Dabur India Limited. – World Leader in Ayurveda

Dabur is a 138-year-old company, promoted by the Burman family. It started operations in 1884 as an Ayurvedic medicines company. Dabur has successfully transformed itself from being a family-run business to become a professionally managed enterprise. Dabur is today lndia’s most trusted name and one of the world’s largest Ayurvedic and Natural Health Care Company. The company operates in key consumer product categories like Hair Care, Oral Care, Health Care, Skin Care, Home Care and Foods.

Dabur marries age-old traditional wisdom with modern-day Science to develop products for consumers across generations and geographies. It has over 18 brands and sales of over Rs.100 crs each. Dabur offers products in over 120 countries across the globe and has manufacturing facilities at 21 locations—13 in India and one each in the UAE, South Africa, Sri Lanka, