What’s your gold strategy?

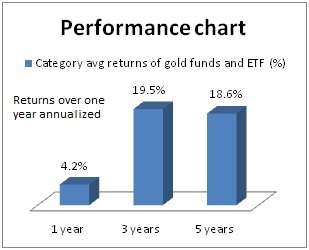

If you have got used to the stellar double-digit returns that gold fetched you every year in the past five years, then brace yourself up for some sedate performance. The political tension in the Korean region, economic turbulence in Cyprus and the disappointing non-farm jobs report in the US notwithstanding, gold is yet to make a strong show thus far in 2013.

Ideally, economic and political tensions should have caused an up-tick in gold holding and prices, as people wish to move to a safer asset class.

While it may be early days to rule out a pick up this year, a broad consensus by institutional investors suggests that the yellow metal may be lacking catalysts at present. The large-scale selling by global ETF holders and hedge funds is evidence to the fact that gold is on the selling mode abroad.

Year to date, gold prices in India fell by about 4 per cent, and in USD, (spot) gold prices fell by about 5 per cent. The one-year returns in the Indian context are in low single digits while it is marginally down globally.

Should you buy?

In such a scenario, should you continue your gold SIPs (if you already have them running) or stop them? If you are planning to buy gold, should you do it now?

Much would depend on your objective behind buying gold:

1. If you’re buying gold because you need to build a kitty to buy physical gold in future, say for a child’s wedding or for your own self, then you are simply saving up for it now, in line with gold prices.

Neither the global turmoil nor the picture of stability showcased by the US should trouble you into taking a call on stopping your savings on gold. And instead of going for unregulated and risky gold schemes offered by jewelers, you are better off investing in gold ETFs or gold funds that can be liquidated to buy gold in future. Read more on why you should prefer gold ETFs over physical gold in : http://ow.ly/jSXDM

But remember, this should be a medium to long-term goal of say 3-20 years. In the short term, if gold prices do fall, you would have been better off saving the money in a liquid fund, or your savings bank, than lose it by buying in to gold funds when prices fall.

2. If you are buying gold for the two reasons for which it is best bought, i.e., lack of credit risk and liquid market (especially given new modes of buying gold such as gold ETFs and gold funds), then here too, not much thought needs to go into timing your buy.

That said, you can buy on short dips to help average your costs. In that sense, the current market prices are closer to the July 2012 prices, giving you some scope to average, if you wish to do so.

After all, gold returns have slipped in to negative territory in three financial years of the last 40 years in India. Also, in this scenario, ensure that you build a portfolio with a mix of moderate to low credit risk instruments other than gold. As gold provides you the hedge, you could well take exposure to other marginally risky asset classes. Read more about allocation in the ensuing point.

3. The third reason, that is often cited by advisors, is buying gold to hedge against inflation. Now this is tricky business. No doubt, if you take the yearly returns of gold from 1970-71 and assume an average 6 per cent inflation (inflation varies over this period as base dates have changed), then gold prices beat inflation 71 per cent of the times. (Source: RBI’s financial year data on gold prices)

But if you test this more consistently, by taking rolling ten-year returns between 2003 and 2013 (that means 10-year returns of gold as of April 2003, May 2003 June 2003 and so on until March 2013), then gold returns beat inflation 65 per cent of the times. That means you cannot always depend on gold to keep your purchasing power intact. And yet, the average returns for this period stood at 10 per cent.

In other words, when gold prices beat inflation, they beat by a good margin. Hence, the key is to hold it in combination with other asset classes.

Allocation

So what do you do in such a case? Globally, institutions talk of an 8-10 per cent optimal allocation to gold as part of a portfolio. You could probably go up to 10 per cent, if your allocation is merely to diversify and provide some purchasing power during down markets.

This would provide you some protection when other asset classes under perform without hurting overall portfolio returns much, when gold itself under performs.

To take an example, had you allocated 60 per cent of your money to Nifty and 40 per cent to the Crisil Composite Bond Index (representing medium-term debt) through SIPs for the last five years, your returns would have been about 7 per cent, what with poor equity market playing spoilsport. A 50 per cent allocation to equities, 40 per cent to debt and 10 per cent in gold would have propped up returns to 10.7 per cent in the same period.

