For those who are looking at long-term investment in debt and want steady returns, holding income accrual funds is a good idea. Among such funds, if you can assume a small dose of risk, then limited allocation to funds with some marginal credit risk would help prop returns in a falling interest rate scenario.

Birla Sun Life Medium Term Plan (BSL Medium Term Plan), a high-risk debt fund, would fit your bill for the above purpose, especially in the current rate scenario. While we have covered this fund in 2013, its high credit risk profile prevented us from providing a recommendation on this fund. For well over a year now, this fund has been steadily decreasing its exposure to lower-rated papers. While it still falls well within the ambit of the ‘credit opportunity’ category, that it has been able to balance risk and returns provides some confidence.

Credit risk and suitability

Credit risk arises when a fund is unable to get back the interest or principal in any of the debt instruments it holds. A downgrade of a debt instrument, even if the company has not defaulted is also a credit risk as the borrower’s creditworthiness is seen to be eroded when a downgrade happens. Credit opportunity funds do not try to actively play the interest rate game. They instead look for companies that are seemingly risky (in their credit profile) but are only temporarily bogged down by short-term financing issues or are at the cusp of an improvement in their financials and credit worthiness.

In such times, a fund can bargain a good coupon rate (interest) and holds the instruments typically till maturity (when not traded), earning the accrual (interest income) from the instrument. It is for this reason when no risk transpires, this class of funds can provide very steady and FD-beating returns with minimum volatility. When the risk emerges, such a fund’s NAV could fall. The fall could be temporary (mark to market) when there is a downgrade or permanent when there is a default. The fall may not necessarily mean you will be in losses. Typically, when you hold for the minimum time-frame (average maturity of the fund), the returns may be recouped.

Investors in this class of investments should not panic on temporary falls and should be willing to hold for the time-frame they set out to hold. They should also be willing to take negative returns that may span over even 1-3 months.

BSL Medium Term Plan is a credit opportunity fund, albeit with relatively lower credit risk now. It is suitable for investors with a time-frame of at least 3 years, who are willing to take some credit risk.

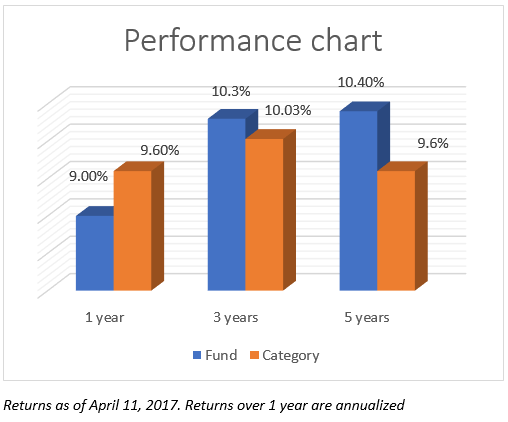

Performance

BSL Medium Term Plan delivered 10.3% compounded annual returns over the last 3 years. That is just above the average returns in this category. But it is noteworthy that most of the funds in the category have higher credit exposure than BSL Medium Term Plan. Hence, on a risk-adjusted basis (measured by Sharpe) the fund scores better than most peers. Only funds such as SBI Corporate Bond (a high-risk portfolio) and IDBI Corporate Debt Opportunities (which has just completed 3 years and lacks a long record) score better than this fund in the credit opportunity category.

BSL Medium Term Plan has a superior long-term track record with double-digit returns over the last 5 years as well. It’s margin of outperformance over peers too, was higher over a 5-year period (by almost a percentage point). However, in earlier years, its credit risk was also higher. To this extent, more recent returns are better indicators. The last one year’s return may seem to underperform category simply because the fund has the lowest risk at present in the category. Hence, risk-adjusted returns provide a better gauge of performance.

You also need to note that credit opportunity funds too can deliver negative returns over short periods without any credit issues. Since most of them hold some AAA-rated listed papers as well, volatility in these papers can result in mark-to-market losses.

BSL Medium Term Plan delivered negative returns 4% of the times on a rolling monthly return basis when returns were rolled daily for the last 3 years. Peers too had a 3-5% negative return occurrence.

Portfolio

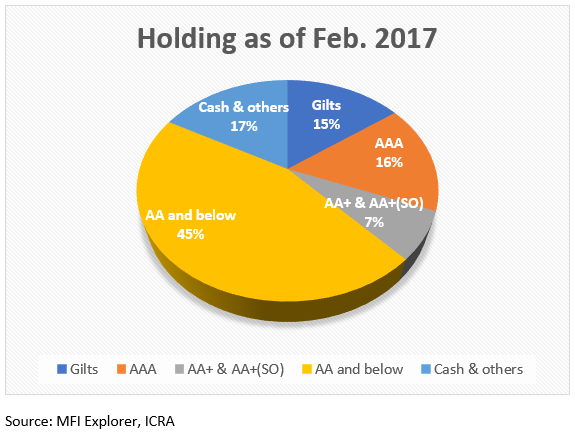

The fund has a yield to maturity of 8.9% as of February 2017. Strangely, this is lower than the category average of 9.1% (and maximum yields at even 10.4%). This is because of 2 reasons: First, the fund’s average holding in papers that are less than AA+ rated stood at 54% for the past 12 months (as of February 2017). This average was far higher, at 67.5%, for the category. Second, the fund held close to 15% in gilts, a not so popular holding in this category. Clearly, to reduce risks and to buttress returns (from capital appreciation in gilts) the fund has taken this strategy now. It is for this reason that its average maturity is higher at 5.5 years compared with the category average of 2.8 years. We expect the average maturity to go down once the fund reduces exposure to gilts.

The fund has a yield to maturity of 8.9% as of February 2017. Strangely, this is lower than the category average of 9.1% (and maximum yields at even 10.4%). This is because of 2 reasons: First, the fund’s average holding in papers that are less than AA+ rated stood at 54% for the past 12 months (as of February 2017). This average was far higher, at 67.5%, for the category. Second, the fund held close to 15% in gilts, a not so popular holding in this category. Clearly, to reduce risks and to buttress returns (from capital appreciation in gilts) the fund has taken this strategy now. It is for this reason that its average maturity is higher at 5.5 years compared with the category average of 2.8 years. We expect the average maturity to go down once the fund reduces exposure to gilts.

The fund is managed by Maneesh Dangi and Sunaina da Cunha, both experienced managers in debt and specifically in credit.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis for investment decisions. To know how to read our weekly fund reviews, please click here.