The recent spate of credit downgrades and defaults serves to highlight a growing risk in debt funds. That risk is funds’ move into lower-quality debt as a trade-off for higher returns. While credit risk is acceptable in debt funds meant for the long-term – given the leeway to ride out rough patches – it is certainly not prudent in ultra-short term funds.

The purpose behind investing in these funds is primarily safety of capital; chasing higher returns in these categories is not a priority. With debt increasingly moving towards the lower end of the credit spectrum and stricter action by credit rating agencies, the risks are higher.

The credit opportunity

Policy rate cuts over 2015 and 2016 and measures to address liquidity demands ensured that lending rates dropped. 1-year CP rates are 7.31% now against the 8.49% last year. The sudden fund inflow post demonetisation also played a role in pulling down very short-term rates.

As rates fell, funds saw portfolio yields (YTMs) move lower. Average YTMs at the start of 2016 were around 8.4% for ultra short-term funds. By mid-2016, YTMs had dropped to 8% and further to 7.3% at the end. With the falling yields, returns would also be lower. 1-year returns for ultra short-term funds in January 2015 were a good 9.1% on an average. In January 2017, the returns were lower at 8.3%.

The rate differential between AAA papers and those rated below turned even more attractive, especially with larger inflows increasing competition. With the financial health of weaker companies still under stress and bank lending drying up, there were better returns to be had lower down the credit line. The yields on AA-rated 3-year paper at 7.68% are 57 basis points higher than the 7.11% for AAA-rated papers. The spread widens to 89 points for a AA- paper and to 118 points for an A+ paper.

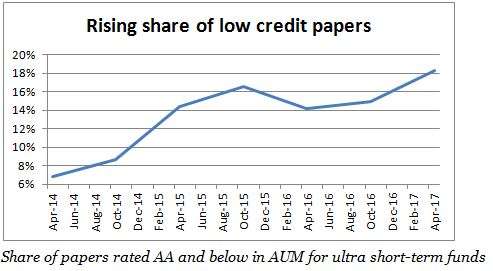

Rising share of low credit papers

The move to lower credit is pronounced in ultra short-term funds far more than short-term funds. For ultra short-term funds, anything lower than the AAA set represents higher risk given the very short time-frame. These papers formed 25% of the total AUM in April 2017 (latest available data), against the 21-22% in April 2016 and 2015. More, the share of AA and AA- papers has been steadily climbing, now forming 15% of the AUM. In 2014, ultra short-term funds held no A-rated paper; today, these papers form 3% of the AUM.

Funds do try to mitigate risks by negotiating some security backing such as cash flows from a project or pledged promoter shareholding, or relying on group promoter strength, or limiting exposure to a single paper. However, risks of downgrades do remain. Rating agencies can downgrade a paper by several notches at one go. And in recent times, a downgrade to ‘D’ or default happens in a matter of months, hardly giving any time for investors or for that matter even AMCs to take preventive or corrective action.