The investment decision

Now what if your purpose of investing in gold is merely from an investment perspective? Then, we have no response to your question on whether you should invest now. But find below some cues that may help you make your decision.

Gold has no fundamentals and hence, it has to depend on global scenarios to buttress its price or to pull it down. Right now, a stable equity market in the US, defying all odds and contrary to many other markets, appears to be a key put off for gold price movements.

A possible inflationary scenario in the US could be one key trigger to buttress a gold rally. Besides, Central Banks across the world could be one of the support factors for gold as they buy into gold steadily.

According to a World Gold Council report, Central Bankers’ strategy to building optimal gold reserves as a means to diversification from currencies such as the dollar and the euro means that they may provide some support, even as global investors liquidate their positions.

Back home in India, the economic uncertainty, and the high inflation, coupled with the weak rupee, have only reinforced faith in gold, what with gold imports picking up significantly in the December quarter of 2012, after a lull in the earlier quarter. Domestic gold prices too have stood ground better than global gold prices, thanks to a weakening rupee.

Therefore, while you could expect some support from a free fall, any near-term trigger for a rally appears uncertain. It may at best be an accumulation phase.

Quantum Gold Savings and Reliance Gold Savings are good options among gold mutual funds. Goldman Sachs Gold BEES, UTI Gold ETF and SBI Gold ETS are options in the ETF category.

Hi Vidya,

Could you please also highlight which one could be best ETF to invest in current scenario in terms of SIP? Also, please provide your views on investment via Reliance My Gold Plan and bullionindia.com portal.

Thanks,

Amit

Hi Amit, we have mentioned some gold ETFs and funds at the end of the article you refer to. Relinace my Gold may be better than the plans provided by jewelers. Yes, it does not need a demat account like ETF but even gold fund of funds don’t need one. Also, the restriction of min. 1 year investment, charges for early exit and delivery of only physical gold ( and no cash option) are limitations. If you again land with physical gold, various charges including wealth tax will apply. Bullion India too is again a physcial mode. Unless, your aim is to hold gold and not just invest/redeem them as wealth we would think gold ETFs/gold fund of fund are better options. Tks, Vidya

Thanks Vidya for elaborate and clear reply. Yes, I had seen the recommended ETFs. However, I was not sure which of them could be the best one to start SIP investment in current perspective. If you can suggest based on performance parameters and lowest possible SIP installment, it would help.

For lack of further explanation in a 1000-word article, I have not mentioned individual performance of funds. But these funds have been picked based on track record and returns. For ETFs, liquidity and expense were factors that were considered besides consistent performance. The fund of funds have been picked based on min SIP and also expense ratios. The min SIP for Reliance is Rs 100 and min for Quantum is Rs 500. The min SIP though, will vary in different platforms. So kindly check in the platform in which you invest. As for ETFs, not all platforms offer SIP facilities on ETF. Kindly check with your broker on SIP facility. Tks, Vidya

Vidya, did you find any difference in the performance among ETFs? I don’t think so..

Hi Anshuk, There will be marginal difference, based on expense ratio as well as the proportion that they hold outside gold (in liquid instruments). Tks, Vidya

Of course. But how much difference did you find in your study? I really don’t think it is even worth mentioning.. 🙂

The one-year returns for the top and bottom gold ETF was 4.11% and 3.36%. Not very high but still good enough to take notice of, given that there is no active management in gold. tks, Vidya

Thanks for your reply. That is a big difference. I wasn’t expecting such a big gap.

Hi Vidya,

Could you please also highlight which one could be best ETF to invest in current scenario in terms of SIP? Also, please provide your views on investment via Reliance My Gold Plan and bullionindia.com portal.

Thanks,

Amit

Hi Amit, we have mentioned some gold ETFs and funds at the end of the article you refer to. Relinace my Gold may be better than the plans provided by jewelers. Yes, it does not need a demat account like ETF but even gold fund of funds don’t need one. Also, the restriction of min. 1 year investment, charges for early exit and delivery of only physical gold ( and no cash option) are limitations. If you again land with physical gold, various charges including wealth tax will apply. Bullion India too is again a physcial mode. Unless, your aim is to hold gold and not just invest/redeem them as wealth we would think gold ETFs/gold fund of fund are better options. Tks, Vidya

Thanks Vidya for elaborate and clear reply. Yes, I had seen the recommended ETFs. However, I was not sure which of them could be the best one to start SIP investment in current perspective. If you can suggest based on performance parameters and lowest possible SIP installment, it would help.

