Make your move before elections

November 26, 2018Many of you fear market volatility or market reactions to the elections. This is not surprising. Political stability would be a clear positive for the markets, while a government change…Continue Reading

FundsIndia Recommends: Axis Long Term Equity

November 21, 2018With only a few months left to the end of this fiscal, you will be looking for avenues to save on taxes. Axis Long Term Equity, an equity-linked savings scheme,…Continue Reading

Should you invest in Motilal Oswal Nasdaq 100 FoF?

November 14, 2018If there is an equity market that is less correlated to the Indian market and provides a diverse set of companies to invest in, it is the US market. Hence,…Continue Reading

FundsIndia Recommends: HDFC Small Cap

October 31, 2018HDFC Small Cap is a recent addition to our Select Funds list. With a 1-year loss of 0.5%, the fund is among the few small-caps whose 1-year returns aren’t deep…Continue Reading

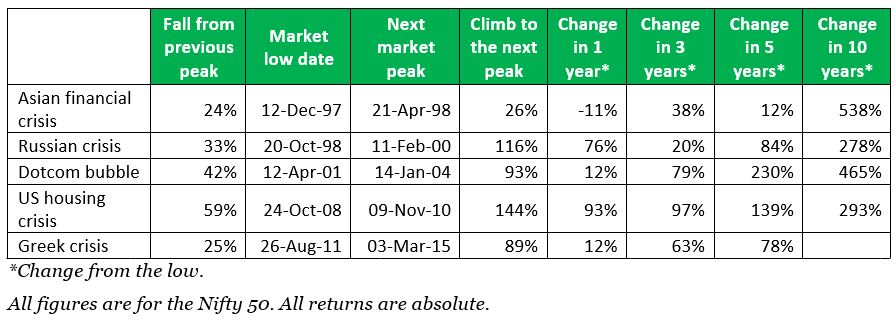

How much markets have crashed and risen

October 29, 2018There are concerns all round – climbing crude oil prices, depreciating domestic currency, escalating trade wars that are already beginning to bite, warnings over slower global economies and US corporate…Continue Reading

FundsIndia Recommends: Franklin India Corporate Debt

October 24, 2018These are times when debt mutual funds appear to be operating on the extremes – taking credit risks for higher returns or playing it very safe and compromising on returns.…Continue Reading

Is the correction good enough to invest?

October 22, 2018Markets have been falling steadily over the past two months. The Sensex and the Nifty 50 have lost more than 12% and the broader markets have seen a deeper fall.…Continue Reading

Changes to FundsIndia’s Select Funds

October 17, 2018These are tough times for equity and even debt markets and for mutual funds. A host of global and domestic factors have sent markets into worry mode. Against this backdrop, we…Continue Reading

FundsIndia Views: What to make of the market fall

October 10, 2018The Nifty 50 is down 12% from its 52-week high on August 28, 2018 and the Nifty Midcap 100 is down 26% from a similar high on January 23, 2018.…Continue Reading

FundsIndia Views: Do actively managed funds underperform benchmarks?

October 3, 2018Over the last couple of years, there has been a lot of talk about index funds. Some are convinced that index funds are better than actively managed funds. Some say…Continue Reading