Jindal Stainless Ltd – Leading Stainless Steel Company in India

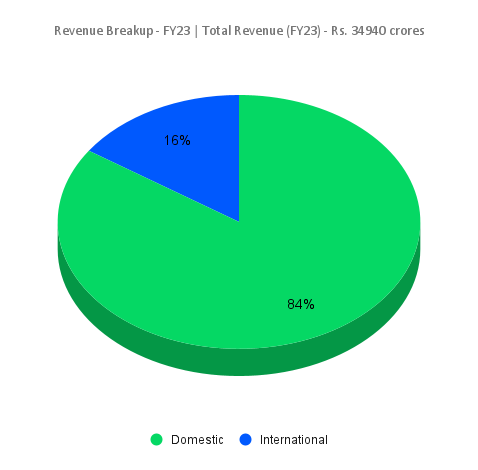

Jindal Stainless Limited (JSL), part of the global conglomerate OP Jindal Group, is one of the key players in the manufacturing and supply of high-quality stainless-steel products. Incorporated in 1980 in the state of Haryana, the company is among the top five stainless steel makers globally (excluding China). Equipped with cutting-edge technologies and advanced production processes, the company has two flagship stainless steel plants in India – in the states of Odisha and Haryana, and an overseas unit in Indonesia intended to serve the markets of South-East Asia and nearby regions. The Odisha plant has a capacity of 2.2 million tonnes per annum and is one of the largest in India. The company was also chosen to pilot the “Make in India” branding of steel and stainless-steel products exports. Jindal Stainless has a worldwide network in 15 countries and one service center in Spain.

Products and Services

JSL’s product range includes stainless steel slabs, blooms, hot-rolled coils and cold-rolled coils, plates, sheets, precision strips, blade steel, and speciality products such as coin blanks, blade steel and precision strips. This wide spectrum of products finds application in various processes like stainless steel roofing, staircase and atrium railings, infrastructure projects such as bridges, airports, and stadiums, automotive and transport, railway wagons and coaches, to name a few.

Subsidiaries: As of FY23, the company has 12 subsidiaries (including step-down subsidiaries).

Key Rationale

- Projects with strategic significance -JSL is one of the two companies globally to supply to the International Thermonuclear Experiment Reactor (ITER) project, ITER’s Cryostat Project in France. JSL also supplied to prestigious nuclear power projects at Bhabha Atomic Research Centre and Indira Gandhi Centre for Atomic Research. The company has secured projects to deliver critical special alloys including low alloy steel grade for the booster engine in satellite launch vehicles and Chandrayaan programs. It is a supplier of stainless-steel products for both ballistic and blast applications. The materials are used in various OEMs in India for bullet proof vehicles in India Materials for space application.

- Expansion plans – During FY23, the company acquired Rathi Super Steel Limited, adding wire rod and re-bars rolling capacity of 0.16 million tons and allowing the expansion of existing product portfolio. The company entered into collaborative agreement with New Yaking Pte Ltd to acquire 49% stake in their nickel pig iron (NPI) smelter facility situated in Indonesia, eyeing on long-term stable and sustained NPI supply for the company. JSL has also acquired the remaining 74% holding of Jindal United Steel Limited (JUSL). JUSL has been operating the Hot Strip Mill (HSM) of 1.6 million tons per annum (MTPA) capacity and Cold Rolling Mills of 0.2 MTPA capacity. This acquisition would result in improved synergies between both the companies and a preferred governance structure, thereby enhancing value for all stakeholders. It is also undergoing capacity expansion of up to 3.2 MTPA at Jajpur, Odisha. JSL is one of the first companies to apply for and secure certification for the recently introduced N5, N6 & N7 grades by the Bureau of Indian Standards for stainless-steel used in utensils and kitchenware applications.

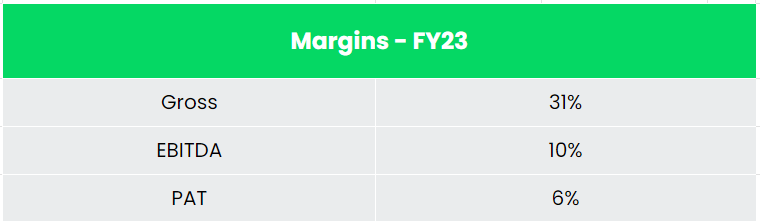

- Q2FY24 – During Q2FY24, the volume increased by 26% YoY basis amid muted global demand. The company marked revenue of Rs.9797 crores during the quarter, indicating an increase of 12% compared to the Q2FY23 revenue of Rs.8751 crores. Notwithstanding the weakened global demand and pricing pressure, the company reported robust increase in profits YoY. The company reported operating profit of Rs.1231 crores, an increase of 80% YoY. Net profit increased by 120% to Rs.764 crores against the Rs. 347 crores of same period previous year. CARE upgraded JSL’s credit rating to AA from AA- in view of the company’s high EBITDA/ton and steady improvement in debt coverage ratios.

