Impacted by Coronavirus and the associated economic crisis, markets world-over have come off their highs. In India, the S&P BSE Sensex has fallen close to 27% from its previous peak.

The S&P BSE MidCap Index and the S&P BSE SmallCap Index too are down 38% and 49% respectively from their earlier highs. Valuations have turned cheap and the future return environment for equities has become attractive. For more details, see our earlier blog ‘Things under our control’.

Prompted by the steep correction, a few fund houses have also recently reopened their small cap funds to lump sum subscriptions by investors.

For patient investors wanting to make use of this opportunity, there is one more question left to be answered.

Should I invest in Large cap or Mid-cap or Small cap funds?

One possible way is to find out how the large cap, mid-cap and the small cap indices (we take indices as proxies for funds) have fared in the past, around market bottoms.

Investing at the bottom

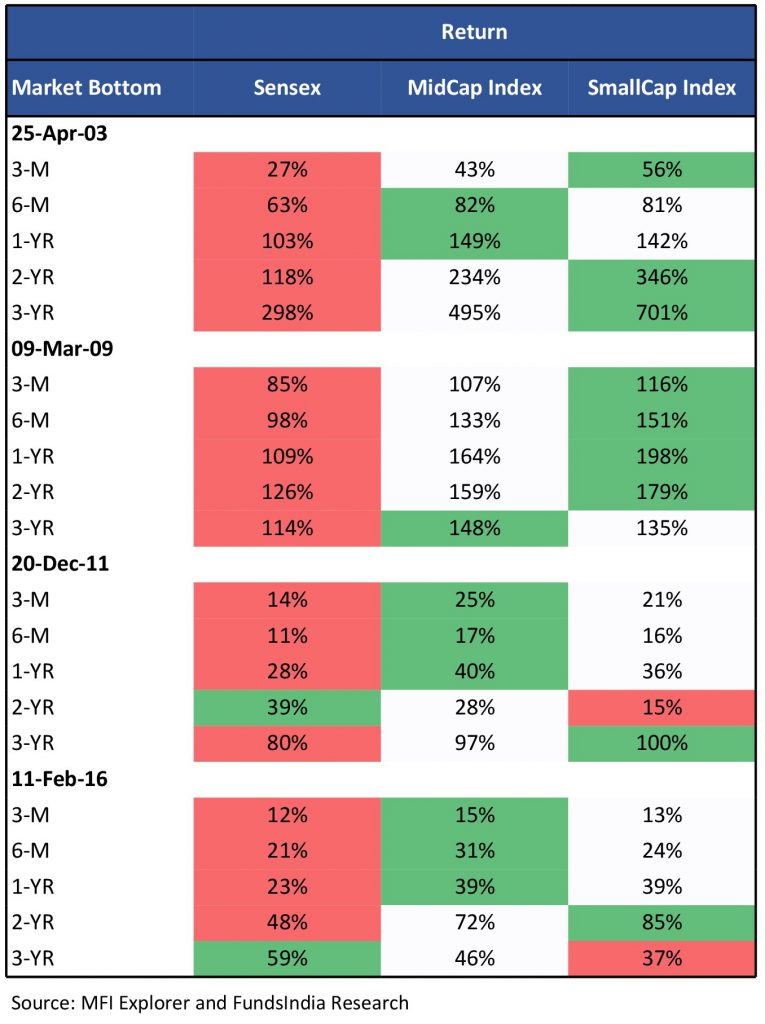

We take data on the S&P BSE Sensex (large caps), the S&P BSE MidCap Index and the S&P BSE SmallCap Index, from April 2003 till date. Let’s see how these indices did after a market bottom.

What were the 3 and 6-month and 1,2 and 3-year returns for these indices?

See the table below (green indicates the highest return, white the second-highest and red the lowest).

As you can see, if you had invested in the MidCap Index or the SmallCap Index at a market bottom, your returns would have surpassed those from the Sensex (large caps) and, by a good margin in many cases.

This was true not just for those who stayed invested long-term but also in the short-term.

That’s because mid-caps and small caps tend to rise more (or capture more of the upside) compared to large caps in periods when the markets are moving up.

