Hindalco Industries Ltd – A force for good

Hindalco Industries Ltd, part of the Aditya Birla Group, is a global leader in aluminium rolling and recycling, and a major player in copper and speciality alumina. Its integrated business model covers bauxite mining, alumina refining, coal mining, power generation, aluminium smelting, and downstream products. As of FY24, Hindalco operates 20 manufacturing units and 23 mines in India, along with 32 overseas plants (Novelis).

Products and Services

- Aluminium: Offering alumina, primary aluminium (ingots, billets, wire rods), and flat rolled products (foils, extrusions).

- Copper: Producing LME grade copper cathodes, continuous cast copper rods, di-ammonium phosphate (DAP) fertiliser, and precious metals (gold and silver).

- Specialty Alumina: Providing coarse alumina hydrate, metallurgical alumina, specialty alumina, and alumina hydrate.

Subsidiaries: As of FY24, the company has 61 subsidiaries, 7 associate companies, 2 joint ventures and 6 joint operations.

Growth Strategies

- Novelis Expansion: Investing $4.9 billion over 3-5 years, including $4.1 billion for a new Bay Minette facility to increase Flat Rolled Products capacity by 600 KT.

- Capacity Boost: Completed a debottlenecking project at Utkal, raising alumina capacity from 2.2 million MTPA to 2.6 million MTPA.

- New Projects: Developing an 850 KT refinery in Odisha and commissioning a 20 KT precipitate hydrate plant by FY25.

- Product Innovation: Enhancing products with new offerings such as white fused alumina, high precision sub-micron alumina, and battery-grade aluminium foil.

- Global Expansion: Establishing warehouses, processing facilities, and sales offices across the USA, Europe, and Southeast Asia.

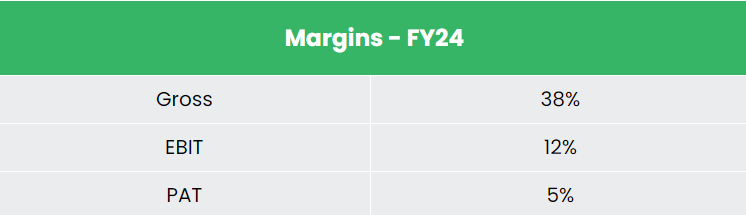

Financial Performance

Q4FY24

- Revenue: Flat at Rs.55,994 crore YoY.

- EBITDA: Increased by 24% to Rs.7,201 crore from Rs.5,818 crore in Q4FY23.

- Net Profit: Grew by 32% to Rs.3,174 crore from Rs.2,411 crore in Q4FY23.

- Performance Drivers: Robust recovery at Novelis, improved cost control in the aluminium India business, and strong copper business performance.

- Shipments Growth: Novelis +2% YoY, Aluminium Upstream +4% YoY, Aluminium Downstream +17% YoY, Copper +16% YoY.

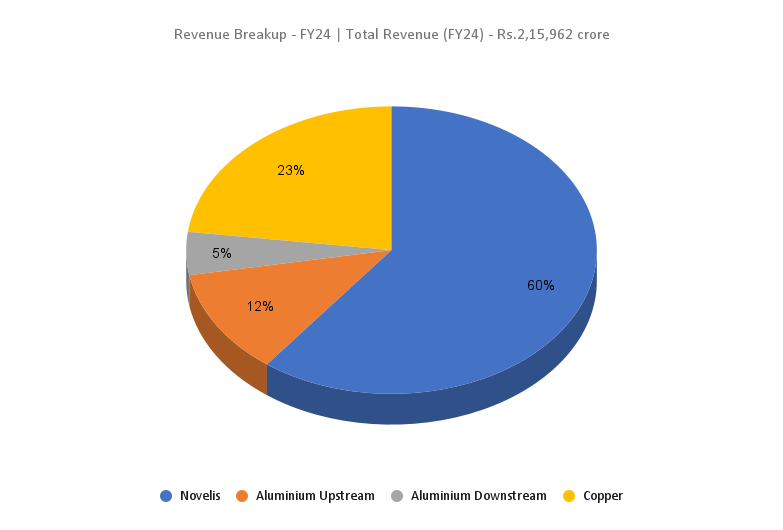

FY24

- Revenue: Rs.2,15,962 crore, down 3% YoY.

- Operating Profit: Rs.25,728 crore, up 7% YoY.

- Net Profit: Rs.10,155 crore, up 1% YoY.

- New Launches: 53 new products and services introduced.

Financial Performance (FY21-24)

- Revenue and PAT CAGR (FY21-24): 18% and 40%, respectively

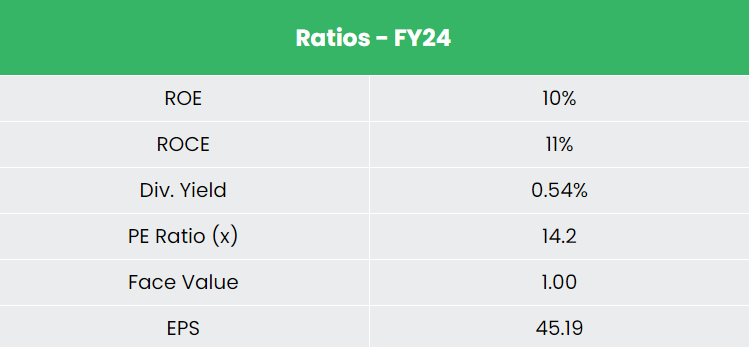

- Average 3-Year ROE & ROCE (FY21-24): ~13% each

- Capital Structure: Debt-to-equity ratio of 0.53

Industry outlook

- Economic Impact: The mining industry can boost GDP, foreign exchange earnings, and support sectors like building, infrastructure, automotive, and electricity by providing essential raw materials cost-effectively.

