Havells India Ltd. – One Stop Shop for FMEG

Havells India Limited is a leading Fast Moving Electrical Goods (FMEG) Company and a major power distribution equipment manufacturer with a strong global presence. Havells enjoys enviable market dominance across a wide spectrum of products, including Industrial & Domestic Circuit Protection Devices, Cables & Wires, Motors, etc. The company pioneered the concept of exclusive brand showroom in the electrical industry with ‘Havells Exclusive Brand Stores’. Today over 700 plus Havells Exclusive Brand Stores across the country are helping customers, both domestic and commercial, to choose from a wide variety of products for different applications. Havells became the first FMEG Company to offer door step service via its initiative ‘Havells Connect’. Its network constitutes of 4000 professionals, over 14000 plus dealers and 35 branches in the country. Its products are available in 60 plus countries. The company has 14 state-of-the-art manufacturing plants in India located at Haridwar, Baddi, Sahibabad, Faridabad, Alwar, Neemrana and Ghiloth manufacturing globally acclaimed products.

Products & Services:

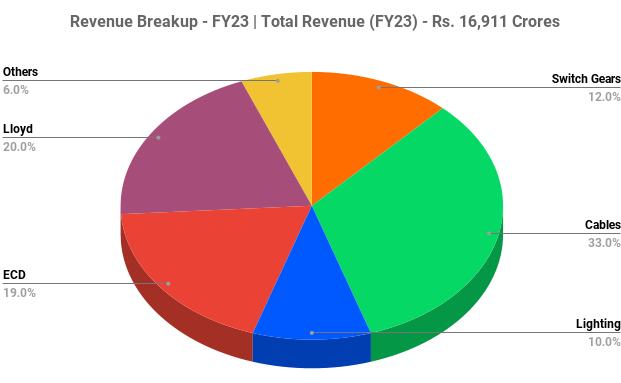

The company manufactures various products under the brands named Havells, Lloyd, Crabtree, Standard, REO, Havells Studio. The products are categorised under six different segments.

- Switch Gears – It includes domestic Switch Gears, Capacitors, Switches, Industrial Switch Gears, etc.

- Cables – It includes Power cables and Flexible Cables.

- Lighting and fixtures – It includes Professional Luminaires and Consumer Luminaires.

- Electronic Consumer Durables (ECD) – It includes Fans, water heaters and other Home & Kitchen appliances.

- Lloyd Consumer – It includes TV, Refrigerators, AC, Washing Machines and Dish Washers under Lloyd Brand.

- Others – It includes Motors, Solar Panels, Pumps, Water Purifiers and Personal Grooming Products.

Subsidiaries: As on FY23, the company has only one subsidiary company located in China.

Key Rationale:

- Established Position – Havells has a wide range of product portfolio such as different switches, premium modular plate switches, MCB, LAN cables, CCTV cables, CATV cables, telecom switchboard cables, lighting products, solar water heaters, air cooler, air purifier, AV, TV. This wide range of product portfolio provides diversification of revenue with growth opportunity. The company has a strong market share in many of its products and it stands among the top 3 players in many segments. Havells is ranked 7th globally in the Electrical Components & Equipment Industry. The company has overall retail outlet reach of 200,000 as on FY23.

- Diversified Target Markets – The company has a diversified portfolio of products caters to diversified target markets. The company’s electrical brands Reo and Standard positioned as affordable mass market and the main brand Havells positioned as mass premium market. Its Havells Studio and Crabtree brands are Premium/luxury category. In the Consumer Electronics segment, Lloyd Consumer is positioned in the Mass Premium market and the company is continuously investing in it to increase its market share. More than 70% of the revenues from Llyod is coming from AC division and the non AC division are growing at a decent pace. During the year, Havells set up a greenfield plant in Sri City, Chennai, with an AC capacity for 1 million units p.a., bringing its total air conditioner capacity to 2 million units p.a. This new unit is expected to increase supply to South Indian markets, thus improving the company’s reach. It will also produce heat exchangers for evaporators and condensers, high-end plastic moulded parts for indoor units and copper tubing, all of which will further reduce dependence on imported parts. The other segment revenue has grown from Rs.91 crs in FY15 to Rs.950 crs in FY23 at a CAGR of 34%.

