In recent times, debt mutual funds have been in the limelight, primarily because of NAV declines in few funds led by credit downgrades and defaults. While the credit-related risks were always there across funds with exposure to lower credit securities, the fact that they did not play out for a long time had led to under-appreciation of credit risks in debt mutual funds. Interest rate risks, on the other hand, since they frequently play out via volatile NAV movement for long-duration based debt mutual funds based on interest rate movements, is better understood by most investors.

Given our learnings from this cycle (both from our mistakes as well as others’), we have brought in significant improvement and changes to our debt fund selection and portfolio construction process especially in terms of risk management.

In the coming few weeks, over a series of new posts, we would like to introduce you to our investment thought process, framework, and investment philosophy.

Understanding Risks in Debt Mutual Funds

There are two major types of risks associated with a debt mutual fund.

1) Interest rate risk: Risk of decline owing to changes in interest rates.

This is the risk that interest rates may rise and cause a fall in the value of traded bonds and hence lead to lower returns. Interest rates and portfolio values/NAVs move in opposite directions. Further, the NAVs would fluctuate more for a long maturity fund and less for a short maturity fund. This risk is best captured by the modified duration of the fund.

The reason why fund managers take this risk is to target higher returns by increasing the modified duration if the expectation is for a decline in interest rates and vice versa.

2) Credit risk: Risk of decline/loss owing to change in the credit profile of an issuer that leads either to downgrade or default.

This is the risk that the issuer will not pay the coupon income and/or maturity proceeds on the specified dates. This could also lead to a decline in the portfolio values/NAVs due to a downgrade in the credit rating or default.

The reason why fund managers take this risk is lower credit-rated papers, if managed well without defaults and minimal downgrades, can be used to target higher returns from the higher yields available in lower credit-rated papers.

Now the key question for us is

To what extent do we need to take both the above risks for improving our debt portfolio returns?

To help us manage these risks better and set the right return expectations in our debt portfolios, we suggest a 3 bucket debt portfolio construction framework.

- Cash Bucket: The purpose of this bucket is for immediate cash requirements. Safety and Liquidity remain the key priority.

- Category: Overnight and Liquid fund categories can be considered for this bucket

- Core Bucket: This portion should be the majority of allocation and should have funds which are low on both interest rate risk (modified duration <3 years) and credit risk.

- Category: 80-100% AAA funds in the Ultra Short Duration/Low duration/Money Market/Short term/Medium term/Corporate bond/Banking PSU categories.

- Alpha Bucket: This is the portion where you try to add on higher returns over and above the core bucket returns.

- Long/active duration – higher duration to capture decline in interest rates

- Credit Risk Funds – higher yields via lower-rated papers

- Debt Oriented Hybrid Funds – 10-40% equity exposure to improve returns

Cash Bucket

The purpose of this bucket is usually for immediate cash requirements, emergency corpus, planning STP (Systematic Transfer Plan) into equity funds etc.

Safety and Liquidity will take the highest priority in this category with returns being a residual of the first two factors.

Overnight and Liquid fund categories will be considered for this bucket.

Core Bucket

For conservative investors, who have moved from FDs, the fixed income allocation should be predominantly in the core bucket.

For the core bucket stick to high credit quality (80%-100% AAA & Equivalent) funds in the Low Duration/Short Term/Medium Term/Corporate Bond/Banking PSU categories.

Alpha Bucket

For investors looking at enhancing overall returns, based on their risk profile, they can have a portion of the overall allocation to the “Alpha Bucket”. This can be done in three ways:

1. Duration Strategy

The first option is to use a duration strategy, where the focus is on capital appreciation from a rise in bond prices due to the fall in interest rates. The intent is to generate higher returns by actively managing interest rate risk by investing in long term debt instruments.

However, given the 3-year taxation for debt funds, it becomes difficult to execute high duration strategy directly via long-duration funds as the entry and exit are critical and the 3-year taxation impacts the exit flexibility.

To address the tax constraints, Dynamic Bond Funds where the fund manager actively manages interest rate risk within the fund can be used to participate in the duration strategy.

The fund manager’s skill and track record in managing interest rate risk over the past cycles remains the key to the success of this strategy.

The success in executing the strategy remains in the fund manager’s ability to time the interest rate cycle.

This will go into our “too hard” bucket, and we will selectively use the strategy only when valuations become extremely cheap (measured by real rates and inflation expectations).

2. Credit Strategy

The second option is to invest in Credit Risk Funds which aim to generate higher returns by managing credit risk (to earn higher yield) while minimizing interest rate risk.

The credit quality of the current portfolio, the track record of the fund manager in terms of his credit selection and previous history of downgrades and defaults, concentration risk, fund size, Stability of flows etc needs to be evaluated.

Since most of the credit papers are not very liquid, concentration risk and the risk of sudden large outflows (in the event of a downgrade) along with the option to side pocket needs to be evaluated.

Unlike other categories, in the event of a downgrade or default, the fund manager in most cases won’t be able to manage the risk real-time by exiting/reducing the exposure as most of the low rated credit securities are illiquid.

This puts the onus on the investor/us to manage the risk by exiting/reducing the fund exposure in our portfolio. Taxation and exit loads reduce this flexibility to a certain extent and need to be factored while making a decision.

The other aspect of credit funds is that they are correlated with equities to a large extent. Under weakening economic conditions, both equity markets and credit markets usually get impacted at the same time. So from a diversification point of view, credit funds may not be able to diversify the equity risk during a down market.

We believe the credit category is only meant for aggressive investors who understand the risks, have a longer time frame and would be comfortable with the possibility of few downgrades and sporadic defaults along the journey.

“Sudden Outflow” leading to an unintended increase in exposure of illiquid lower-rated papers (concentration risk) remains the biggest risk in this category and investors must have pre-decided checkpoints to exit if there is a sharp fall in AUM.

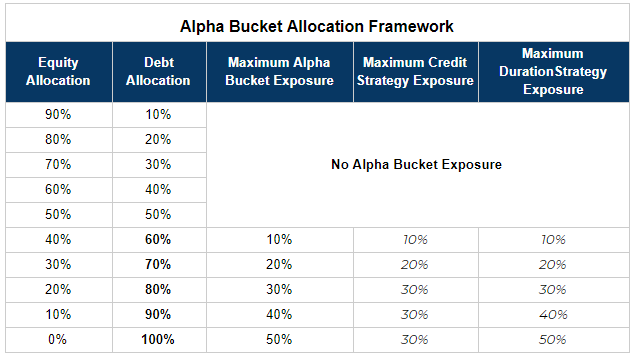

Overall while this category is not meant for conservative investors, for investors wanting to participate, taking the diversification perspective into consideration, we would suggest capping the maximum exposure to credit portion based on the overall asset allocation.

3. Debt Oriented Hybrid Funds

This is a category where some exposure to equities in the range of 10-40% is taken to enhance returns. We would prefer the debt portion to have the highest credit quality and low-interest rate risk.

Products: Equity Savings, Conservative Hybrid

Overall the “Alpha” bucket comes with higher risk but with the potential of higher returns.

It is important to remember that, the alpha bucket can lead to both positive outcomes (read as higher returns) as well as negative outcomes (read as risk and declines).

Hence, this bucket should be considered as a portion of overall fixed income allocation, only for investors with much higher risk appetite.

In our next post, we will discuss our framework to evaluate the different buckets.

An extract of this article was published in ET Wealth. Click here to read it.