For lack of further explanation in a 1000-word article, I have not mentioned individual performance of funds. But these funds have been picked based on track record and returns. For ETFs, liquidity and expense were factors that were considered besides consistent performance. The fund of funds have been picked based on min SIP and also expense ratios. The min SIP for Reliance is Rs 100 and min for Quantum is Rs 500. The min SIP though, will vary in different platforms. So kindly check in the platform in which you invest. As for ETFs, not all platforms offer SIP facilities on ETF. Kindly check with your broker on SIP facility. Tks, Vidya

Vidya, did you find any difference in the performance among ETFs? I don’t think so..

Hi Anshuk, There will be marginal difference, based on expense ratio as well as the proportion that they hold outside gold (in liquid instruments). Tks, Vidya

Of course. But how much difference did you find in your study? I really don’t think it is even worth mentioning.. 🙂

The one-year returns for the top and bottom gold ETF was 4.11% and 3.36%. Not very high but still good enough to take notice of, given that there is no active management in gold. tks, Vidya

Thanks for your reply. That is a big difference. I wasn’t expecting such a big gap.

HI Vidya

What are your thoughts on spot gold offered by NSEL? how are they in compare to ETFs/gold funds.

Hi Sougato,

E-gold will require you to have a demat account with an affiliate of NSEL. This would be diff. from the regular equity demat account. E-gold’s brokerage charges and transaction charges is said to be less than ETF/gold funds as there is no fund management involved like with MFs. But there would be a small stamp duty on such gold when it is bought. You can take deliver of gold under e-gold but this option is possible only under few plans in gold funds/ETFs.

But the biggest limitation comes from tax angle. For one, you will have to hold the gold for 36 months to enjoy LTCG benefit and is taxed at 20%. Where for ETF and gold fund it is one year. After a year, ETF and gold funds will have 10% tax without indexation and 20% after indexation. Two, any holding of over 30 lakh as e-gold will entail wealth tax every year because you are holding gold for all practical purposes (although in e-form). Tks, vidya

Dear bala,

Pls suggest is buying gold funds like reliance my gold is good for current market scenario where gold prices are melting down, i am not very much into mf studies does market gold price effects the fund gains.

also what should be better plan of investment if i am 21 year old

Is it better to invest in gold funds then regular balances and equity diversified funds.

Hi Ashwani,

1. Reliance My gold will require you to take delivery of gold in physical mode only. No cash option is available. Unless you want physical gold (which will be subject to wealth tax and other charges), you are better off going for a gold fund, if your objective is simply long-term investment.

2. For someone of your age, you should have a good combination of equity, debt and gold. Over the long-term, actively managed equity mutul funds hold potential to beat gold. it is because of the poor economic condition globally that gold has done well in recent years. You should have equity funds for long-term investments and hedge it with some debt and gold exposure. Investing in equity funds is easy through online platform like FundsIndia. You also have advisors to guide you with investments at no addl. cost. You can also read up so many material available on the net for this. Direct equity investing can be riskier. To that extent funds are a good bet for a beginner.

tks,

Vidya

“After all, gold returns have slipped in to negative territory in three financial years of the last 40 years in India”

Do you mean “only” in three out of last 40 years? How is this possible? When you look at the last 40 years of the history, there are many years in which gold price ended up lower than when it started. E.g. take a look at this nice chart: http://www.macrotrends.org/1333/gold-and-silver-prices-100-year-historical-chart

You can see that the gold price currently is lower than what it was in 1980, after adjusting for inflation, of course. The outlook is much different if you only consider data from 2000, but it looks like we are heading into another major dip.

