Dr Reddy’s Laboratories Ltd – Good Health Can’t Wait

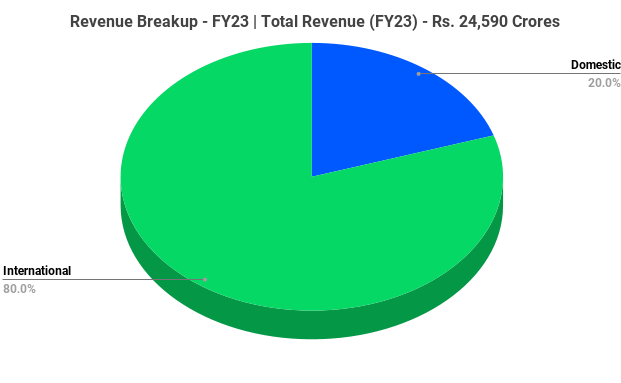

Dr Reddy’s Laboratories Ltd is a leading India-based pharmaceutical company headquartered in Hyderabad. Established in 1984, the company offers a portfolio of products and services, including Active Pharmaceutical Ingredients (APIs), generics, branded generics, biosimilars and over the counter (OTC) pharmaceutical products around the world. It’s major therapeutic areas of focus are gastrointestinal, cardiovascular, diabetology, oncology, pain management, central nervous system (CNS), respiratory, anti-infective and dermatology with major markets including USA, India, Russia & CIS countries, China, Brazil and Europe. As of 31 March 2023, with 25,000+ employees, the company has 22 manufacturing facilities and 8 R&D facilities spanning across the globe.

Products & Services:

The company operates across two key business segments – Global Generics (GG) and Pharmaceutical Services, and Active Ingredients (PSAI). GG includes branded and unbranded prescription medicines, biosimilars as well as OTC pharmaceutical products. PSAI comprises of APIs and Aurigene Pharmaceutical Services (APSL).

Subsidiaries: As of FY23, the Company had 40 overseas subsidiary companies (including stepdown subsidiaries), nine subsidiary companies (including step-down subsidiary) in India and one joint venture.

Key Rationale:

- Expansion plans – Dr Reddy’s completed integration of the cardiovascular brand Cidmus acquired from Novartis in India during FY23. This is expected to strengthen the company’s presence in chronic space in India. It also acquired US generic prescription product portfolio of Australia based Mayne Pharma Group Limited, and some key branded and generic injectable products from Eton Pharma. This will complement the company’s US retail prescription pharmaceutical business with limited competition products. Company’s plans to set footprint is progressing positively acquiring 6 approvals during FY24 as of 30 September 2023. The company is expecting to file for approval of more than 15 products in a year now and China portfolio is expected to contribute from next fiscal year.

- Product portfolio diversification – During Q2FY24, the company launched 4 new products in North America whereas in Europe and Emerging Markets, the new products launched totalled to 20 and 32 respectively. The company launched its first digital therapeutic product ‘Nerivio’ in India, addressing the unmet need of migraine patients. They also launched a direct-to-consumer platform, ‘celevidawellness.com’ for serving the needs of diabetic patients in India. The company is waiting approval for biosimilar Rituximab in US and European markets, expecting the launch in the beginning of FY25.

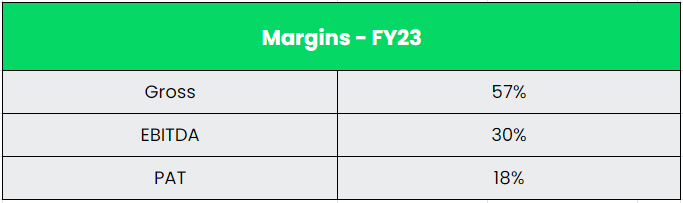

- Q2FY24 – Dr Reddy’s reported a consolidated revenue of Rs.6880 crores, an increase of 9% compared to Rs.6306 crores of Q2FY23. The EBITDA for the quarter is Rs. 2181 crores and the EBITDA margin is 32%. The profit after tax stood at Rs.1480 crores which is a robust growth of 33% as compared to the Rs.1113 crores of same period in the previous year. The net profit margin is 22%. The growth was driven by new product launches and base business transaction despite this growth being constrained by price erosion and increased competition.

