Action Construction Equipment Ltd – Lifting India’s Growth

Incorporated in 1995 and headquartered in Haryana, Action Construction Equipment Limited (ACE) specializes in manufacturing cranes, material handling equipment, road construction machinery, and agricultural tools like tractors and harvesters. With manufacturing facilities in Haryana, ACE offers over 60 products and has a presence in 100+ locations across India. As the world’s largest pick-and-carry crane manufacturer, ACE operates in 37 countries, including regions in the Middle East, Africa, Asia, and Latin America, serving sectors like construction, manufacturing, logistics, and agriculture.

Products and Services

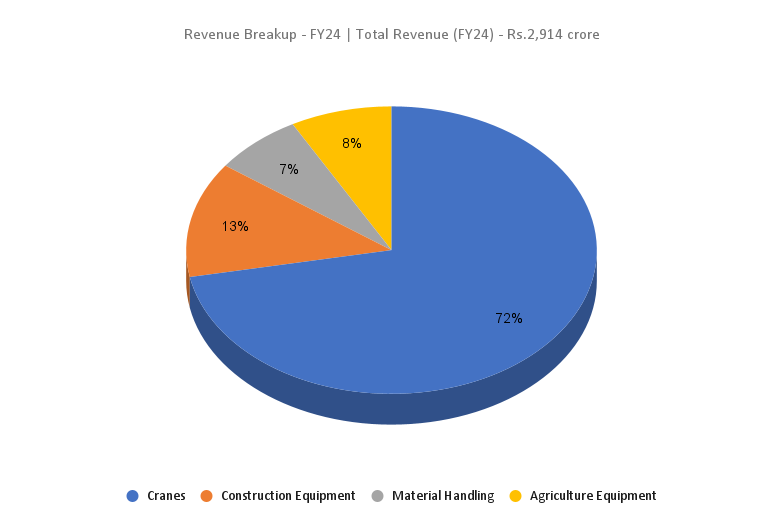

The company operates across four main segments:

- Cranes: Pick & carry cranes, lorry loaders, rough terrain cranes, crawler cranes, truck cranes, and tower cranes.

- Construction Equipment: Backhoe loaders, telehandlers, vibratory rollers, motor graders, and access platforms.

- Material Handling: Forklift trucks, warehousing equipment, and piling rigs.

- Agri Equipment: Tractors and track harvesters.

Subsidiaries – As of FY24, the company has 2 subsidiaries and a partnership firm.

Growth Strategies

- Forming a joint venture with Japan’s Kato Works Limited to manufacture medium and large-sized cranes for the Indian market, with subsequent plans to target export markets.

- Developed India’s first fully electric mobile crane, pending government approval, with higher pricing reflecting superior efficiency.

- New product lineup, including 45-ton and 60-ton cranes, is expected to drive higher profit margins.

New Opportunities:

- Aiming to significantly increase export revenue over the next 2-3 years with innovative products like the Forma Range of Tractors and “Phantom 4×4” Backhoe Loader.

- Upgrading products to meet CEV IV emission norms by January 2025.

- Recent launches include India’s largest mobile crane, aerial work platforms, and next-gen 35-ton 4×4 cranes.

Financial Performance

Q1FY25

- Revenue reached ₹762 crore, marking a 14% growth compared to ₹668 crore in Q1FY24.

- EBITDA increased by 29% to ₹126 crore, up from ₹98 crore in Q1FY24.

- Net profit grew by 24%, rising from ₹68 crore in Q1FY24 to ₹84 crore this quarter.

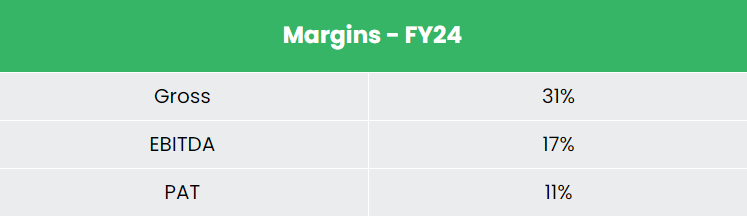

- EBITDA margin improved by 212 bps to 17%, while net profit margin expanded by 107 bps to 11%, driven by better price realization, an improved product mix, and efficient cost control measures.

FY24

- Revenue reached ₹2,914 crore, reflecting a 35% increase compared to FY23.

