Marico Ltd. – No.1 Coconut Oil Brand

Marico Limited is one of India’s leading consumer goods companies operating in global beauty and wellness categories. The company nurtures leading brands across categories of hair care, skin care, edible oils, healthy foods, male grooming, and fabric care. In India, Marico touch the lives of one out of every three Indians through its portfolio of brands, such as Parachute, Saffola, Saffola FITTIFY, Nihar Naturals, etc. Headquartered in Mumbai, the company has a presence in 50 countries across emerging markets of Asia and Africa. It operates seven factories in India, located at Puducherry, Perundurai, Jalgaon, Guwahati, Baddi and Sanand. Marico reaches 5.6 million outlets, serviced through its expansive network of 900 distributors and 7,500 stockists. This network covers 59,000 villages in India and almost every Indian town with a population of over 5,000.

Products & Services:

The company has several Brands spread across several segments in Domestic & International Markets.

- Domestic Brands – Parachute and Nihar Naturals in Coconut Oil Segment; Saffola in Super-premium Refined edible oil Segment; Parachute advanced, Nihar naturals and Hair & Care in Value added hair oil Segment; Saffola oats, Coco Soul and Saffola FITTIFY Gourmet Range in Healthy foods; Livon Serums and Hair & Care in Premium Hair Nourishment Segment; Set Wet, Beardo and Parachute in Male Grooming & Styling Segment; Kaya Youth and Parachute advanced in Skin Care Segment; Mediker, Veggie Clean in Hygiene Segment.

- International Brands – Parachute, HairCode, Nihar Naturals, Mediker SafeLife, Fiancee, caivil, Hercules, Black Chic, Code 10, Ingwe, X-Men, Sedure, Hercules, Just for Baby, Just for kids, Thuan Phat and Isoplus.

Subsidiaries: As on FY23, the company has 19 subsidiaries.

Key Rationale:

- Market Leader – Marico is the market leader in the branded coconut oil market in India with a market share of 62% as on June 2023 based on the overall volumes. The company also ranks number 1 position in other products like Parachute Rigid with 53% volume market share and post wash serums with 57% volume market share. Value wise, Saffola Oats ranks number 1 position with 42% market share, Value added hair oil segment with 28% market share and Hair gel/cream segment with 53% market share.

- Acquisition – The Company has recently signed definitive agreements to acquire upto 58% of the paid-up share capital of Satiya Nutraceuticals Private Limited at a pre-money valuation of ~4x of its annualized revenue run-rate (ARR) of ~Rs.150 crore. Satiya Nutraceuticals Private Limited owns “The Plant Fix – Plix”, a digital-first, clean label, plant-based nutrition brand. With its portfolio of non-GMO, Vegan, Gluten-free and Cruelty-free offerings, spanning across Weight Management, Hair & Beauty, Sleep and Lifestyle Nutrition categories, Plix has established itself as one of the leading players in the online plant-based nutrition segment.

- Q1FY24 – Marico reported a consolidated revenue growth of -3% YoY in Q1FY24 to Rs.2477 crore. Gross margin expanded by 494 bps YoY and 257 bps sequentially, owing to incrementally softer input costs. EBITDA margin was at 23.2%, up 253 bps YoY. The India business delivered a turnover of Rs.1,827 crore, down 5% on a YoY basis. In the domestic business, Parachute Rigids posted a volume decline of 2%, followed by Saffola Edible oils with a low double digit volume growth and Value-added hair oils with Flat growth. Foods continued its healthy scale up with 24% value growth YoY, aided by steady growth in core and newer franchises. The International business continued its strong momentum and delivered constant currency (cc) growth of 9%, amidst macroeconomic and currency devaluation headwinds in some of the geographies. Bangladesh, Vietnam, South Africa and MENA delivered around 9%, 5%, 37% and 15% growth on cc terms respectively.

