In this article, I wish to share a few thoughts from an interesting presentation made by Prashant Jain, ED and CIO, HDFC Mutual. In this presentation, Prashant Jain points out the mistake of most retail investors in timing the market, at the wrong point, repeatedly. He points out how a simple indicator such as the Sensex forward P/E can provide sufficient indicators for you to make the right moves.

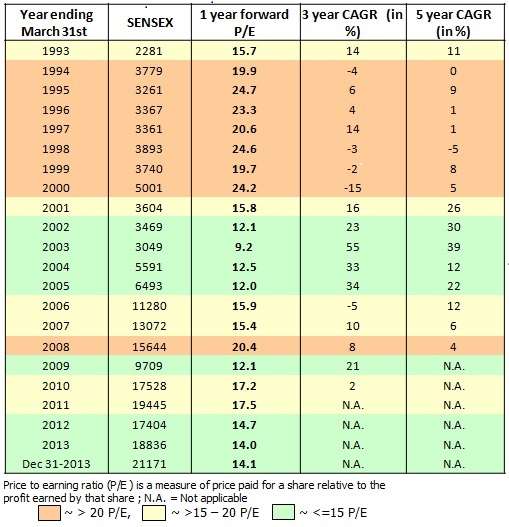

Low P/E, key to good returns

The table above clearly shows how investing in the equity market when valuations (measured by forward price to earnings ratio) are low (seen the green area between 2002 and 2005) have delivered rich returns over 3 and 5 years.

For instance an investment in the Sensex in 2003 would have meant your money grew 3.7 times in 3 years and more than 5 times in 5 years! Typically a price earnings ratio below 15 times can be considered low.

Why is that so? Because in a normal scenario the economy can be expected to grow at a nominal rate (nominal rate includes inflation) of 15%.

That is also the rate at which economy expanded at nominal rate over the last 5 years and 10 years on an average. A forward P/E ratio below that would therefore indicate that corporate valuations are not reflecting the higher economic growth and therefore will be re-rated.

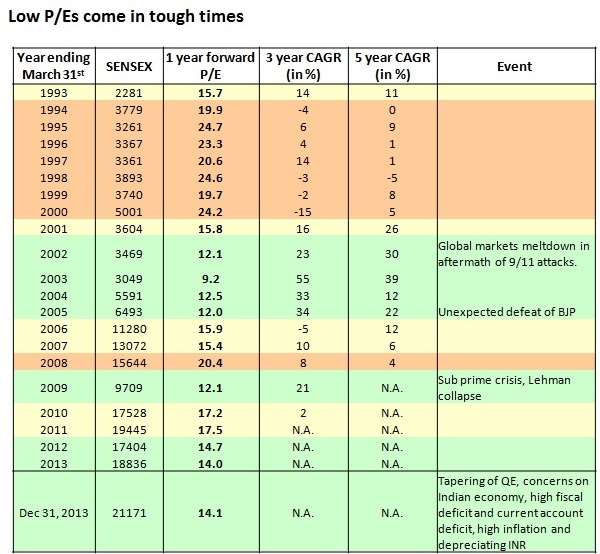

Low P/E but not good times

But the next table, given below, makes it hard for you to actually invest when P/Es are low; simply because those seem to be the worst of times to invest. The table shows it was during setbacks such as the 9/11 attack, unexpected defeat by a political party and the sub-prime crisis that forward price earnings ratios were low.

In other words, markets had a very bleak forward view of corporate/stock fortunes. But those were the times to invest to harvest rich dividends later.

Of course the QE tapering and the Indian economic concerns prevailing now, have once again posed a low P/E opportunity.

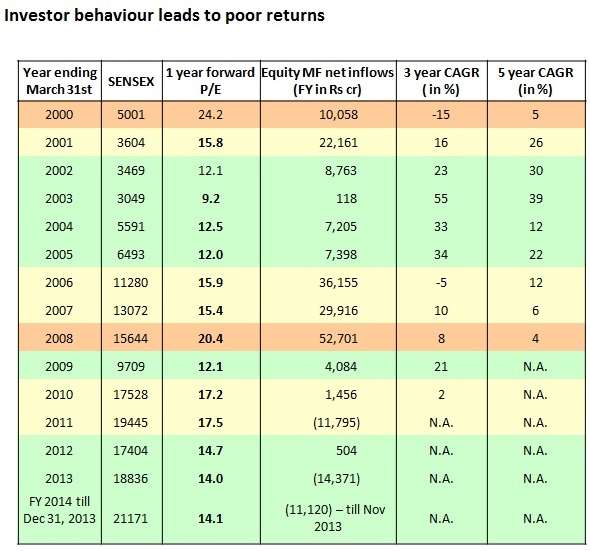

Timing it wrong

So have investors deciphered this clue, hidden by all negative events and sentiments? Seldom, suggests data again. The following table shows how mutual fund investors have, time and again, floundered by trying to join the market euphoria rather late.

Data shows that investors poured money in market peaks every time, only to burn their fingers later and then completely withdraw into a shell (such as the year 2003 when the investment into MFs was paltry), when valuations were actually compelling.

As can be seen, 2013 was one such year when investors withdrew money. It is not hard to figure how much you would have missed in the quick rally post September 2013 till date.

The above presentation by Prashant Jain enabled us to easily correlate our own investors’ behaviour. How many of thought you should enter the markets only when you see returns and are reluctant to invest when markets are down? Worse still, how many of you were tempted to stop SIPs as you saw the markets go down line ninepins?