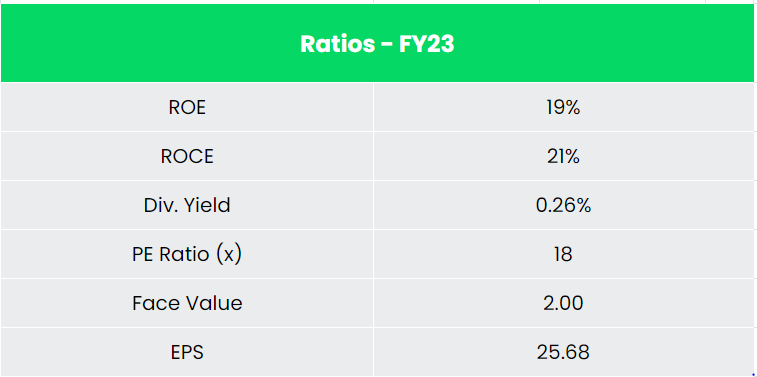

- Financial performance – The company has generated a revenue and PAT CAGR of 25% and 44% over the period of 5 years (FY18-23). Average 5-year ROE & ROCE is around 22% and 21% for FY18-23 period. The company has strong balance sheet with debt-to-equity ratio of 0.43.

Industry

Steel sector has always been at the forefront of industrial progress and that it is the foundation of any economy. The availability of raw materials such as the presence of abundant iron-ore, and cost-effective labour has been the growth drivers in Indian steel sector, making it a major contributor to India’s manufacturing output. On the domestic front, the consumption of stainless steel in India has grown by nearly 10% over the past financial year to reach 4 million tonnes, according to the Indian Stainless Steel Development Association (ISSDA). India’s finished steel consumption is anticipated to increase to 230 MT by 2030-31 from 119.17 MT in FY23.

Growth Drivers

Under the Union Budget 2023-24, the government allocated Rs. 70.15 crore (US$ 8.6 million) to the Ministry of Steel. Government has taken various steps to boost the sector including the introduction of National Steel Policy 2017 and allowing 100% Foreign Direct Investment (FDI) in the steel sector under the automatic route. The Indian government’s initiatives, such as the National Infrastructure Pipeline (NIP) and the Atmanirbhar Bharat Abhiyaan (Self-Reliant India Campaign), are expected to drive the demand for stainless steel in the country.

Competitors: Tata Steel, Steel Authority of India Limited (SAIL) etc.

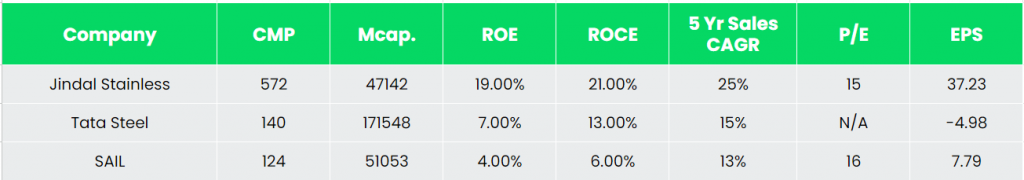

Peer Analysis

Among the above competitors, with a robust growth in revenue, JSL heads ahead of its competitors in terms of performance ratios and, indicating the company’s financial stability and its efficiency to generate income and returns from the invested capital.

Outlook

The company anticipates the global stainless-steel market to witness a CAGR of 4-4.5% during 2023-2029. The Indian stainless-steel industry is also projected to experience a healthy demand outlook consequent to the government’s push for stainless steel and strategic sectors. This growth is driven by factors such as railways, process industries, Automobile industry and Architecture, Building and Construction (ABC). We believe JSL is well positioned to capitalise on this growth due to its strong market presence and diverse product offerings.

