The Dilemma!

Generally there are a number of questions when deploying large sums of money into equities.

- Should you invest now or wait for a market correction?

- What if you invest now and the market falls?

- What if you don’t invest now and the market continues to rally?

- What if markets correct and you are not able to enter back at the right time?

OOPS!

So,

HOW DO YOU INVEST IN EQUITIES NOW?

Existing Solutions

- Stagger your investments across 3-12 months

This works well most of the time as it lets you average out the entry price over time and helps you minimize regret. If markets go down, you are happy that you didn’t invest the entire amount at one go. If markets continue to go up, you are happy that you at least got to participate partially as otherwise, you would have been waiting without investing!

But…

If markets continue to go up through the entire period, you end up buying at a far higher average cost. If starting valuations were already expensive, this will further increase your entry valuations.

- Invest in Balanced Advantage Funds and gradually move into equity funds

But…

There is an exit load impact for 1 year which removes flexibility. There is a lot of manual intervention required – you have to manually move into the equity funds at the right time.

What if we try and build a simpler and better solution?

Let us start with the basics…

What are we essentially trying to do?

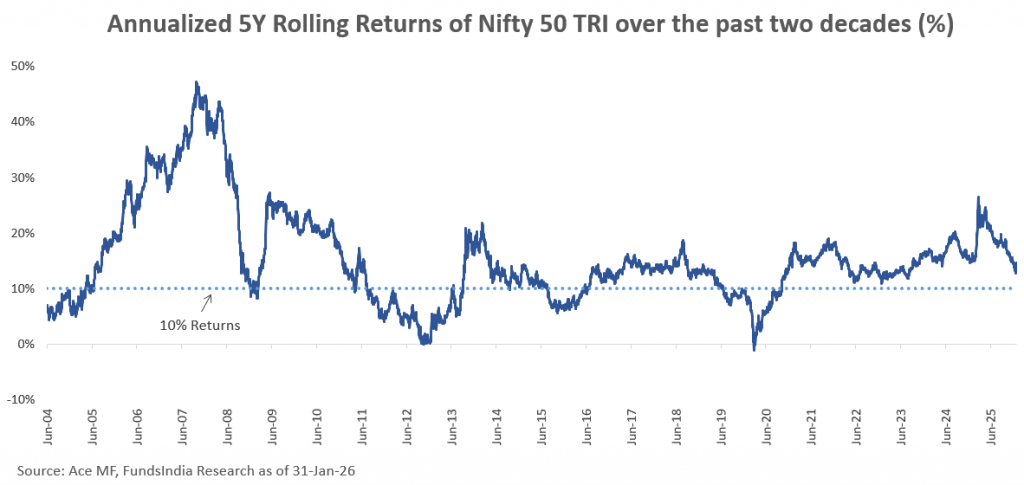

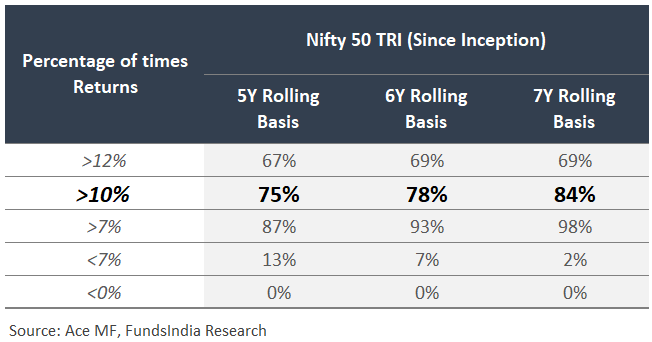

Equity markets usually do well over 5-7 year time frames.

Let us check our odds…

GREAT!

So roughly 75% of the times a simple don’t-think-too-much-one-time investment with loads of patience to ignore the market tantrums for 5 years provided us with decent return outcomes (greater than 10% CAGR).

Further, simply extending time frames by 1-2 years improved the odds to 84%.

BUT…

What if we end up in the unlucky 10-20% part of the statistics where even the 5-7 year returns looked dismal?

