There are essentially three key ingredients for building wealth,

- Savings rate – How much can you save and invest?

- Time – How long can you stay invested?

- Returns – How much returns can you get from the investment?

But, out of these three factors, most of us spend the maximum time & effort on improving the third ingredient – Returns.

Why?

Now, tell me honestly. Who wants to increase savings and stay patient. This is super boring.

We have had enough of the ‘eat your veggies, exercise everyday’ kind of advice.

Higher returns on the other hand, is super fun, exciting and can get us sorted once and for all!

While the attempt is perfectly fine, there is, however, a small underrated problem.

Returns are not completely under our control.

Sample this:

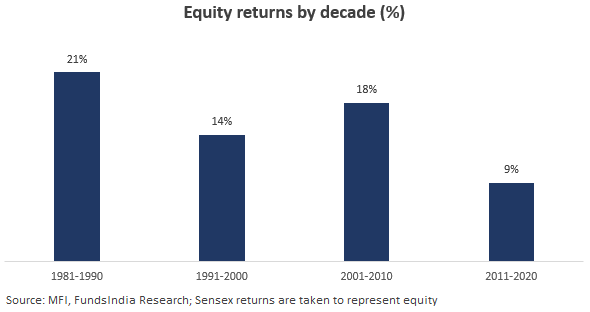

Equity returns have been different across different periods

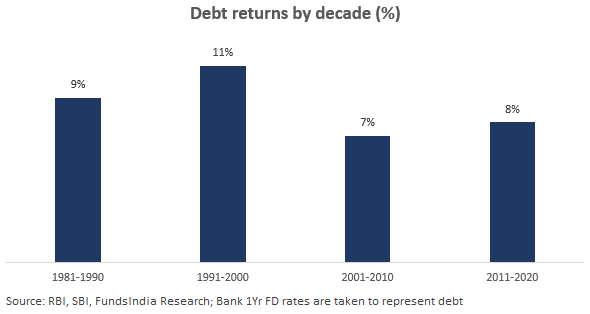

Debt returns have also been different across different periods

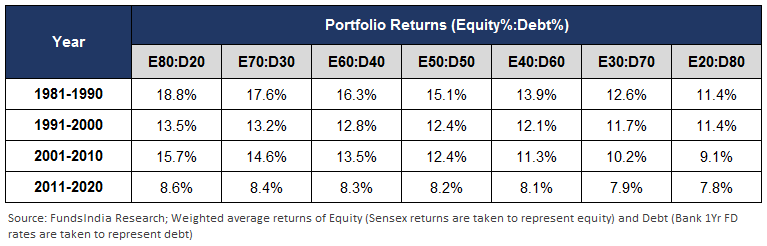

To understand this better, let us look at the returns of a simple portfolio that invests only in Equity and Debt. This is how our portfolio would have performed for different Equity and Debt allocations.

The same portfolio has led to completely different returns based on the period in which we started to invest. While the returns have been decent enough, how high our returns will turn out also has a component of ‘luck’.

We usually tend to underestimate the contribution of luck.

If we end up on the wrong side of luck this may lead to the biggest risk – falling short of the money required to fulfil our goals.

Think about it – how painful would it be if you were forced to work in your retirement due to shortage of money or compromise on the house that you wanted to buy all your life etc.

While no one can predict the exact equity returns of the future, the practical way out is to build some room for error in our investment plan just in case our expected returns don’t materialize.

Now, how do we do that?

We need to shift our attention to the other ingredients that are under our control – ‘Time’ and ‘Savings Rate’.

The power of the underrated ‘Savings Rate’ and ‘Time’ in increasing your wealth

Most of us usually save and invest some part of our salary every month.

What if we decide to increase our monthly savings by just Rs 1000…

And add to it the power of a long time frame…

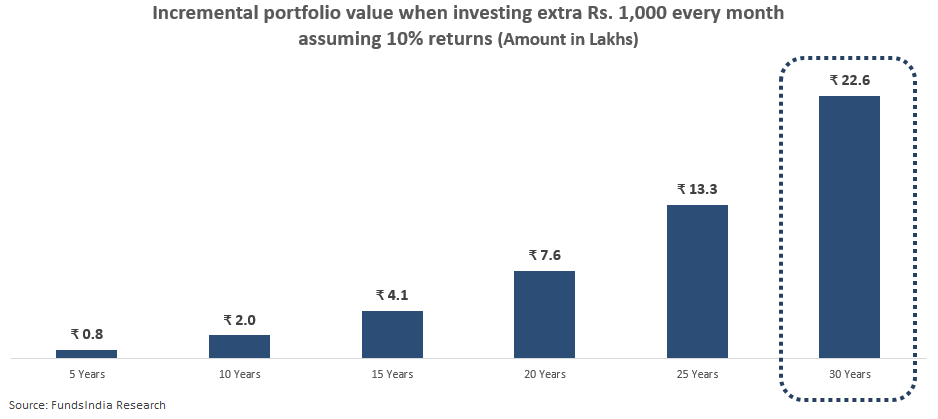

Take a guess what a decent 10% returns can do to this small increase in savings over the next 30 years

A whopping Rs 23 lakhs!

