Aurobindo Pharma Ltd. – Committed to healthier life!

Aurobindo Pharma Ltd., established in 1986 and headquartered in Hyderabad, is a global pharmaceutical company focusing on generic pharmaceuticals, branded specialty pharmaceuticals, and active pharmaceutical ingredients (APIs). With a diverse portfolio and a strong international presence, Aurobindo serves key therapeutic segments across 150 countries, backed by extensive R&D capabilities.

Product Portfolio of AUROPHARMA

Aurobindo’s service segments include formulations and APIs. Its diverse product portfolio consists of biosimilars, dermatology, respiratory, vaccines, peptides, oncology, hormones, and sterile products.

Subsidiaries: Aurobindo boasts 85 subsidiaries, 6 joint ventures, and 2 associate companies, enhancing its global footprint and diversification efforts.

Growth Strategies of Aurobindo Pharma Ltd

- Diversification into injectables with a focus on EU and emerging markets.

- Expansion into untapped global markets like China.

- Clinical trial studies for biosimilar products.

- Strong focus on the domestic formulation market.

- Enhancing manufacturing capacity with specialized facilities:

- Commissioning a specialized injectable facility in Vizag to meet rising demand.

- Installation of the Lyfius plant for Pen-G and the 6-APA plant.

- Aggressive product expansion in the US market:

- Filed 7 ANDAs and received approval for 16 products in Q3FY24.

- Launched 21 products, including 4 specialty and injectable products.

Financial Highlights of Aurobindo Pharma Ltd

Q3FY24 Performance

- Revenue: Rs.7,352 crore (15% YoY increase).

- Operating profit: 68% YoY growth to Rs.1,601 crore.

- Net profit: Surged by 91% YoY to Rs.936 crore.

- EBITDA margin: 22% (highest ever).

- Gross margin: 57%.

Financial Performance

- Revenue and PAT growth: 15% and 30% respectively over the last twelve months.

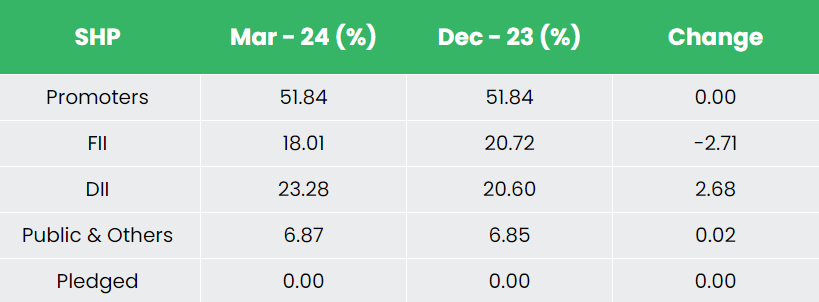

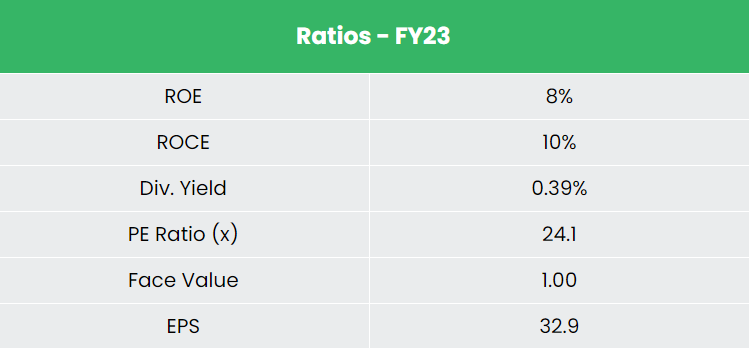

- ROE & ROCE: Average of 14% and 16% respectively for FY18-23.

- Debt-to-equity ratio: 0.24, indicating a robust capital structure.

Industry Outlook

- Indian pharmaceutical industry poised to reach US$ 57 billion by FY25.

- Projected CAGR of over 10% to reach US$ 130 billion by 2030.

- Favorable regulatory environment with up to 100% FDI allowed for pharmaceutical projects.

- Increasing focus on research and development, with government allocation for research and healthcare.

- Growing emphasis on innovation and technology adoption to meet global healthcare demands.

Growth Drivers

- Government Allocation:

- Rs.3,201 crore (US$ 419.2 million) allocated for research.

- Rs.83,000 crore (US$ 10.86 billion) allocated for the Ministry of Health and Family Welfare in Union Budget 2022-23.

- Global Demand for Generic Drugs:

- Indian pharmaceutical industry projected to grow at a CAGR of over 10% to reach US$ 130 billion by 2030.

- India supplies over 40% of generic demand in the US.

- Cost Advantage and Efficient R&D:

- India offers medicines at costs 30%-35% lower than the US and Europe.

- R&D costs in India are approximately 87% less than in developed markets.

Competitive Advantage

Compared to competitors like Lupin Ltd, Mankind Pharma Ltd, etc, Aurobindo Pharma Ltd has the following advantages

- Undervalued stock with potential for P/E expansion.

- Strong margin and earnings growth compared to competitors like Lupin Ltd. and Mankind Pharma Ltd.

Outlook

- Aurobindo is poised for robust growth amidst US drug shortages.

- Diverse product portfolio meets market needs.

- Targeted FY24 EBITDA margin: 20%.

- New facilities in China and Vizag enhance market presence.

- Pipeline includes high-margin biosimilars and peptides.

- Strategic initiatives ensure sustained success.

Valuation

- Aurobindo Pharma Ltd. is positioned for growth amidst heightened drug shortages, particularly in the US market.

- With its expansion initiatives and optimization of product mix, Aurobindo Pharma Ltd. is poised to capitalize on market opportunities, warranting a BUY rating with a target price (TP) of Rs.1,361 by 28x FY25E EPS.

Risks

- Forex Risk: Exposure to forex fluctuations due to significant operations in foreign markets.

- Regulatory Risk: Vulnerability to regulatory changes, especially scrutiny by agencies like USFDA, impacting operations.

Recap of our previous recommendations (As on 03 May 2024)