As the election fever reaches a peak, it is important not to lose sight of 2 things in your investment life – your own goals and your investment time frame, plus the fundamentals of the market and the economy.

The former, of course, means that your choice of whether to invest or not, or when to invest does not even arise when you have certain fixed commitments to meet over a fixed time frame. In other words, external factors should not determine your savings/investments.

Hence, the issue of whether to invest before the elections or post the election results, in our opinion, does not exist if you need to work towards a goal. You simply need to invest in avenues that help you build the required wealth.

That said, your choice of investments can vary, either based on the fund’s performance (when it comes to mutual funds), or based on the opportunities that sector and the changing economic scenario throw up.

It was in relation to the second point – that is changing fundamentals of the economy and sectors – that we came up with our strategic call in March. You can click here to read it. It was, of course, not meant to be an election bet. Rather, it was chosen based on fund portfolios that we believed held more potential at this point.

Of the funds chosen there, we mentioned HDFC Top 200 as a dark horse play. We had a few investors asking us about the fund’s underperformance in 2012-13. Our choice of the fund was more based on the scheme’s portfolio potential and the improving performance, its chequered record over the past 2 years notwithstanding. In this weekly call, we seek to review the fund a bit more in detail.

Performance & Suitability

To know if HDFC Top 200 fits you, it is important to understand the fund’s characteristics. One, HDFC Top 200 is a diversified fund with a large-cap bias; but, it takes an exposure of 15-20% to mid-cap or nascent large-cap stocks as well. This makes it a tad riskier than most pure large-cap funds.

Two, HDFC Top 200 certainly does not score as high as many other large-cap funds in terms of containing risks. In other words, the fund takes a hard knock in down markets even as it outperforms in market rallies. Just to illustrate this point, in the last 5 years, the maximum knock the fund took (1-year fall) was 24% as against funds such as ICICI Pru Focused Bluechip Equity or UTI Opportunities that fell by 16%.

On the other hand, the highest 1-year return over the same 5-year period was 129% for the fund, as against 113-115% for the funds mentioned above. In other funds, HDFC Top 200 is a high beta fund and can be highly volatile over short-to-medium time frames. The last couple of years were cases in point.

Three, HDFC Top 200’s fund manager, Prashant Jain, is known to stick to his guns when it comes to his conviction calls on certain stocks/sectors. This may mean not touching certain sectors even as they rally, or sticking to an underperforming stock – case in point being the fund’s still-top holding – SBI (the stock was an underperformer for a good part of 2013 but rallied 34% in the last 6 months). That means, you might see the fund go contrary and therefore underperform in certain phases.

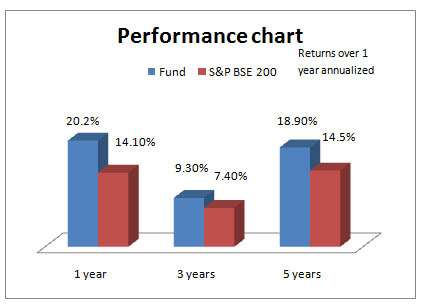

Despite it volatility, the fund has beaten its benchmark, S&P BSE 200, 80% of the times on a rolling one-year basis for the last 5 years. This record is not way off the 82% statistics of a similar nature for UTI Opportunities when compared with its own benchmark, S&P BSE 100.

Of course, in the last 3 years, HDFC Top 200 underperformed its benchmark more number of times as a result of its sector and stock bets that are only now beginning to work.

In all, HDFC Top 200 may not be the right fund for a beginner’s core portfolio. While its long-term returns compensate investors for such risks, its volatility may not appeal to a new investor. We have recommended HDFC Top 200 as a strategic call, based on its portfolio. We believe that its portfolio, which has a good dose of cyclical sectors, is well placed to qualify from any improvement in the economy.

