Short on time? Listen to a brief overview of this week’s review.

- Returns swing heavily due to the fluidity of the portfolio and its management

- Fund managers do the job of managing rate cycles

- Investors should avoid trying to time these cycles

- For those wanting less volatility income accrual funds are a better option

In recent months, your dynamic bond fund’s annualised returns may have fallen from high double-digit returns to single-digit returns. Some of you have been asking if it is time to shift out of these funds. We don’t think so. Dynamic bond funds, unlike long-term gilt funds, do not require timing your entry and exits. This is because the fund manager does that job for you.

Here are some facts about dynamic bond funds that will help clarify your queries on why returns of these funds swing and what your return expectation should be with such funds.

Dynamic bond fund returns move drastically

Dynamic bond funds take bets on rate cycle movements. Rate cycle movement and anticipation of rate changes are best captured in the yields of long-term securities like government (gilt) securities. When the yields of gilts adjust themselves to a changing rate scenario, the returns of dynamic bond funds also change drastically. Please read our primer on dynamic bond funds here.

Dynamic bond funds load up on long-term gilts when they wish to make the best of a falling rate cycle and shed them when the rate fall is almost done or if a rate hike is expected. A fall in yields causes the price of gilts to rise. This results in higher returns in these funds. At the same time, when there is an up move in gilt yields, they tend to lose, especially if they are caught on the wrong foot, holding very long maturity papers.

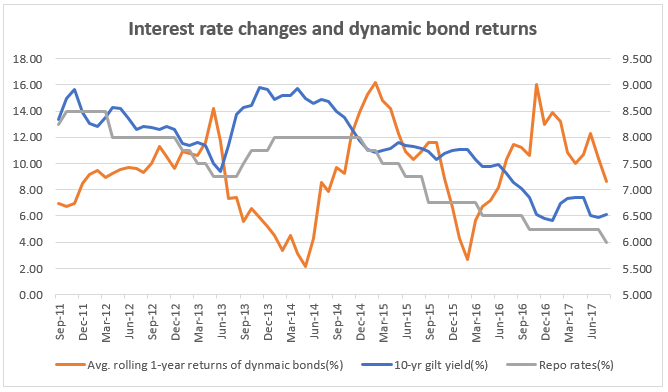

The graph above captures the rolling 1-year returns of dynamic bond funds along with 10-year gilt yield movements and interest rate changes. You can observe the following:

- The 10-year gilt movements follow repo rate (rate declared by RBI) and have a positive correlation. In other words, they move together. However, yields may also move on false hopes/alarms. This happens when yields move in anticipation of rate cuts or rate hikes and such an announcement does not come by. For example, yields moved up in February 2017 because the market was disappointed that an anticipated rate cut did not transpire.

- Dynamic bond fund returns are clearly inversely correlated to the yield movements. When yields move up bond returns fall and vice versa.

- You will notice that the fund returns move up and down drastically. You will also notice that the 1-year returns as of February 2016 was as low as 2.7% but moved to 16% by November 2016! Between these two periods, the RBI cut repo rate from 6.75% to 6.25%. This caused sharp fall in the yield of gilts, thus triggering a price rally. If 1-year returns can swing this sharply, then monthly returns can swing much more.

What fund managers do

The earlier graph tells us that returns can be highly cyclical in dynamic bond funds especially over 1-year periods or lower. Fund managers do not have control over how interest rates and yields will move. However, they can effectively reduce the volatility of the portfolio by tweaking the average maturity of their portfolios.

