Company Overview:

R R Kabel is one of the leading companies in the Indian consumer electrical industry (comprising wires and cables and fast-moving electrical goods (“FMEG”)), with an operating history of over 20 years in India. The company sells products across two broad segments – (i) wires and cables including house wires, industrial wires, power cables and special cables; and (ii) FMEG including fans, lighting, switches and appliances. Currently, RR Kabel Ltd manufactures and markets wires and cable products under the brand name RR Kabel while the FMEG products are sold under the brand name of Luminous Fans and Lights to distinguish the FMEG segment from the cables segment. The company has two manufacturing facilities for wire & cable production and three manufacturing facilities for FMEG segment.

Objects of the Offer:

- Repayment or prepayment, in full or in part, of borrowings availed by the company from banks and financial institutions.

- General corporate purposes.

Investment Rationale:

- Diversified Operations: R R Kabel is the fifth largest player in the wires and cables market in India, representing approximately 5% market share by value as of March 31, 2023. In Fiscal 2023, revenue contribution from the wires and cables segment is around 89% and the same from FMEG segment is approximately 11%. 71% of its revenue from the wires and cables segment and 97% of its revenue from the FMEG segment are from the B2C sales channel. According to Technopak, the company’s FMEG products cover approximately 77% of the FMEG industry by value in India as on March 31, 2023. During the three months ended June 30, 2023, R R Kabel has launched 6 and 28 new products in the wires and cables and FMEG segments, respectively.

- Wide Presence: The company has an extensive pan-India distribution presence and as on June 30, 2023, they have 3,450 distributors, 3,656 dealers and 1,14,851 retailers. As part of the company’s distribution strategy, they strive to provide their end-users a seamless experience through several touchpoints. Distributors purchase products from the company and on-sell the products to end-users through retailers. Dealers purchase products from the company and either, directly or through retailers, on-sell to end-users. The dealers, distributors and retailers, directly and indirectly, cover electricians. The company has one of the largest networks of electricians, covering 2,71,264 electricians across India, as of March 31, 2023. As on June 30, 2023, RR kabel has 789 employees in its sales and marketing team, who manage and coordinate with distributors, dealers and retailers. The company export its range of wires and cable products directly as well as through distributors across the world. During Fiscals 2021 to 2023 and three months ended June 30, 2023, it sold products to 63 countries in North America, APAC, Europe and Middle East.

- Financial Track Record: The company reported a revenue of Rs.5599 crore in FY23 as against Rs.4386 crore in FY22. The revenue has grown at a CAGR of 31% between FY20-23. The EBITDA of the company in FY23 is at Rs.358 crore and the PAT is at Rs.190 crore for the same period. The PAT has grown at a CAGR of 16% between FY20-23. The EBITDA margin and PAT margin of the company in FY23 is around 6.3% and 3.3% respectively. The revenue from exports in FY23 caters to 23% of the overall revenue.

Key Risks:

- Raw Material Risk – The costs of the raw materials in the company’s manufacturing process are subject to volatility. Any Increase or fluctuation in raw material prices may have a material adverse effect on the business, financial condition, results of operations and cash flows.

- OFS – The IPO is a mix of offer for sale (OFS) and Fresh issue with OFS being 91% of the overall issue size. In the offer for sale (OFS), Promoter selling shareholders named Mahendrakumar Rameshwarlal Kabra, Hemant Mahendrakumar Kabra and Sumeet Mahendrakumar Kabra each will offload up to 7,54,417 equity Shares and another promoter named Kabel Buildcon Solutions Private Limited will offload up to 7,07,200 equity Shares. Other and Investor selling shareholders named Ram Ratna Wires Limited and TPG Asia VII SF Pte. Ltd. will offload up to 13,64,480 and 1,29,01,877 equity shares.

Outlook:

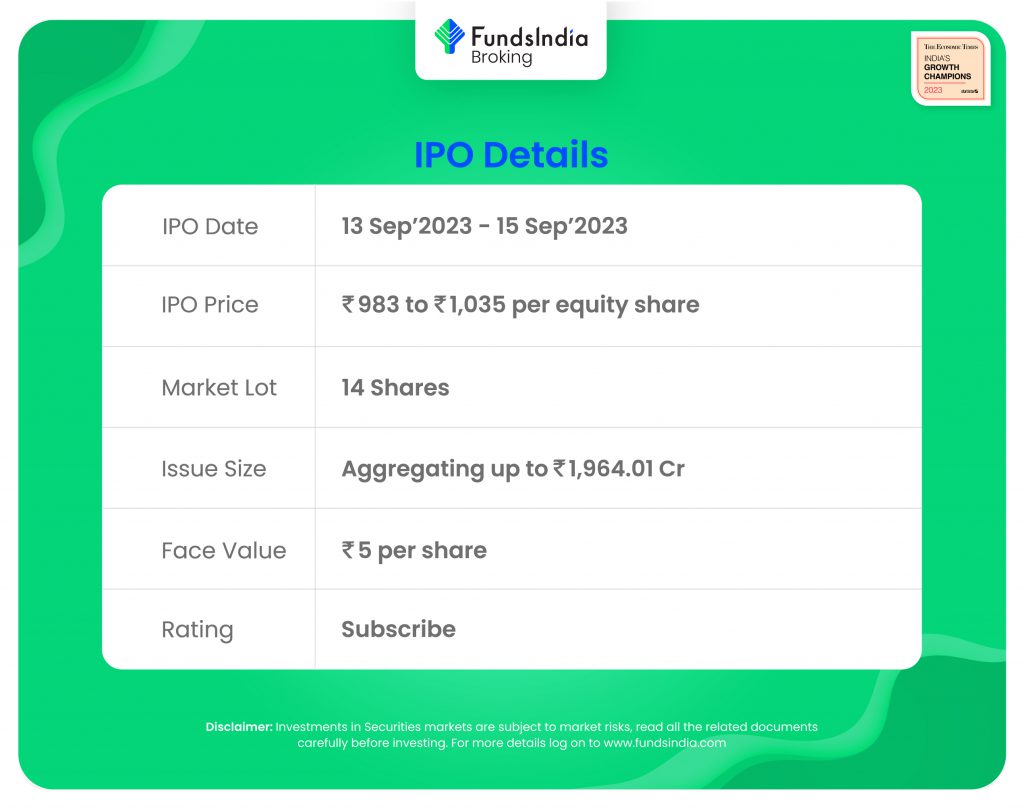

RR Kabel has a strong franchise in both the domestic and export market. They have also acquired few companies recently that expanded their product offerings and market reach. According to RHP, the company’s listed peers are Havells India, Polycab India, KEI Industries, Finolex Cables, V-Guard Industries, Crompton Greaves Consumer Electricals and Bajaj Electricals. The peers are trading at an average P/E of 58x with the highest P/E of 79x and the lowest being 34x. At the higher price band, the listing market cap of R R Kabel will be around ~Rs.11675 crore and the company is demanding a P/E multiple of 61x based on post issue diluted FY23 EPS of Rs.16.83. When compared with its peers, the issue seems to be fully priced in (fairly valued). Based on the above views, we ` provide a ‘Subscribe’ rating for this IPO for a medium to long-term Holding.

If you are new to FundsIndia, open your FREE investment account with us and enjoy lifelong research-backed investment guidance.