Over the last couple of years, there has been a lot of talk about index funds. Some are convinced that index funds are better than actively managed funds. Some say that actively managed funds are effectively defrauding investors by charging exorbitant expense ratios. This article will seek to explore whether these views stem from performance metrics, in the Indian context.

How did index investing emerge?

In the 1950s, American investor John C. Bogle conducted a study for his undergraduate thesis. He found that most mutual funds in the US failed to beat their benchmark index. Some of the funds did beat the benchmarks, but couldn’t pass on the benefits to the investors as the charges were higher than the margin of outperformance. Hence Bogle concluded that it was better for retail investors to invest directly in the index.

In 1976, Bogle launched the first passively managed fund, also known as an index fund, based on the S&P 500. The fund was called Vanguard 500 Index fund. This index constitutes the 500 largest companies in the US market. Because it was passively managed, Bogle charged a very low fee. Later Bogle launched more funds, but the Vanguard 500 Index fund remains the most popular fund till date.

Relevance in the Indian market

While index investing has a big market in the US, its relevance in the Indian context is debatable for various reasons. The number of actively traded companies in India is significantly lower than that of the US. That means markets are far less efficient thus providing enough opportunities to generate alpha. Besides, the size of the mutual fund industry in India compared with the total market capitalisation is insignificant. For example, the size of MF industry crossed 16% of total market cap only last year. As opposed to this, MF AUM accounts for over 85% of the total US market cap. In addition to that, indices in India are not managed the same way as the S&P 500 of the US. Popular Indian indices simply weigh the components based on their market capitalisation. The S&P 500 weights are actively decided.

What about fund performances in India

Looking at returns today might convince you that active funds are on the decline in our markets as well. But it is not that simple. Looking at performance history and trends in funds will give a better understanding of where active funds stand. There are two questions which need to be answered for this analysis:

- Which funds to include

- What period to consider

In trying to strike a balance between the above two questions, we considered data for the last 11 years and include all open ended equity funds which existed as on 31st July 2007 and have survived till date. This gave us a sample of 110 funds. We used this period because it covers a wider universe of funds and incorporates different market cycles.

Looking at fund performance

We divided the fund into five different categories, ELSS funds, large-cap funds, midcap funds, multicap funds, and small cap funds. We compared each category of funds to a common benchmark, using the TRI version of the indices. We used the following benchmarks:

| Category | Benchmark used |

|---|---|

| ELSS Funds | NSE Nifty 500 TRI |

| Large-cap funds | S&P BSE 100 TRI |

| Mid-cap funds | NSE Midcap 100 TRI |

| Multi-cap funds | NSE Nifty 500 TRI |

| Small-cap funds | S&P BSE Small cap TRI |

Based on these, we assessed the performance on three different parameters:

- Rolling returns

- Margin of outperformance

- SIP performance

Performance based on rolling returns

When it comes to assessing returns, rolling returns (as opposed to point-to-point returns) is a superior metric to look at since it helps assess performance irrespective of when you invested. Looking at the performance of the fund on a single day would be like watching a match where Sachin Tendulkar scored a duck and pronouncing him to be a poor batsman. We all know that is not the case; consistency matters more. So we look at the rolling returns of funds, which gives us an idea of how funds have performed over time.

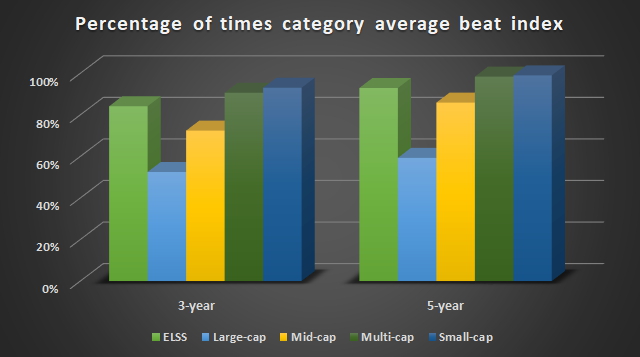

For this analysis, we looked at 3-year and 5-year rolling returns of funds. On a 3-year rolling return basis, apart from large-cap category, all other categories beat their indices over 70% of the times in the last 8 years. The large-cap category still managed 53%.

On a 5-year rolling return basis, multi-cap and small-cap funds have almost always beaten their indices over the last 6 years. ELSS and mid-cap funds have managed to beat the indices around 90% of the times. Large-caps beat the index 60% of the time.

Here is a graph showing how often category averages beat benchmark indices:

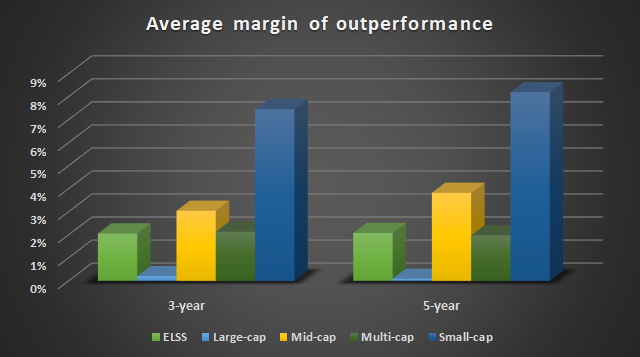

Margin of outperformance

Margin of outperformance is calculated by subtracting the average rolling return of the index from the average rolling return of the benchmark.