Portfolio

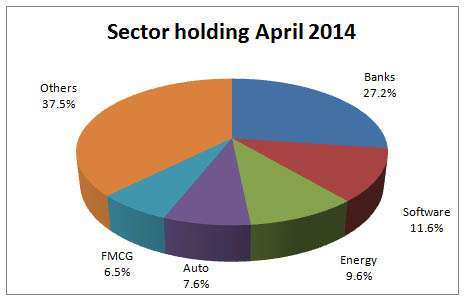

HDFC Top 200 has maximum weight to the banking and financial services sector, with SBI being the top stock. Exposure to IT, energy, auto and consumer non durables also means that the fund has a fine mix of cyclical as well as defensive sectors.

Capital good stocks such as Siemens and Crompton Greaves, as well as cement plays such as Grasim Industries and Century Textiles & Industries all point to a portfolio strategy that is waiting for an economic recovery. While we do not expect the fund to benefit simply because the market is factoring a revival, over a three-year period, these sectors and stocks are likely to provide a sufficient upside on improved domestic capex spending.

THE VALUE RESEARCH HAS DOWN GRADED THE FUND.AND THERE HAS BEEN RECOMMENDATIONS TO QUIT OR AVOID THE FUND.IN SUCH A SCENERIO YOUR RECOMMENDATION HAS COME AS WELCOME RELIEF BOOSTING THE CONFIDENCE OF THE INVESTORS WHO HAVE MADE INVESTMENTS IN THE FUND.THANK YOU.

Hi Vidya,

I am regular follower of your blog. My specific question in regards to HDFC Top 200 is do you suggest the fund to be in one’s retirement portfolio which is 20-30 yrs away. It has beaten it’s benchmark since inception, however, from last 2-3 yrs, the fund has not performed well as you mentioned. Most of the sites/advisors have advised to move out of the fund. I am unable to decide and take an informed decision about this fund. Also, you mentioned it might not be a good choice for a beginner’s portfolio: my question would be if a beginer want this fund in his/her portfolio keeping retirement in mind, it can be included, Your thoughts please. Thank you.

Hello Debojoyoti, If you are a beginner, you may not be prepared for volatility. That is why I would hesitate to suggest this fund to you unless you are comfortable with seeing your fund take a knock in the short to medium term. I suggest you go with established funds (pl. use the help tab in your account and use the advisory appt. to choose the right funds for you) for now and once comfortable with equity fund’s way of working, slowly take exposure to more aggressive funds such as this one. thanks, Vidya

I had invested in this continuously from Nov 09 to Mar 12. After that its performance dipped and I diverted my money to IDFC premier equity. I haven’t redeemed any unit of HDFC top 200.

What do you suggest? Should I get back to investing in this. Currently I am regularly investing in ICICI focussed bluechip, IDFC premier equity and PPFAS long term MF.

Hi Abhishek, since youa re investing in mid-cap fund (IDFC Premier) and large-cap fund (ICICI Pru Focused Bluechip), you are good for now. I would suggest since you have accumulated quite a bit of HDFC Top 200, simply hold it. It should provide the required kicker returns. thanks,vidya

Hi Vidya,

Extremely Good article at the right time.

I have one question, I have both Mutual Funds (HDFC Top 200 and HDFC Equity) in my portfolio.

Which one do you recommend one over other? Which one should be retained for long term investment?

Regards,

Anjani Singh

Hi Anjani,

I would prefer HDFC Top 200 for an aggressive largecap fund. For a diversified fund, I think there are plenty of substitutes for HDFC Equity. You can find them in our select funds list. thanks, Vidya

Hello Vidya,

I am new holder of Funds India Account.

i have myself selected a few funds for retirement which is 34 years from now and right now thought of investing 3500 monthly. I have selected

Axis LT Equity ELSS (Rs .500/Month) -chosen by me

Franklin India Blue Chip (Rs. 1000/Month) – suggested by Soumya of Funds iNdia

UTI Equity Fund( Rs. 1000/Month) -Chosen by me

HDFC Mid Cap Opportunities Fund (Rs. 1000/Month) – Chosen by me

I am looking forward to invest long. Are these funds are the right choice fro retirement corpus. I ‘ll gradually increase my monthly amount as my earnings increases. I am looking for a 10 crore retirement corpus atleast.