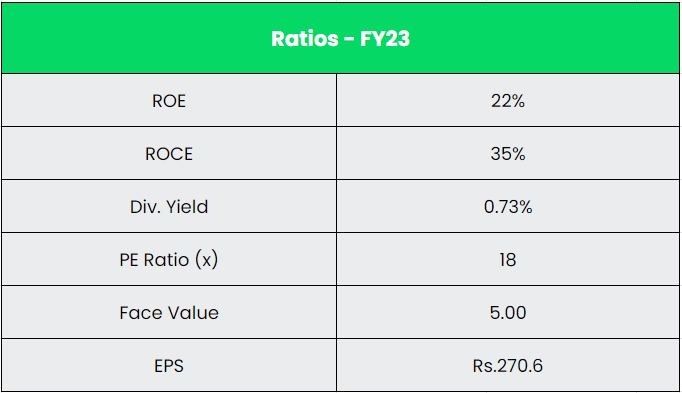

- Financial Performance – The company has generated a revenue and PAT CAGR of 12% and 39% over the period of 5 years (FY18-23). Average 5-year ROE & ROCE is around 15% and 16% for FY18-23 period. The company has strong balance sheet with debt-to-equity ratio of 0.05.

Industry:

The Indian Pharmaceutical industry is currently ranked third in global pharmaceutical production by volume with a CAGR of 9.43% since the past nine years. India is the largest provider of generic drugs globally and is known for its affordable vaccines and generic medications. India has the highest number of pharmaceutical manufacturing facilities that are in compliance with the US Food and Drug Administration (USFDA) and has 500 API producers that make for around 8% of the worldwide API market. The Indian pharmaceutical industry is projected to grow at a CAGR of over 10% to reach a size of US$ 130 billion by 2030. The domestic pharmaceutical industry would likely reach US$ 57 billion by FY25 and see an increase in operating margins of 100-150 basis points (bps). It includes a network of 3,000 drug companies and ~10,500 manufacturing units. The biosimilars market in India is estimated to grow at a compounded annual growth rate (CAGR) of 22% to become US$ 12 billion by 2025. This would represent almost 20% of the total pharmaceutical market in India.

Growth Drivers:

The Indian Ministry’s scheme “Strengthening of Pharmaceutical Industry (SPI)” with a total financial outlay of US$ 60.9 million (Rs. 500 crore) extends support required to existing pharma clusters and MSMEs across the country to improve their productivity, quality and sustainability. The Government has set a target to increase the number of Pradhan Mantri Bhartiya Jan Aushadhi Kendras to 10,500 by March 2025. The product basket of PMBJP comprises 1,451 drugs and 240 surgical instruments. The Department of Pharmaceuticals will soon launch the Scheme for the Promotion of Research and Innovation in Pharma (PRIP) MedTech Sector. The scheme has been approved by the Union Cabinet for a period of five years starting from 2023-24 to 2027-28 with a total outlay of Rs. 5,000 crore (US$ 604.5 million).

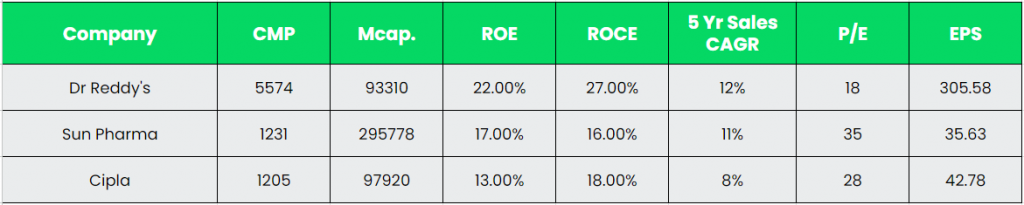

Competitors: Sun Pharmaceuticals Industries Ltd, Cipla, etc

Peer Analysis:

As can be seen in the comparison, Dr Reddy’s is ahead of the above competitors in terms of key performance metrics. The higher return ratios and earnings highlights the company’s ability of optimal utilisation of invested capital.