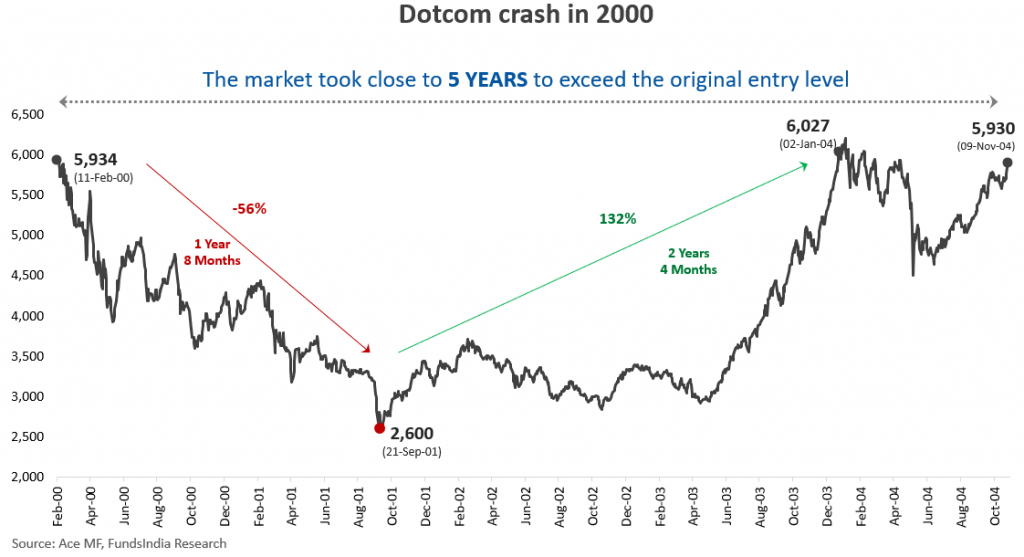

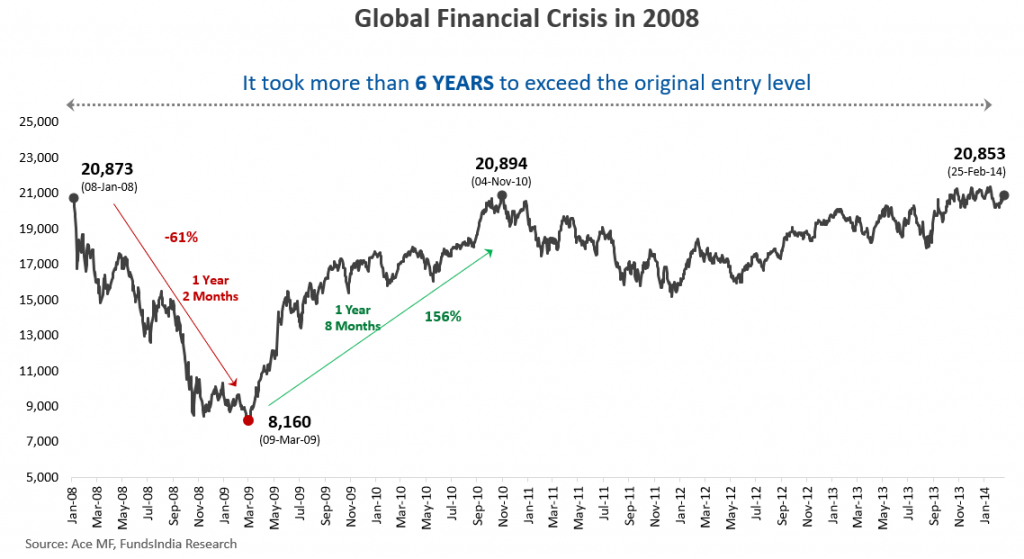

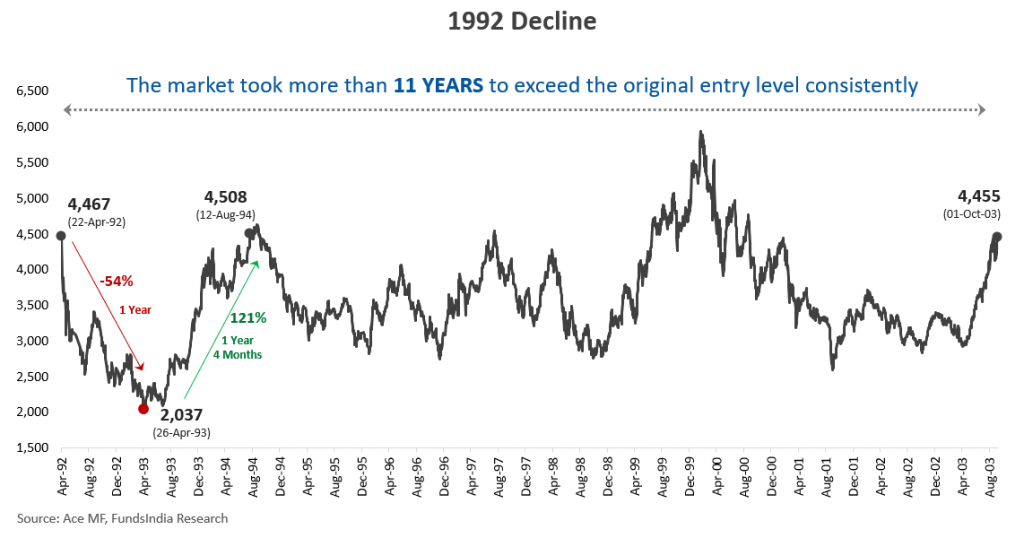

To put that in perspective, this is how bad it gets when you get the entry wrong,

So the logical question is,

If you have a large sum of money to invest in equities as a part of your long-term asset allocation plan, how do you ensure that you don’t end up with such rare but dismal long-term outcomes?

