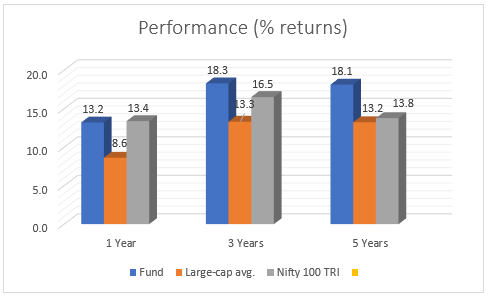

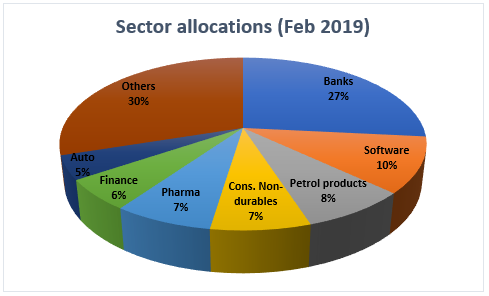

A largecap-oriented equity fund Why Whom All investors with a horizon of 5 years and above Mirae Asset India Equity is among the steadiest equity funds. It beats the broad-market Nifty 500 TRI index all the time in any 3-year period since its inception. The average 3-year returns it has delivered is a healthy 18.1% compared to the Nifty 500 TRI’s 12.4%. It hasn’t delivered a loss in any 3-year period even as the indices have slipped marginally into the negative. This fund is currently categorised as a multicap fund. Effective May 1st, this fund will be categorised as a largecap fund and see its name change to Mirae Asset Large Cap fund. So, what happens to the phenomenal track record that the fund has built up? What should you do with your holdings and SIPs in this fund? For that, look to the fund’s portfolio and strategy. While classified as a multicap fund, Mirae Asset India Equity’s portfolio aligns towards that of a largecap fund. The change in category does not necessarily entail a change in the fund’s make-up or prospects. In fact, the change in category now reflects its actual portfolio. The definition of a largecap fund requires a minimum 80% allocation to largecaps. Mirae Equity already fulfils this and also has enough room to move into midcaps or smallcaps to improve returns, if required. The fund already has been following such a strategy. The change in category, therefore, does not indicate that the fund will do anything different. The fund should continue in your long-term portfolio as a moderate-risk stable fund and can be accumulated further through SIPs or lumpsum. Oriented towards largecap Mirae Asset India Equity (Mirae Equity) always sported a higher largecap allocation in its portfolio, even when it was a multicap fund. The minimum largecap holding that the fund had was 70%. This gave it a moderate-risk nature. Volatility in its returns was lower than peers and the fund clocked high risk-adjusted returns. From 2016 onwards, the fund began stepping up largecap exposure in earnest. Prior to SEBI’s category definitions last year, at research, we categorised funds based on their market-cap allocations. We had classified Mirae Equity into the largecap category from 2017 and moved it into the multicap category only due to SEBI’s categorisation. In the past 12 months, its average allocation to largecap stocks was 84%. Its current portfolio has a 12% allocation to mid and smallcap stocks. Performance Mirae Equity’s past performance is valid and comparable despite recategorization. On this count, Mirae Equity scores very well. Consider the rolling 1-year returns over the past three years, a timeframe when the fund was decidedly largecap based. The fund beat the Nifty 100 TRI 70% of the time. As a category, largecaps managed to beat the benchmark only 27% of the times over the same period! In the category, the only funds that come close to Mirae Equity are ICICI Prudential Bluechip and Axis Bluechip. Other funds are well below. Mirae Equity’s average margin of this outperformance is 2.06 percentage points which is the best in its category. The fund, like most largecap peers, trailed the Nifty 100 TRI for much of 2018. This is partly due to the index returns being skewed by a handful of stocks that shot up while others lagged. But Mirae Equity’s portfolio also held it in good stead, with top stocks featuring strong performers such as Axis Bank, Reliance Industries, TCS, Infosys, HUL and Kotak Mahindra Bank. Smaller plays that supported performance included Titan Company, Info Edge, Aditya Birla Fashion & Retail, and Divis Labs. Returns over 1 year are annualised. Returns as of April 2nd, 2019. Mirae Equity’s volatility is slightly above the average for largecap funds, on account of its active profit booking and paring stake in underperformers. However, its risk-adjusted return, measured by the Sharpe ratio, holds well above category average and is higher than that of ICICI Prudential Bluechip. Mirae Equity’s ability to contain downsides, measured by the capture and Sortino ratios, ranks above the average for largecap funds as well. Strategy Mirae Equity holds a large and diversified portfolio with the top ten stocks making up less than half the portfolio. It does not go deviate too much from the index’s sector weights. It tends towards a growth-based approach but also looks at valuations to pick up potential outperformers and prevent paying too high a price for its stocks. The fund actively reduces exposure to stocks that have run up or are laggards. This ensures that it captures upsides and reduces the impact of falling stock prices. Over the past year, for example, the fund booked profits or exited stocks such as Apollo Hospitals, Adani Ports, HCL Technologies, Yes Bank, Vinati Organics, GAIL, Tata Motors, and Emami. It used declines to buy into several stocks in both cyclical and defensive sectors. For example, it bought into ITC, Hindalco, Bharat Electronics, L&T, Maruti Suzuki, NTPC, Sun Pharma, and Cipla. Software, pharmaceuticals, retail, consumer staples and discretionary are some of the sectors to which it added over the past year. On the cyclical side, petroleum products and power saw additions. The fund also built up exposure early on in banks and it has maintained holdings since. Construction, capital goods, metals, are other cyclical sectors where exposure has been maintained. Neelesh Surana is the fund’s manager since its inception. Additional fund managers are Gaurav Misra and Harshad Borawake.

