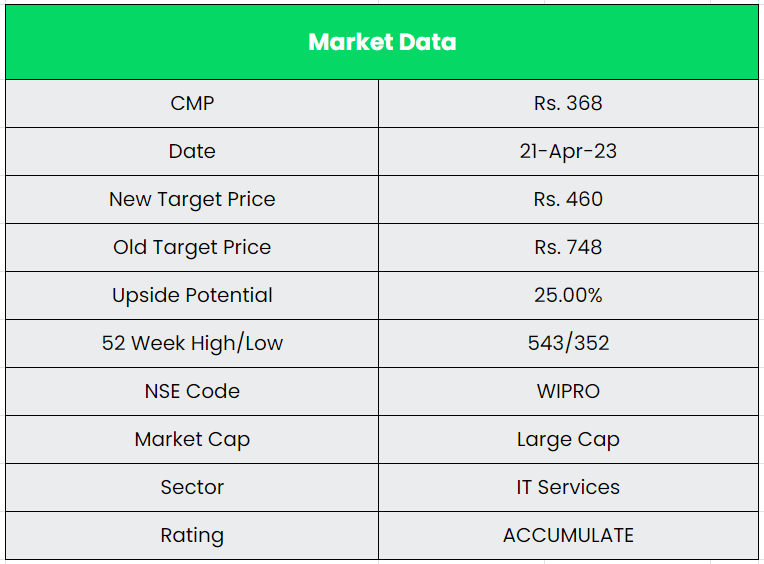

Wipro Ltd. – Western India Products

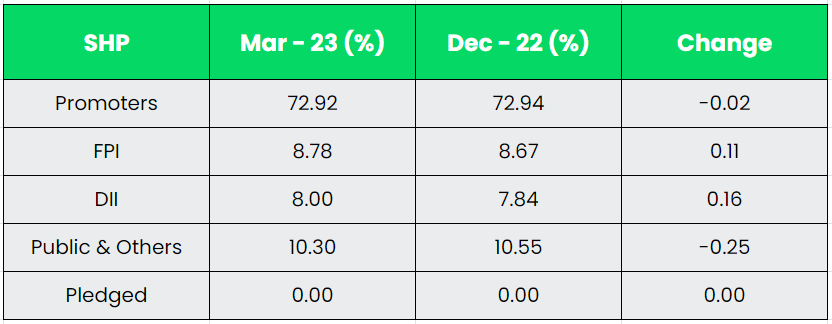

Wipro is one of the leading global IT, consulting and business process services company. It is the fourth largest Indian player in the global IT services industry, in terms of revenue, after Tata Consultancy Services (TCS), Infosys Limited (Infosys) and HCL Technologies Limited (HCL). They harness the power of cognitive computing, hyper-automation, robotics, cloud, analytics and emerging technologies to help their clients adapt to the digital world and make them successful. Wipro was incorporated in 1945 as Western India Vegetables Product Limited and was predominantly a consumer care product manufacturer till 1980 after which it diversified into the IT services business. With effect from April 1, 2012 (FY2013), the company demerged its other divisions (consumer care and lighting, medical equipment and infrastructure engineering) into a separate company called Wipro Enterprises Limited (WEL), to enhance its focus and allow both businesses to pursue their individual growth strategies. Wipro has over 258,000 dedicated employees serving clients across six continents.

Products & Services:

The company’s Key offerings under IT related products and Services are digital strategy advisory, customer-centric design, technology consulting, IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, cloud infrastructure services, analytics services, business process services, research and development and hardware and software design to leading enterprises worldwide.

Subsidiaries: As on FY22, the company had 140 Subsidiaries and 1 Associate company.

Key Rationale:

- Diversified clientele – Wipro has a strong base of 1,369 customers with 95% of the business generated from existing clients in FY2022. Company has added 428 new customers in FY2022 as against 280 customers in FY2021. For Q3FY23, the company added 80 new customers. The total active customers at the end of Q3FY23 stands at 1484. Clients in ‘More than USD 75 million’ bucket increased from 27 in FY2021 to 29 in FY2022. The company is witnessing healthy renewal of deals and adding new deals from existing clients in the field of digitization. Going forward, Wipro is expected to maintain a diversified revenue stream across customers in various segments.

- Record Deal Win – Wipro for the first time reported a Total Contract Value (TCV) of US$ 4.3 bn for the quarter, which was up 26% YoY in CC terms. The company’s large deal TCV wins also remains strong with wins of 11 large deals of US$ 1 bn. Wipro indicated that the deal wins are healthy mix of new wins & renewal. The company’s net employees during the quarter declined by 435 taking the total employee strength to 258,744 employees. Wipro indicated that the supply side challenges are easing while LTM attrition also continues to decline. The LTM attrition during the quarter declined 180 bps QoQ to 21.2% while the quarterly annualised attrition declined 360 bps to 17.5%. The company expects attrition to moderate further, which would be one of the levers for margin improvement.