All this is fine. But if we have to find a solution we need to find out,

WHY DOES THIS HAPPEN?

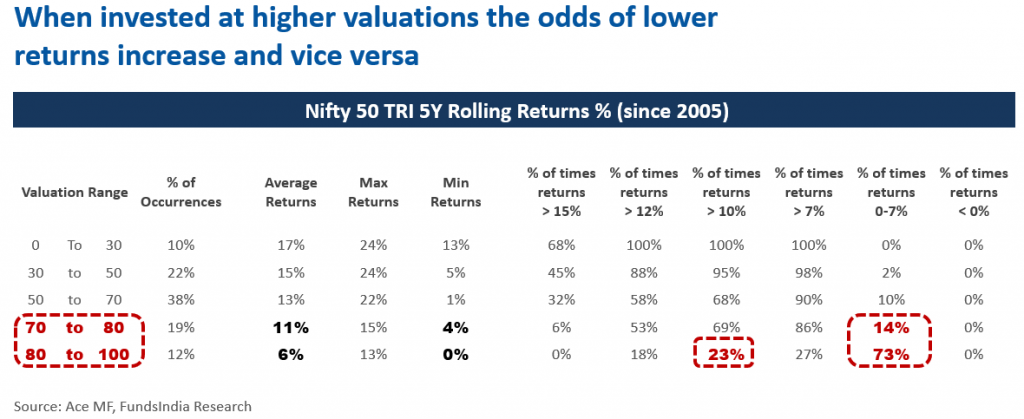

When we studied the past history, poor long-term return outcomes from equities while rare are usually the result of very expensive starting valuations.

Here is an interesting thing we did.

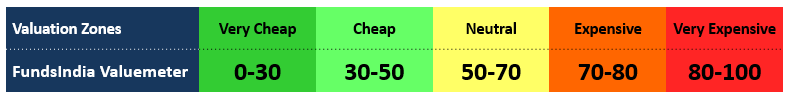

We went back 20+ years and checked for future 5-year equity returns for Nifty 50 TRI at different starting valuations (proxied by our internal valuation indicator – FundsIndia Valuemeter – more on this later).

Here is what we found…

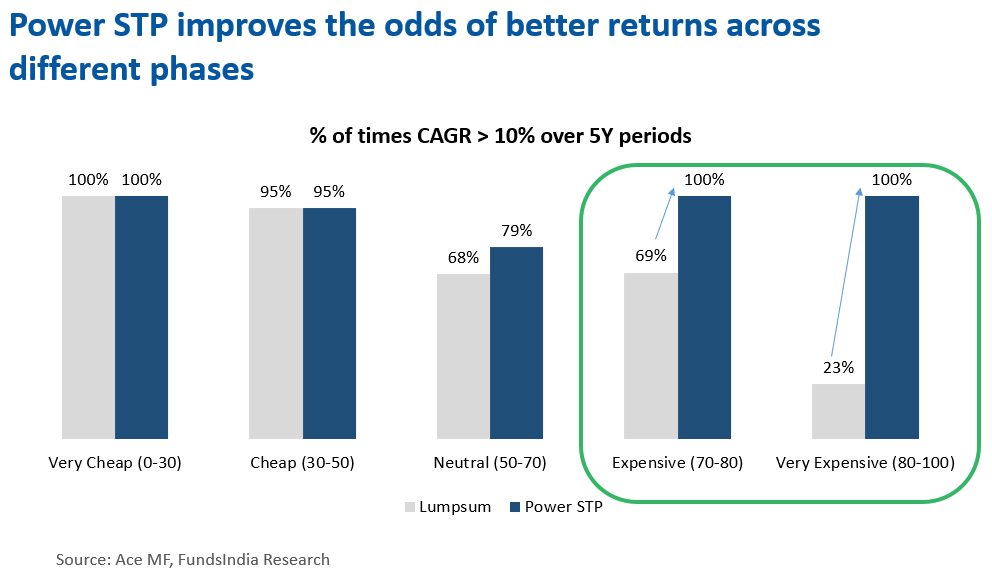

- When starting valuations were in the VERY EXPENSIVE zone (i.e Valuemeter >80), 73% of the times the 5-year future returns have been less than 7%. Just 23% of the times, returns were above 10%.