- Operating profit surged by 83% to ₹480 crore.

- Net profit climbed 90% YoY, reaching ₹328 crore.

Financial Performance (FY21-24)

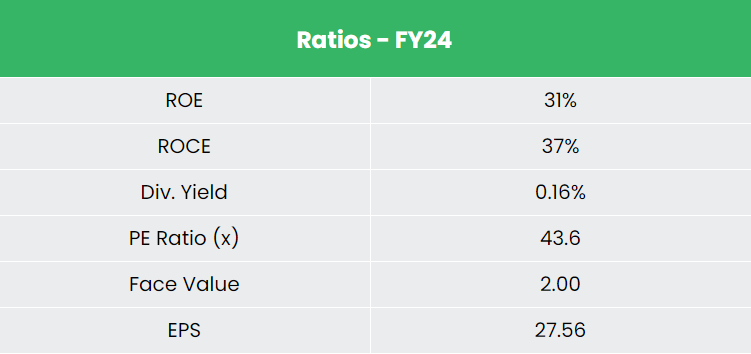

- The company’s revenue and PAT CAGR over the past 3 years (FY21-FY24) are approximately 33% and 63%, respectively.

- The 3-year average ROE and ROCE stand at around 23% and 30%, respectively.

- The company maintains a debt-free capital structure, showcasing its financial prudence and strong fundraising capabilities.

Industry outlook

- India has tripled its capital expenditure over the past 4 years, significantly boosting economic growth and job creation.

- Demand for construction machinery and equipment surged, leading to a 26% increase in manufacturing sales, reaching 135,650 units in FY24.

- Ongoing infrastructure projects, including airports, railways, ports, and metro systems, continue to strengthen the construction market, indicating a promising future for the industry.

Growth Drivers

- Capital investment outlay of ₹11.11 lakh crore (US$ 133.86 billion) for infrastructure in the Interim Budget 2024-25, marking an 11.1% increase.

- 100% Foreign Direct Investment (FDI) permitted in key sectors like roads and highways, railways, ports & harbours, and urban development projects.

- Government initiatives such as Atmanirbhar Bharat Abhiyaan, Metro Rail expansion, and Pradhan Mantri Awas Yojana (PMAY) are expected to boost demand for construction equipment in India.

Competitive Advantage

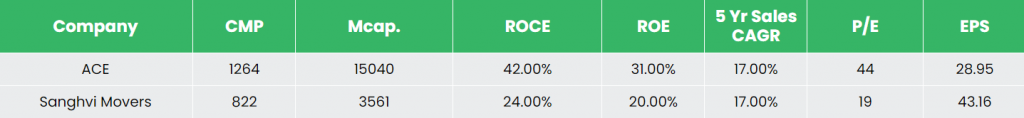

Sanghvi Movers is the only listed competitor of ACE operating in similar business and comparable market cap. Compared to its competitor, the company has better return ratios and stable revenue growth, indicating the company’s financial stability and its efficiency in generating income and returns from the invested capital.

Outlook

- The company is well-positioned to expand further across diverse industries.

- FY25 guidance includes 15-20% top-line growth with additional margin expansion.

- Expected growth rates: 20% in cranes, material handling, and agri portfolios; 30-40% in the construction segment.

- The joint venture with Kato is anticipated to create new business opportunities.

- Ongoing focus on research and development for innovative products is a key strength.

- Evolving product mix, capacity expansion, and export market opportunities support continued growth momentum.

