FundsIndia Views: Why you can go wrong with point-to-point returns

December 13, 2017Today, the 1-year return of BNP Paribas Midcap looks to be among the best at 40%. L&T India Value sports a 1-year return of 31.7%. On a 3-year basis too,…Continue Reading

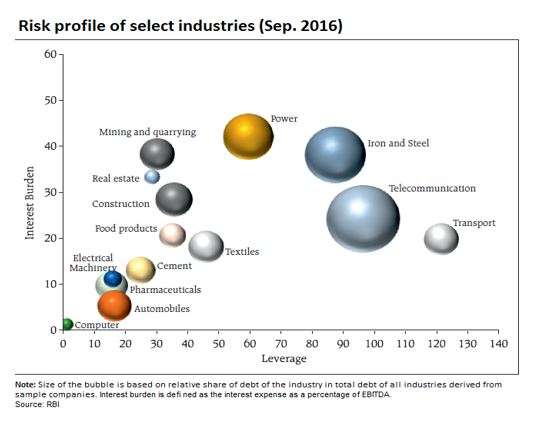

FundsIndia Views: Recapitalisation – Impact beyond the banking sector

November 8, 2017While the stock market may have cheered the announcement of bank recapitalisation instantly, we think this is more a long-drawn but game-changing play – not just for the banks but,…Continue Reading

FundsIndia Views: The lowdown on sector funds

November 1, 2017< p style=”text-align: justify;”> Look at the top performing funds in any year. Often, the toppers are sector-specific funds. In some years, the returns these sector funds post are far…Continue Reading

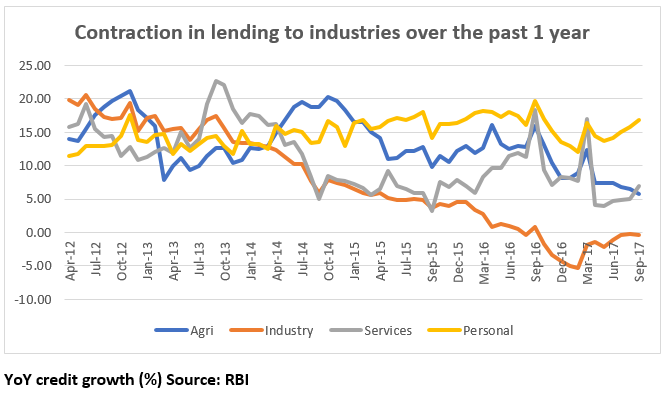

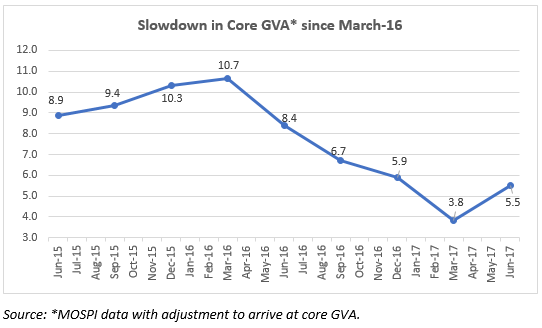

FundsIndia Views: Indian economy – are experts’ concerns overblown?

September 27, 2017Distress calls by a large section of the media and by economists on feeble GDP growth of 5.7% for the quarter ending June 2017 has spilled over into stock markets.…Continue Reading

FundsIndia Views: Why you need help choosing debt funds

September 13, 2017Short on time? Listen to a brief overview of this week’s review. Most of you look at returns of equity mutual funds to pick a fund to invest. When the…Continue Reading

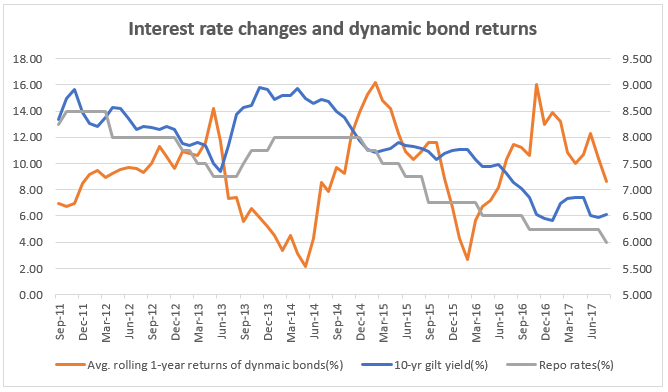

FundsIndia Views: Why your dynamic bond fund returns will not be static

August 31, 2017Short on time? Listen to a brief overview of this week’s review. In recent months, your dynamic bond fund’s annualised returns may have fallen from high double-digit returns to single-digit…Continue Reading

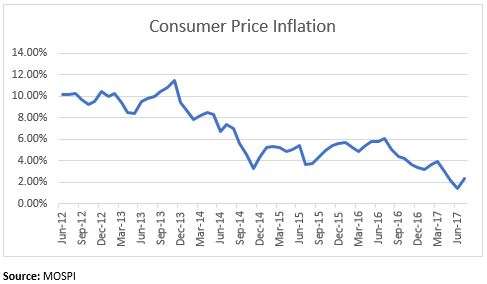

FundsIndia Views: Reset your return expectations

August 16, 2017Short on time? Listen to a brief overview of this week’s review. [soundcloud url=”http://api.soundcloud.com/tracks/338109395″ params=”color=ff5500&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /] With the markets delivering close to 20% returns on a year-to-date…Continue Reading

FundsIndia Views: Don’t go by high returns in ultra short-term funds

June 7, 2017The recent spate of credit downgrades and defaults serves to highlight a growing risk in debt funds. That risk is funds’ move into lower-quality debt as a trade-off for higher…Continue Reading

FundsIndia Views: What to expect from GST – the ‘One India tax’

May 31, 2017The Goods and Services Tax (GST) will be a reality in India from July 1. GST can be a gamechanger in the way India does business in the long term.…Continue Reading

FundsIndia Views: More bank clean-up and what to expect

May 10, 2017The government, last week, passed a new ordinance to change the Banking Regulations Act, towards empowering the RBI to deal with bad loans. Broadly, the change will mean that the…Continue Reading