Last week, we wrote on liquid fund returns and how the high returns of 2018 have begun sliding. This trend is both on account of an abnormal credit situation easing and as market interest rates have turned. But that same interest rate turn, expectations going into 2019 that rates were headed lower and the two rate cuts we have had this year have benefited longer term debt funds. And that’s because as rates drop, bond prices rise with the effect pronounced in longer-term papers.

1-year and 6-month returns of banking & PSU, corporate bond, dynamic bond, medium-to-long duration and gilt funds have been improving of late.

Changing tide

Much of 2018 and even 2017 saw debt markets build up expectations that the Reserve Bank would raise interest rates. Inflation creeping up along with a rupee depreciation, rising crude oil prices, and higher US interest rates fed into these expectations.

Towards the close of 2018, though, this reversed. Persistent low inflation, worries over a slowdown in global growth leading to a rate hike pause globally, and cooling crude prices prompted markets into expecting rate cuts.

Bond prices and interest rates are inversely correlated – prices fall when rates go up and rise when rates fall. Gilt prices react the most efficiently to rate movements, followed by AAA bonds.

Bond prices and interest rates are inversely correlated – prices fall when rates go up and rise when rates fall. Gilt prices react the most efficiently to rate movements, followed by AAA bonds.

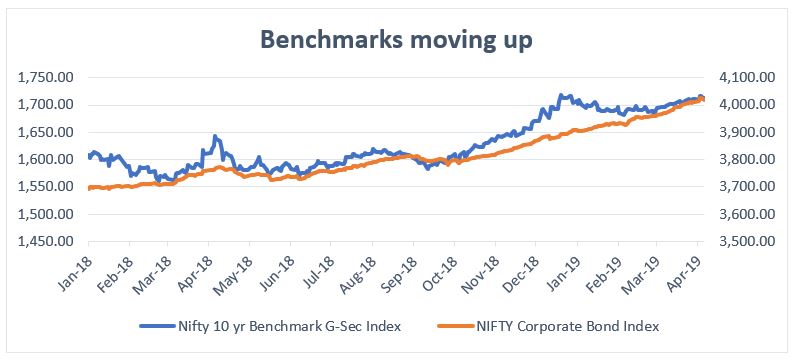

Responding to the changed interest rate outlook, yields began falling from October-November 2018. Prices began shifting higher. This period also signaled the credit scare that began in September easing, which saw short-term bond yields spike sharply.

In debt funds, there are two routes to returns. The first is plain accrual from interest earned on bonds held in the portfolio. The second is through bond price changes. The impact of these two routes depends on the average maturity of the fund.

Gaining from rate cuts

For funds with longer maturities, the impact of bond price changes is more significant than those with shorter maturities. Impact is deeper for funds that hold gilt securities, followed by those holding PSU bonds and other AAA-rated corporate bonds. Funds taking credit risk see lower impact. It also takes time for longer-duration funds to see their portfolio yields change to reflect new interest rates.

Therefore, while liquid funds saw their portfolio yields and returns drop, longer-duration funds gained from bond price rallies. 1-year returns for funds in categories such as gilt, corporate bond, dynamic bond, short duration, and banking & PSU have moved significantly higher. The lower returns these funds had generated during the 2018 upward rate cycle have reversed. On an average, 6-month returns for these categories put together have jumped to 6.4% now compared to less than 1% in June last year.

Banking & PSU funds, for instance, saw their 1-year returns jump to above 7% on an average by March 2019 compared to the 5-6% returns had been over 2018. PSU bonds are liquid and traded instruments and thus reflected rate cut expectations clearly. Funds such as Axis Banking & PSU, IDFC Banking & PSU, and Franklin Banking & PSU had even higher 1-year returns as the bulk of their portfolio were in PSU bonds. A similar story plays out in corporate bond funds with funds such as Kotak Corporate Bond, Franklin India Corporate Bond, HDFC Corporate Bond seeing a smart uptick in returns.

Gilt, gilt with constant 10-year maturity, and dynamic bond funds have seen a sharper move in returns on account of gilts reacting more. 1-year returns for constant-maturity gilt funds have shot up to 9.5-10%.

You would have noticed this improvement in debt fund returns in your portfolio already. With the Reserve Bank maintaining a neutral stance on interest rates, there may be a pause on rate cuts from here or rates may move lower. Whichever the scenario, longer-term debt funds have the advantage of locking into higher-coupon papers. This apart, price rallies may continue to sustain returns.

But before you get carried away by high returns in gilt funds, know that the interest rate scenario and bond price movement is getting increasingly tricky, as dynamic bond funds have shown over 2017 and 2018. For those of you who hold debt funds as part of your asset-allocated portfolio or as an alternative to fixed deposits, sticking to high-quality accrual is a surer bet than taking calls on duration.