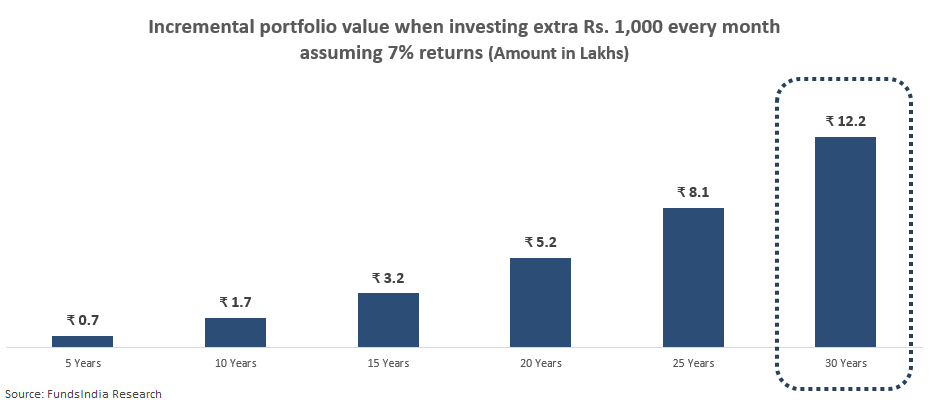

Even at 7% returns (historical long term debt fund returns), we end up with incremental savings of Rs 12 lakhs.

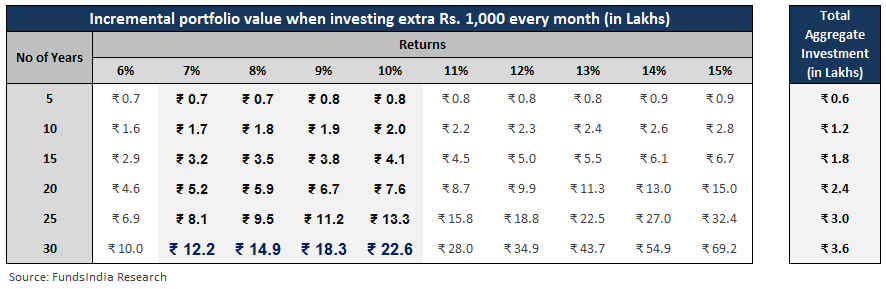

The below table depicts the power of investing a thousand rupees every month consistently for 5 to 30 years at different return expectations.

By simply investing an extra amount of just Rs.1,000 every month and adding the power of time (30 years), we end up adding Rs 12 lakhs to Rs 23 lakhs to our final portfolio value, at a reasonable return expectation of 7-10%.

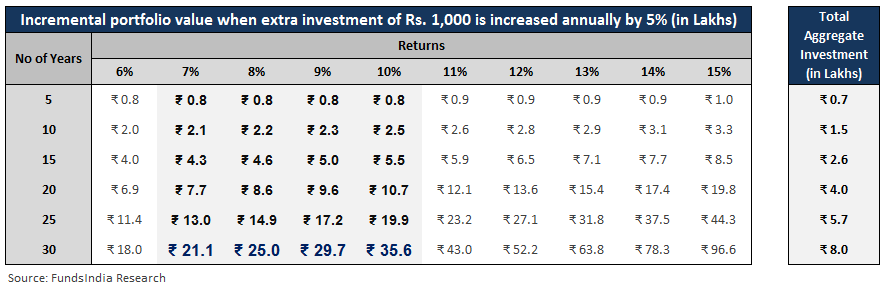

What if we increase the extra savings of Rs. 1,000 annually by 5%?

By simply investing an extra amount of just Rs.1,000 every month and increasing it by 5% every year for 30 years, we end up adding a whopping Rs 21 lakhs to Rs 36 lakhs to our portfolio value, at a reasonable return expectation of 7-10%.

Savings Rate and Time – The Underrated Components of Wealth Creation

The simple and boring takeaway for us is that even a small increase in our savings combined with the power of time can significantly add up to our overall portfolio value over the long run.

So as we try and attempt to increase our returns, let us also make a decent attempt to improve our humble savings rate and provide our portfolios with a long enough time frame for compounding to work its magic.

While there is no sacrosanct level of savings rate for everyone and will differ for each of us based on our unique circumstances, a minimum of 30% savings rate is a good benchmark to target.

If your savings rate is lower, this is a far simpler problem to focus and improve. The best part is – it’s completely under your control. This can have a meaningful and as large an impact as trying to improve your portfolio returns.

So here is a simple ask – before we spend all our energy and time on improving returns, let us also give the humble and underrated ‘savings rate’ and ‘time’ a little attention that they always deserved!

Happy Investing as always 🙂