EPL Ltd – Leading the pack sustainably

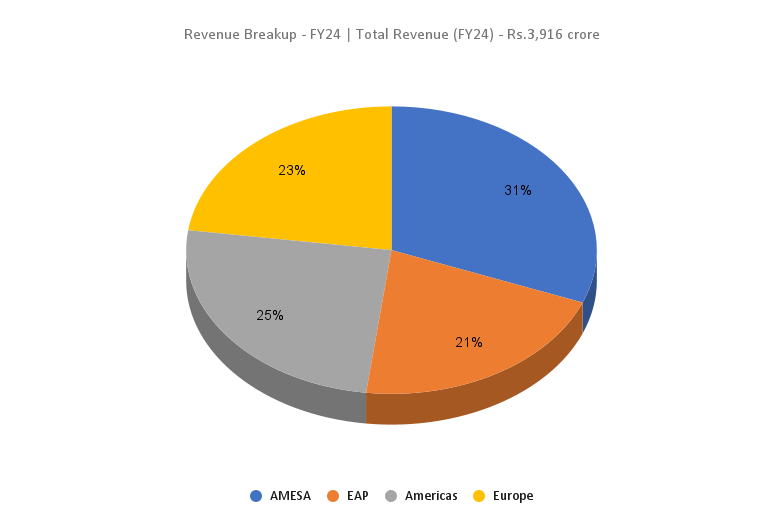

Incorporated in 1992 and headquartered in Mumbai, EPL Ltd. (formerly Essel Propack) is a global leader in specialty packaging, serving categories like oral care, beauty, pharma, food, and home care. With an annual production of 8+ billion tubes, EPL manufactures 1 in 3 oral care tubes globally. The company operates 21 advanced facilities across 11 countries, including Europe, the Americas, AMESA, and EAP regions. EPL’s major clients include Colgate, P&G, Unilever, L’Oréal, Cipla, Johnson & Johnson, etc.

Products and Services

The company’s product portfolio comprises laminates, laminated tubes, extruded tubes, caps and closures and dispensing systems/applicators.

Subsidiaries: As of FY24, the company has 17 subsidiaries and 1 associate company.

Growth Strategies

- Innovation focus: Developed tubes with up to 50% PCR content; sustainable tube volumes doubled to 21% in FY24; 43% of packaging is recyclable, with 85% capacity ready for sustainable tubes; 24 new patents granted in FY24.

- NeoSeam technology: Gaining traction as a recyclable, sustainable alternative to traditional tubes.

- Brazil expansion: New greenfield plant operational, serving anchor customers and winning orders from multinationals and local clients, boosting presence in the Americas and export opportunities.

- European restructuring: Ongoing efforts to optimize costs and improve margins, with benefits expected from the current fiscal year.

- Key project wins: Significant orders for 100% recyclable Platina tubes from brands like Colgate, Joy, and Sensodyne.

- Client growth: Expanded business with major clients and attracted new beauty and cosmetics customers, especially in EAP and the Americas.

Financial Performance

Q1FY25

- Revenue: Rs.1,007 crore, up 11% from Q1FY24’s Rs.910 crore.

- Regional growth: AMESA +9.5%, EAP +14%, Europe +9%, Americas +19%.

- EBITDA: Rs.192 crore, 21% growth from Rs.159 crore in Q1FY24.

- EBITDA margin: Expanded to 19%, up 160 bps YoY.

- Net profit: Adjusted net profit rose 35%, from Rs.47 crore to Rs.64 crore.

FY24

- Revenue: Rs.3,916 crore, up 6% YoY.

- Operating profit: Rs.715 crore, 24% growth YoY.

- Net profit: Rs.210 crore, a 9% decline YoY.

Financial Performance (FY21-24)

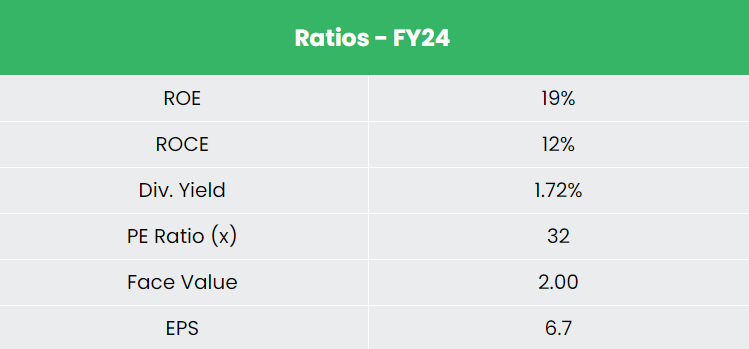

- 3-year average ROE: 12% (FY21-24)

- 3-year average ROCE: 14% (FY21-24)

- Capital structure: Healthy with a debt-to-equity ratio of 0.44

Industry outlook

- Industry size: Packaging is the 5th largest sector in the Indian economy.