Hi Hari, Thanks for sharing the data. What you have is global prices. What I took was RBI’s data on Indian (mubai bullion) gold prices, and that too for each financial year only. Also, there have certainly been dips but not for a full financial year, except for 3 occasions. Yes, gold certainly seems weak and may well dip, given that it does have its cycles. But what we need to remember is that unlike earlier dips, this time, some Central Bank or the other has been buying, suggesting that Federal Banks across the globe are in a diversification mode, from a point where they went overweight on the currency, mostly dollar or Euro.

But if you consider inflation adjustments it is likely that even debt as an asset class has real negative returns. Hence, if one’s goal is mere investment, we expressed our reluctance to take a call on gold. For others, whose objective behind gold is different, market swings should not matter too much.

Tks, Vidya

Thank you, for taking the time to clarify your thoughts. Would you please take a look at this chart of “Dow to Gold Ratio – 100 Year Historical Chart” and provide your valuable insights?

http://www.macrotrends.org/1378/dow-to-gold-ratio-100-year-historical-chart

Hello Hari, I am not a chart reader nor a technical analyst 🙂 to provide insights on the Dow gold ratio used by not only traders but supposedly by Central bankers to purchase gold. I believe increasingly, the monetary policies (influenced of course by economy and inflation) and Central bank movements will be key determinants, besides what the chart throws from historical data. Tks, Vidya

HI Vidya

What are your thoughts on spot gold offered by NSEL? how are they in compare to ETFs/gold funds.

Hi Sougato,

E-gold will require you to have a demat account with an affiliate of NSEL. This would be diff. from the regular equity demat account. E-gold’s brokerage charges and transaction charges is said to be less than ETF/gold funds as there is no fund management involved like with MFs. But there would be a small stamp duty on such gold when it is bought. You can take deliver of gold under e-gold but this option is possible only under few plans in gold funds/ETFs.

But the biggest limitation comes from tax angle. For one, you will have to hold the gold for 36 months to enjoy LTCG benefit and is taxed at 20%. Where for ETF and gold fund it is one year. After a year, ETF and gold funds will have 10% tax without indexation and 20% after indexation. Two, any holding of over 30 lakh as e-gold will entail wealth tax every year because you are holding gold for all practical purposes (although in e-form). Tks, vidya

Dear bala,

Pls suggest is buying gold funds like reliance my gold is good for current market scenario where gold prices are melting down, i am not very much into mf studies does market gold price effects the fund gains.

also what should be better plan of investment if i am 21 year old

Is it better to invest in gold funds then regular balances and equity diversified funds.

Hi Ashwani,

1. Reliance My gold will require you to take delivery of gold in physical mode only. No cash option is available. Unless you want physical gold (which will be subject to wealth tax and other charges), you are better off going for a gold fund, if your objective is simply long-term investment.

2. For someone of your age, you should have a good combination of equity, debt and gold. Over the long-term, actively managed equity mutul funds hold potential to beat gold. it is because of the poor economic condition globally that gold has done well in recent years. You should have equity funds for long-term investments and hedge it with some debt and gold exposure. Investing in equity funds is easy through online platform like FundsIndia. You also have advisors to guide you with investments at no addl. cost. You can also read up so many material available on the net for this. Direct equity investing can be riskier. To that extent funds are a good bet for a beginner.

tks,

Vidya

“After all, gold returns have slipped in to negative territory in three financial years of the last 40 years in India”

Do you mean “only” in three out of last 40 years? How is this possible? When you look at the last 40 years of the history, there are many years in which gold price ended up lower than when it started. E.g. take a look at this nice chart: http://www.macrotrends.org/1333/gold-and-silver-prices-100-year-historical-chart

You can see that the gold price currently is lower than what it was in 1980, after adjusting for inflation, of course. The outlook is much different if you only consider data from 2000, but it looks like we are heading into another major dip.

Hi Hari, Thanks for sharing the data. What you have is global prices. What I took was RBI’s data on Indian (mubai bullion) gold prices, and that too for each financial year only. Also, there have certainly been dips but not for a full financial year, except for 3 occasions. Yes, gold certainly seems weak and may well dip, given that it does have its cycles. But what we need to remember is that unlike earlier dips, this time, some Central Bank or the other has been buying, suggesting that Federal Banks across the globe are in a diversification mode, from a point where they went overweight on the currency, mostly dollar or Euro.