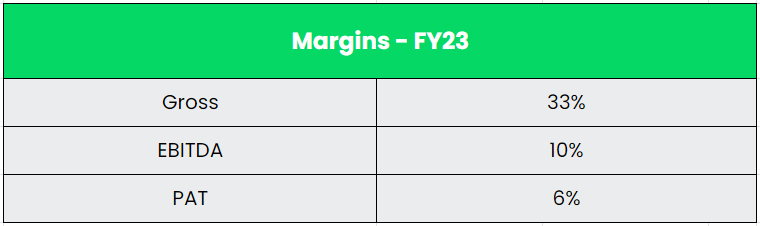

- Q4FY23 – Havells reported revenue, EBITDA and PAT growth of 9.8%, 1.3% and 1.7%, respectively YoY in Q4FY23. While gross margin improved 115bps YoY, higher staff cost and brand building expenses as percentage of sales pulled the EBITDA margin down by 90bps YoY. Segment-wise, Switchgears grew 26.7 YoY%, followed by Cable & Wires at 5.4%, Lighting & fixtures at 2.6%, Electrical consumer durables at -14.1%, others at 12% and Lloyd at 32.5%. Strong construction led demand benefited switchgear segment growth.

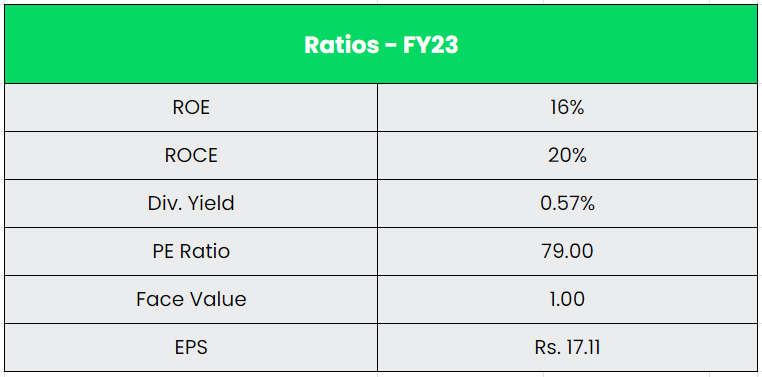

- Financial Performance – The company’s revenue and PAT CAGR stands at 16% and 10% between FY18-23. It has a cash & equivalents of ~Rs.2070 crs, which easily covers the Rs.600 crs capex target for FY24. The company has incurred a R&D spend of Rs.163 crs in FY23, rising at a 23% CAGR over FY18-FY23. It has more than tripled it spends from Rs.49 crs in FY17 to keep pace with the changing consumer environment.

Industry:

Appliances & Consumer Electronics (ACE) industry body CEAMA is “optimistic about good growth in 2023 as well” and expects to almost double the value of the industry in the next three years to Rs.1.48 lakh crore by 2025, as well as make the country an alternative hub for exports. In 2022, ACE industry logged an overall value growth of around 35 percent, led by an unprecedented rise in sales of cooling products such as residential air conditioners and higher festive sales in the second half of the year. Strong demand for mid and premium products also helped the sector, which was significantly hit by the pandemic. India Air Conditioner Market is projected to reach US$ 399.88 Billion by 2028 growing with CAGR of 7.76% from 2022 to 2028.

Growth Drivers:

- The Government of India has announced a PLI Scheme with an investment of Rs.6,238 Crore ($851 Mn) for white goods (Air Conditioners, Washing Machines, etc.).

- The relatively low penetration of home appliances in India presents a significant opportunity for the industry to capture a larger market share.

- The Government’s strong focus on infrastructure expansion including highway construction, railway modernization and airport additions is expected to create demand for electrical goods.

Competitors: Crompton Greaves Consumer Electricals, Voltas, Polycab etc.

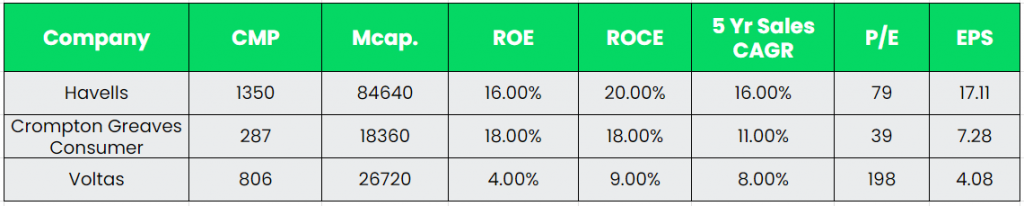

Peer Analysis:

Crompton Greaves is the close competitor for Havells when comparing with the broad consumer electronics portfolio like Fans, Lightings, Small Appliances and Large Appliances. In terms of financials, Havells is way ahead of Crompton with a solid revenue growth. Voltas is a key competitor for Lloyd segment (AC) of the Havells.