- When starting valuations were in the EXPENSIVE zone (i.e Valuemeter between 70-80), 31% of the times the 5-year future returns have been less than 10%.

So the simple takeaway for us:

More expensive the starting valuation, the higher the odds of dismal future returns!

The market delivers good returns (in line with or over and above the aggregate profit growth of underlying companies) when invested during cheaper or neutral phases. But the returns become not-so-great (much lower than the aggregate profit growth of underlying companies) when invested at expensive phases.

So while a simple 6-12 month STP or a lump sum investment works great when markets are trading at reasonable or cheap valuations (which they do for most of the time – roughly 70% of the time), the real challenge comes when the market valuations are expensive.

Given a choice, you would obviously like to invest when valuations are reasonable or cheap and invest as little as possible when valuations are expensive.

But this is far easier said than done. This requires constant monitoring of the markets, good control of our emotions without getting swayed by the news flow, and significant time and effort to execute this.

While a lot of us try to take this approach, execution is where the real trouble lies. We grossly underestimate our emotions’ ability to wreak havoc with our plans.

Here is where we think we can help you.

What if you had an intelligent solution that does all the above for you with almost zero effort required from your side?

We hear you and have built a simple yet intelligent investment strategy called FundsIndia Power STP.

*STP stands for Systematic Transfer Plan

Sounds interesting! But first things first, what is Power STP?

POWER STP – Making Anytime a Good Time to Invest

The Power STP is a fully automated, intelligent valuation-driven deployment strategy that helps you invest large lumpsum amounts into equities anytime without worrying about current market valuations.

The endeavor is to help you generate reasonable returns from equities over 5-7 years and lower the odds of dismal returns which is usually due to high entry valuations.

How does Power STP work?

- GRADUAL & OPPORTUNISTIC vs GO-ALL-IN APPROACH:

- Instead of investing all your money into equities at one go (the traditional lumpsum approach) or dividing it equally across several months through a simple STP, the Power STP takes the WAIT-FOR-THE-RIGHT-OPPORTUNITY-TO-INVEST approach.

- Your money is initially parked in a safe debt fund. Then it is intelligently moved into your chosen equity fund – over a period of time, based on market valuations.

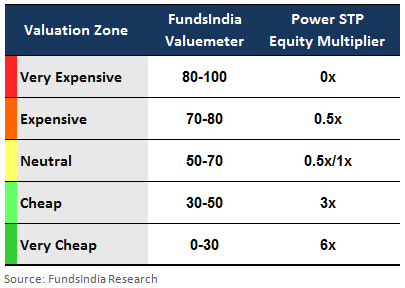

- MONTHLY DEPLOYMENT Amount into Equities is not static and is AUTOMATICALLY ADJUSTED based on VALUATIONS

- A higher amount is moved into equities when valuations are low and a lower amount is moved into equities when valuations are high.

- The equity monthly transfer amount is decided based on FundsIndia Valuemeter (our in-house valuation model).

- The transfer value can vary between 0x to 6x times the pre-decided monthly transfer amount.

- Fully Automated Solution with Complete Flexibility over Choice of Funds

- You can choose from any of the FundsIndia Select lists of funds.

- Once you set your Power STP (which takes less than 5 minutes), the entire hard work of opportunistically deploying your money into equities is on us and you can peacefully spend your time on things that you enjoy doing.

By the way, what is this FundsIndia Valuemeter?

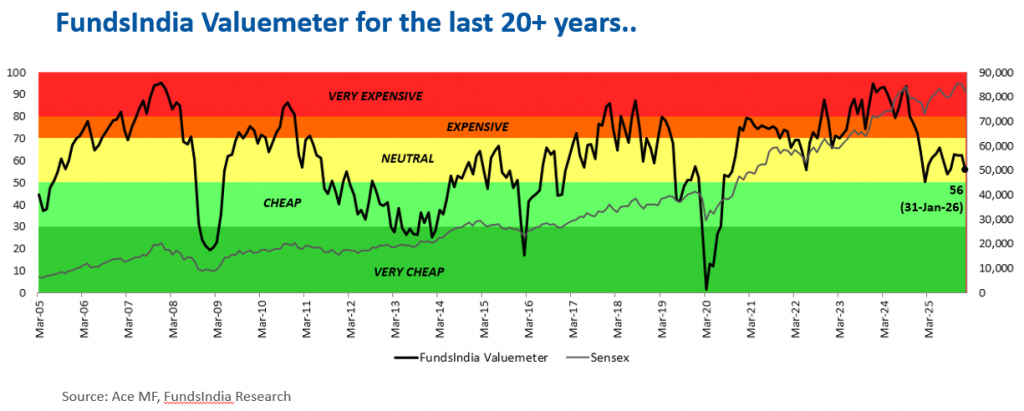

The FundsIndia Valuemeter is our in-house valuation model which tells us if the market is cheap or expensive by evaluating four key valuation parameters.