- Energy Demand: As the third-largest energy consumer globally, India faces high demand for power and electricity, leading to increased coal demand.

- Alumina Advantage: India benefits from low alumina production and conversion costs and ranks as the second-largest global producer of aluminium.

- Global Aluminium Demand: Expected to grow by 3% in CY2024, reaching around 72 million MT.

- Copper Demand: Global refined copper demand is projected to increase by approximately 2.5% in CY2024.

Growth Drivers

- FDI Policy: 100% foreign direct investment (FDI) allowed through the automatic route in the mining sector.

- Government Initiatives: Programs like Gati Shakti Master Plan, Make in India, Pradhan Mantri Awas Yojna, and Urban Infrastructure development schemes are expected to boost the Metals and Mining sector’s growth in India.

Competitive Advantage

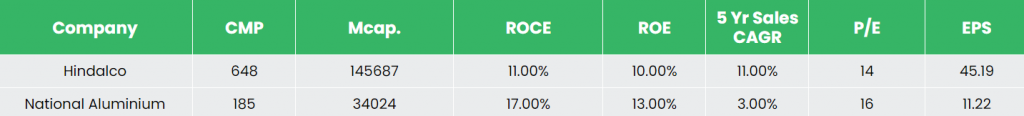

National Aluminium Company Ltd is the sole listed competitor with similar operations.

Compared to it, Hindalco shows more stable return ratios and superior revenue and profit growth, reflecting better financial stability and efficiency in generating returns.

Outlook

- Revenue: Flat growth; EBITDA improved across major segments.

- Performance Drivers: Higher volumes, better margins, strategic product mix, stable operations, and strong copper business.

- Investments: ~$2 billion for India operations, focusing on downstream expansions (3-5 years).

- Alumina Production: Planning to double capacity by FY26-27.

- Coal Supply: Acquired two captive coal mines to enhance supply chain and coal quality.

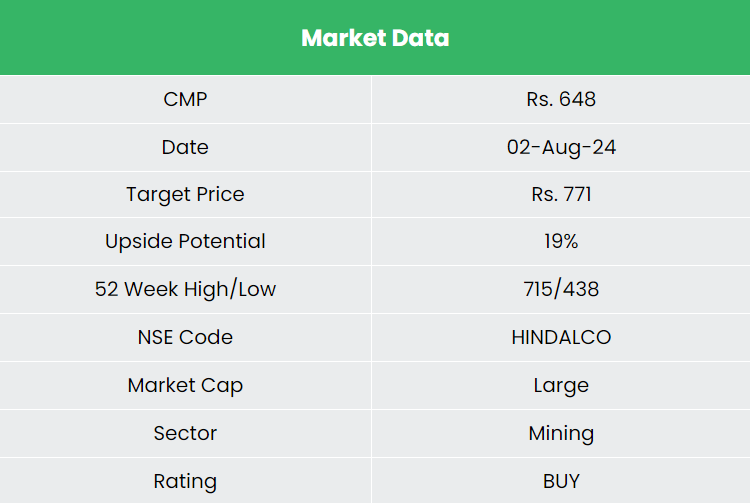

Valuation

Hindalco’s commitment to expansion, strong balance sheet, strategic capex plans, and proven execution—amid robust demand in packaging, automotive, transport, building, construction, and industrial machinery—are expected to enhance future performance. We recommend a BUY rating with a target price of Rs.771, based on 13x FY26E EPS.

Risks

- Environmental and Social Impact: Mining activities may pose significant environmental and social challenges.

- Input Costs: Fluctuations in domestic resource availability (particularly coal) and raw material prices could affect profit margins.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

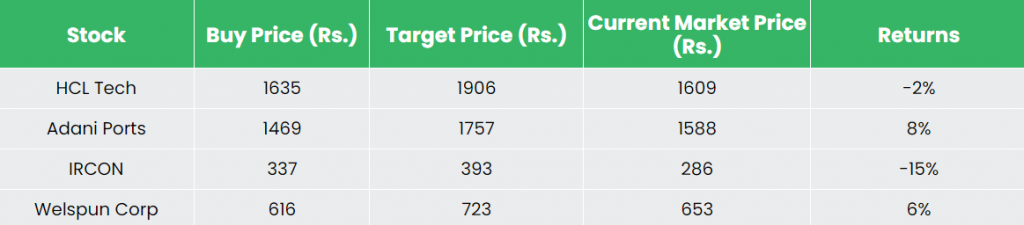

Recap of our previous recommendations (As on 02 August 2024)

Adani Ports & Special Economic Zone Ltd