In recent times, we have been receiving a lot of queries on –

Is it the right time to invest in Gilt funds?

Instead of straight away revealing our views, we wanted to use this as an opportunity to introduce you to our thinking process.

We have realized that some of the best decisions come from changing the way we think about problems, and examining them from different viewpoints.

So, instead of approaching this question from a single point of view, we will be approaching this via 6 different vantage points.

Let us check what our 6 different friends have to tell us..

QUICK GUN MURUGAN: Looks at problems using intuition, gut reaction, and emotion!

His mind voice goes like this..

Credit Risk Funds are going through several issues – defaults, downgrades, redemption pressure, illiquidity, concentration risk etc.

A lot of credit risk funds have given poor returns in the last 1-2 years!

Franklin Templeton Mutual Fund recently has closed 6 of its credit risk oriented funds!

OOPS! I guess it is better to stay away from credit risk and stick to safe high credit quality debt funds.

Umm..So what can possibly be the safest debt option out there?

Debt funds which lend to the Government of India!

It is reasonable to expect that the Government of India most likely will not default on their payments.

So how about Gilt Funds which lend only to the Government?

Let me check their returns..

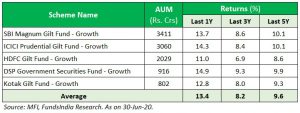

Note: We have considered the largest 5 funds in the category with more than 15 years of track record.

WOW! Great Safety & Great Returns – Let me buy Gilt Funds!

This is one perspective which most of us would have at this point in time. But let us also explore other perspectives before we decide.

CURIOUS KID: Damn curious and asks a lot of questions

If the last 1 year, average returns of gilt funds are 13.4%. So I should have invested 1 year back.

But why didn’t I invest then?

What was the fund’s underlying interest rate (for the purists, read it as YTM) a year back?

Umm..Something is not adding up..

The government had borrowed money from this fund at an average of 7.2%. So logically we were supposed to make 7.2% minus the expense ratio (1.1%) at 6.1%. How come we ended up with 13.4%.

Where in the world did that extra 7.3% (13.4% minus 6.1%) return come from?

Anyway, What is the underlying interest rate now?

So should I expect 4.9% returns going forward? Or like last year will I get a similar extra return?

What if it becomes lower than 4.9%?

Someone care to explain??

MR SPOCK – inspired from the super rational Star Trek character

Past returns are already over. I am only worried about how much I will make going forward.

What will be my future returns?

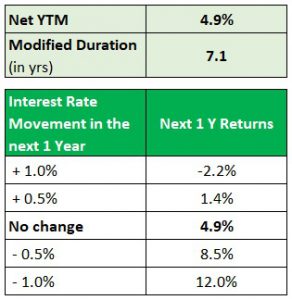

1 Year Returns = Net YTM + NAV changes due interest rate movement*

NAV changes due interest rate movement = (-1) (Modified Duration) * (Change in yields)

Looking at past returns (13.4% in the last 1 year), we might subconsciously get our expectations anchored to the same returns. However we must remember that, out of the 13.4% returns, roughly 6.1% returns came from the Net YTM (6.1%). The extra 7.3% were predominantly due to gains from fall in yields (~120 bps or 1.2%).

So using the same logic, the current Net YTM is ~4.9%. Whether you make returns higher or lower than this will depend on yield movement. If yields go down, you will make higher returns and vice versa.

Let us look at what can be the possible return outcomes for different moves in interest rates.

*These are approximate return estimates given for illustrative purposes. The actual returns may vary based on the intermittent changes in the portfolio

HISTORY PROFESSOR: Ardent believer of the Mark Twain quote ‘History doesn’t repeat itself but it often rhymes’

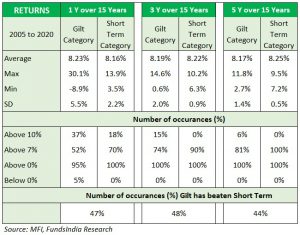

1. Do past returns predict future returns in Gilt funds?

Note: For Short term funds we have considered the largest 5 short term funds with 15 year track record – DSP Short Term Fund – Growth, ICICI Prudential Short Term Fund – Growth, IDFC Bond Fund – Short Term Plan – Growth, Kotak Bond Short Term Fund – Growth, Nippon India Short Term Fund – Growth

As seen above unlike the plain vanilla short term category (black line), gilt funds have had a wider range of return outcomes. Usually above average returns are followed by below average returns which is mostly a reflection of interest rate movements.

Takeaway 1: Past returns have been a poor predictor of future returns in gilt funds.

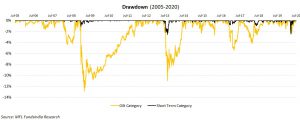

2. Are Gilt funds more volatile?

Let us check the Volatility of the category vs Short term funds.

As seen above visually, Gilt funds have far higher volatility.

Even the maximum drawdown has been much higher for Gilt funds!

Also the occurrence of negative returns has been much higher across time frames.

Takeaway 2: Gilt funds have far higher volatility and intermittent declines compared to the plain vanilla short term funds.