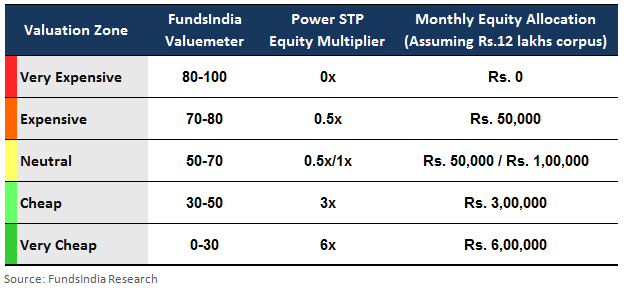

The FundsIndia Valuemeter indicates a value between 0-100 and classifies the market into 5 phases based on valuations.

*FundsIndia Valuemeter uses BSE 100 for evaluating valuations as it covers more than 80% of the overall Indian market capitalization.

How does Power STP dynamically move money into Equities based on the FundsIndia Valuemeter?

Depending on the valuations at the time of investment – the Power STP allocates between 0 times (0x) and 6 times (6x) your STP amount.

The Base Power STP amount will be your investment amount divided by 12.

Let us take a simple example.

Assume you want to invest Rs. 12 lakhs in equities. You will first invest the entire amount in a safe debt fund and set the Power STP on this. The Base Power STP amount will be set to Rs. 1 lakh (i.e Rs 12 lakhs/12 months = Rs 1 lakh).

Applying the 0x to 6x multiple, the equity deployment for any month can be from Rs. 0 (which means the markets are insanely expensive and we stay in debt and don’t invest in equities) up to Rs. 6 lakhs.

This is how the equity allocation is done at various valuation phases

An overlay may be done depending on the signal we receive from our Earnings Cycle indicator and Trend indicator (based on the 100-Day Moving Average of the stock market index).

Cool! How did Power STP historically auto-adjust the monthly deployment?

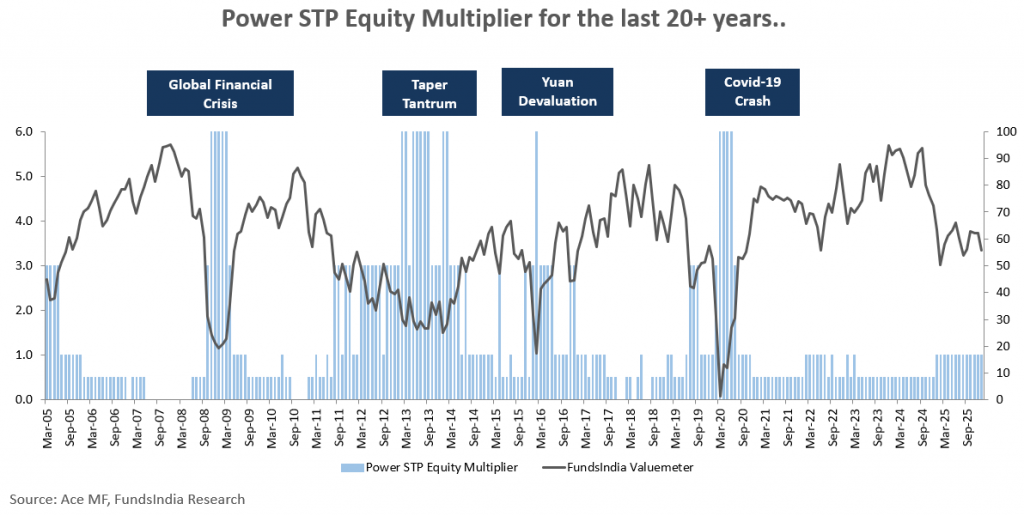

Here is how the equity multiplier applicable for each month moved over the past 20+ years.

As seen above, Power STP automatically deploys aggressively when markets are cheap and conservatively when markets are expensive.

Can you explain this with an example?

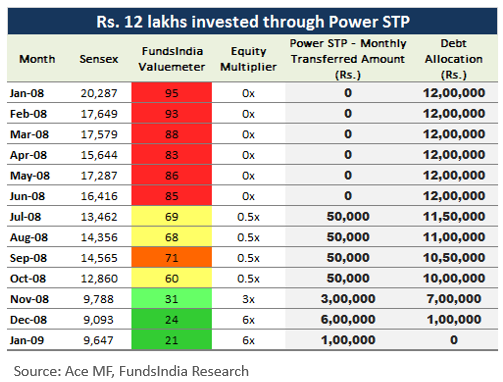

Assume you had Rs. 12 lakhs to invest in Jan-2008 when the markets were in the VERY EXPENSIVE phase as per our Valuemeter. This is how the Power STP would have deployed your money into equities. (Debt gains are not considered for simplicity)

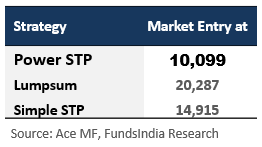

To give you a rough sense of how POWER STP gave you a better entry point, here is the approximate Sensex entry levels that you would have realized while using different entry strategies.