This becomes clear from the capture ratios. An Upside Capture Ratio of 135% for the MidCap Index and 162% for the SmallCap Index imply these indices have risen more than the Sensex during a market up-cycle.

An Upside Capture Ratio of greater than 100% indicates that the MidCap / SmallCap Index has captured more of the upside relative to the Sensex in periods when the markets are rising. Likewise, a Downside Capture Ratio of more than 100% means the indices have captured more of the downside when the markets are falling.

The only two periods where the Sensex did better was where the investment was made on 20 Dec-11 (for 2 years) and on 11 Feb-16 (for 3 years).

Where’s the bottom?

The results are not surprising. But, they can be achieved only if you invest at the market bottom. And there’s no way knowing if you are at the bottom except for in hindsight.

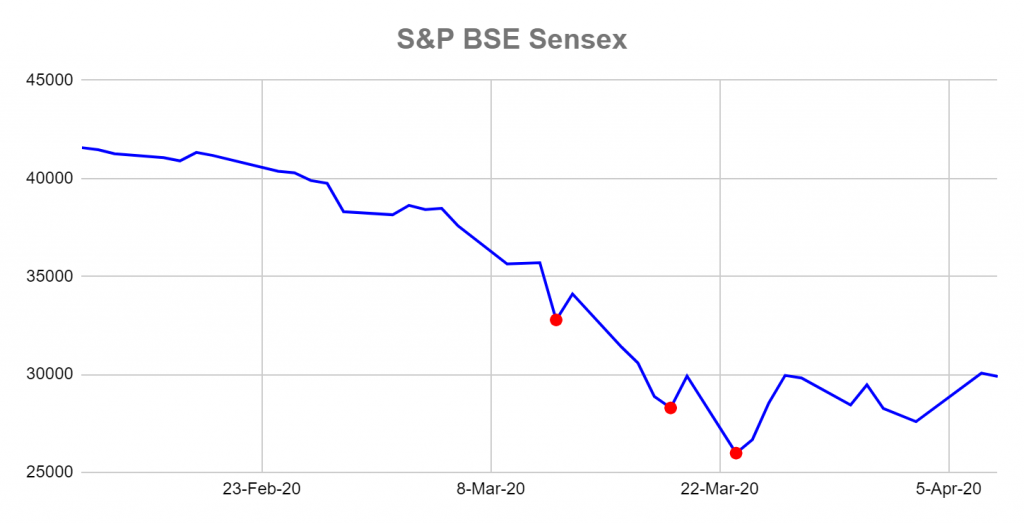

Take the last one or two months – equity markets have been very volatile. See the chart below.

Every time the Sensex went up (after 23 Mar, for instance), it was hard to tell if the market had bottomed out and had started recovering or if it was only a temporary rise. For more on this see our earlier blog Things No One Tells You About ‘Exit Now and Enter Later’.

So, it’s unrealistic to assume that investors can precisely predict and therefore invest at the bottom.

You are probably going to invest at a point where the markets have fallen sharply but may not still have bottomed out (though one doesn’t know it then).

Alternatively, you may go past the bottom (without realizing it) and then invest.

What happens to your returns then?

