Kajaria Ceramics Ltd. – India’s No.1 Tile Company

Kajaria Ceramics Limited (KCL) was incorporated in 1985 as a manufacturer of floor and wall tiles by Mr. Ashok Kajaria in technical collaboration with Todagres SA, Spain. Today, Kajaria Ceramics is the largest manufacturer of ceramic/vitrified tiles in India. It has an annual aggregate capacity of 84.45 mn. sq. meters, distributed across eight plants – Sikandrabad in Uttar Pradesh, Gailpur & Malootana in Rajasthan, Vijayawada & Srikalahasti in Andhra Pradesh, Balanagar in Telangana and two plants in Gujarat. Kajaria’s manufacturing units are equipped with cutting edge modern technology. Intense automation, robotic car application and a zero chance for human error are few reasons for Kajaria to be the number 1 in the industry. Kajaria Ceramics has increased its capacity from 1 mn. sq. mtrs to 84.45 mn. sq. mtrs. in last 34 years and offers more than 3000 options in ceramic wall & floor tiles, vitrified tiles, designer tiles and much more.

Products & Services:

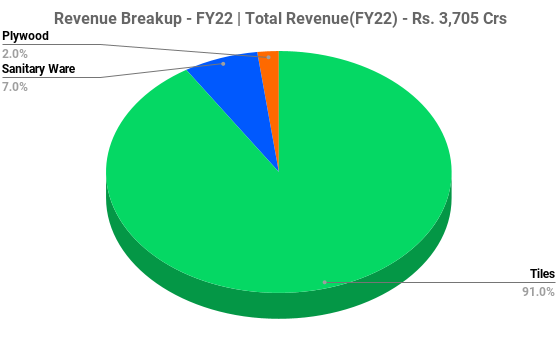

The company is producing various types of tiles, sanitaryware and plywood under various segments namely Ceramic Wall & Floor Tiles, Polished Vitrified Tiles, Glazed Vitrified Tiles, Bathware and Plywood & Laminates.

Subsidiaries: As on FY22, the company had 5 Subsidiaries and 1 Step down subsidiary.

Key Rationale:

- Largest Player – Kajaria is the largest player in the domestic tiles industry operating more than three decades. The company has a strong brand presence with a PAN-India Distribution network of 1825 operative dealers. The company had a base of 1700 dealers across India at FY22 end. Later, it added 125 dealers during 9MFY23.

- Expansion – Kajaria announced an expansion for large sized glazed vitrified tiles capacity of 1.8 MSM/annum at the Sikandrabad plant recently, which will increase the total capacity of the plant from 8.4 MSM/annum to 10.2 MSM/annum at the capex of Rs.70 crs. The expansion is likely to be completed by September, 2023. Furthermore, it is undertaking modernization of its ceramic tile manufacturing capacity at Gailpur (Rajasthan) for a capex of ~Rs.51 crs. The modernized capacity will produce tiles of larger size (and will have higher realization). Additionally, the company is expected to invest Rs.70 crs to set up a 6 lakh pieces/annum of sanitary ware manufacturing facility in Gujarat (revenue potential: ~Rs.150 crs at full capacity utilization). The expansion is expected to be completed by December, 2023. Further, the company is adding new capacity of 6 lakh pieces/annum in its faucet plant at Gailpur, which will take the total the capacity to 16 lakh pieces/annum. Estimated cost for this expansion is ~Rs.5 crs and is expected to be completed by March, 2023.

- Q3FY23 – The company generated an overall revenue of Rs.1091 crs, an increase of 2.1% YoY & 1.2% QoQ. Kajaria’s sales volume in the tiles segment was muted YoY (down 0.7%) to 25.5 MSM (million Square Metres) mainly impacted by a subdued demand scenario. Three-year volume CAGR was at 8%. Tiles revenue were up 2.3% YoY at Rs.984 crs. Kajaria’s subsidiaries and allied businesses reported muted growth during Q3FY23. In the faucet and sanitary ware segment, revenues were down 2.7% YoY at Rs.79.5 crore. In the plywood business, revenues were down 25% YoY and were at Rs.18.8 crore while adhesive business contributed Rs.9 crs to the overall revenue.

