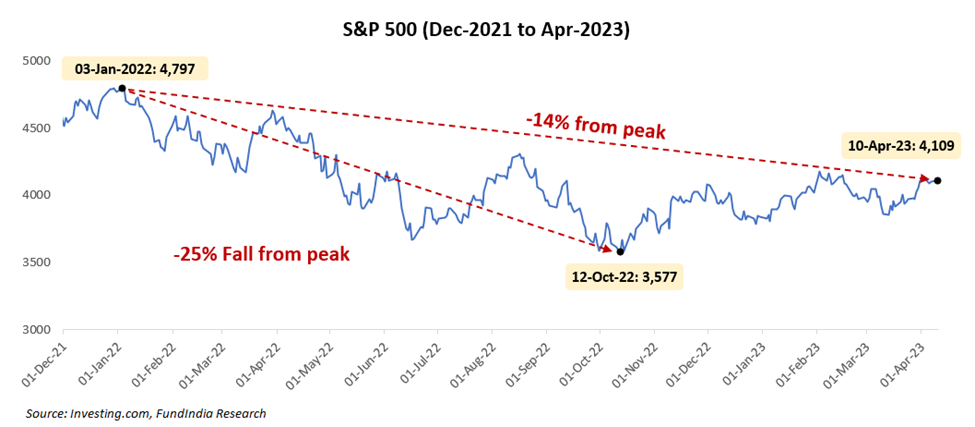

The US equity markets fell starting 03-Jan-2022 and entered a bear market (read as fell more than 20%). It was down over 25% by 12-Oct-2022. There has been some recovery post that and currently its down around 14%.

In a historically rare occurrence, the Indian markets haven’t had a similar fall and have largely remained flat.

While we have enough evidence of these 5 counter-intuitive patterns repeating from past bear markets, currently we have a unique opportunity to actually see how this plays out in real time (through US markets) sans the emotional pain that usually comes with it (as India is not impacted).

Now let’s assume you have taken out the money from US equity markets after a 20% fall and are looking to re-enter back again.

Here are the dilemmas you will actually go through and this will give you a good feeler of why it’s so difficult to try and time the entry back into equity markets

Counter-Intuitive Pattern 1: Equity market recoveries usually happen in the middle of bad news

Lot of Bad News..

- High US Inflation

- Fed Increasing Interest Rates

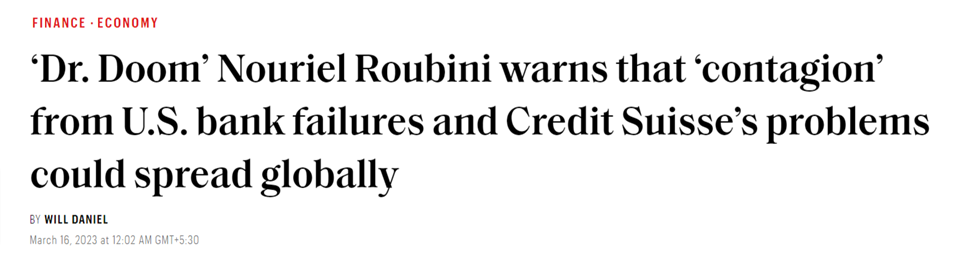

- Concerns of a Banking Crisis led by problems at US Regional Banks & Credit Suisse Bank

- High Possibility of US Recession

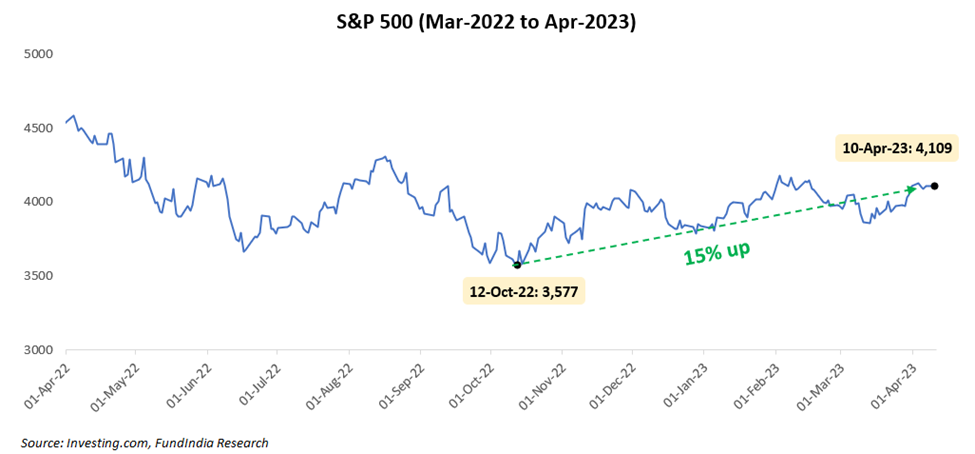

Now despite all the bad news, the US market is up 15% from its previous lows on 12-Oct-2022.