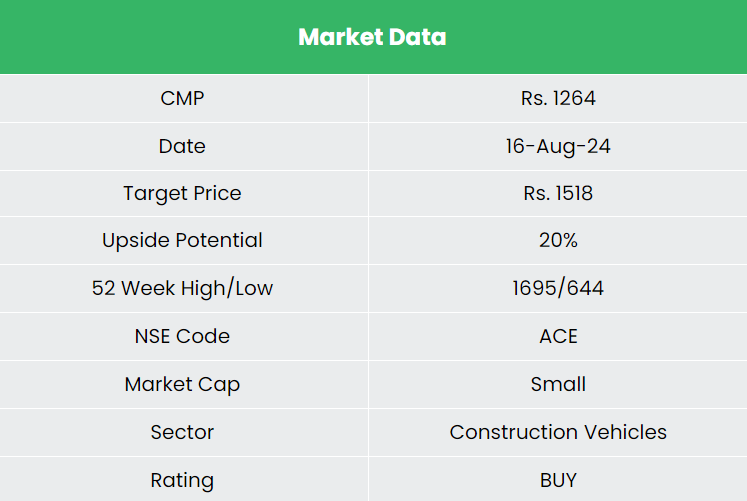

Valuation

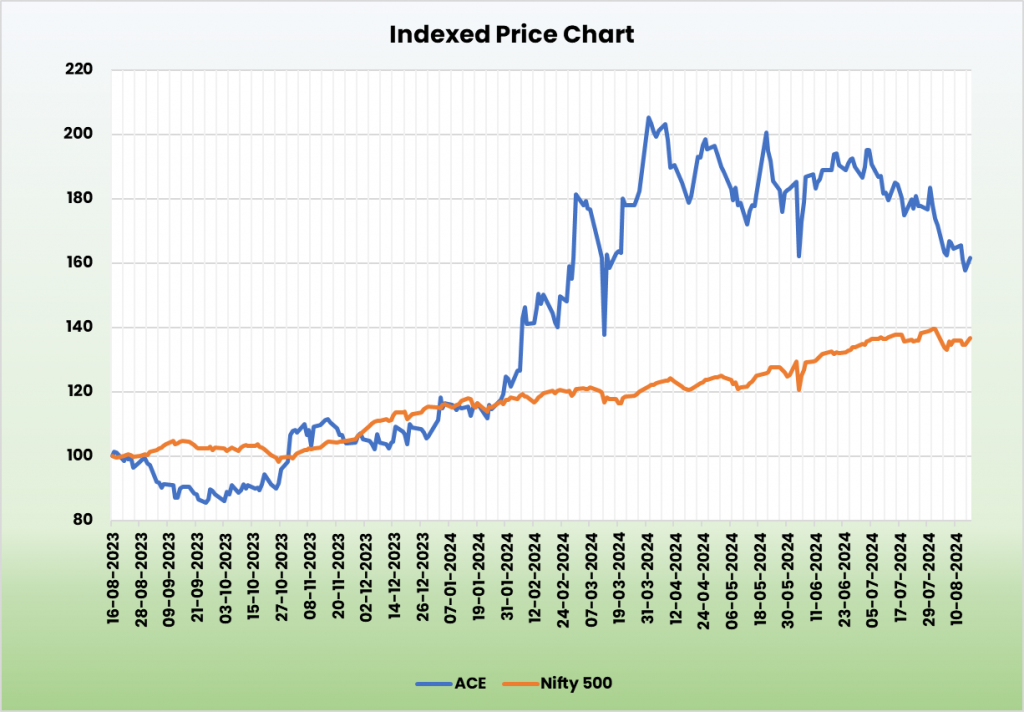

Government’s ongoing focus on infrastructure spending and ACE’s strong brand reputation provide clear revenue visibility for the medium to long term. We recommend a BUY rating for the stock with a target price (TP) of ₹1,518, representing 33x FY26E EPS.

Risks

- Slowdown in Economy: An economic downturn could lead to reduced capital expenditure on infrastructure projects, potentially impacting the company’s turnover.

- Raw Material Price Volatility: Fluctuations in raw material prices and demand may affect earnings and cash flow.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

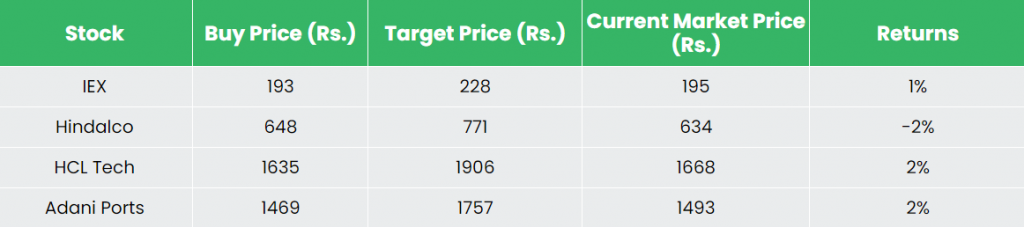

Recap of our previous recommendations (As on 16 August 2024)

Adani Ports & Special Economic Zone Ltd