This article was originally published in Financial Express. Click here to read it.

We have all heard that it’s important to have a long-time horizon when investing in equity markets via SIPs.

But have you ever wondered how long is ideally ‘long term’ when it comes to investing in Equity via SIPs?

Don’t worry, we’ve got you covered here.

Let’s put different time frames to test…

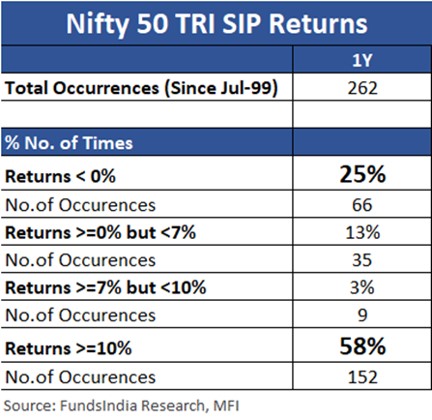

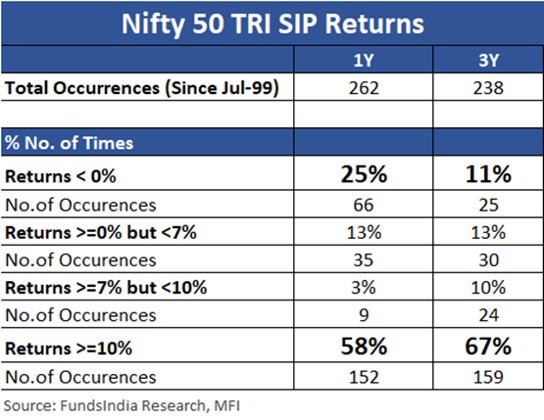

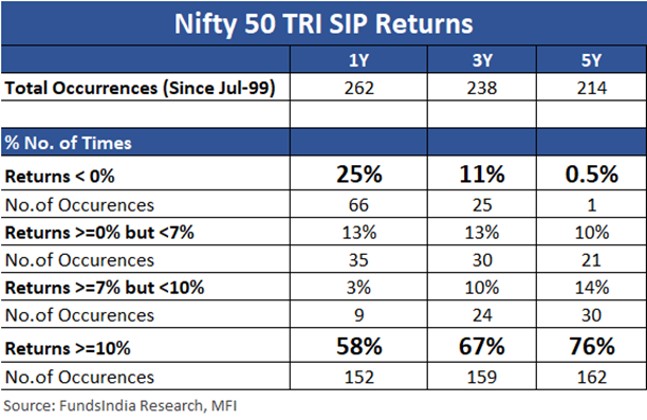

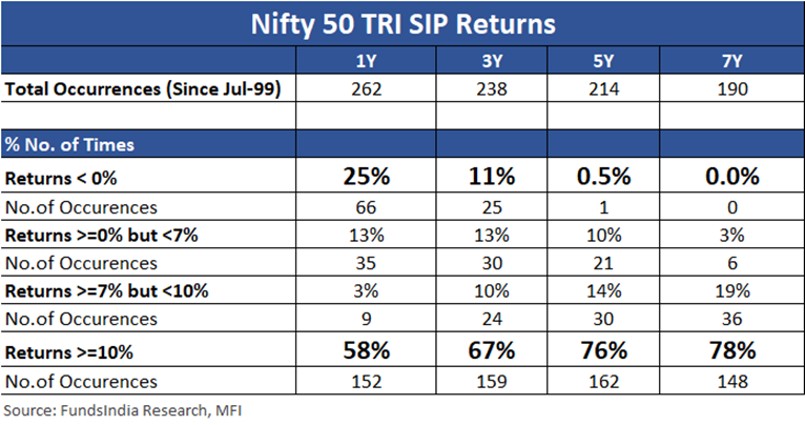

Let us evaluate SIP returns of Nifty 50 TRI over different time frames. For this, we have considered different SIP journeys starting at the beginning of each and every month from Jul-99. So the series would look for SIP journeys beginning on 01-Jul-99, 01-Aug-99, 01-Sep-99, and so on up to the present.

1 Year Time Frame

Over a 1-year time frame, there were 66 occurrences (out of 262 occurrences) where the SIP portfolio ended up making negative returns. In other words, 25% of the time which is 1 out of 4 times your Equity SIP made negative returns over a 1-year time frame.

Verdict: 1 Year is too short a time frame and definitely not suitable for Equity SIP investing.

3 Year Time Frame

When we extend the time frame to 3 years, the occurrences of negative returns are reduced from 25% to 11%. While this is definitely an improvement over 1 Year time frame, negative returns for 11% of the time are still a concern.

Verdict: 3 Year Time Frame is also not suitable for Equity SIP investing

5 Year Time Frame

Let us now extend the time frame to 5 years. Unlike 1 and 3-year time frames, the number of negative occurrences has drastically dropped. Out of a total of 214 occurrences, there was only 1 occurrence where the returns were negative!

By extending the time frame to 5 years we,

- Lower the chances of negative returns – only 0.5% of the time the portfolio gave negative returns compared to the 3Y and 1Y time frames.