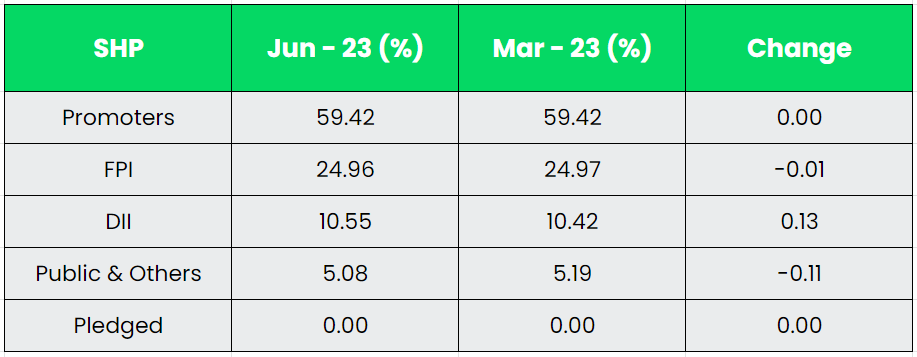

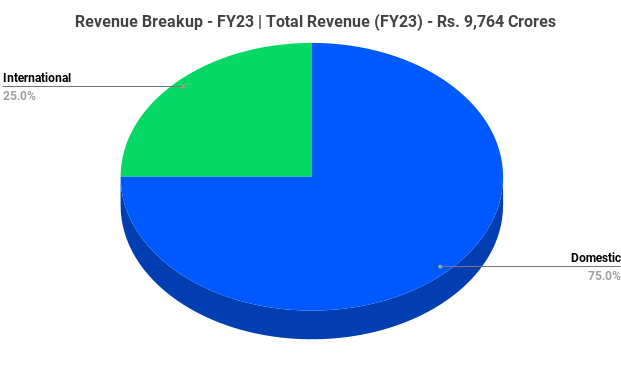

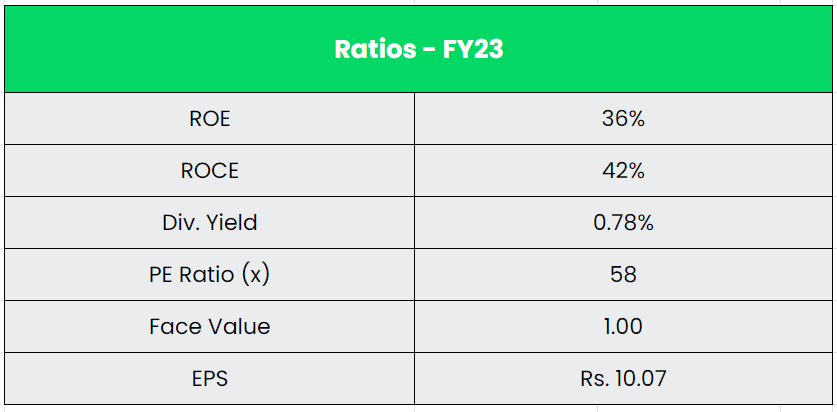

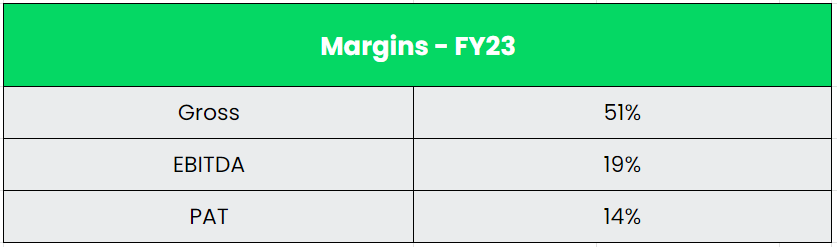

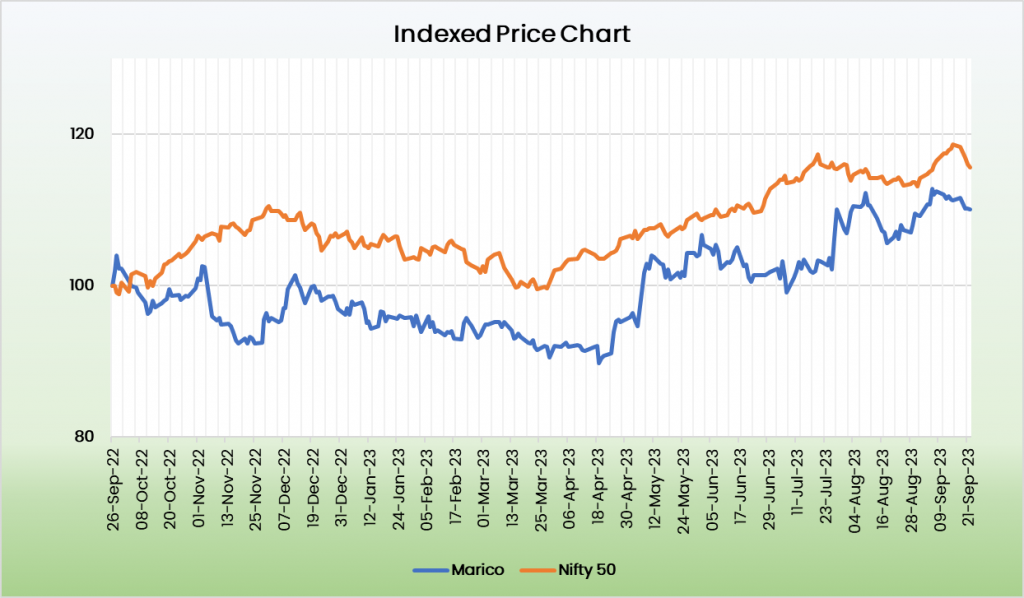

- Financial Performance – The 3 Year revenue and profit CAGR stands at 10% and 7% respectively between FY20-23. The share of international business has grown by 300 bps from 22% in FY19 to 25% in FY23. The company has a strong balance sheet with a debt-to-equity ratio of just 0.16x. The last 5-year accumulated FCF (Free Cash Flow) have crossed over Rs.5900 crore, depicting the cash generating potential of the company.