But if you consider inflation adjustments it is likely that even debt as an asset class has real negative returns. Hence, if one’s goal is mere investment, we expressed our reluctance to take a call on gold. For others, whose objective behind gold is different, market swings should not matter too much.

Tks, Vidya

Thank you, for taking the time to clarify your thoughts. Would you please take a look at this chart of “Dow to Gold Ratio – 100 Year Historical Chart” and provide your valuable insights?

http://www.macrotrends.org/1378/dow-to-gold-ratio-100-year-historical-chart

Hello Hari, I am not a chart reader nor a technical analyst 🙂 to provide insights on the Dow gold ratio used by not only traders but supposedly by Central bankers to purchase gold. I believe increasingly, the monetary policies (influenced of course by economy and inflation) and Central bank movements will be key determinants, besides what the chart throws from historical data. Tks, Vidya

Hi Vidya,

1)

Quoting you :

“Quantum Gold Savings and Reliance Gold Savings are good options among gold mutual funds…”

Any reason, why, SBI Gold or ICICI Pru Reg Gold Savings Fund (G) do not figure.

Pls note : This is a question coming from a novice, who is trying to pick your brains. & not from an expert, who is questioning your recommendations. 🙂

2) Would this be the right time to start a SIP in a Gold Fund ( from a perspective of say – 3 – 10 years ), or is it advisable to wait & watch for some time?

Thanks

Hi Shishir, Questions are always welcome from whosoever. We choose these funds on the basis of few criteria. One, their parent ETFs have been around for sometime and enjoy decent volumes as well as delivered good returns. Two, their expense ratio is reasonable and in fact very low for Quantum. Three, they allow small sums (as is the case with Reliance) as investment. Tks, Vidya

Hi,

Thanks.

Shishir.

As per Quantum Mutual Fund website (http://www.quantumamc.com/SchemesNAV/gold_fund.aspx), they don’t support SIP:

———

Systematic Investment Plan, Systematic Transfer Plan and Systematic Withdrawal Plan are not available under QGF.

Investors can avail of these facilities by investing in the Quantum Gold Savings Fund. Click here to read about Quantum Gold Savings fund.

Investors do have the option of regularly buying units from the listed exchanges and accumulating their QGF holdings.

——-

Are they referring to their own brokerage service, or will it also be applicable if traded from others such as your own or ICICI direct? Also, I can’t seem to be able to determine the exact code for this fund. Per moneycontrol.com, it is QGOLDHALF, while I can only find it on ICICI Direct with the code QUGOLD. Is this expected?

Hello Hari, FundsIndia offers SIPs in gold ETFs as well. Hence the said fund will be available with us through brokerage account. The savings fund can be bought through our usual mutual fund route. We will be unable to comment about the practices of other brokerages. Thanks, Vidya

i think due to global turmoil and the negative currency INR movements, there are huge fall in dollar prices of gold whereas they do reflect very little in INR terms.

Dont you think when the rupee appreciates, gold will itself give negative returns to those who have already invested. Why Don’t you should suggest some other way to invest?

Hello Adarsh,

When rupee recovers, it is likely that the economy will be back in shape. That is a while away. But when that happens, equities may do far better. But Indian consumers may also be back to their gold-spending ways, mostly in jewellery, thus keeping gold demand and prices reasonably healthy.

Having said that, we do not advocate gold as a standalone investment option. It is at best used to diversify a portfolio that already has equity and debt. We do not also normally recommend over 10% of a portfolio in gold. Hence, I suppose, a downturn in gold should not hurt a portfolio, where gold is merely used as diversifier. Tks, Vidya

I am interested in investing in SIlver ETF for a long horizon. Please offer some insight on investing in silver for a very long term (say 15-20 years through SIP?

Hello Rahul,

Silver ETFs have so far not received approval in India. You can buy in to e-silver at the National spot exchange, provided you hvae a seprate demat for commodities. You would have to check with commodity analysts on the prospects for silver. We do not track the commodity market. tks, Vidya

Hello Vidya,

Thanks for your advise. What do you think about energy and mining as a sector. Based on that do you suggest any international fund – which invests in global mining companies in Brazil or Australia,or Africa.