And emergency funds are to invested in ultra short term funds or liquid funds. Which u will suggest.

Plz comment

Hello Kamal,

Being our investor, I have raised this as a ticket in your name and you shall receive my response through mail.

In future, request you to use the help tab where you will find a feature called ‘Advisory appointment’. Kindly send your query there. This will help us track it and respond in a timely manner. The blog is more of a discussion forum.

thanks

Vidya

My risk profile comes out be aggressive

Hi Vidya,

I have HDFC top 200 fund and HDFC tax saver fund. shall i hold it or sell it ?

B’cas, tax saver fund i purchased at 204 in 2010. will it go to 400 mark or not?

Hello Sir,

thank you for writing to us. Specific fund advice to our investors are done through our advisory feature (where you raise a query and our advisors respond). In future, pl. use this feature (click help tab and advisor appointment) to enable us to reply to you promptyl and track your queries. The blog is more of a discussion forum.

I am passing your query to our advisor as I do not have details about your investments etc (You do not have investments yet with FundsIndia). We usually review funds that are invested through our platform. But to answer your query, only in stocks, whether price will hit a target or not can be said. From your query, Rs 204 to Rs 400 between 2010-14 means a return expectation of 18% per annum. If the current rally continues you may achieve that. As to whether you should hold the tax saver fund, our advisors will talk to you before responding to this.

thanks

Vidya

I have sip of 5 fund in my portfolio 1)hdfc top 200 2)hddc equity 3)hdfc midcap opportunist 4)icici focus blue chip 5) icici value discovery , for long term , my sought should i continue hdfc top 200 & hdfc equity .

Thank you

Hello Sir,

The blog is a public forum. We have a separate process to answer FundsIndia’s investor queries.

I checked for your holding in FundsIndia to get more details about your investment, before reviewing them. I suppose you do not have these on your FundsIndia account. If you have an activated FundsIndia account, please write to us using the advisor appointment feature (in the help tab) with details on your investment, when it was started, time frame etc. Also, in general, it will help you to have all investments in one place (consolidated) so that portfolio review and decisions can be done with ease. You can use the ‘easy transfer’ option with us to shift your holding, if any, outside FundsIndia. thanks, Vidya

THE VALUE RESEARCH HAS DOWN GRADED THE FUND.AND THERE HAS BEEN RECOMMENDATIONS TO QUIT OR AVOID THE FUND.IN SUCH A SCENERIO YOUR RECOMMENDATION HAS COME AS WELCOME RELIEF BOOSTING THE CONFIDENCE OF THE INVESTORS WHO HAVE MADE INVESTMENTS IN THE FUND.THANK YOU.

Hi Vidya,

I am regular follower of your blog. My specific question in regards to HDFC Top 200 is do you suggest the fund to be in one’s retirement portfolio which is 20-30 yrs away. It has beaten it’s benchmark since inception, however, from last 2-3 yrs, the fund has not performed well as you mentioned. Most of the sites/advisors have advised to move out of the fund. I am unable to decide and take an informed decision about this fund. Also, you mentioned it might not be a good choice for a beginner’s portfolio: my question would be if a beginer want this fund in his/her portfolio keeping retirement in mind, it can be included, Your thoughts please. Thank you.

Hello Debojoyoti, If you are a beginner, you may not be prepared for volatility. That is why I would hesitate to suggest this fund to you unless you are comfortable with seeing your fund take a knock in the short to medium term. I suggest you go with established funds (pl. use the help tab in your account and use the advisory appt. to choose the right funds for you) for now and once comfortable with equity fund’s way of working, slowly take exposure to more aggressive funds such as this one. thanks, Vidya

Hi Vidya,

Extremely Good article at the right time.