Outlook:

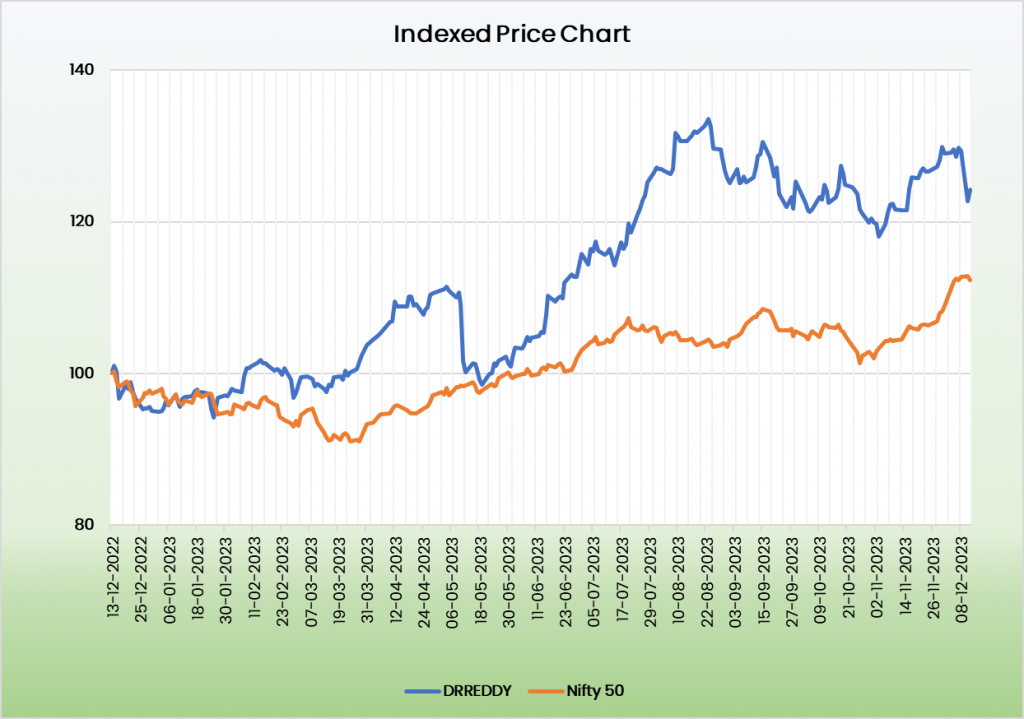

Dr Reddy’s has established position as one of leading Indian pharmaceutical companies. The company has strong cash accrual generation and liquidity position. It is focusing on launching new products and entering new markets while also targeting to increase its market share in existing business lines. Margins are expected to largely sustain over the long term. The company’s strong cash reserve coupled with low reliance on debt has continued to result in a strong capital structure. The management is expecting to utilise the surplus cash reserves to capitalise on short term and long-term deals which will help in generating growth for the company.

Valuation:

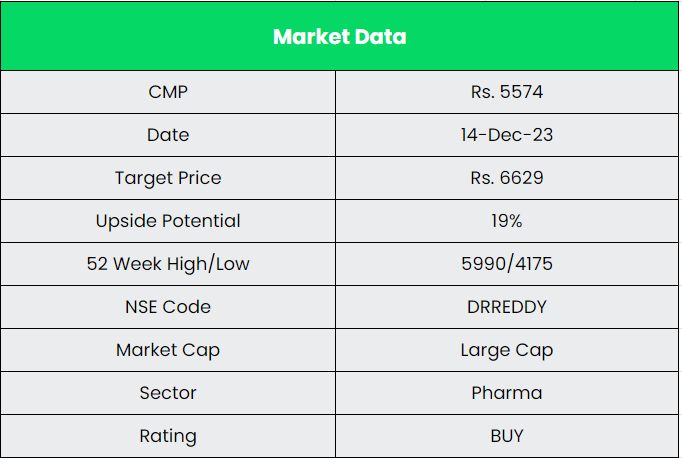

We believe Dr Reddy’s Laboratories Ltd is in a position for robust growth in the coming years. It’s growing market share in the existing business and upcoming projects the company has in pipeline places it in a position for a strong growth potential. We recommend a BUY rating in the stock with the target price (TP) of Rs.6629.

Risks:

- Forex Risk – The company has significant operations in foreign markets and hence is exposed to forex risk. Any unforeseen movement in the forex market can adversely affect the company.

- Regulatory risk – The industry is highly susceptible to regulatory changes, and this might result in limitation/ban of certain products, affecting revenue. The operations are exposed to regulatory risk, including scrutiny by regulatory agencies like the USFDA which might lead to restrictions/ban in products, affecting company operations.