Should we press the ‘exit’ button?

Most of us at this juncture, will have a narrative similar to this running in our minds..

- Coronavirus is dangerous and it’s spreading across the world

- It will have a negative impact on business & economy

- Sharp fall in oil prices is adding to the worries on global growth

- There can be second order impacts (unintended consequences) which we don’t know yet

- It has already kicked off of a sharp equity market decline

- This decline will continue

- I should sell my current equity holdings to avoid further impact

- I can enter back at lower levels

Conclusion: Let me exit now, and enter later at lower levels

While logically the above argument makes perfect sense, we think there are several challenges in executing the above view.

Challenge 1:The market is already down more than 35% from its peak

While losses till date are still notional, the moment we sell, they become actual losses. To offset a sharp decline, historically equity markets have always provided a sharp recovery in the future.

The recoveries are usually extremely fast (sample this: 2009 recovery was 85% in the first 3 months).

If we are not able to re-enter at lower levels, the cost of missing the recovery can be significant.

Challenge 2: There are several false upsides during a market fall and several false downsides in a market recovery – How will you know the real one?

2008 Sub Prime Crisis – 61% Decline

2011 Euro Crisis – 28% Decline

2015 Chinese Market Crash – 23% Decline

Challenge 3: Market keeps alternating between positive and negative weekly returns making it – Confusing and Emotionally Challenging

Can you differentiate between the decline and recovery?

2008 Sub Prime Crisis – 61% Decline

2011 Euro Crisis – 28% Decline

2015 Chinese Market Crash – 23% Decline

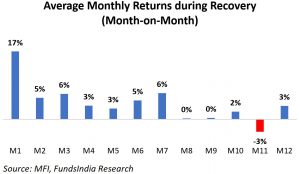

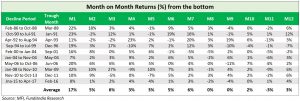

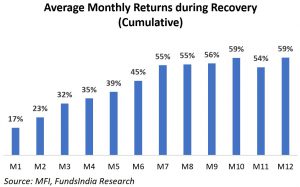

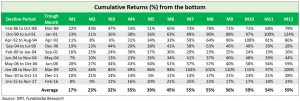

Challenge 4: The initial recovery is extremely fast – usually first 1 to 3 months capture most of the recovery gains – cost of mis-timing is substantial

The first 1-3 months end up capturing a significant portion of the recovery. The risk of delay in re-entering is significant!

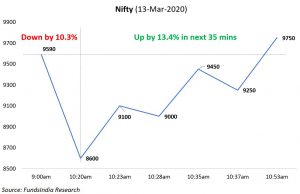

Challenge 5: The pace of moves are extremely fast

Challenge 6: We haven’t factored the government and central bank response

Negatives:

- Coronavirus Pandemic

- Sharp drop in oil prices (positive for India but negative for global growth)

- Concerns of global recession

- FII Outflows

Positives:

- Global Central Banks cutting interest rates

- Fiscal stimulus expected from various governments

- Containment of the virus in China – Incremental news flow on possible vaccine solutions and containment of the virus

- DII Flows

Historically, Governments and Central Banks have played a significant role in counteracting the negative news flow.

2008 – QE programme by global central banks + Bank Bailouts + Fiscal stimulus

2011 – “Whatever it takes” speech from European Central Bank president Mario Draghi

2013 – Raghuram Rajan’s FCNR (B) scheme under which it offered discounted currency swaps to banks to spur inflow

2016 – Chinese stock market crash – the Chinese central bank cut interest rates, the China Securities and Regulatory Commission altered regulations to increase liquidity flows into the stock market, brokerages injected funds into the market, trading was temporarily suspended etc

As these two forces counteract each other, it is extremely difficult to tell when the balance will tilt towards a recovery.

Markets usually recover much before the actual change in fundamentals, as expectations and sentiments change much ahead of time.

The important thing to remember is as the market keeps factoring in bad news, at some point in time the markets will no more be shocked by further bad news. At such low expectations, we don’t need things to move from ‘really bad’ to ‘good’. A simple change in perception from “really bad” to “less bad” is all it takes for a reversal.

Summing it up

So while it may seem logical to exit and wait for lower levels to get back in..

It is much more challenging to execute the re-entry part and the cost of delay in re-entering the markets may be significant.

While we crave for the magical solution, the painful yet honest answer continues to be – ‘Wait longer’

This article was originally published on ET Wealth. Click here to read it.