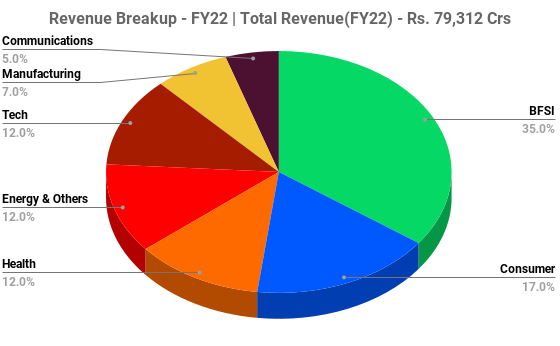

- Q3FY23 – The company generated a Gross Revenue of Rs.23,229 crs ($2.8 billion), an increase of 3.1% QoQ and 14.4% YoY. IT Services Segment Revenue increased to $2,803.5 million, an improvement of 6.2% YoY. Vertical wise, in CC terms, health (12% of mix), energy (11% of mix), consumer (19% of mix) & manufacturing (7% of mix) reported growth of 4.7%, 2.8%, 0.6% & 0.6% YoY, respectively, while BSFI (35% of mix), Communications (5% of mix) & Technology (11% of mix) declined 0.2%, 2.6% & 1.3%, respectively. The company’s operating margins, improved by 120bps and stood at 17.4% YoY, largely led by lower operating expenses and a favourable currency mix during the quarter. Its net profit for Q3FY23 stood at Rs.3065 crs, registering a growth of 15.7% QoQ.

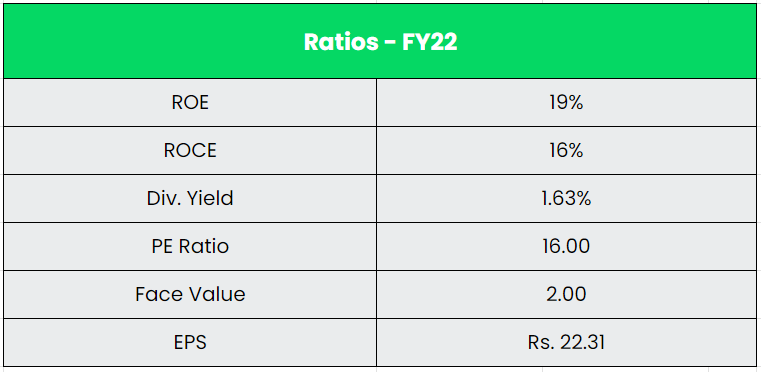

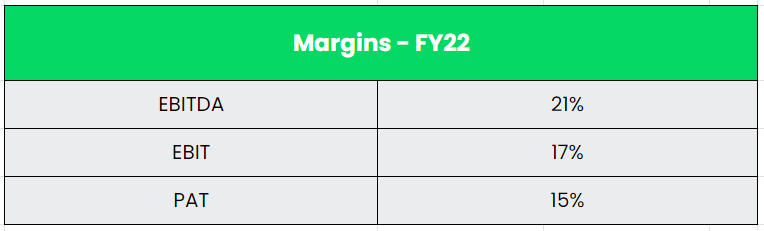

- Financial Performance – The company has a strong balance sheet a debt-to-equity ratio of 0.2 and a cash and equivalents of Rs.36937 crs as of H1FY23. The company maintained a 20%+ EBITDA margins for many years historically. The Five-year average RoE and RoCE of the company are 18% and 20%.

Industry:

The IT & BPM sector has become one of the most significant growth catalysts for the Indian economy, contributing significantly to the country’s GDP and public welfare. The IT industry accounted for 7.4% of India’s GDP in FY22, and it is expected to contribute 10% to India’s GDP by 2025. According to National Association of Software and Service Companies (Nasscom), the Indian IT industry’s revenue touched US$ 227 billion in FY22, a 15.5% YoY growth. The export revenue from this industry (excluding e-commerce) has been estimated at close to $178 Bn in FY2022. Indian software product industry is expected to reach US$ 100 billion by 2025. Indian companies are focusing on investing internationally to expand their global footprint and enhance their global delivery centres. The IT industry added 4.45 lakh new employees in FY22, bringing the total employment in the sector to 50 lakh employees. Over 280,000 employees were reskilled and made digital skilled in FY22. At 30-32% of industry revenue, digital revenues grew five times the rate of overall services growth.

