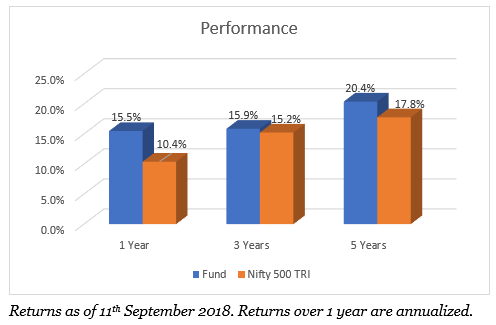

Why: Excellent at containing downsides and makes for a good portfolio diversifier Whom: Moderate to high risk investors with at least a 5-7 year horizon Among equity funds, Parag Parikh Long Term Equity stands apart. Its difference comes from its portfolio, its strategy, and its performance. The fund is categorised as a multicap fund, and has delivered an annualised 19.1% since its launch five years ago against the 15.5% of the Nifty 500 TRI. In the 1,3, and 5-year periods, the fund’s returns beat the Nifty 500 TRI by a margin of 1-5 percentage points. It’s also in the top quartile when compared to peer funds that invest across market capitalisations. Strategy Parag Parikh Long Term Equity (Parag Parikh LTE) picks stocks on a value basis. It holds a compact portfolio. Therefore, there is no sector bias and its overlap with the Nifty 500 is minimal. Its focus on early identification of companies with long-term prospects saw it picking stocks such as Zydus Wellness, Maharashtra Scooters, and ICRA early on. While some stocks may have corrected in the year to date, they have nevertheless made the fund good money. There are other equity funds that have a similar bottom-up and benchmark agnostic strategy. Where Parag Parikh LTE differs is that it keeps churn to a minimum of just 10% and truly follows the buy-and-hold approach. This is its first differentiating strategy. In the year so far, for example, the fund has added one stock and exited one stock. In 2017, it added 3 stocks and exited 5. Some of its holdings, such as Mahindra Holidays, Mphasis, Maharashtra Scooters have been part of the portfolio for five years now. The closest comparable to this fund is Motilal Oswal Multicap 35 but that fund follows a more growth-oriented approach. That brings up the second differentiator. Parag Parikh LTE looks for value across the globe. So, if it can hold a company in the same field for a lower valuation overseas, it goes for it. Examples include Nestle SA instead of Nestle India, 3M instead of 3M India, Suzuki Motor Corp, instead of Maruti Suzuki. The third differentiator is the international exposure. Parag Parikh LTE can invest up to 35% of its portfolio in overseas securities; historically, international holding has been around a quarter to 30% of the portfolio. This gives it the ability to hold stocks that aren’t present in the domestic market, such as Alphabet Inc., Facebook, IBM, and Apple. With limited but adequate foreign stocks, the fund provides a tax-efficient international exposure. To ensure that currency movements do not impact returns, the fund hedges nearly its entire currency risk. The fourth differentiator is that the fund can hold cash if it does not find investment opportunities and it can take arbitrage exposure. Since mid-2017 for example, derivative exposure has climbed from 10% to 18% of the portfolio. The fund has moved to arbitrage in periods such as mid-2015 as well. This keeps volatility and downsides low.

Performance The fund’s recent returns have it beating other multicap funds (including categories such as value, dividend yield, etc) by a solid 10 percentage points. Taking cash positions and hedging to contain downsides, holding a compact portfolio and holding foreign stocks have all helped deliver superior returns. But over the long term, the fund picks up well. It is able to beat the Nifty 500 TRI index 92% of the time when rolling 3-year returns since inception. The average of these 3-year returns if 16.29% against the Nifty 500 TRI’s 14.3%. The funds’s value-based approach, ability to hedge risk, and its overseas exposure have all helped limit return fluctuations. The fund keeps downsides contained far better than multicap and even large-cap peers. Its worst 1-year performance since 2014 was a loss of 4.9%. Peers slid much more on a 1-year basis. Suitability Parag Parikh LTE is a good option to bring in diversity to a portfolio. However, the fund requires a timeframe of 5-7 years at the minimum, given it’s long-term, value-oriented strategy. The fund suits investors with a moderate to high risk appetite. Rajeev Thakkar, Raunak Onkar, and Raj Mehta are the fund’s managers. It has an AUM of Rs 1,352 crore. FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis for investment decisions. To know how to read our weekly fund reviews, please click here.

Top ten holdings - August 2018

Stock % holding

Alphabet Inc. 9.81%

Bajaj Holdings & Investment 5.88%

HDFC Bank 5.63%

Facebook Inc. 5.13%

Suzuki Motor Corp (ADR) 5.03%

Zydus Wellness 4.72%

Balkrishna Industries 4.61%

Persistent Systems 4.32%

Nestle SA-ADR 3.26%

Mphasis 3.11%

The long-term, value-rooted, buy-and-hold nature of Parag Parikh LTE sees it underperforming in the short term as some of its value picks (like Mphasis, for example) take remain flat for long, before they deliver. Therefore, on a 1-year basis, the fund beat the Nifty 500 TRI only 60% of the time since its inception.

The long-term, value-rooted, buy-and-hold nature of Parag Parikh LTE sees it underperforming in the short term as some of its value picks (like Mphasis, for example) take remain flat for long, before they deliver. Therefore, on a 1-year basis, the fund beat the Nifty 500 TRI only 60% of the time since its inception.Other articles you may like

What: Equity fund that invests across domestic stocks and in foreign securities

[fbcomments]

It is not a comment, but a question.

Do you have facility to align the present portfolio with recommended one, similar to icicidirect.com. or a facility similar to scripbox.com?

Hello Sir, Sorry I don’t follow your question. What exactly did you mean by align? Do you mean bring your holdings outside, into the platform? If so, yes. If you mean consider that for adviory review, yes we do if information is provided. Thanks, Vidya

What I mean is this.

Redeem all the present holdings.

Buy only those funds recommendeded by funds india.

Parthasarathy

What I mean is this.

Redeem all the present holdings.

Buy only those funds recommendeded by funds india.

Parthasarathy

It is not a comment, but a question.

Do you have facility to align the present portfolio with recommended one, similar to icicidirect.com. or a facility similar to scripbox.com?

Hello Sir, Sorry I don’t follow your question. What exactly did you mean by align? Do you mean bring your holdings outside, into the platform? If so, yes. If you mean consider that for adviory review, yes we do if information is provided. Thanks, Vidya