Outlook:

During FY23, Havells continued with its strategy of pursuing market share gains in Lloyd, focusing on manufacturing and improving rural distribution. Management indicated that it wants to be among top three players for segments in which Lloyd operates. It believes there is strong growth potential. The company’s continuous efforts toward cost optimization, premiumization, go-to-market improvement, and market share capture make it one of the top players in the sector. The ratio of B2B: B2C sales is 25:75 in FY23. However, the B2B: B2C ratio was 30:70 in Q4FY23. The chief reason is higher demand from infrastructure projects in Q4FY23. The profitability is largely similar in B2B and B2C products in lighting as well as switchgears. However, the profitability of wires (B2C) is higher than cables (B2B). The company has Distributor presence in 3,000 towns (with 10,000-50,000 population) covering 42,000+ retail points through Rural Vistaar initiative and Presence in towns with <10,000 population through 400+ Havells UTSAV exclusive store in FY23, which is targeted to be increased to 2,000 by FY24.

Valuation:

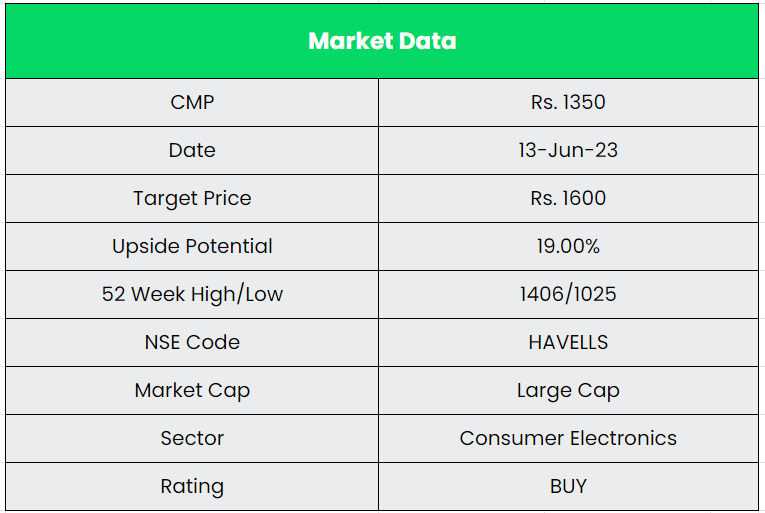

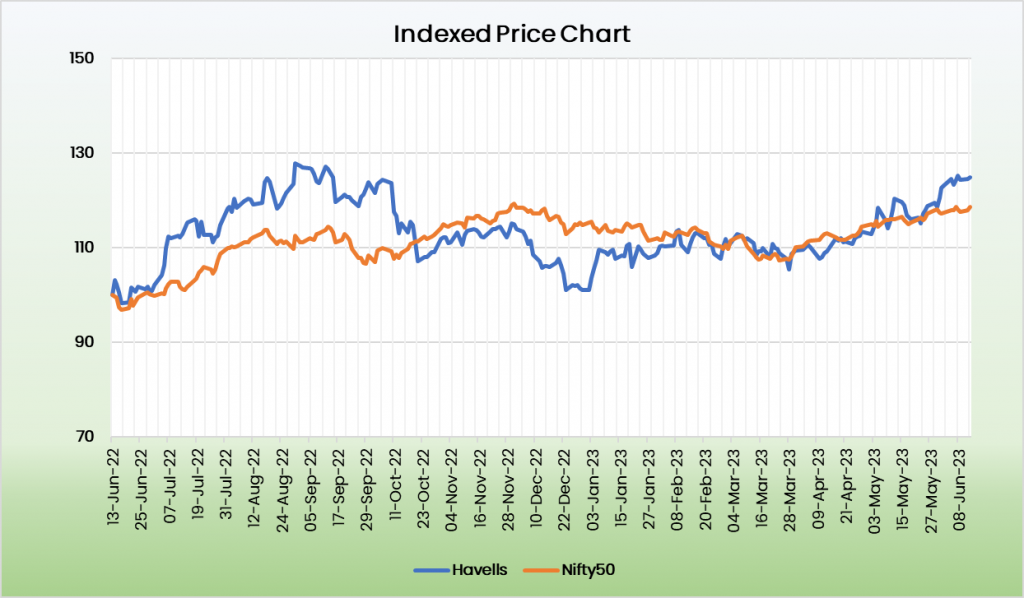

Havells is a strong play in the consumer durables space with a strong presence across categories. Added to that, the strong balance sheet of the company makes it to concentrate and expand the specific business areas like Lloyd. We recommend a BUY rating in the stock with the target price (TP) of Rs.1600, 65x FY25E EPS.

Risks:

- Raw Material Risk – Havells has been impacted by sharp commodity price inflation over the past few years. The Company is affected by the price volatility of certain commodities. Its operating activities require a continuous supply of copper and aluminium being the major input used in the manufacturing.

- Production Risk – Any delays in launch of new products/commissioning of plants may result in lower revenue growth than expected.

- Competitive Risk – Intense competition in each of the categories that Havells is present in remains a concern area. Slowdown in economy and in turn consumer spending could impact demand for Havells’ products.