- Improve our chances of better returns – 8 out of 10 times the portfolio earned returns of more than 10%

- However, there is still a 10% chance that you end up with mediocre positive returns (0-7%)

Verdict: Five-year time frame works reasonably well most of the time. But there is still a 10% chance of mediocre returns

7 Year Time Frame

Let us extend the time frame further to see what the returns looked like over a 7-year time frame,

- There were zero occurrences of a negative return

- Lower occurrence of mediocre returns – only 3% of the time the portfolio earned lower than 7% returns

- Improved our chances of better returns – 78% of the time the portfolio earned greater than 10% returns

And the winner is…

Verdict: Investors who invest in equity SIPs should choose a time frame of at least 7 years – this helps to increase the odds of reasonable returns and reduce the odds of mediocre/negative returns.

But why do the returns improve with time?

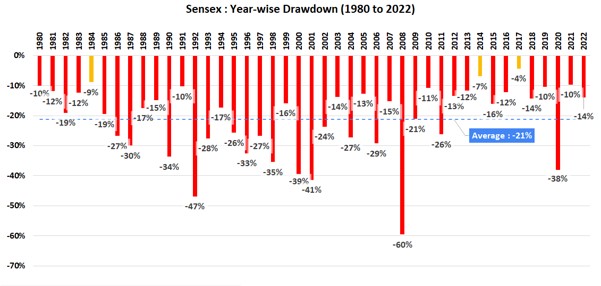

- Market Declines of 10 – 20% happen every year

Equity markets witness 10 -20% temporary declines almost every year. In the below table we can see the calendar year-wise drawdown for Sensex from the period 1980, 40 out of the 43 years had intra-year declines of 10 -20%.

- Large market declines of 30 – 60% happen once every 7-10 years

Historically, large market declines of 30 – 60% have occurred once every 7 – 10 years and subsequent recoveries have usually taken around 1 – 3 years. In the below table, we can see the periods of large market fall and subsequent recoveries.

SIP investors benefit from market falls and recoveries as they accumulate more units at lower prices and when the market recovers the extra units accumulated also participate in the upside, thereby enhancing overall returns.

So the key here is that the SIP time frame should be reasonably long enough to accommodate both the market fall and the recovery time.

While the 10-20% falls are common and markets recover quickly, the larger falls (>30%) take around 1-3 years to recover.

This is why a longer time frame of 7 years helps as it provides a sufficient buffer time to accommodate for occasional large falls and recovery in the middle of your SIP journey.

What if the sharp decline occurs near the end of a 7-year period?

In the earlier section, we found out that, if large falls happen during the first few years of your Equity SIP journey then a 7-year time frame provides enough time to recover.

However, if such large falls happen close to the end of your 7-year time frame (say in the 6th or 7th year), then your 7 Year SIP returns most likely will be impacted.

How do we solve this?

By simply extending the time frame by 1-2 years!

Let us see if this suggestion works well in reality.

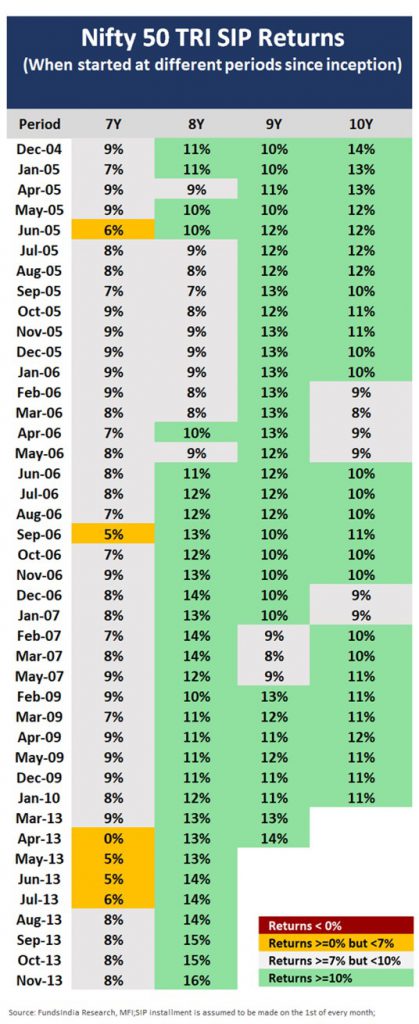

We isolated all 7-year SIP returns where the returns were less than 10% and there were 42 occurrences out of a total of 190 occurrences.

As seen from the SIP matrix below,

- In 31 occurrences out of 42, extending the time frame by just 1 year brought the returns back to more than 10%

- In the remaining 11 occurrences out of 42, extending the time frame by just 2 years brought the returns back to more than 10%

Summing it up

When it comes to your Equity SIPs,

- Invest with a time frame of at least 7 years – historically a 7+ Year time frame helps you minimize your odds of negative returns (no occurrences in the last 22+ years) and increases your odds of better returns (>10% CAGR).

- Longer Time Frames allow enough time for recovery from large market falls

During periods of intermittent market declines, Equity SIP investors benefit by accumulating more units at lower prices, and subsequently when markets recover (usually in 1 – 3 years) you improve your chances to earn better returns as higher units accumulated at lower prices participate in the upside.

- If markets experience sharp temporary declines near the end of your 7-year time horizon, then you may need to extend your time frame by 1-2 years to allow for market recovery and reasonable returns.

Good Article and informative.

Good information with all supportive data.

Nice Information.

very use full information, I am the witness of this article

good article

Confident to have invested in safe portal.

Equally hopeful when my kids will grow up

they will have enough of money to lead their

future, studies, or new ventures.

Thanks to SIP planning.

Spent time get money