But we also know that market recoveries have historically happened in the middle of bad news. This happens because markets are forward looking and the recovery usually happens much ahead of the actual recovery in economy/earnings/news. All it requires is for the market sentiment to change from “things are really bad” to “things are bad”. This shift in sentiment unfortunately is only clear in hindsight and is too hard to predict in real time.

Historically equity market recoveries have happened 6-12 months ahead of the actual recovery.

Dilemma 1: Is this the real recovery in the middle of bad news? Should you enter back now or wait further for the news/economy/earnings to improve? What if you enter now and the market falls back again? What if you wait too long and the market recovers?

Counter-Intuitive Pattern 2: Market decline has several false upside rallies and the actual recovery also has several false declines

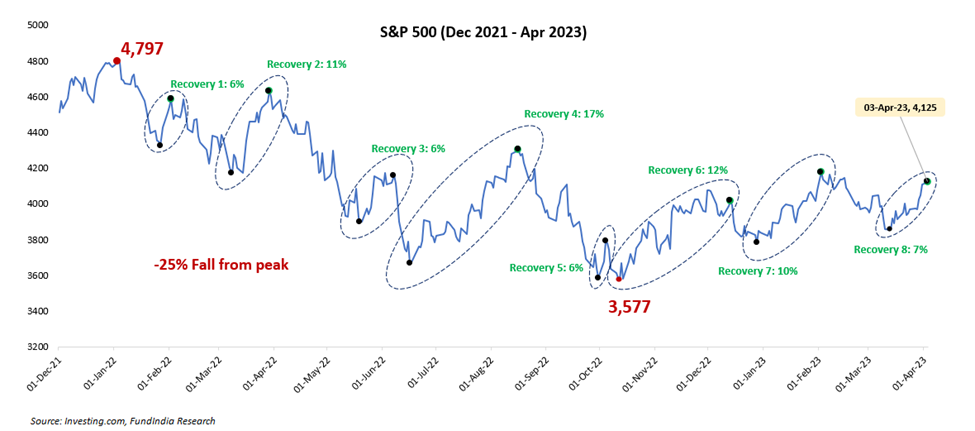

We have already seen 7 false recoveries in this bear market. Three of them were more than 10%!.

Now we are seeing the 8th recovery.

Dilemma 2: Is this the real recovery or yet another false rally?

Counter-Intuitive Pattern 3: Recovery is usually extremely fast – the first few months capture most of the rally.

Dilemma 3: Should you wait further for more upside to confirm or enter back now? What if the market suddenly goes up really fast and you miss the recovery? When should you get back in that case? What if you instead enter now but the market falls back again?

Counter-Intuitive Pattern 4: We get psychologically anchored to the bottom levels

The US Equity markets hit a low of 3,577 on 12-Oct-2022. Now it’s 15% higher at 4,124.

Going by your gut, it feels like it will go back to those lower levels. The current levels look psychologically expensive as you had a chance to buy them at much lower levels.

Dilemma 4: Should you wait for the previous bottom? What if the market continues to go up?

Counter-Intuitive Pattern 5: No one can predict the markets in the short run

The doomsday experts and scary media articles as expected are back to the limelight.

Dilemma 5: No expert has historically predicted market bottoms on a consistent basis. These experts are also mostly wrong. So, how will you know when to enter back?

Now you can see why it’s insanely difficult and stressful to get back in once you exit the equity markets in the middle of a bear market.

Parting Thoughts

Thanks to the 5 counterintuitive patterns of a bear market, what looks like an easy decision to ‘move out and enter back later’ ends up becoming an insanely hard and confusing decision with no easy solution.

This is exactly why most people who exit the markets, stay out a lot longer (than expected), end up missing the recovery rally and mess up their portfolios undoing all the hard work of several years.

So, the next time you are tempted to ‘exit now and enter back later’, you know what to do. Or rather what not to do!

Happy Investing as always 🙂