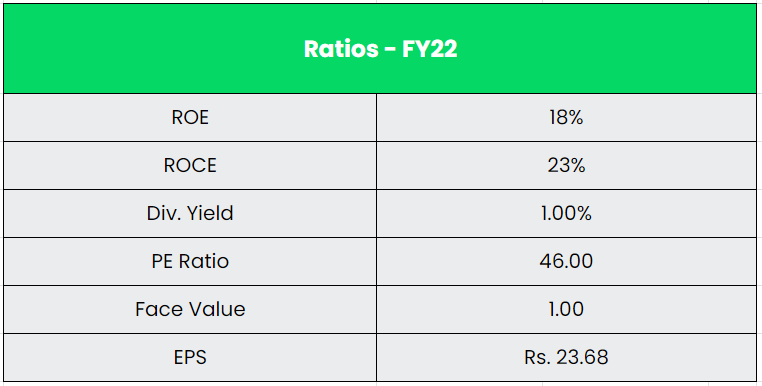

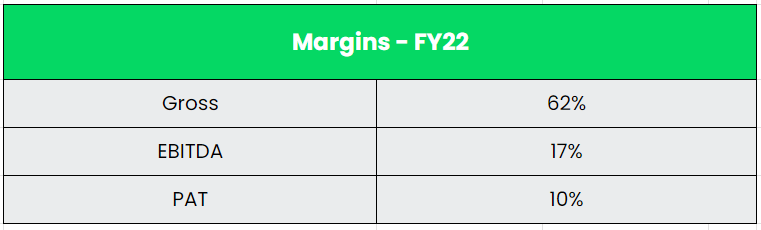

- Financial Performance – Despite the company’s products catering to real estate industry, Average Gross margin has been solidly stood at 64% for FY18-22. The 5-year average Return on Equity (ROE) and Return on Capital Employed (ROCE) of the company is around 16% and 22%, respectively. The balance sheet is strong with cash & cash equivalents stood at Rs.424 crs (as on FY22) and a very low Debt-to-Equity ratio of only 0.08x as on the same period.

Industry:

The Construction industry in India consists of the Real estate as well as the Urban development segment. The Real estate segment covers residential, office, retail, hotels and leisure parks, among others. While Urban development segment broadly consists of sub-segments such as Water supply, Sanitation, Urban transport, Schools, and Healthcare. The construction industry market in India works across 250 sub-sectors with linkages across sectors. The construction Industry in India is expected to reach $1.4 Tn by 2025. The Real Estate Industry in India is expected to reach $1 Tn by 2030 and will contribute 13% to India’s GDP. The government’s focus on building infrastructure of the future has been evident given the slew of initiatives launched recently. The US$ 1.3 trillion national master plan for infrastructure, Gati Shakti, has been a forerunner to bring about systemic and effective reforms in the sector, and has already shown a significant headway. The Indian tile industry size is estimated to be ~Rs. 52,700 crs as of FY22. Out of this, domestic consumption is ~Rs.40,000 crs and exports constitute ~ Rs.12,700 crs.

Growth Drivers:

- Under Budget 2023-24, capital investment outlay for infrastructure is being increased by 33% to Rs.10 lakh crore (US$ 122 billion), which would be 3.3% of GDP and almost three times the outlay in 2019-20.

- Urban areas are expected to become home to 40% of India’s population and contribute to 75% of India’s GDP by 2030 with the increase in urbanization.

- The outlay for PM Awas Yojana is being enhanced by 66 % to over 79,000 crs. As of August 2022, 122.69 lakh houses have been sanctioned, 103.01 lakh houses have been grounded, and 62.21 lakh houses have been completed, under the Pradhan Mantri Awas Yojna scheme (PMAY-Urban).

Competitors: Cera sanitaryware, Somany Ceramics, etc.