- Growth rate: Annual growth of 22-25%.

- Tech-driven: Advancements in technology and infrastructure fuel growth.

- Sustainability shift: Industry moving towards eco-friendly practices and materials.

- Government support: Initiatives to reduce plastic packaging and promote sustainable manufacturing are driving change.

Growth Drivers

- 100% FDI permitted through automatic route in the packaging sector.

- Expansion of the middle class and increasing disposable income levels, rising consumer awareness and the rise of e-commerce platforms.

- Regulatory trends favouring recyclable and eco-friendly materials.

Competitive Advantage

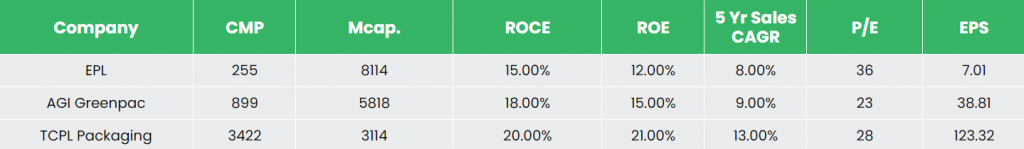

EPL is the leading player in laminates and laminated packaging solutions, consistently generating stable revenue and earnings growth. Competitors like AGI Greenpac Ltd and TCPL Packaging Ltd also operate within the packaging industry, but EPL maintains its leadership position in this niche segment.

Outlook

- Sustainability focus: 100% recyclable tubes meet eco-friendly packaging demand.

- Global expansion: New manufacturing units in emerging markets boost capacity.

- Industry reputation: Strong alliances with top global brands.

- Growth outlook: Management projects double-digit revenue growth.

- Profitability: EBITDA margin expected to exceed 20%.

Valuation

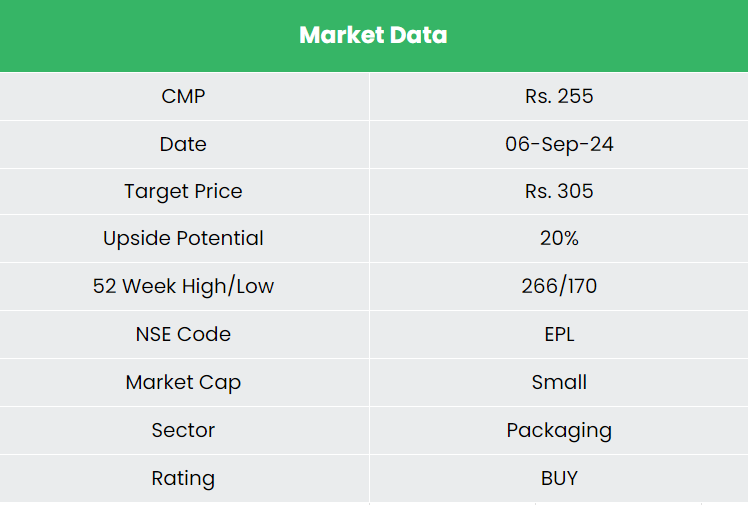

The company’s diverse product portfolio, continuous investment in advanced technologies and initiatives to improve operational efficiency is expected to drive future growth and further establish the company’s position in the market. We recommend a BUY rating in the stock with the target price (TP) of Rs.305, 27x FY26E EPS.

Risks

- Forex risk: Exposure to foreign markets makes the company vulnerable to currency fluctuations.

- Raw material price volatility: Fluctuations in raw material costs may impact margins.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

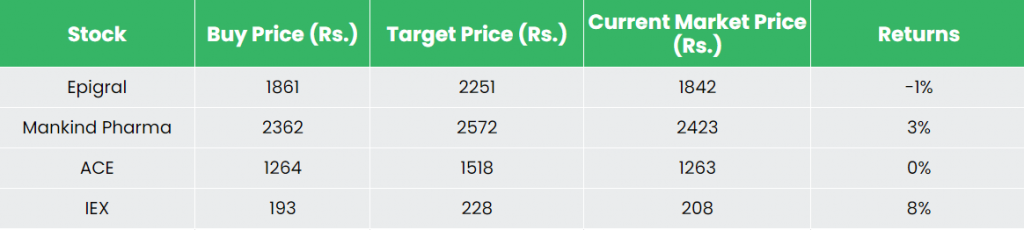

Recap of our previous recommendations (As on 06 September 2024)

Action Construction Equipment Ltd