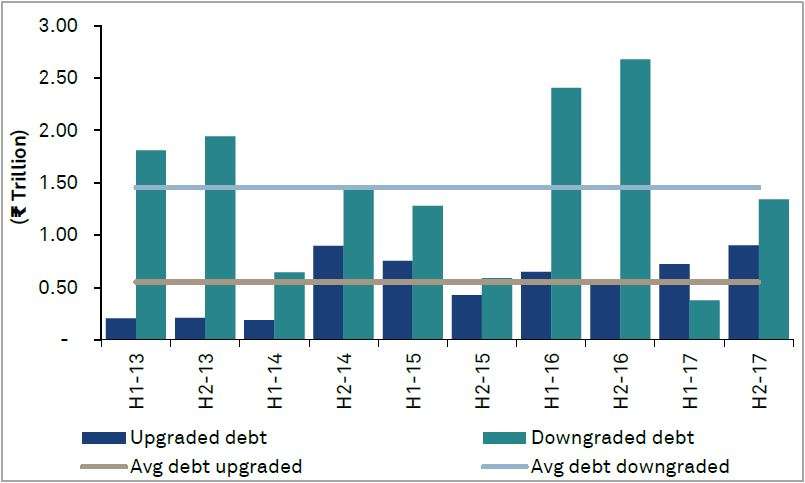

We are not suggesting that debt as an asset class is facing pressure of downgrades now. In fact, if you take the companies rated by rating agency CRISIL, the number of companies being downgraded is moving lower. The value of debt downgraded in FY-17 was below the last 5-year average. But this value of debt downgraded is still more than the value of debt upgraded as shown in the chart below. The upgrade-to-downgrade ratio has also not improved, staying steady at 1.22 times in FY-17 against the 1.29 times in FY-16. In other words, things have not become worse but they have not dramatically turned around either for you to assume these risks.

Source: CRISIL report

High risk-high return uncalled for

All ultra short-term funds do not collectively move to low-rated papers. While the average low credit exposure (defined by us as AA+ rated and below for this category) over the past year is 18.4% for the category, the highest exposure is a whopping 72% of the portfolio while the lowest is nil. Portfolio YTMs, therefore, are equally disparate. The highest YTM is that of Franklin India Low Duration at 8.99% against the category average of 7.18%. Its low credit exposure averaged 72% in the past year and holds high at 70% for April 2017. The fund’s return is also at the top of the category at 10% and far above the average 7.86%. Kotak Low Duration similarly scores high on returns, but has 60% in low credit papers, a good chunk of which is AA- and below.

Yes, a downgrade involves a mark-to-market loss and is not an actual loss. The fund can still hold the bond to earn interest and so wipe off the loss. In case of a default, interest accrual from the other papers in the portfolio will slowly help recoup the loss. In either case, it requires an investor to wait out the fall and allow the accrual to play out. The time taken for such reversal also depends on the maturity of the papers, and many ultra short-term funds have average maturities of more than one year.

But remember, as a category, you do not usually invest in ultra short-term funds with a long-term time-frame. The purpose of investing in an ultra short-term fund is to park money that will be needed a few months later, or generate income through systematic withdrawals post retirement, or to maintain an emergency corpus. Thus, an ultra short-term fund should simply be able to deliver returns above short-term FD rates. And this, ultra short-term funds can do even without overloading on credit risk or capitalising on ‘inefficient’ prices.

Choosing funds in the ultra short-term category

It is for the above reason that choosing funds in the ultra-short-term category can be tricky if not risky. FundsIndia’s ‘Select Funds’ lays emphasis on weeding out excessive credit risk and retaining those funds that hold potential to deliver returns higher than short-term FD rates. You will find that these funds may not be chart toppers and may sometimes deliver returns hovering around the category averages.

Funds in our Select Funds list such as ICICI Prudential Flexible Income Plan, Birla Sun Life FRF LTP, Tata Ultra Short, DHFL Pramerica Ultra Short Term, and UTI Treasury Advantage don’t go below AA- and even where they do, it is below the category average. At the same time, these funds are able to generate returns better than the category, consistently. Here again, there is no such thing as nil risk. It is always about minimising risks for optimal returns.

If you pick your own funds in this category, especially based on high returns, please be prepared to assume the risks in such funds. Such risks need the benefit of time if there is a credit slip. The simplest way to safeguard yourself is to stay away from high returning funds in this space.

This article has been updated to correct the caption in Graph 1.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.

One should not treat UST funds as a substitute for the savings bank. It should be used along with other higher yielding options like short-term debt fund or dynamic/income fund to build a debt portfolio.

Hi Rishika,

Thanks for your comment! But just to clarify, we’ve not compared UST funds with bank accounts here, we’ve talked about short-term FDs. Only liquid funds are bank account substitutes. UST funds are useful for those investing with a short horizon in mind or as a part of an emergency corpus.

Thanks,

Bhavana

One should not treat UST funds as a substitute for the savings bank. It should be used along with other higher yielding options like short-term debt fund or dynamic/income fund to build a debt portfolio.

Hi Rishika,

Thanks for your comment! But just to clarify, we’ve not compared UST funds with bank accounts here, we’ve talked about short-term FDs. Only liquid funds are bank account substitutes. UST funds are useful for those investing with a short horizon in mind or as a part of an emergency corpus.

Thanks,

Bhavana