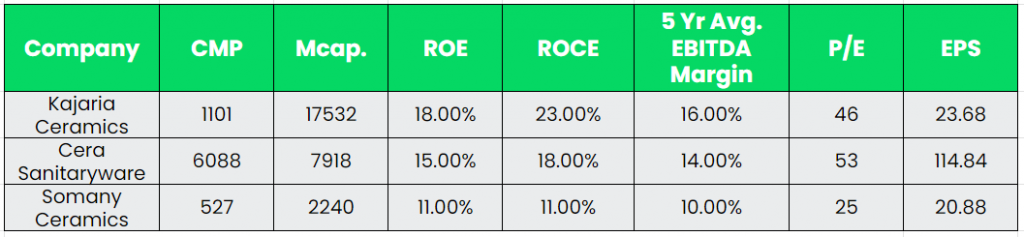

Peer Analysis:

KCL continues to maintain its margin leadership position among peers in the tiles business. In the last 5 years, KCL has seen average EBITDA margin of 16% while the same for Somany Ceramics has been at only 10%. Primary reasons for KCL’s better margins are favourable product mix, higher proportion of in-house produced tiles and technologically advanced manufacturing process.

Outlook:

The company has started using Mustard husk, an alternate fuel with secure supply arrangements and will cost around Rs.30/SCM (Cost may decline if it’s a new crop). The Management in its Q3FY23 con-call stated that by February 2023, 65-70% of the fuel mix will be natural gas and the remaining will be alternate fuel. So, if the operations have commenced as per the statement, there is huge chance that the company’s average fuel price will come down to Rs.47-48/SCM in Q4FY23 (vs. Rs.53/SCM in Q3FY23). The Management also guided for a 13-15% YoY increase in Volume growth in the tiles segment during FY24. The factors driving the growth would be healthy capacity utilisation, Rise in Demand from Tier 2 and 3 cities, expected increase in the manufacturing capacity, enhanced dealer network and a strong brand recall. Apart from Volume guidance, the Management also told that they expect a minimum of 200 bps improvement in the EBITDA Margin (12% to 14%) during Q4FY23 on account of fuel mix and the relaxation in the gas prices. The company expect capex of Rs.90 crs in FY23 (Rs.75 crs in 9MFY23) and ~Rs.300-350 crs in FY24.

Valuation:

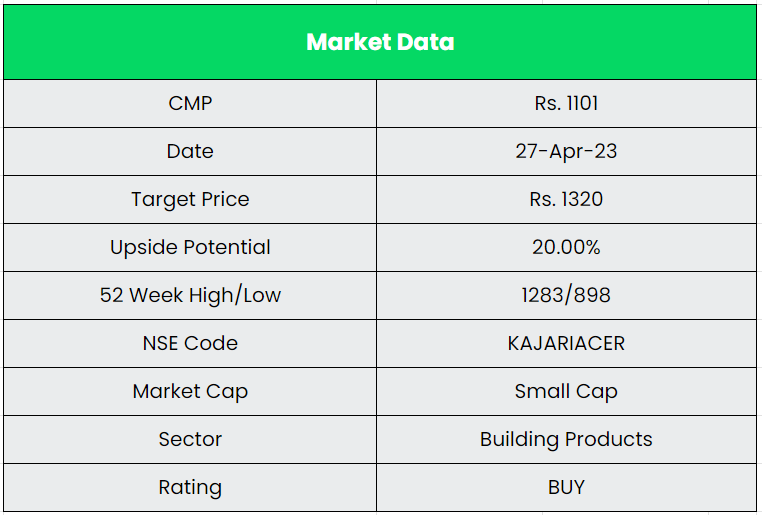

The brand ‘Kajaria’ is a strong play in the Tiles segment supported by a strong financial performance and balance sheet. With the decline in the gas prices, we believe the margin will start to recover anytime soon. We recommend a BUY rating in the stock with the target price (TP) of Rs.1320, 35x FY25E EPS.

Risks:

- Raw Material Risk – KCL’s profitability remains vulnerable to any increase in the prices of raw materials and natural gas as these two components form a major part of the cost structure.

- Economical Risk – Building material industry derives its demand from the real estate industry. Hence, any slowdown in the real estate sector will affect KCL. The company’s revenues and cash flows remain vulnerable to the cyclicality in the end-user industry.

- Competitive Risk – Tile industry is highly competitive, which restricts players’ ability to pass on cost inflation. While KCL continues to gain market share, it certainly does not influence prices.