What to do

Let’s first admit the problem. There’s money to be made in the market and plenty too. But it’s not easy, it’s not quick nor is the opportunity available at all times. So how do you counter this problem?

Only in 2 ways: stay invested long enough to tide over the negative periods and stay invested through the ups and downs of the market through systematic investing to average your costs so that your returns are optimal.

Simply put: have a long-term time frame for equities/equity funds and use SIP to tide over the ups and downs to stay invested and buy on dips. Sounds simple? Then why is it so tough to follow this?

Datas taken from a presentation by HDFC AMC.

HDFC Mutual Fund /AMC is not guaranteeing or promising or forecasting any returns on investments

as usual, great stuff fm Vidya.

The only way to benefit with mutual funds is to be invested in it for a long period of time – 3 to 5 years. We should not try to time the markets. Just take the ups and downs in stride.

Well, in theory it is all true long-term investment in mutual funds will yield the returns but practically the situation might just be the opposite. i was reading an article in TOI that investors who invested in mutual funds in 2008 they have just earned max of 7% return uptill now considering the level of NAV then and now have just become same. Markets fall and then rise so the time-period which the market takes to pass the same level from which it fell takes time and sometimes it might take years to become profitable again in equities. So, yes we have to be patient in equities but we need to time the market so as to get the best out of it otherwise we won’t even get returns equivalent to an RD, that is for sure.

Hello Saurabh,

Thanks for sharing your views. The 2008 data you mention is true if one invested in lump sum. It is exactly to avoid such a mishap that one should go for SIPs. Even if you had started SIP in the peak of January 2008 and continued till date you could have got easily managed anywehere between 12-19% annual returns (XIRR), if you had used the SIP mode and invested in any of the top quartile funds or our FundsIndia’s Select funds. You will appreciate that these returns are far superior when compared with RD returns, esp. ;post tax. Hence, it is for people who time the market that the TOI article makes sense. Just take a look at how RDs worked (based on actual interest) and SIPs worked in the past in this blog article: https://blog.fundsindia.com/blog/mutual-funds/substitute-your-rd-with-sips-in-income-funds/3239

thanks, Vidya

True, SIP is Good ,

but I tend to experience similar to Mr Saurabh , because I also experienced similar problem.

If only we can catch some nearer tops and nearer bottoms, when we can reduce and increase, respectively by some lump some amount , we get Best returns.

But when mkt rises we become Greedy hoping it will rise again!!!

How to overcome dilemma?

Thanks and Regards.

hello Dilip, if you want the best of both worlds, then running SIPs and ocassioanlly investing lump sums in the same fund using ntriggers or your own filters when market falls is an option.

thanks, Vidya

Hi Vidya,

This article is a Gem. Really nice.

Can we invest in stocks when P/E is below 16?

Can we Top Up/ Boost MF SIP by investing as lumpsum when P/E is below 16?

AMOL

Hi Amol, thanks! Sorry for the delayed response. P/E is only 1 indicator…a stock that has poor fundamentals and therefore trading low is not a good bet. Yes, you may keep the index level to add more to equity funds…provided the funds are solid ones. thanks, Vidya

as usual, great stuff fm Vidya.

The only way to benefit with mutual funds is to be invested in it for a long period of time – 3 to 5 years. We should not try to time the markets. Just take the ups and downs in stride.

Well, in theory it is all true long-term investment in mutual funds will yield the returns but practically the situation might just be the opposite. i was reading an article in TOI that investors who invested in mutual funds in 2008 they have just earned max of 7% return uptill now considering the level of NAV then and now have just become same. Markets fall and then rise so the time-period which the market takes to pass the same level from which it fell takes time and sometimes it might take years to become profitable again in equities. So, yes we have to be patient in equities but we need to time the market so as to get the best out of it otherwise we won’t even get returns equivalent to an RD, that is for sure.

Hello Saurabh,

Thanks for sharing your views. The 2008 data you mention is true if one invested in lump sum. It is exactly to avoid such a mishap that one should go for SIPs. Even if you had started SIP in the peak of January 2008 and continued till date you could have got easily managed anywehere between 12-19% annual returns (XIRR), if you had used the SIP mode and invested in any of the top quartile funds or our FundsIndia’s Select funds. You will appreciate that these returns are far superior when compared with RD returns, esp. ;post tax. Hence, it is for people who time the market that the TOI article makes sense. Just take a look at how RDs worked (based on actual interest) and SIPs worked in the past in this blog article: https://blog.fundsindia.com/blog/mutual-funds/substitute-your-rd-with-sips-in-income-funds/3239

thanks, Vidya

True, SIP is Good ,

but I tend to experience similar to Mr Saurabh , because I also experienced similar problem.

If only we can catch some nearer tops and nearer bottoms, when we can reduce and increase, respectively by some lump some amount , we get Best returns.

But when mkt rises we become Greedy hoping it will rise again!!!

How to overcome dilemma?

Thanks and Regards.

hello Dilip, if you want the best of both worlds, then running SIPs and ocassioanlly investing lump sums in the same fund using ntriggers or your own filters when market falls is an option.

thanks, Vidya

Hi Vidya,

This article is a Gem. Really nice.

Can we invest in stocks when P/E is below 16?

Can we Top Up/ Boost MF SIP by investing as lumpsum when P/E is below 16?

AMOL

Hi Amol, thanks! Sorry for the delayed response. P/E is only 1 indicator…a stock that has poor fundamentals and therefore trading low is not a good bet. Yes, you may keep the index level to add more to equity funds…provided the funds are solid ones. thanks, Vidya