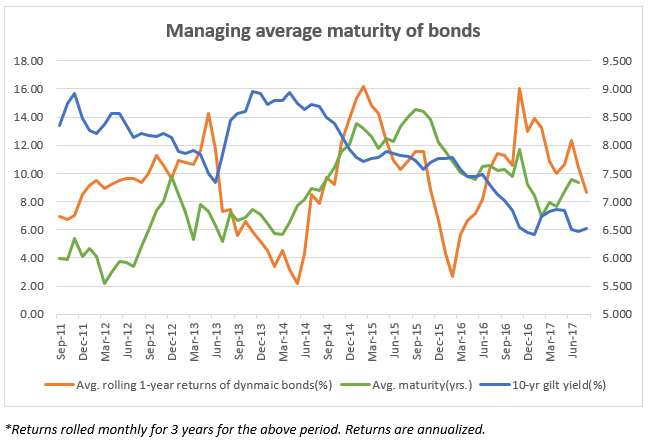

The below graph shows how fund managers increase the average maturity as yields are about to fall or are falling and vice versa and the resultant movement of fund returns.

Longer-dated gilts are more sensitive to interest rate changes. So, the fund manager’s job is to go long on maturity to gain the most and reduce the maturity when rate cycle turns out of favour. Such moves help either contain falls or make the most of gains. In 2012, for example, hiking average maturity of portfolios by December helped deliver handsome gains. On the other hand, reducing average maturity between November 2011 and March 2012 propped up returns from 7% to 9%.

Notice that from 2.1 years of average maturity in March 2012, fund managers loaded their portfolios with long-dated gilts thus increased average maturity to 9.7 years by December 2012. They did this in anticipation of a rate cut. When a 25-basis point interest rate cut happened in January 2013 and then again in March 2013, the funds gained, with their forecast turning out to be right. On the other hand, when the rupee saw a free fall in July 2013 and yields started moving up, dynamic bond funds reduced their average maturity to 5 years in July 2013. A rate hike by RBI was announced in September 2013. Had the fund managers not reduced the portfolio maturity, they would have taken a harder knock when a rate hike happened.

But funds can be caught on the wrong foot. For example, a successful fund like Aditya Birla Sun Life Dynamic Bond fund took a knock of 2-3% percent in February 2017, when a much-anticipated rate cut by RBI did not happen.

What is hard for you to do

While fund managers may slip temporarily, you may get your timing wrong when you try to exit these funds. For example, the high double-digit returns in 2012 may have prompted many of you to join the party late, only to see your returns slip to low single digit in 2013. Had you spooked and exited, trying to avoid falls, you would have entirely missed the next leg of rally in the following 3 years.

Hence, rather than trying to time your entry and exit, a SIP approach to dynamic bond funds may work better to capture the volatility. Remember, these funds are not meant for the short term and ideally require a 3-year holding period, which lets you benefit from capital gains indexation as well.

How longer period returns stack up

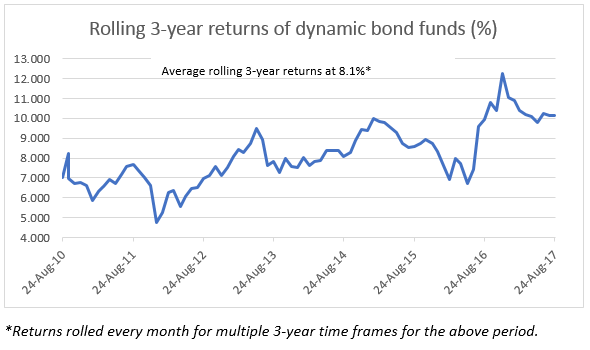

While we said that returns can move drastically in dynamic bond funds, many of you who invested in this category in recent years would have been used to high returns. You can see that the 3-year returns have been in double digits since 2016. This is because we have had a prolonged rate-cut scenario, where rates have been very gradually cut since January 2015.

However, as can be seen in the graph, the rolling 3-year returns are now dipping to more realistic levels now. It may, therefore, be prudent to temper your return expectations. The average 3-year returns have been a little over 8% in the past 7 years. It is possible that based on the time of your entry, many of you may enjoy higher returns than this average, but it would be more realistic to use the average for your return expectations. Remember, even in times of high FD rates, the post-tax return for this category of funds will be higher if you hold them for over 3 years.