Investing before the bottom

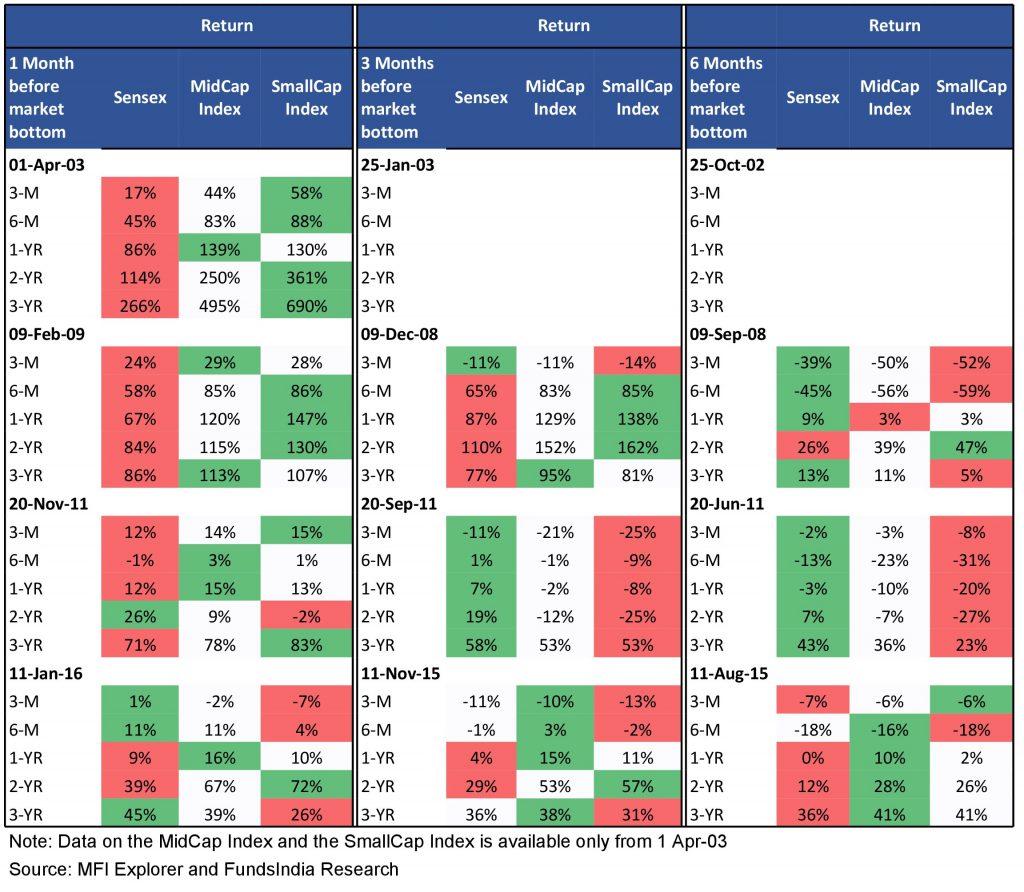

Let’s assume you invest a few months (1/3/6 months) before the market bottoms out.

Do mid-caps and small caps still give you the best deal? Not quite.

In fact, no one single category – large, mid or small – has outperformed in all cases, in the past.

See the tables below.

Investing 1 month before the bottom

If you had invested a month before the market bottom of Apr-03, Mar-09 and Dec-11, the MidCap Index and the SmallCap Index would have given you better returns (across tenures) than the Sensex.

But it wouldn’t be so if you had invested a month before the Feb-16 bottom.

Investing 3 months before the bottom

For an investment made 3 months before the market bottom, no single index would have been the all-time outperformer. For instance, the SmallCap Index would go from being the best bet, if the investment was made 3 months before the Mar-09 bottom to being the worst choice, if it was made before the Dec-11 bottom!

Investing 6 months before the bottom

It would have been the same story for an investment made 6 months before the market bottomed out.

That is, no single index turns out to be a consistent outperformer (across tenures) when you invest 1/3/6 months before a market bottom.

This is in contrast with what happened when the investment was made at the bottom. Then, the MidCap Index and the SmallCap Index outperformed the Sensex.

What’s happening?

How does investing a few months before the bottom make such a difference to the conclusions? As mentioned earlier, mid-caps and small caps capture more upside than large caps when the market is rising. But they also capture more of the downside when the market is falling (on its way to the bottom).

A Downside Capture Ratio of 153% for the MidCap Index and 200% for the SmallCap Index imply that these indices have fallen more than the Sensex (or captured more of the downside) in periods when the markets fell.

In the end, it’s a combination of the index fall during the market slide and the index gain during the market rise that determines the overall index return.

