An abridged version of this article was first published in Livemint, Click here to read it

Most of us think, bull markets are easy to participate and make money. However, surprisingly, many investors don’t perform well even during a bull market, thanks to these 3 behavioral mistakes.

What are these 3 behavioral mistakes and how do you avoid them?

Behavior Mistake 1: Panic Selling at All Time Highs

Whenever markets hit an all-time high, it’s normal to feel uncomfortable and think they may fall. You remember the adage ‘Buy Low, Sell High’, and are tempted to sell and get back in later post a market fall.

But, here is why this maybe a bad idea!

All-time highs are a normal and inevitable part of long-term equity investing. Without all-time highs, equity markets cannot grow and generate returns.

Sample this. If you expect Indian equities to grow at say 12% per annum (in line with your earnings growth expectation), then mathematically it means the index will roughly double in the next 6 years, become 4X in the next 12 years, and 10X in the next 20 years.

In other words, the index will inevitably have to hit and surpass several all-time highs over time if it has to grow as per your expectation.

In fact for the last 23+ years, the average 1Y returns, when invested in Nifty 50 TRI during an all-time high, is ~14%!.

So ‘all-time highs’ in isolation don’t imply a market fall and in fact, the majority of times, market returns have been strong post an all-time high.

What should you do at all time highs?

Solution: Stick to your asset allocation and rebalance your equity allocation if it deviates more than 5% from the original allocation.

Behavior Mistake 2: Procrastination in Deploying New Money

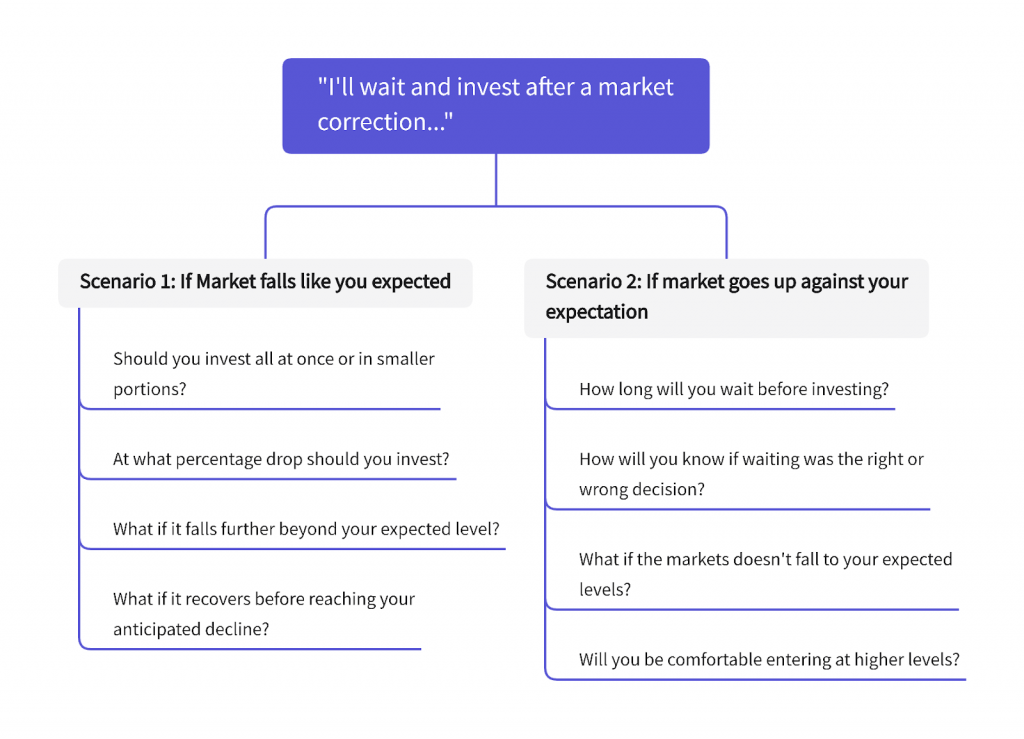

When you get new money to invest but the markets have already moved up, there is an inescapable temptation to time the market – “What if I just stayed in cash for a while and waited for the market to correct by 10-15%? There’s no harm in that right?”.

While this seems like a simple decision, there is a lot more nuance to this than what meets the eye.

The more you think of these questions and add a “What if…” to the mix, you suddenly realize that what looked like a simple decision is far more complex than you thought.

Say you have to deploy Rs 10 lakhs but as you stay waiting in cash, assume the markets go up by 10%. This opportunity loss of Rs 1 lakh may not seem significant now. But when you assume 12% returns over 20 years that translates to 10 times in 20 years. So the cost of this missed Rs 1 lakh over 20 years at 12% returns is almost 10 lakhs!

These small mistakes (which look negligible now) eventually add up over time and lead to a significant impact on your long term outcomes.

The famous investor Peter Lynch sums up the problem aptly – “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

Solution: Build a rule-based framework for deploying new money, combining lump-sum and staggered investments over 3-6 months, depending on market valuations. When valuations are high, stagger a larger proportion of the money, and vice versa.

Refer to FundsIndia Deployment Framework (published every month) which will help you with this decision based on our inhouse valuation model – FI Valuemeter.

Behavior Mistake 3: Panic Buying

In a bull market as discussed above, a lot of investors attempt market timing by delaying new investments waiting for the markets to correct or taking out some money with the intent to deploy after a market fall. More often than not, the market tends to surprise them by going up further. Even in cases where the markets fall, most investors tend to postpone their buy decision as they extrapolate the fall and convince themselves that ‘it looks like markets will fall more. I will wait and invest’.

Once you miss the upside, the wait for a fall gets frustrating and eventually at much higher levels the ‘fear of a fall’ is replaced by ‘fear of missing out on further upside’. Inevitably you give in.

But since you missed the upside so far, you try to compensate by excess risk taking. This takes the form of increasing equity exposure much above original asset allocation, chasing recent performers, taking sector bets, higher smallcap exposure, trading etc.

How this story eventually ends is familiar to all of us.

Solution: The key as the market continues to go up, is to resist the temptation to take excessive risks. Stick to your original asset allocation and watch out for bubble market signs (insane valuations, last phase of earnings cycle, euphoric sentiments, very high past returns, high inflows, lot of new investors entering, IPO craze, media frenzy etc).

Summing it up

To successfully navigate a bull market, keep an eye out for these common behavioral mistakes, and remember to stay humble, resist the urge to time the market, and avoid taking on excessive risks.

Happy Investing!