Growth Drivers:

- The computer software and hardware sector in India attracted cumulative foreign direct investment (FDI) inflows worth US$ 93.58 billion between April 2000-December 2022.

- Indian telecoms are offering 1GB mobile data at $0.086 – one of the cheapest globally. By offering affordable data to consumers, the digital infrastructure enables ease of access to services like banking, governance and more.

- Over 45 new data centres to come up in India by 2025. Data centres in India attract investment of $10 Bn since 2020.

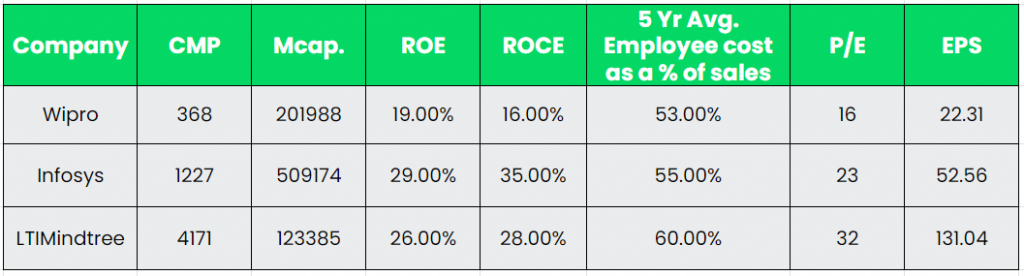

Competitors: Infosys, LTIMindtree, etc.

Peer Analysis:

While comparing with peers, Wipro is trading at a cheaper price to earnings ratio. The 5-year average employee cost as a % to sales stands at 53% for Wipro which is less than its peers.

Outlook:

Management stated that tech spends remained robust during the quarter despite continuing macro challenges resulting in record order book TCV of $4.3 bn of which 44% was derived from hyperscalers. Order book has healthy balance of renewals and new wins as Cloud & Engineering services which saw YoY of growth of 25% & 45% respectively drove the growth in bookings. However, conversion of order book to revenue will lag due to delay in decision making and cut in discretionary spend. Company expects to grow in the European region on the back of market share gains and vendor consolidation opportunities. For FY23, management expects revenue to grow in the range of 11.5%-12% in CC terms on the back of market share gains, vendor consolidation opportunities, robust demand across cloud, engineering & security. Also, Company does not foresee any slowdown in hyperscalers impeding the growth.

Valuation:

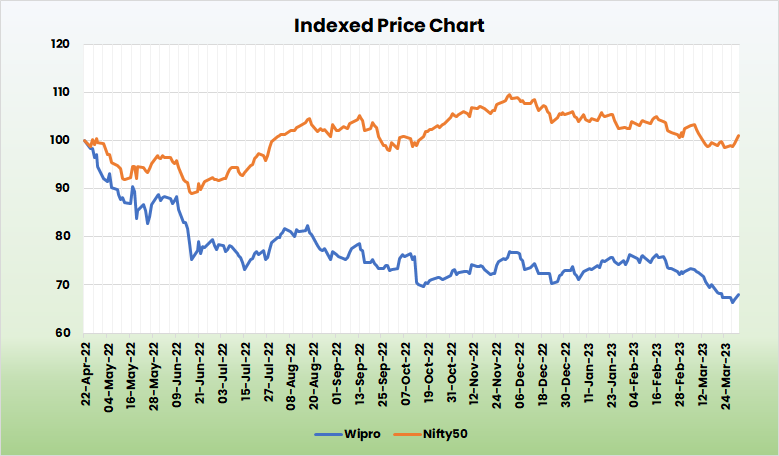

From a long-term perspective, we believe Wipro has a strong deal pipeline and superior financial structure. Also, the confident commentary from management and the moderating attrition rate are positive triggers in the stock. We recommend an ACCUMULATE rating in the stock with the target price (TP) of Rs.460, 18x FY25E EPS.

Risks:

- Forex Risk – Fluctuations in the USD-INR and GBP-INR and GBP-USD, as majority of the revenue comes from international territories. Fluctuation in the currencies will impact the revenue of the company.

- Visa related Risk – Increase in Visa fees will increase the cost. Rise in the visa fees will lead to rise in the operating cost (Employee expenses) to IT industry. So, it plays a major role in the IT industry.

- Remuneration Risk – Salary hikes i.e., wage inflation may play as a spoil sport. Rising economic growth will create more jobs in the country. This will ultimately give rise to wages hikes. Wage hikes will affect the operating margins of the company. So, fluctuation in the wages is a significant risk in IT service Industry.