Tags: FundsIndia

RSS feed for this sectionFundsIndia Explains: Regular Vs Direct Mutual Funds – Which is the best?

July 24, 2019When it comes to investments, people generally tend to take cautious steps. They would prefer to make informed decisions while moving forward. There is a lot of confusion involved in…Continue Reading

Changes to FundsIndia’s Select Funds

July 19, 2019Equity markets have been volatile since early last year and debt markets have been going through some turmoil since mid-2018. Not surprisingly, category average returns may look poor regardless of…Continue Reading

FundsIndia Features : Easy Transfer

July 13, 2019You’ve invested in 20+ Mutual Fund schemes through 4+ online/offline platforms and AMCs. Your funds are scattered all over the place, and you are unable to track and manage them…Continue Reading

FundsIndia Features: Portfolio Review

July 10, 2019Mutual funds are a versatile and accessible way of entering the world of investment, even with negligible knowledge of all the technical jibber-jabber. While funds offer a free-for-all pass to…Continue Reading

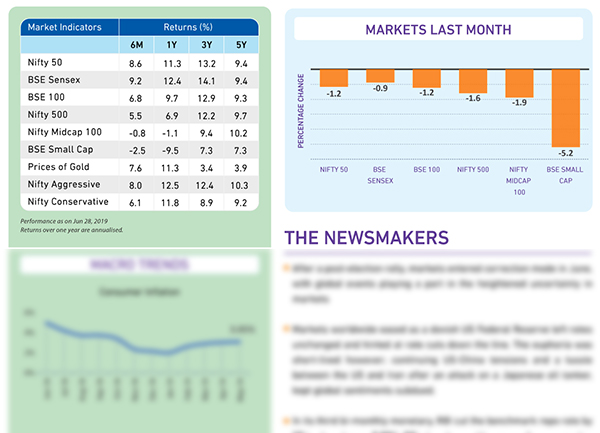

Monthly Market Insight – June 2019

July 6, 2019The June 2019 edition of FundsIndia’s Monthly Market Insight compares conservative hybrid and equity savings funds, and the way investors can plan for their children’s education. After a post-election rally,…Continue Reading

Key Takeaways from the Union Budget 2019

July 5, 2019This being an election year, the Union Government had only declared an interim budget in February. The final union budget 2019 was presented by the new finance minister, Nirmala Sitharaman,…Continue Reading

FundsIndia Recommends: Axis Bluechip

July 3, 2019Axis Bluechip (previously called Axis Equity) delivered 12.8% returns in the last 5 years against 12% delivered by benchmark index Nifty 100 TRI. At a time when largecap funds have…Continue Reading

FundsIndia Strategies: Conservative Hybrid Vs. Equity Savings for 1-3 years

June 26, 2019For a person looking for a low-risk mutual fund option for parking short term money, we recently took a look at the pros and cons of arbitrage funds vs. liquid…Continue Reading

FundsIndia Recommends: HDFC Capital Builder Value

June 19, 2019Markets have given up their post-election euphoria and are factoring in global concerns. In this volatility, aggressive investors can go for midcaps and smallcaps as opportunities are ripe. But for…Continue Reading

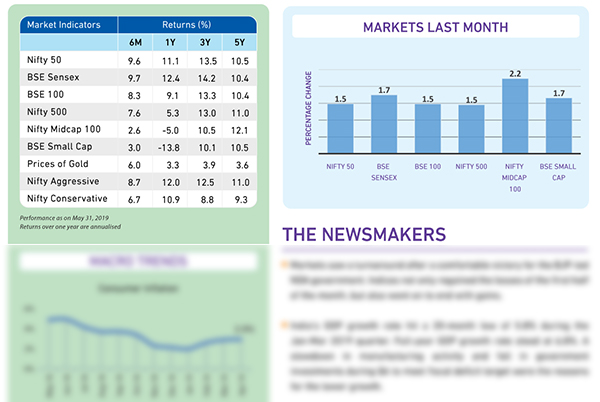

Monthly Market Insight – May 2019

June 1, 2019The May 2019 edition of FundsIndia’s Monthly Market Insight discusses the right fund that can be chosen for short-term money, and the post-election strategies that can be followed. It also…Continue Reading