To sum up:

- Dynamic bond funds will be volatile They are cyclical in nature and the volatility can be contained but not avoided.

- If the volatility in dynamic bond funds spook you then you will be better off with income accrual funds (learn about this category here).

- However, if you are in favourable periods of rate cycles, the returns of dynamic bond funds will outweigh income funds. Therefore, your advisor may give you a mix of both these categories.

- When rate cuts are done, dynamic bond funds behave somewhat like income accrual funds.

- If you are a very long-term investor (5-10 years or more) then the returns between these two categories of funds will not be too divergent.

Mutual fund investments are subject to market risks. Read all scheme related documents carefully before investing. Past performance is not indicative of future returns.

Well if expected returns from dynamic bonds over a 3 year period are 8% or so, and it is exposed to greater risk then what is the point in investing in dynamic bond funds where risk outweighs rewards. Why funds india is recommending investment in dynamic bond funds. I have invested rs. 5 Lakh in dynamic bond funds as advised by funds india and the returns are hovering around 5-6% only.

Hello Jaspal,

The thing is for 2-3 year time frames in the current scenario of prolonged rate cut since 2014, dynamic bond funds have delivered far higher than income accrual. While most of you claim to be long term, our experience suggest that many want to take out money sooner than originally stated. Hence we give a mix so as not to miss out on the additional return generation that happens in such markets. We are only cautioning you not to expect high double digit returns. As far as the returns are FD-plus – what is wrong in holding these funds?

As for your investment, please tell me how long you held your fund for 5-6% return. Was it 2-3 years?

Thanks

Vidys

Hi vidya

Is it like Dynamic bond funds yield 2 digi returns say 10 to 11% if holded for 3 years irrespective of voltility?

Thanks

Suresh

Hello Suresh. No, dynamic bond funds can yield double digit returns only when rates are falling. Then they becom more normalised. Rate fall cycles can be short (6months to 1 year) or long (like we have had now for 2.5 years). Thanks, Vidya

Well if expected returns from dynamic bonds over a 3 year period are 8% or so, and it is exposed to greater risk then what is the point in investing in dynamic bond funds where risk outweighs rewards. Why funds india is recommending investment in dynamic bond funds. I have invested rs. 5 Lakh in dynamic bond funds as advised by funds india and the returns are hovering around 5-6% only.

Hello Jaspal,

The thing is for 2-3 year time frames in the current scenario of prolonged rate cut since 2014, dynamic bond funds have delivered far higher than income accrual. While most of you claim to be long term, our experience suggest that many want to take out money sooner than originally stated. Hence we give a mix so as not to miss out on the additional return generation that happens in such markets. We are only cautioning you not to expect high double digit returns. As far as the returns are FD-plus – what is wrong in holding these funds?

As for your investment, please tell me how long you held your fund for 5-6% return. Was it 2-3 years?

Thanks

Vidys

Hi vidya

Is it like Dynamic bond funds yield 2 digi returns say 10 to 11% if holded for 3 years irrespective of voltility?

Thanks

Suresh

Hello Suresh. No, dynamic bond funds can yield double digit returns only when rates are falling. Then they becom more normalised. Rate fall cycles can be short (6months to 1 year) or long (like we have had now for 2.5 years). Thanks, Vidya

Hi,

I have invested a sum of 50k in Birla Sun Life Dynamic Bond fund a year ago and the returns till date are close to 5%, which is very low per my expectations. Should I be exiting this category and invest elsewhere?

I don’t mind going long upto 3 years in the same category provided there is a positive anticipation of good returns.

Regards,

Shaunak

Hi,

I have invested a sum of 50k in Birla Sun Life Dynamic Bond fund a year ago and the returns till date are close to 5%, which is very low per my expectations. Should I be exiting this category and invest elsewhere?

I don’t mind going long upto 3 years in the same category provided there is a positive anticipation of good returns.

Regards,

Shaunak