Investing after the bottom

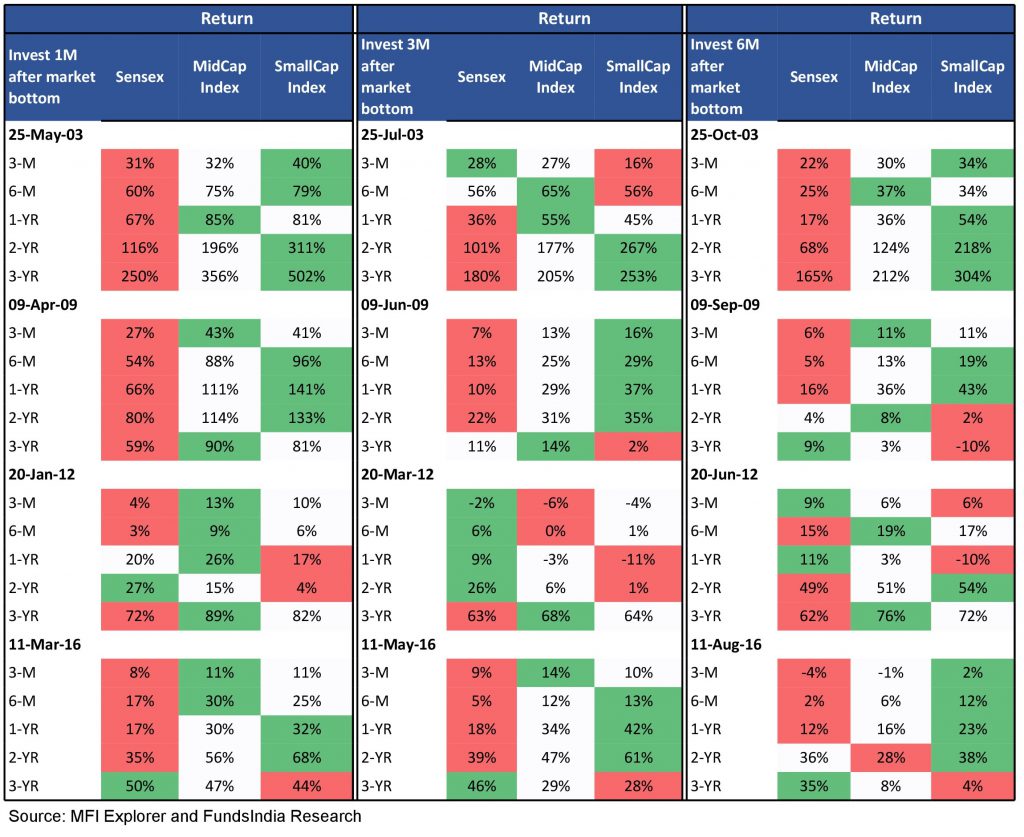

We now consider the third case – where you wait for the bottom, miss it and then invests once the market starts going up. That is, let’s consider an investment made 1/3/6 months after the market bottoms out.

What do we find?

The story repeats. See the tables.

Investing 1 month after the bottom

An investment made a month after the bottoms of Apr-03, Mar-09 and Feb-16 would have been best made in the MidCap Index and the SmallCap Index rather than the Sensex. It isn’t that clear cut when we consider the Dec-11 bottom.

Investing 3 months after the bottom

Similarly, if you had invested 3 months after the market bottomed out on Mar-09 and Feb-16, your best bets would have been the MidCap Index and the SmallCap Index. But, not so for the Dec-11 bottom.

Investing 6 months after the bottom

Once again, you get a mixed picture on which is the outperforming index.

So, except for when you invest at the market bottom (which we don’t know), you can’t be sure whether the large, mid or small cap index will be the outperformer.

Summing it up

- Unless you can precisely predict and invest at the market bottom, in which case mid-caps and small caps generate the best returns going forward, it is difficult to pick any one category – large, mid or small – which is an outperformer at all times, when you invest a few months before / after the bottom.

- One doesn’t know at the time of investing if that is indeed the bottom or whether the market will decline further.

- More importantly, while the MidCap Index and the SmallCap Index have outperformed the Sensex – all the time (when you invest at the bottom) and several times (when you invest before/after the bottom) – the Sensex returns by themselves (in an absolute sense) have been impressive too even though not the highest. Please see the tables once again.

- Also, the downside risk with the Sensex (large caps) is lower than that with mid-caps and small caps, which can cushion your returns if the markets fall further.

As things stand today, we don’t know whether the market has bottomed out or will fall further.

Given this and the points discussed above, we recommend that conservative investors should consider investing in large cap funds.

Those with a higher risk appetite, can however consider taking a small exposure to mid caps and small caps. This, they can do by investing in multi-cap funds (funds that invest in a mix of large, mid and small cap stocks).

We recommend multi-cap funds with a large cap bias, that is those with 65-80% of their portfolio in large caps and the rest in small and mid-cap stocks.