Valuation

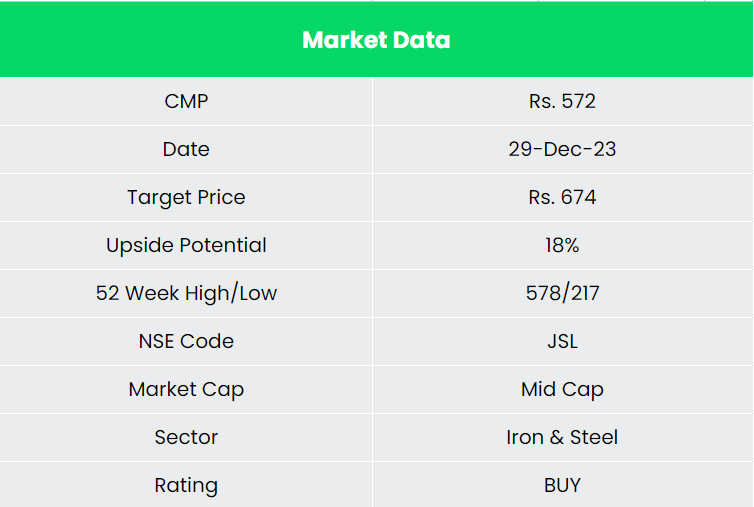

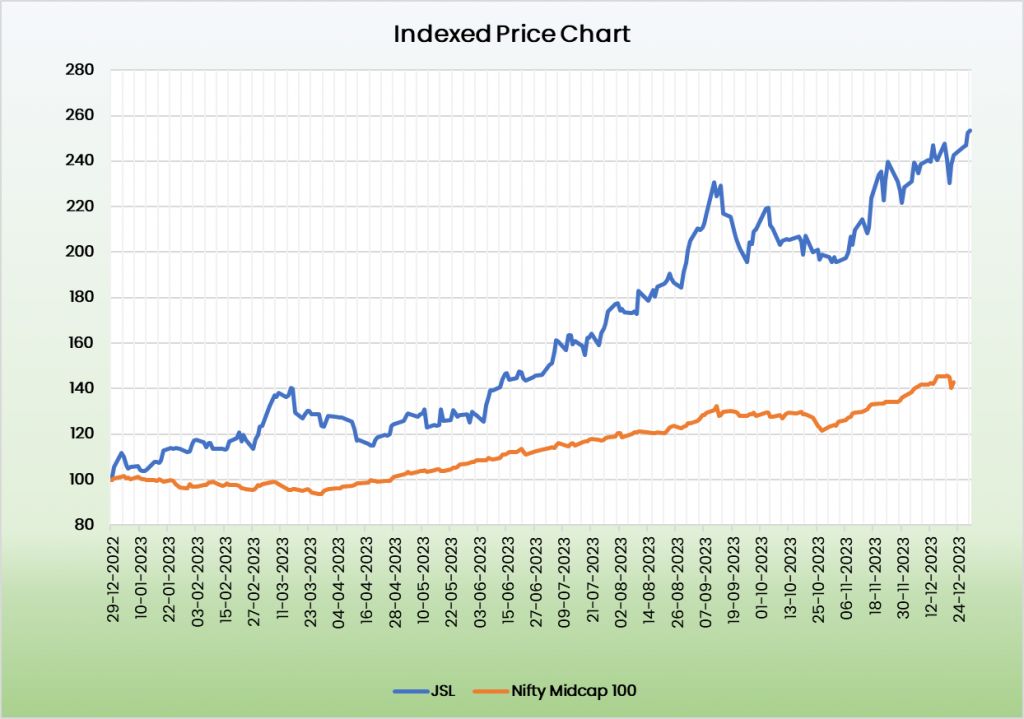

We believe Jinal Stainless Ltd is well placed for future growth given the forecast of increase in demand for stainless steel from allied industry. The company has given a robust EBITDA per tonne guidance of Rs. 22,000 to 24,000 per tonne. We recommend a BUY rating in the stock with the target price (TP) of Rs.674, 18x FY25E EPS.

Risks

- Threat from imports – Subsidised and substandard Imports from countries like China is capturing market share in their favour and distorting the price ecosystem, adversely impacting the domestic players.

- Raw material price risk – JSL imports significant portion of its raw material, primarily comprising of stainless steel, scrap & nickel. Given the significant imports, the company needs to keep a large inventory, which exposes to price-variation risks.

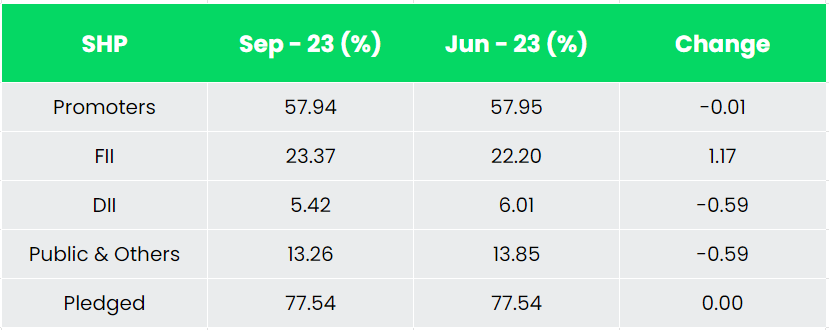

- Pledging of promoter holdings – High proportion of promoter holdings have been pledged which could eventually impact the stock prices if the collateral value is not maintained.