The banker to the world’s economic powerhouse, the US Federal Reserve, has successfully kept the guessing game on its rates going. While the Fed’s pause led to a relief rally, we are back to volatility, thanks to different parts of the world interpreting and reacting differently to the Fed’s statements.

With an equity market that is down 8% year-to-date, we think even the much expected RBI rate cut next week may not be sufficient to push the market into a rallying zone. We do believe that the current volatility will continue for some more time even as certain green shoots on the macro and corporate side are increasingly visible. That simply means that the volatility will provide you with a good opportunity to buy into the market reasonably early.

Read on to know why we think volatility will persist even as there are positive signs of stability and early signs of growth.

Inflation expectations

The Federal Reserve’s pause together with India’s own low consumer inflation and deflation in WPI does provide room for the RBI to cut its policy rate, as many experts forecast. While the bond markets may cheer such an event with a rally, a rate cut is unlikely to cause any drastic change in the equity market’s outlook, save for a relief rally at best.

This is because, despite moving to new lows, the gap between the WPI and the CPI has widened significantly (WPI at -4.9% Y-o-Y in August and CPI at 4.1% Y-o-Y in the same month).

This suggests that despite lower input inflation, underlying capacity constraints as well as supply-side paucity is hurting, not only in products but in services as well (since CPI in household goods and services as well as health and education segments remained sticky at above 5%). This explains why inflation expectations (as surveyed by RBI) remain elevated.

Long story short, the RBI’s worries with inflation are not set to fully recede; a small rate cut notwithstanding, the RBI is likely to take a cautious approach, especially given the 16% below normal seasonal monsoon deficit. Added to this, two fiscal announcements from the government – the 50-additional working days under the MGNREGA and the One Rank One Pension scheme – may keep the RBI on its guard on terms of the government’s ability to contain fiscal deficit. This means any aggressive rate cuts, that may be needed to lift corporate mood, may not happen too soon.

Legislative and political uncertainties

Assembly elections in Bihar will be held from mid-October to first week of November in five phases with results due November 8. With the model code of conduct kicking in, reforms are set to happen at a slower pace until the election results are out.

Winning assembly elections in large states such as Bihar is crucial for the ruling party to move from its current ‘minority’ position in the Rajya Sabha, if it has to get reforms implemented.

GST, Direct Benefit transfer for subsidies on cash and fuel other than LPG, power tariff increases at state level (required for overall fiscal consolidation) divestment of PSUs, proposal on improved management of PSUs, market pricing formula for oil, restructuring of PSU banks and land reforms are some of the work-in-progress/delayed reforms that can have a direct impact on economic revival/growth.

While the good news is much of these have seen partial or significant progress, the implementation of these will be vital in terms of impact on the economy and thereby corporate earnings growth.

Need for economic growth not just stability

While India can boast of stability across various fronts – inflation, twin deficits, reserves and foreign currency movements, the stability factors appears to have been factored into the equity market for quite a while. That means, the focus would now be on growth.

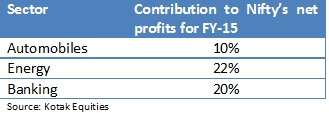

As of FY-15, over 40% of the Nifty’s net profits came from sectors such as banking and energy. These are sectors that are directly linked to macro economic variables. That means, a shift in the GDP needle is essential to influence and push corporate earnings growth for the benchmark index portfolio.

The green shoots

What are we alluding to, by stating all the above not-so-positive factors that may delay a recovery soon? We are simply suggesting that the recovery may not be too soon.

And that means not only is investor patience a key here; investor participation is THE key. Yes, while the above factors suggest that recovery is delayed, it is certainly not denied, if we read a bit into what numbers are suggesting. And here they are:

– While we discussed that the spread in WPI and CPI suggests heightened inflation expectations, the collapse in international commodity prices and input prices means that input inflation will be kept low. That means corporate profit margins can be far better without it having to translate necessarily into higher pricing by companies. This is especially possible in sectors such as energy and automobile, which account for about a third of the Nifty’s net profits. This current sweet spot is already being reflected in improved margins of companies, thus providing scope for better valuations

– The industrial recovery is slow but continues, led by the consumer sector. The IIP numbers at 4.2% y-o-y for July is encouraging, even as it ended the June quarter with 3.3%, thus showing sustained momentum. This, despite the impact of public projects and fresh investments in infrastructure not yet kicking in.

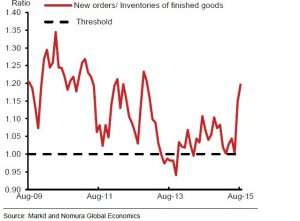

– The Purchasing Manager’s Index’ ratio of new orders to inventory of finished goods rose to a 3-year high of 1.2, from a flat zone beginning of the year. This implies that production will likely pick up in the ensuing months.

– Interestingly, while import value growth has been falling as a result of lower prices of oil, import volumes overall have remained positive in recent months. That means that domestic demand is recovering (import of goods), and is being met more by higher imports.

It is our view that the delayed recovery is an opportunity for those of you who either wish to average or enter the equity market.

Remember, your risks are lowered when you enter the market when the mood is skeptical; in a market euphoria your risks are heightened.

We reiterate our strategy on how to invest in a falling market to make the best of the delayed recovery. Do note that it is going to be hard to time the markets over the next few quarters and hence our strategies are focused on averaging smartly, than trying to time the recovery. Read our strategy here: How to invest in a falling market

Really interesting information…

Really interesting information…