Industry:

India’s fast-moving consumer goods (FMCG) industry grew 12.2 percent in value in the April-June quarter of 2023 driven by higher consumption growth, according to data from NIQ India (formerly NielsenIQ). The industry recorded a volume growth of 7.5 percent, the highest in the last eight quarters. Price growth came in at 4.4 percent, which is the lowest in at least nine quarters. This comes after the FMCG industry saw high inflation translating into price-led growth for over two years. Total revenue of FMCG market is expected to grow at a CAGR of 27.9% through 2021-27, reaching nearly US$ 615.87 billion. In 2022, urban segment contributed 65% whereas rural India contributed more than 35% to the overall annual FMCG sales. Good harvest, government spending expected to aid rural demand recovery in FY24.

Growth Drivers:

- India continues to be an immense growth opportunity since it still has one of the lowest per capita FMCG consumption in the world with many sub-categories of FMCG having very low penetration levels.

- The Government of India has approved 100% FDI in the cash and carry segment and in single-brand retail along with 51% FDI in multi-brand retail.

- Union budget 2023-24 focuses on reviving rural demand by boosting disposable income, allocation to farms and higher fund allocation on rural infrastructure, connectivity, and mobility to create long-term jobs.

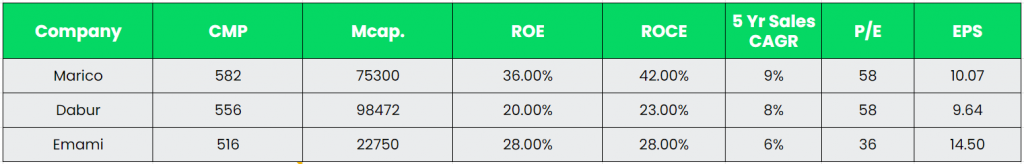

Competitors: Emami, Dabur, etc.

Peer Analysis:

While comparing Marico with its listed peers in terms of Sales CAGR, Marico is leading from the front. Return ratios are also on par for Marico among its listed peers.

Outlook:

During the quarter, the FMCG sector retained its positive sentiment from the previous quarter, although clear green shoots in rural on a sequential basis, as anticipated, were not visible. Growth remained urban led, while rural consolidated on a lower base. Over the medium term, the Management aspires to deliver 13-15% revenue growth on the back of 8-10% domestic volume growth in the domestic business and double-digit constant currency growth in the international business. On a consolidated basis, the Management anticipate a significant expansion in gross margin, ranging from 250 to 300 basis points (bps). This optimistic outlook is underpinned by several factors, including favourable trends in input costs, the effective implementation of cost management strategies, and a more advantageous product portfolio mix. While the company remain committed to investing in brand development to fortify the core and foster growth in new franchises, it also expects to witness a substantial enhancement in operating margin, an improvement of over 150 bps, to achieve operating margins of around 20% in FY24.

Valuation:

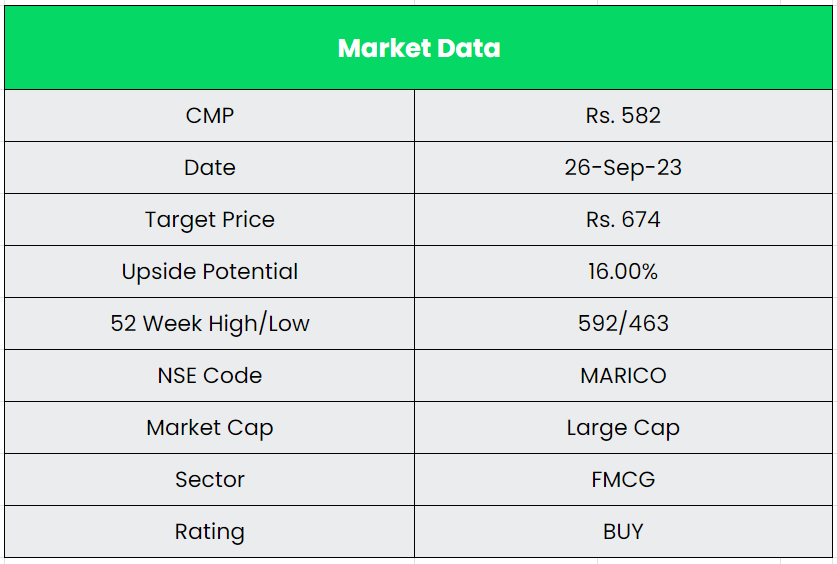

We believe Marico will maintain and accumulate market share on account of inflation downtrend, gradual recovery in the rural volume, increase in contribution from Foods and Premium personal care segment through new launches and strong international business. We recommend a BUY rating in the stock with the target price (TP) of Rs.674, 49x FY25E EPS.

Risks:

- Competitive Risk – Intense competition has reduced the ability of players to pass on any increase in raw material prices. While Marico has fairly been able to maintain its position and pricing in the industry, competitive intensity will continue to be high with new product launches from other large players, especially in the premium segment.

- Forex Risk – The company has significant operations in foreign markets and hence is exposed to forex risk. Any unforeseen movement in the forex market can adversely affect the company.

- Raw Material Risk – The cost of key raw materials, copra, safflower, rice bran and liquid paraffin and polymers, account for more than 50% of sales. Their prices depend on geo-climatic conditions, international prices, and the domestic demand-supply situation. Hence, the operating margin is partially susceptible to fluctuations in raw material prices.