I have one question, I have both Mutual Funds (HDFC Top 200 and HDFC Equity) in my portfolio.

Which one do you recommend one over other? Which one should be retained for long term investment?

Regards,

Anjani Singh

Hi Anjani,

I would prefer HDFC Top 200 for an aggressive largecap fund. For a diversified fund, I think there are plenty of substitutes for HDFC Equity. You can find them in our select funds list. thanks, Vidya

Hello Vidya,

I am new holder of Funds India Account.

i have myself selected a few funds for retirement which is 34 years from now and right now thought of investing 3500 monthly. I have selected

Axis LT Equity ELSS (Rs .500/Month) -chosen by me

Franklin India Blue Chip (Rs. 1000/Month) – suggested by Soumya of Funds iNdia

UTI Equity Fund( Rs. 1000/Month) -Chosen by me

HDFC Mid Cap Opportunities Fund (Rs. 1000/Month) – Chosen by me

I am looking forward to invest long. Are these funds are the right choice fro retirement corpus. I ‘ll gradually increase my monthly amount as my earnings increases. I am looking for a 10 crore retirement corpus atleast.

And emergency funds are to invested in ultra short term funds or liquid funds. Which u will suggest.

Plz comment

Hello Kamal,

Being our investor, I have raised this as a ticket in your name and you shall receive my response through mail.

In future, request you to use the help tab where you will find a feature called ‘Advisory appointment’. Kindly send your query there. This will help us track it and respond in a timely manner. The blog is more of a discussion forum.

thanks

Vidya

My risk profile comes out be aggressive

Hi Vidya,

I have HDFC top 200 fund and HDFC tax saver fund. shall i hold it or sell it ?

B’cas, tax saver fund i purchased at 204 in 2010. will it go to 400 mark or not?

Hello Sir,

thank you for writing to us. Specific fund advice to our investors are done through our advisory feature (where you raise a query and our advisors respond). In future, pl. use this feature (click help tab and advisor appointment) to enable us to reply to you promptyl and track your queries. The blog is more of a discussion forum.

I am passing your query to our advisor as I do not have details about your investments etc (You do not have investments yet with FundsIndia). We usually review funds that are invested through our platform. But to answer your query, only in stocks, whether price will hit a target or not can be said. From your query, Rs 204 to Rs 400 between 2010-14 means a return expectation of 18% per annum. If the current rally continues you may achieve that. As to whether you should hold the tax saver fund, our advisors will talk to you before responding to this.

thanks

Vidya

I had invested in this continuously from Nov 09 to Mar 12. After that its performance dipped and I diverted my money to IDFC premier equity. I haven’t redeemed any unit of HDFC top 200.

What do you suggest? Should I get back to investing in this. Currently I am regularly investing in ICICI focussed bluechip, IDFC premier equity and PPFAS long term MF.

Hi Abhishek, since youa re investing in mid-cap fund (IDFC Premier) and large-cap fund (ICICI Pru Focused Bluechip), you are good for now. I would suggest since you have accumulated quite a bit of HDFC Top 200, simply hold it. It should provide the required kicker returns. thanks,vidya

I have sip of 5 fund in my portfolio 1)hdfc top 200 2)hddc equity 3)hdfc midcap opportunist 4)icici focus blue chip 5) icici value discovery , for long term , my sought should i continue hdfc top 200 & hdfc equity .

Thank you

Hello Sir,

The blog is a public forum. We have a separate process to answer FundsIndia’s investor queries.

I checked for your holding in FundsIndia to get more details about your investment, before reviewing them. I suppose you do not have these on your FundsIndia account. If you have an activated FundsIndia account, please write to us using the advisor appointment feature (in the help tab) with details on your investment, when it was started, time frame etc. Also, in general, it will help you to have all investments in one place (consolidated) so that portfolio review and decisions can be done with ease. You can use the ‘easy transfer’ option with us to shift your holding, if any, outside FundsIndia. thanks, Vidya