In case you had opted for a lump sum, you would have invested the entire amount into equities at 20,287 (Sensex value as on 01-Jan-08). Had you invested through a simple 12-month STP, you would have invested at a 12-month average index value of 14,915.

Power STP waited it out during the initial high valuation phase and aggressively deployed the money when valuations became very cheap. This allows it to perform much better than both Lumpsum and 12M Simple STP and was able to deploy at a weighted average index value of less than 10,100 – a whopping discount of 50% versus lumpsum investment and 32% versus the simple STP investment.

Before you get too excited, this was an extreme phase where any valuation-led model does well.

The key question for us was…

Does it work well consistently over long periods of time and across different market phases?

Let us put it to test over the last 20+ years (i.e from Apr-2005). We have taken Nifty 50 TRI as the proxy for equities and HDFC Liquid Fund as the proxy for the debt portion.

Consistent long-term performance irrespective of starting valuations

We noticed that the Power STP significantly improves your return experience when compared to a regular Lumpsum or STP investment over 5-7 year time frames.

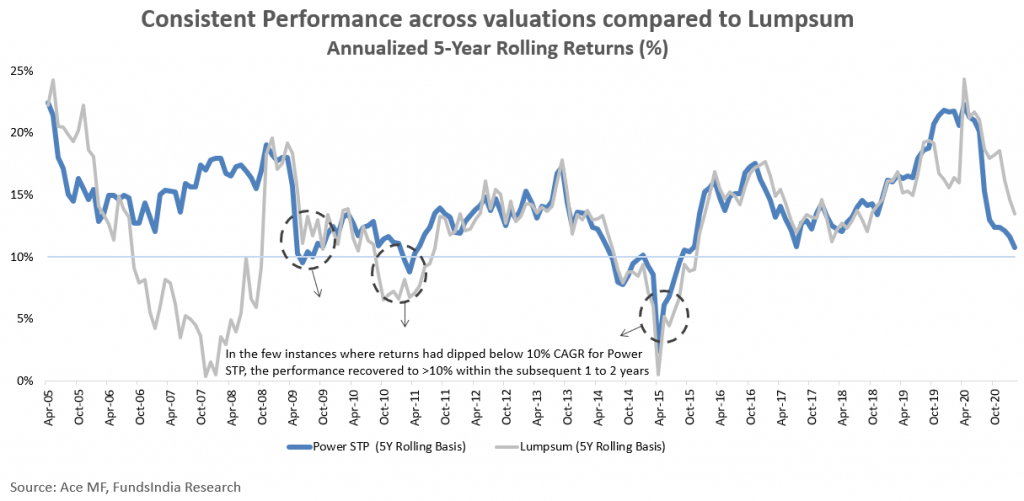

On a 5 Year rolling return basis,

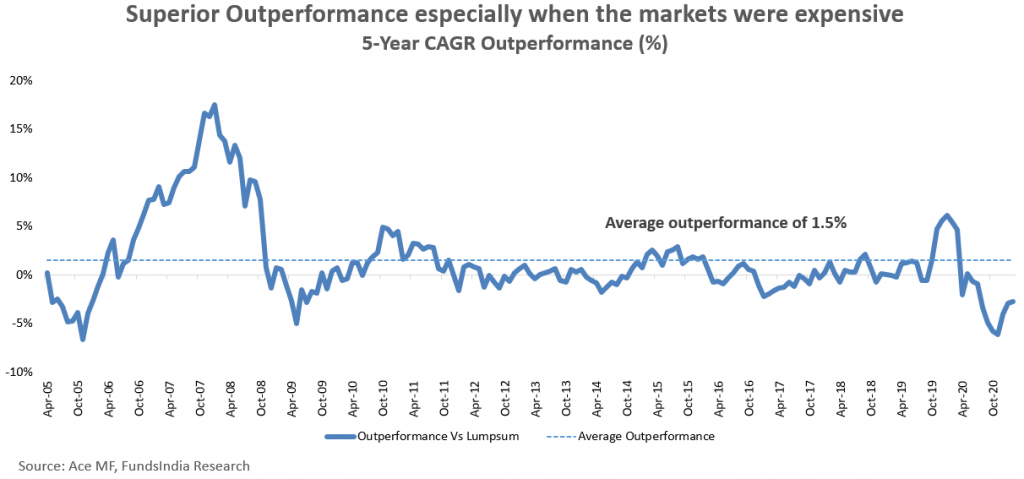

- POWER STP strategy outperformed Lumpsum the majority of the times – Average outperformance of 1.5% CAGR

