What:

Equity fund investing predominantly in midcap stocks

Why:

- Able to contain losses when midcaps correct

- Follows a buy-and-hold strategy with minimum churn

- Steady performer across time frames

Whom:

High-risk investors with a minimum 5-year time frame

From the peak in January 2018, midcap stocks have been on a downward slide. The Nifty Midcap 100 TRI lost 17.7% from then till date. 4 in every 10 midcap stocks have corrected even more than this figure. Smallcap stocks too have corrected and by much more. Volatility has also marked the midcap and smallcap segments since the start of this year, with weekly returns ticking higher in some weeks and falling sharply in others.

For those with a risk-taking mindset and a long-term horizon of at least 5 years, this fall and volatility present good opportunities through midcap funds. Midcap funds invest predominantly in midcap stocks with some exposure to smallcap stocks as well. The SIP route will be the best way to capture these opportunities.

Within the midcap category, Franklin India Prima stands out in its ability to remain steady across cycles and deliver well over the long-term. It suits all investors who want a midcap allocation in their long-term portfolios.

Strategy and performance

Franklin India Prima (Franklin Prima) follows a buy-and-hold approach, picking stocks that have growth potential better than their largecap counterparts. It stays conscious of valuations in its stock-picking. It does not churn its portfolio much. Still, it gradually exits underperformers or books profits or exits outperformers; both of which are essential strategies in the midcap space.

This measured approach helps it stay away from frothy stocks and markets and keep downsides contained during market corrections.

Over 2017, for example, the fund reduced exposure or exited several stocks to make most of the market run-up. These include Arvind, CARE Ratings, Federal Bank, Repco Home Finance, Punjab National Bank, Blue Dart Express, TVS Motor Company, and Bajaj Holdings. In the past year, it got out of or pared stake in Havells India, Vardhman Textiles, Axis Bank, United Breweries, and Whirlpool of India.

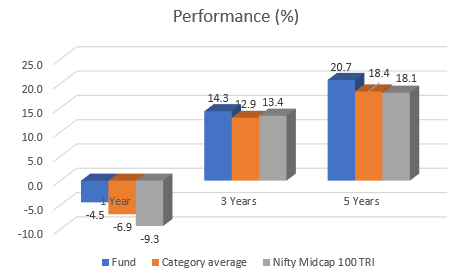

Franklin Prima’s strategy enables it to contain downsides well when markets correct. From the January 2018 peak after which the Nifty Midcap 100 was steadily losing, the fund was outperforming the index by a steadily widening margin. Rolling its 1-year return on a daily basis from March 2018, the average margin by which Franklin Prima beat the Nifty Midcap 100 TRI was 3.12 percentage points. Its 1-year returns are well above the category average and the index.

Returns over 1 year are annualised. Returns as of March 5th, 2019

The fund’s volatility is also well below the average for its category while its risk-adjusted return is in the top quartile.

Franklin Prima, however, may not be among the chart-toppers in heady markets. Over 2017, the fund was lagging the benchmark and many peers as it booked profits in stocks, exited some, and added to beaten-down stocks in industrial products, software, auto ancillaries, construction and so on. The fund is more of a steady performer than one that rises and falls. Its SIP returns across different timeframes of 5 years and above places it steadily above average, compared to funds in its category and well above the benchmark. On a 3-year rolling return over the past 7 years, the fund beats the Nifty Midcap 100 TRI 83% of the time.

Portfolio

Franklin India Prima holds a diffused portfolio of several stocks, as is the won’t for most midcap funds. This limits liquidity and concentration risks. The fund has used the market correction to its advantage, adding back those such as Arvind Mills, picking up or adding to those beaten down, such as Emami, BEL, Bharat Forge, and Ashok Leyland.

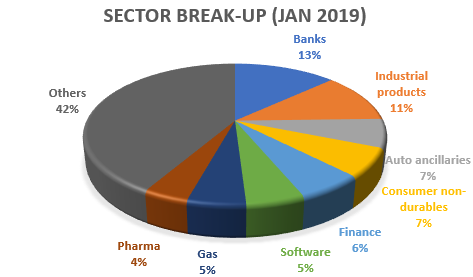

The fund has been gradually adding to sectors such as capital goods, construction, infrastructure, and cement. Capital goods and engineering form a significant portfolio share of about 14%. These sectors are starting to see a turnaround or can pick up over increased infrastructure and real estate activity.

Banks and finance form another large portfolio share, partly due to the fund’s holding of largecap stocks such as HDFC Bank and Kotak Mahindra Bank to counter the market correction. It does hold small banks such as RBL, Equitas Holding, and City Union Bank as well. Apart from this, the fund has added to consumer non-durables and other consumer stocks. This balanced approach can help it participate in a cyclical rally if markets turn attention to these beaten-down sectors later this year, as well as make the most of the consumer theme.

Franklin India Prima is managed by R. Janakiraman who has been with the fund for over a decade, and by Srikesh Nair and Hari Shyamsundar. It has an AUM of Rs 6,458 crore.