Company overview

India Shelter Finance is a retail focused affordable housing finance company engaged in the business of providing loans for house construction, extension, renovation, and purchase of new homes or plots. Incorporated in 1998 as Satyaprakash Housing Finance India Limited, the company was renamed as India Shelter Finance Corporation Limited in 2010. The company’s granular retail-focused portfolio comprises of home loans and loans against property with the primary target segment being the self-employed customer with a focus on first time home loan takers in the low- and middle-income group in Tier II and Tier III cities in India. The interest rates for loans vary, and typically range from 10.50% to 20.00% per annum, with a ticket size primarily ranging from ₹0.50 million to ₹5.00 million. As of 30 September 2023, the company has an extensive and well-established network of 203 branches spread across 15 states with significant presence in the states of Rajasthan, Maharashtra, Madhya Pradesh, Karnataka and Gujarat.

Objects of the offer

- To meet future capital requirements towards onward lending.

- General corporate purposes.

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

- Carry out offer for sale of up to 8,113,590 Equity Shares by the Selling Shareholders.

Investment Rationale

- Fast growing Assets Under Management – The company primarily finances the purchase and self-construction of residential properties by first-time home loan takers through home loans and also offer loans against property. As of September 30, 2023, 70.7% of its customers were first-time home loan takers and home loans account for 57.6% of the company’s AUM, while loans against property represent 42.4% of AUM. According to the CRISIL Report, the company achieved AUM with a growth of 40.8%, among housing finance companies in India, between FY21-23.

- Focus on reducing financing costs – The company has a focused approach to maintaining a long-term and diversified borrowing profile by engaging with multiple lenders to ensure timely funding throughout the year. Its average cost of borrowings and average incremental cost of borrowings for the six months ended September 30, 2023 and September 30, 2022 was 8.9% and 8.3%, and 8.4% and 7.6%, respectively. The average borrowing costs reduced to 8.3% as of March 31, 2023 from 8.7% as of March 31, 2021, and average incremental cost of borrowings for March 31, 2023 was 7.9%, as compared to 8.0% for the Financial Year 2021. By reducing borrowing costs, the company has been able to generate consistent margins and achieve higher profitability.

- Digitization – As a step towards combining digital solutions with personal interactions, the company has introduced IndiaShelter iServe application, a dedicated customer service solution designed to promptly address customer concerns and queries. Additionally, the company has iSales application which integrates, streamlines and optimizes customer acquisition process and IndiaShelter iCredit application which facilitates underwriting.

- Financial Track Record – The company reported a revenue of Rs.585 crores in FY23 as against Rs.448 crores in FY22, an increase of 31% YoY. The revenue has grown at a CAGR of 36% between FY2021-23. The EBITDA of the company in FY23 was Rs.419 crores and EBITDA margin was at 72%. The PAT of the company in FY23 is at Rs. 155 crores and PAT margin is at 26%. The CAGR between FY2021-23 of EBITDA is 37% and PAT is 33%. The ROE of the company stands at 13% in FY23. GNPA improved from 2.79% in H1FY23 to 1.00% in H1FY24. NNPA improved from 2.16% for H1FY23 to 0.72% for H1FY24.

Key Risks

- OFS risk – In addition to fresh issue, the IPO will see the sale of shares worth upto Rs.0.02 crores by Catalyst Trusteeship Limited (as trustee of MICP Trust), Rs.171 crores by Catalyst Trusteeship Limited (as trustee for Madison India Opportunities Trust Fund), Rs.54 crores by Madison India Opportunities IV, Rs.31.7 crores by MIO Starrock and upto Rs.143 crores by Nexus Ventures III, Ltd.

- Compliance with covenants – The company’s ability to comply with the financial and other covenants under the debt servicing agreements could adversely affect its business, results of operations and financial condition.

- Default risk – The risk of non-payment or default by customers may adversely affect the company’s business, results of operations and financial conditions.

Outlook

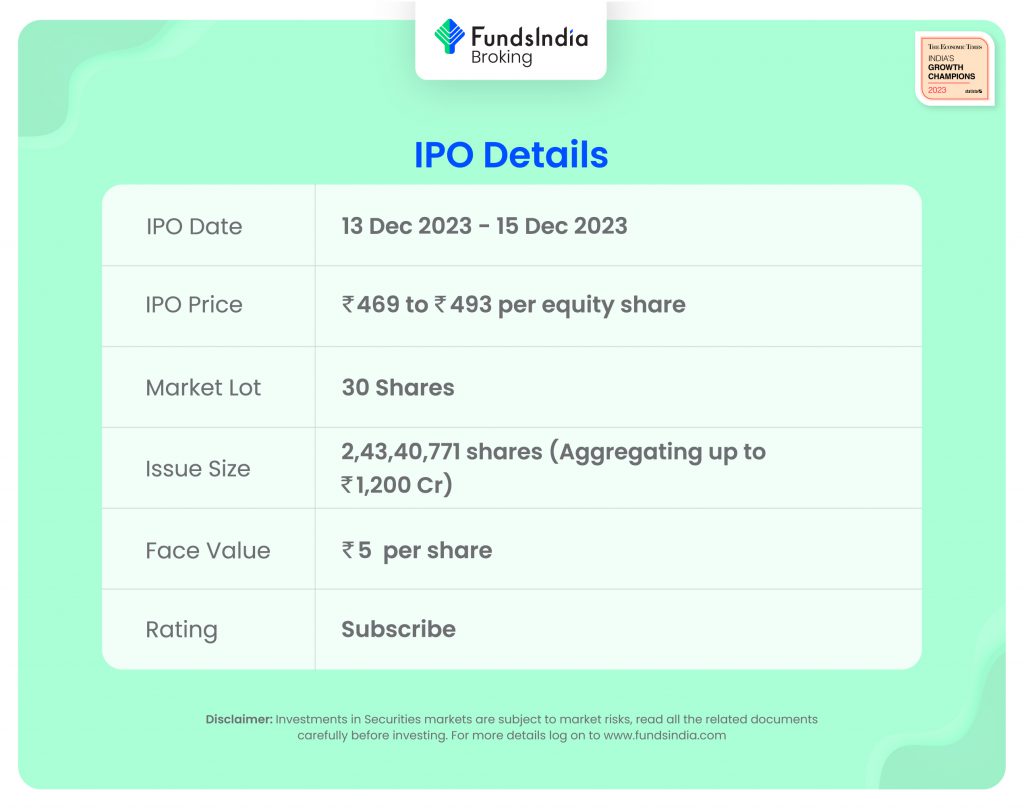

The company’s strategy of penetrative expansion across India by targeting areas with high economic growth and substantial demand for affordable housing finance for low-and middle-income groups in Tier II and Tier III cities is expected to aid the company to continue its ongoing growth for future years as well. According to RHP, Aptus Value Housing Finance India Limited, Aavas Financiers Limited and Home First Finance Company India Limited are the only listed competitors for India Shelter Finance. The peers are trading at an average P/E of 31.67x with the highest P/E of 37.70x and the lowest being 27.40x. At the higher price band, the listing market cap of India Shelter Finance will be around ~Rs.5239.22 crores and the company is demanding a P/E multiple of 33.73x based on post issue diluted FY23 EPS of Rs.14.62. When compared with its peers, the issue seems to be fully priced in (fairly valued). Based on the above views, we provide a ‘Subscribe’ rating for this IPO for a medium to long-term Holding.

If you are new to FundsIndia, open your FREE investment account with us and enjoy lifelong research-backed investment guidance.