Appreciate your reply!

Hi Rahul,

As a theme energy and mining sound good and hold promise but the last few years of extreme volatility in these funds makes us believe that they can hurt an investors’ core portfolio. Regulations (such as taxes in mining) and government policies make these sectors uncertain. In general, we do not hold a view on theme funds. Investors would have to take a call on how well they can track these sectors and time their moves.

hello mam

I started 2000/- pm sip in reliance gold savings fund. I have paid around 34000 and current value stands at 29940.

I started late investing in gold to diversify and to gain from luster prevailing around one and half year back. Now prices are diving nose down.

what you suggest should I continue my sip or hold.

Hello Deepak,

Much would depend on why you invested in gold and whether you are investing with a long-term goal in mind. If you invested merely to make hay when the going was good, it certainly was not a prudent strategy. However, if you have no near-term goal ear-marked to this and do not need the money for at least another 3-5 years, then you should consider continuing SIPs and ensuring that you average them. But keep gold exposure to 10-15% of your total portfolio as a diversification strategy. If it exceeds this, better to shift some to equities or debt. Tks, Vidya

Hi,

I have gone through this blog and few other blog on your site.

Thanks a lot for detailed write-up about these investment gyans.

I have a question and still not concluded so asking here –

I am 30 years old married person and would like to invest in gold.

My idea is to do a very long term investment, may be around 15 years-20 years.

Why I want to invest in gold (some e form), because after 15-20 years or even later, whenever I need gold, I don’t need to plan for that, I can just liquidate this gold stuff and get my gold need satisfied. So, instead of collecting gold biscuits or ornaments every year or so, I want to invest in some ETF or some other suggested fund.

Need your suggestion to go for gold fund or ETF?

What are the tax implications after so many years, when I liquidate to get the gold ornaments?

Thanks

Deepak

Hello Deepak, With gold funds or gold ETfs, unless you deal with very large quantities of gold, you cannot get gold back. You will get money equivalent of the then market price of gold. if you are ok with that go for gold ETFs if you have a demat account. Else, go for gold funds. Vidya

@vidhya Bala

U r clearly working for Reliance fund……………. 🙁

Hi Hari, 🙂 We have all gold funds on the platform and do not therefore ‘work’ for one 🙂 We picked funds for this call (in april 2013) based on the then low expense ratio for gold. Investors are free to choose the funds they want. If you are talking of Reliance My Gold Plan, it is not a mutual fund. It is buying physical gold through averaging. I do not track it 🙂

thanks

Vidya

i think due to global turmoil and the negative currency INR movements, there are huge fall in dollar prices of gold whereas they do reflect very little in INR terms.

Dont you think when the rupee appreciates, gold will itself give negative returns to those who have already invested. Why Don’t you should suggest some other way to invest?

Hello Adarsh,

When rupee recovers, it is likely that the economy will be back in shape. That is a while away. But when that happens, equities may do far better. But Indian consumers may also be back to their gold-spending ways, mostly in jewellery, thus keeping gold demand and prices reasonably healthy.

Having said that, we do not advocate gold as a standalone investment option. It is at best used to diversify a portfolio that already has equity and debt. We do not also normally recommend over 10% of a portfolio in gold. Hence, I suppose, a downturn in gold should not hurt a portfolio, where gold is merely used as diversifier. Tks, Vidya

Hi,

I have gone through this blog and few other blog on your site.

Thanks a lot for detailed write-up about these investment gyans.

I have a question and still not concluded so asking here –

I am 30 years old married person and would like to invest in gold.

My idea is to do a very long term investment, may be around 15 years-20 years.

Why I want to invest in gold (some e form), because after 15-20 years or even later, whenever I need gold, I don’t need to plan for that, I can just liquidate this gold stuff and get my gold need satisfied. So, instead of collecting gold biscuits or ornaments every year or so, I want to invest in some ETF or some other suggested fund.

Need your suggestion to go for gold fund or ETF?

What are the tax implications after so many years, when I liquidate to get the gold ornaments?