Average market-cap exposure from Jan 2017

Largecaps Midcaps Smallcaps

Fund

82.0% 10.7% 4.4%

Largecap category average 84.2% 7.8% 2.8%

Other articles you may like

What

[fbcomments]

Will it be a good time to invest in Mirae equity fund right now instead of SIP, a lump sum amount ?

Hello Amit,

It depends on how much you want to invest and what proportion it forms of your portfolio. If it’s not significant, then you can invest through a lump sum. You can do this lump sum investment in addition to your existing SIPs or follow it up with SIPs. SIPs are meant to bring in certainty and discipline to your investing – and to avoid problems in market timing. Stopping and starting SIPs, switching between SIPs and lump sums depending on your view of the market and so on will make it difficult to keep track of your investing and would be eventually inefficient.

Thanks,

Bhavana

Will it be a good time to invest in Mirae equity fund right now instead of SIP, a lump sum amount ?

Hello Amit,

It depends on how much you want to invest and what proportion it forms of your portfolio. If it’s not significant, then you can invest through a lump sum. You can do this lump sum investment in addition to your existing SIPs or follow it up with SIPs. SIPs are meant to bring in certainty and discipline to your investing – and to avoid problems in market timing. Stopping and starting SIPs, switching between SIPs and lump sums depending on your view of the market and so on will make it difficult to keep track of your investing and would be eventually inefficient.

Thanks,

Bhavana

Will it make sense to add this fund to ones portfolio if he already has the Mirae Asset Emerging Bluechip fund ? or would there be considerable overlap ?

Hello,

Yes, you can have both Mirae Emerging Bluechip and Mirae India Equity (Mirae Largecap now). They invest in different market segments – Emerging Bluechip has a high mid-cap exposure which Largecap does not. Emerging Bluechip has about half its portfolio in large-cap now but it can reduce this much further if mid-caps pick up. Mirae Largecap needs to necessarily maintain 80% in large-caps and historically has always been large-cap dominant. Both funds have different roles in your portfolio.

Thanks,

Bhavana

Will it make sense to add this fund to ones portfolio if he already has the Mirae Asset Emerging Bluechip fund ? or would there be considerable overlap ?

Hello,

Yes, you can have both Mirae Emerging Bluechip and Mirae India Equity (Mirae Largecap now). They invest in different market segments – Emerging Bluechip has a high mid-cap exposure which Largecap does not. Emerging Bluechip has about half its portfolio in large-cap now but it can reduce this much further if mid-caps pick up. Mirae Largecap needs to necessarily maintain 80% in large-caps and historically has always been large-cap dominant. Both funds have different roles in your portfolio.

Thanks,

Bhavana