Given the recent sharp decline in equity markets, it is natural for us to extrapolate this trend to the near future. Add to it, the concerns regarding the safety of our families, continuing lockdowns, high likelihood of a slowdown in global economic growth.

In this worrisome backdrop, investing in equities at this juncture is not something that makes us comfortable. Most of us would want to wait till there is some clarity or evidence on how the Coronavirus will be contained, before deciding to invest.

While the above thought process makes intuitive sense, there are a few not-so-obvious perspectives which bring out the difficulty in catching the bottom.

Perspective 1: Markets recover before the actual economic/earnings recovery

As we had discussed in our previous article here, markets are forward-looking and usually recover much ahead of the economic and earnings growth recovery, in the midst of bad news.

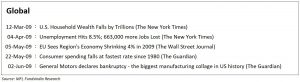

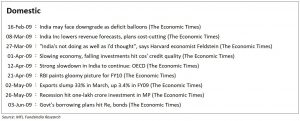

News headlines negative even as the market starts recovering

The magazine covers in 2009 give us a sense of how scary the news was, while the market silently started to recover in the middle of all this.

The takeaway for us is that, if we wait to invest only after the earnings/economy recovers or news turns positive, it might become too late. The markets usually recover much ahead of the actual earnings or economic recovery.

Now, one way to workaround this issue would be…

Ok. So let me not wait till the earnings or economic recovery. But the moment the market breaks the negative trend and starts going up, I will invest.

Sounds intuitive, but there is a small catch.

Perspective 2: A bear market decline includes several false upside rallies

The journey of a bear market decline is not a one-way smooth straight line. There are several false-upsides during the decline.

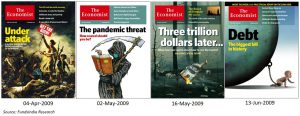

In fact, the recent bear market is no exception.

Till 23-Mar-2020, there had been a sharp continuous decline in the markets from the February peak levels.

But suddenly, in the next 3 days, there was a sharp up-move of ~15%.

So was 23-Mar-2020 the market bottom.

How do you know if this is a false rally or the beginning of a real rally?

The news is bad. The economy is yet to recover. But again markets usually move much ahead of the actual recovery.

This is the real dilemma which makes timing the bottom, a very difficult endeavour.

As we write, on 07-Apr-2020, the markets are up by 9% in a single day.

Is this a false rally – or the real one?

We will never know for sure, except in hindsight.

Perspective 3: The real recovery is difficult to identify and participate as we are psychologically anchored to lower levels

The more the false rallies, the more they lull you into complacency. When finally the real rally begins, we begin to think – we have seen this before – this too will be false. To add to our woes, even a real recovery has lots of false intermittent declines which convinces us that this one is also false.

And most importantly we are still anchored to the lower levels. For example, in today’s situation, most of us are anchored to the 26,000 levels of Sensex which it reached on 23-Mar-2020. This makes it difficult to invest as we keep expecting a fall again towards those levels since we have seen these levels before.

Take away: Psychologically it is extremely hard to invest back at higher levels.

Perspective 4: The recoveries are extremely fast

The initial recovery is extremely fast – usually, the first 1 to 3 months capture most of the recovery gains. Sample this – During the market recovery of the 2008-09 Sub Prime Crisis, the markets went up a whopping 85% in the first three months.

Take away: The cost of delay is substantial.

While waiting for the bottom seems to make intuitive sense, in reality, it is far easier said than done.

The combination of continuing bad news, several false rallies and psychological anchoring to lower prices makes it extremely confusing and difficult to identify and participate in a recovery. Since the recoveries are extremely fast, the risk of missing out a substantial portion of the recovery is very high.

Now that we realise that waiting for the bottom to invest is extremely difficult, what do we do?

Start with gradual and incremental investments into equities

The current valuations (measured via MCAP/GDP, Price To Book, Price To Earnings multiples) post the decline indicate attractive future return potential from this juncture.

So, instead of waiting to catch the exact market bottom (which we will only know in hindsight), we would recommend taking a gradual and incremental approach where you start investing a small portion of your cash on a regular basis. If there are sharp further corrections, the amount deployed can be increased aggressively.

Here is a simple plan to follow (which can be evolved based on your personal risk profile and time frame)

- Invest 1% of your earmarked amount into equities daily (this can be automated via a process called Systematic Transfer Plan)

- If markets decline by 40% i.e Sensex@26,000 – Invest up to 50% of your earmarked amount in equities

- If markets decline by 45% i.e Sensex@24,000 – Invest up to 75% of your original earmarked amount in equities

- If markets decline by 50% i.e Sensex@22,000 – Invest entire 100% of your earmarked amount in equities

You can also read a detailed explanation of the above strategy here.

This is really a hard time for the whole world