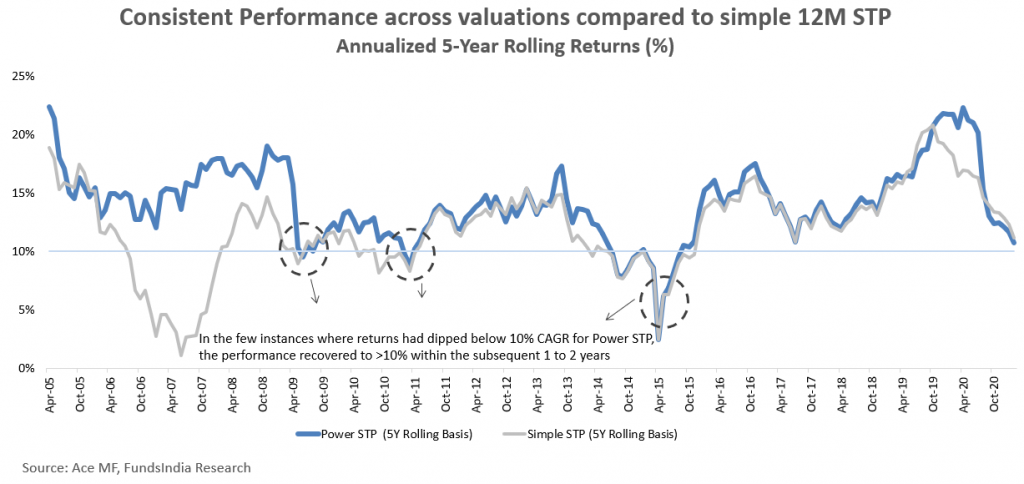

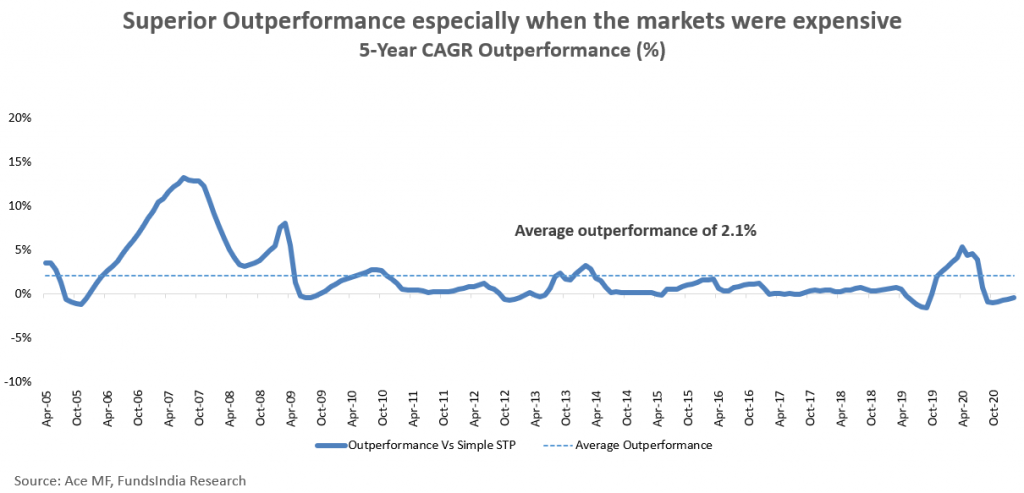

- POWER STP strategy outperformed 12M Simple STP, 82% of the times – Average outperformance of 2.1%

Consistent & Superior Performance vs Lumpsum investments

1. Consistent Performance compared to Lumpsum investments

- >10% CAGR: 91% of the times for Power STP vs 72% for Lumpsum on 5Y Rolling Return periods in the last 20+ years

- >12% CAGR: 78% of the times for Power STP vs 63% for Lumpsum on 5Y Rolling Return periods in the last 20+ years

- Even in instances where 5Y returns fell below 10%, the returns recovered back to >10% CAGR, in the next 1-2 years

2. Superior outperformance of Power STP versus Lumpsum investments

- Average outperformance of 1.5% vs lumpsum on a 5 year rolling basis

Consistent & Superior Performance vs 12M STP

1. Consistent Performance compared to 12M STP

- 91% of the times returns above 10% versus 76% of the times when invested through a regular 12M STP

- 78% of the times returns above 12% versus 54% of the times when invested through a regular 12M STP

2. Superior outperformance of Power STP versus 12M STP

- Average outperformance of 2.1% vs 12M STP on a 5 year rolling basis

Great! So it has been consistent across different phases. But coming to our real worry point, how does it perform specifically across expensive phases?