Investors for putting up with this higher volatility should ideally be compensated by higher long term returns. Let us check if this is true?

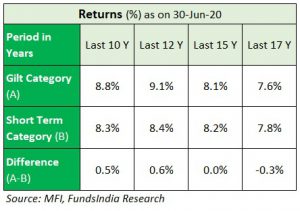

3. Do Gilt funds compensate for their volatility with higher long term returns?

As seen above, over long periods the returns from Gilt funds and Short Term funds is more or less similar.

As seen above for the last 15 year period,

- 3 year rolling return average of Gilt funds are 8.19 % vs Short Term funds at 8.22%

- 5 year rolling return average of Gilt funds are 8.17% vs Short Term funds at 8.25%

So this leaves us with..

Takeaway 3: Long term returns of Gilt funds are more or less similar to short term funds.

4. Where do the current yield levels stand with respect to history?

Takeaway 4: These are very low levels of yield compared to long term history. The 10Y Gsec has traded below these levels only for a very short period of time (6.3% of the times since 1998).

Overall, History professor has some interesting takeaways for us –

- Past returns are not a great predictor of future returns especially when it comes to Gilt funds

- They run interest rate risk – the risk of a higher degree of fall in NAV when yields move up.

- They do well when yields are declining and do badly when yields are moving up.

- Gilt funds have far higher volatility and intermittent declines compared to the plain vanilla short term funds

- Long term returns are more or less similar to short term funds

- These are very low levels of yield compared to long term history. The 10Y Gsec has traded below these levels only 6.3% of the times since 1998.

MR PESSIMIST – What can go wrong?

If interest rates go up, the returns of Gilt funds will be impacted 🙁

Interest rates may go up because:

- Rising Government Debt

- Fiscal Deficit Concerns

- RBI may not completely absorb the fiscal deficit funding

Just think of the downside risks buddy..

Taxation issue

Three year long term taxation period for debt funds hampers the exit flexibility. If the interest rate cycle turns and starts moving up before three years forcing us to exit, this becomes tax inefficient.

MISS OPTIMIST – What can go right?

If interest rates go down, the returns of Gilt funds will be very good 🙂

Interest rates may come down because:

- India GDP Growth is expected to be weak for the near term

- Near term inflation outlook looks benign

- CAD is under control

- Low Oil Prices

- High Liquidity

- Domestic Monetary Policy expected to remain accommodative – possibility of further rate cuts

- Globally interest rates are expected to remain lower for longer – led by central banks policies

- Credit Growth is expected to remain subdued in the near term

- 10Y Yields remain high compared to shorter term yields

- RBI may absorb the fiscal deficit funding

Just think of the upside buddy!

Finally, wrapping our heads around everything that our 6 friends have to say, we come to the views of yours faithfully. Yup it’s us..

The FundsIndia Research Team

No Credit Risk..

Given the underlying exposure only to government bonds, there is practically no credit risk involved.

However Interest Rate Risk is high..

If Interest rates stay at the same level, the return expectation should be approximately anchored to YTM – Expense Ratio (i.e. ~4.9% +/- 0.5%).

However Interest rates are cyclical as seen from history.

Thus these funds will:

- Outperform when Yields move down

- Underperform when Yields move up

Need to time the interest rate cycle – easier said than done..

This means to get the best out of the category we need to time the interest rate cycle – i.e get in during periods of decline in yields and move out during periods of increase in yields.

That leads us to the next question – How to time the interest rate cycle?

What are the factors that impact interest rates?

- Inflation Trajectory

- Domestic Growth

- Fiscal Deficit

- Current Account Deficit

- Monetary Policy

- Liquidity

- Global Environment – Interest Rates and Growth

Timing the interest rate cycle will imply taking a call on all the above factors. This is far easier said than done and sometimes even the best of fund managers get this call wrong.

Taxation Constraints

Even if you get the timing correct, the three year long term taxation period for debt funds hampers the exit flexibility. If interest rate cycle turns and starts moving up before three years forcing us to exit, this becomes tax inefficient.

Long term evidence also shows that the returns from gilt funds in spite of having far more volatility are more or less similar or only slightly higher than plain vanilla high quality short term funds.

Summing it up..

We believe for the majority of investors, high credit quality (read as high AAA & Equivalent exposure) debt funds with short duration (<3 years) should form the core portion of the debt portfolio.

For investors wanting to take a shot at excess returns, Gilt funds can be considered as a part of the ‘alpha’ bucket (upto 20% of the entire debt portfolio).

That being said, we are not big fans of this category given our concerns on

- The need to time interest rate cycle – even seasoned fund managers have got this wrong often

- Higher volatility leading to inconsistent investor experience

- Exiting before 3 years leads to higher short term taxation

However for investors wanting to play this category, make sure you have a framework to exit the category as you see initial signs of the interest rate cycle turning (and moving up). Otherwise, you have to hold it for a longer time frame (5-7 years) to even out the volatility.

A lucid explanation on Gilt Fund. I have not seen so far a better way to explain this concept to lay man. Kudos to the research team. Well written and presented.