Tags: Mutual funds

RSS feed for this sectionFundsIndia Recommends: Mirae Asset India Equity

April 3, 2019Mirae Asset India Equity is among the steadiest equity funds. It beats the broad-market Nifty 500 TRI index all the time in any 3-year period since its inception. The average…Continue Reading

FundsIndia Recommends: DSP Equity Opportunities

March 27, 2019DSP Equity Opportunities fund has traditionally been a volatile, opportunistic fund that can swing either way, heavily, in the short term. This large & midcap equity fund had one such…Continue Reading

FundsIndia Recommends: Invesco India Growth Opportunities

March 13, 2019Large-and-midcap funds play a unique role in a portfolio. They straddle the middle ground between midcap funds and multicap funds. In this category, Invesco India Growth Opportunities is a good…Continue Reading

Why hybrid aggressive funds underperformed large-cap funds

March 11, 2019On a 1-year basis, hybrid aggressive funds are in the low single digits at just 1.2% on an average. Not just that, the category was clocking 1-year losses in preceding…Continue Reading

FundsIndia Recommends: Franklin India Prima

March 6, 2019From the peak in January 2018, midcap stocks have been on a downward slide. The Nifty Midcap 100 TRI lost 17.7% from then till date. 4 in every 10 midcap…Continue Reading

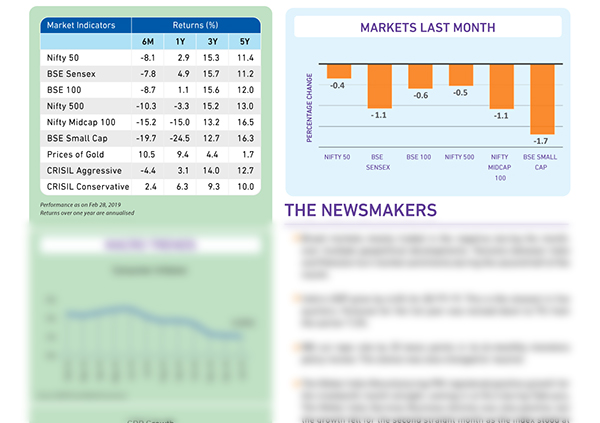

Monthly Market Insight – February 2019

March 3, 2019The February 2019 edition of FundsIndia’s Monthly Market Insight discusses the changes in the debt fund landscape and the various investment options that will help you build wealth. Broad markets…Continue Reading

FundsIndia Reviews: UTI Transportation and Logistics Fund

February 27, 2019Investors with a penchant for risk and those who do not have exposure to thematic funds can consider limited exposure (5-10% of total equity) to UTI Transportation and Logistics Fund…Continue Reading

FundsIndia Reviews: UTI Equity

February 20, 2019Among multicap funds today, UTI Equity holds a 1-year return of 3.8% at a time when most peers and the Nifty 500 TRI are sporting losses. This is a far…Continue Reading

FundsIndia Recommends – Aditya Birla Sun Life Tax Relief ‘96

February 6, 2019Haven’t invested enough to save taxes yet? Consider Aditya Birla Sun Life Tax Relief ’96, an ELSS fund that qualifies for deductions under Section 80C of the Income Tax Act.…Continue Reading

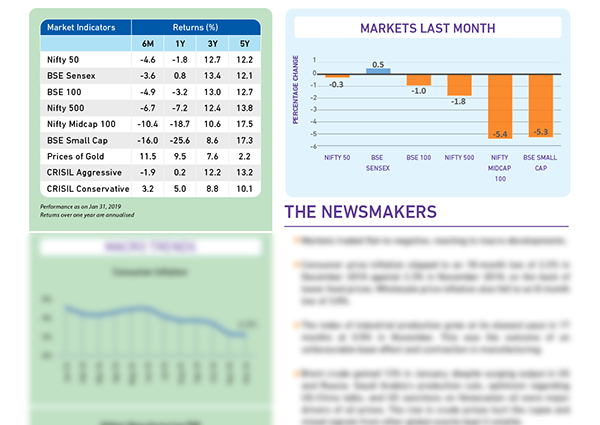

Monthly Market Insight – January 2019

February 2, 2019The January 2019 edition of FundsIndia’s Monthly Market Insight discusses the interim budget and how it could affect your tax outgo in the upcoming year. The Interim Budget of 2019…Continue Reading