The improvement in returns has been significant for periods when starting valuations were either ‘EXPENSIVE’ or ‘VERY EXPENSIVE’.

The odds of a 10% return increase from 23% to 100% in the VERY EXPENSIVE phase and from 69% to 100% in the EXPENSIVE phase using the POWER STP. This is exactly what we were expecting from the strategy and it doesn’t disappoint us.

Should we use Power STP even when valuations are cheap?

Ideally, when the valuations are cheap (0-50), you can simply make lumpsum investments.

But even if you choose to invest in a POWER STP instead, it would still work out fine as the Power STP operates almost like a lump sum during the cheaper phases of the market.

How?

When valuations are cheap the Power STP allocates three or six times the monthly installment into equities, meaning the whole amount gets deployed into equities quickly within 2 to 4 months.

Thus, the Power STP is an ‘all-weather’ solution given its valuation-driven approach and you can use it anytime to deploy large lumpsum money into equities.

How long does the Power STP take to deploy your money?

The Power STP historically has taken around 4 to 20 months to deploy the corpus completely into equities depending on the valuations during the time of deployment.

What are the risks that might impact the performance of Power STP?

- The Power STP may underperform lumpsum in the initial 1-3 years as it usually takes 1-2 years to deploy the money when market valuations are expensive.

- In bubble-like phases where the markets continue to rally despite higher valuations for long periods of time, Power STP might underperform as it will allocate a lower amount into equities, waiting patiently for the markets to correct or the valuations to become reasonable.

- In such a scenario, the time taken for the Power STP to deploy the corpus into the equity funds may also get extended.

PLEASE REMEMBER that this is not a magical solution that will always outperform lumpsum. It is a simple valuation-driven approach that provides you a reasonable return experience over 5-7 year time frames and the primary intent is to minimize the odds of a dismal outcome.

Who is it suitable for?

Long-term investors (5-7 years at least) with the patience for measured deployment into equities especially during highly expensive markets.

They can be –

- Investors are concerned about investing during phases of expensive market valuations.

- Investors with fresh money (from retirement, sale of property etc) who would like to deploy the same in Equity markets

- Investors who took their money out of markets and are looking to reinvest

You shouldn’t invest…

- If you have a time frame of fewer than 7 years

5 years is good enough but an extra leeway of 1-2 years allows the performance to recover in rare cases where 5 year returns are lower - If you expect this product to maximize your returns

The primary intent is to minimize the odds of a dismal outcome and provide consistent & reasonable return outcomes over 5-7 year time frames - If you can’t tolerate near-term underperformance vs lumpsum investments in the first 1-3 years

Summing it up

1. Intelligent Valuation based Deployment Strategy

- Opportunistic Deployment – Instead of deploying your entire money one shot into equities, it is initially parked in a safe debt fund and gradually moved into equities over a period of time

- Valuation Driven Strategy – deploys larger amounts of money into equities when valuations are low and lower amounts of money when valuations are high

- Eliminates the need to Time Markets – Patiently waits & buys equities only at reasonable valuations

2. Consistent Performance with Reduced Risk of Subpar Long Term Outcomes

- Consistent Return Experience over the Long Term (5-7 years)

- POWER STP strategy outperformed lumpsum majority of the times – Average outperformance of 1.5% CAGR – on a 5 year rolling basis

- POWER STP strategy outperformed 12M Simple STP – 82% of the times – Average outperformance of 2.1% – on a 5 year rolling basis

- Reduces Risk of Poor Long-Term Outcomes usually due to High Starting Valuations

- >10% CAGR: 91% of the times for Power STP vs 72% for Lumpsum vs 76% for 12M Simple STP on 5Y Rolling Return basis

- >12% CAGR: 78% of the times for Power STP vs 63% for Lumpsum vs 54% for 12M Simple STP on 5Y Rolling Return basis

- Even in instances where 5Y returns fell below 10%, the returns recovered back to >10% CAGR, in the subsequent 1-2 years

3. For Patient Long Term Investors with Reasonable Return Expectations

- The primary intent is to minimize the odds of a dismal outcome and is meant for patient investors looking at consistent and reasonable return experience over 5-7 years

- May underperform in the initial few years vs lumpsum as the strategy takes 1-2 years to deploy the money

4. Hassle Free Automated Execution

- Hassle-Free Execution – Entire strategy is automated and takes less than 5 minutes to set up your Power STP

If you are interested in this strategy and would like to talk to us: Click here

(The blog has been updated with latest data on 11-Feb-26)