Thanks

Deepak

Hello Deepak, With gold funds or gold ETfs, unless you deal with very large quantities of gold, you cannot get gold back. You will get money equivalent of the then market price of gold. if you are ok with that go for gold ETFs if you have a demat account. Else, go for gold funds. Vidya

Hi Vidya,

1)

Quoting you :

“Quantum Gold Savings and Reliance Gold Savings are good options among gold mutual funds…”

Any reason, why, SBI Gold or ICICI Pru Reg Gold Savings Fund (G) do not figure.

Pls note : This is a question coming from a novice, who is trying to pick your brains. & not from an expert, who is questioning your recommendations. 🙂

2) Would this be the right time to start a SIP in a Gold Fund ( from a perspective of say – 3 – 10 years ), or is it advisable to wait & watch for some time?

Thanks

Hi Shishir, Questions are always welcome from whosoever. We choose these funds on the basis of few criteria. One, their parent ETFs have been around for sometime and enjoy decent volumes as well as delivered good returns. Two, their expense ratio is reasonable and in fact very low for Quantum. Three, they allow small sums (as is the case with Reliance) as investment. Tks, Vidya

Hi,

Thanks.

Shishir.

As per Quantum Mutual Fund website (http://www.quantumamc.com/SchemesNAV/gold_fund.aspx), they don’t support SIP:

———

Systematic Investment Plan, Systematic Transfer Plan and Systematic Withdrawal Plan are not available under QGF.

Investors can avail of these facilities by investing in the Quantum Gold Savings Fund. Click here to read about Quantum Gold Savings fund.

Investors do have the option of regularly buying units from the listed exchanges and accumulating their QGF holdings.

——-

Are they referring to their own brokerage service, or will it also be applicable if traded from others such as your own or ICICI direct? Also, I can’t seem to be able to determine the exact code for this fund. Per moneycontrol.com, it is QGOLDHALF, while I can only find it on ICICI Direct with the code QUGOLD. Is this expected?

Hello Hari, FundsIndia offers SIPs in gold ETFs as well. Hence the said fund will be available with us through brokerage account. The savings fund can be bought through our usual mutual fund route. We will be unable to comment about the practices of other brokerages. Thanks, Vidya

hello mam

I started 2000/- pm sip in reliance gold savings fund. I have paid around 34000 and current value stands at 29940.

I started late investing in gold to diversify and to gain from luster prevailing around one and half year back. Now prices are diving nose down.

what you suggest should I continue my sip or hold.

Hello Deepak,

Much would depend on why you invested in gold and whether you are investing with a long-term goal in mind. If you invested merely to make hay when the going was good, it certainly was not a prudent strategy. However, if you have no near-term goal ear-marked to this and do not need the money for at least another 3-5 years, then you should consider continuing SIPs and ensuring that you average them. But keep gold exposure to 10-15% of your total portfolio as a diversification strategy. If it exceeds this, better to shift some to equities or debt. Tks, Vidya

Hello Vidya,

Thanks for your advise. What do you think about energy and mining as a sector. Based on that do you suggest any international fund – which invests in global mining companies in Brazil or Australia,or Africa.

Appreciate your reply!

Hi Rahul,

As a theme energy and mining sound good and hold promise but the last few years of extreme volatility in these funds makes us believe that they can hurt an investors’ core portfolio. Regulations (such as taxes in mining) and government policies make these sectors uncertain. In general, we do not hold a view on theme funds. Investors would have to take a call on how well they can track these sectors and time their moves.

@vidhya Bala

U r clearly working for Reliance fund……………. 🙁

Hi Hari, 🙂 We have all gold funds on the platform and do not therefore ‘work’ for one 🙂 We picked funds for this call (in april 2013) based on the then low expense ratio for gold. Investors are free to choose the funds they want. If you are talking of Reliance My Gold Plan, it is not a mutual fund. It is buying physical gold through averaging. I do not track it 🙂

thanks

Vidya

I am interested in investing in SIlver ETF for a long horizon. Please offer some insight on investing in silver for a very long term (say 15-20 years through SIP?

Hello Rahul,

Silver ETFs have so far not received approval in India. You can buy in to e-silver at the National spot exchange, provided you hvae a seprate demat for commodities. You would have to check with commodity analysts on the prospects for silver. We do not track the commodity market. tks, Vidya