The average margin of outperformance is very small for large-cap funds, slightly more for multi-cap and ELSS funds and bigger for mid-cap and small-cap funds. Again, the margin of outperformance was higher over a 5-year period.

What the numbers say is that outperformance still exists in most fund categories, especially over the longer term. Given that equity funds are meant to for long timeframes, market-plus returns are not a thing of the past.

You might argue based on recent fund performance as they all seem to be undershooting their benchmarks. We’ve explained the reason for this in earlier posts. To recap, the primary reason behind the recent underperformance is that benchmark returns are being driven by a small set of stocks while the broader market is in a corrective phase.

This apart, going by the historical rolling return, funds also tend to underperform towards the end of a long bull run. Outperformance is also higher in the year following a correction. This stems from the point that quality funds tend to become cautious and move to cheaper stocks when valuations are high triggering an underperformance. This also helps push returns when markets recover.

SIPs beat the market all the time

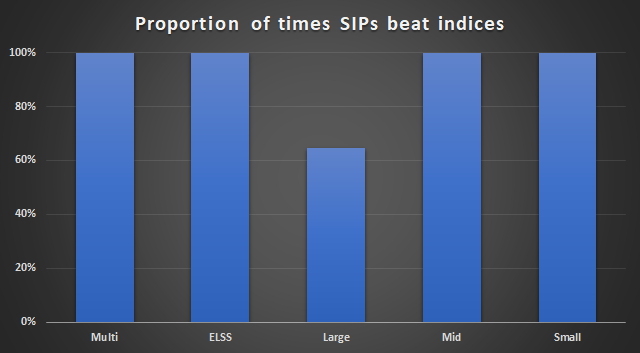

SIP is a popular method of investing in mutual funds. So we looked at how SIP investments compare with the benchmark. You might conclude that the same outperformance metric would apply to SIP investments too. But here’s the actual trend – SIP returns is where the actively managed funds deliver the knockout blow. We took a 5-year SIP for this purpose as that is the normal holding period recommended for equity funds. We took the value of SIPs starting at various points, on 5 dates of each month, starting August 2007.

SIP performance is where actively managed funds outshine the indices. Barring large-cap funds, all other categories beat the indices on all occasions – not 75% or 90%, but 100% of the SIPs beat the index SIPs.

SIPs help smoothen out the market volatility and average your costs. This also means that investing through the period of fund underperformance helps average costs down. When funds move back into outperformance, the lower costs help pull returns higher. Regardless of when you started the SIP in the last 11 years, you would have beaten the index on a 5-year basis.

What’s the way forward?

We can definitely observe that large caps have found it difficult to beat indices. With the exception of Aditya Birla Sun Life Frontline Equity, no other fund has consistently beaten the benchmark index.

In this space, funds would have to be cost conscious to generate superior returns and the recent change in total expense ratio might help pass on higher returns to investors. Still, the period of high return outperformance in the large-cap space may well not come by again. In other categories, the challenge is the changing nature of the market. Ten years ago, funds found it easier to beat the index since the market was less developed with more information arbitrage. Discovering new stocks was easier as the information flow was lesser. This opportunity has reduced now. Hence, only select funds with the right strategies and stock picks outperform. That also means that there been a significant variation in the performance of funds even within a category, with fewer funds managing consistent outperformance.

On the other hand, there is the emergence of newer index funds such as the Nifty Next 50 that can provide competition, especially to the large-cap category. Smart-beta and multi-factor index strategies which decide stock allocations based on factors such as sector/ theme, volatility, valuations, fundamental metrics and so on are also emerging; albeit with limited awareness at this stage. These have the potential to outperform the traditional market-cap weighted indices. For example, the Nifty Next 50 is one index which has managed to beat traditional large cap indices like Nifty 100 as well as some multi-cap funds.

These emerging products, which may be little more actively managed than traditional indices, may provide efficient substitutes to the lagging segments in mutual funds.

Should you invest in actively managed funds

Our answer would be an overwhelming yes. While sustained bull runs like the present one do reduce a fund manager’s ability to outperform benchmarks, in the long run, there is no doubt that fund managers have delivered returns higher than indices.

But fund selection plays an important role, to ensure that you are with the fund that is able to beat the market on a sustained basis. This comes from having a clear strategy and being able to adapt to the changing nature of the market. This, along with investing through SIPs provides significant chances of beating the market.

Our market indices are not yet at the stage where it becomes impossible to beat them. This apart, currently, index fund returns remain poor due to management costs and tracking error. Our analysis shows us that on a 3-year basis, there is an approximate tracking error of close to -1%. This means fund returns will be a percentage point below the index itself!

Also, the concern of underperformance is mainly in the large-cap space. Investors can reduce the risk of underperforming by carefully mixing large & mid and multicap funds. These funds not only offer higher returns than large cap funds, they also have a high historical track record of outperforming their benchmark.

Coupled with the fact that AMCs currently mostly offer funds only based on large cap indices, you do not have much choice in the mid-cap and small-cap space at all. So by investing only in index funds, you will lose out on the superior return potential of companies outside the index, which is where stock discovery happens in the first place!

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis for investment decisions. To know how to read our weekly fund reviews, please click here.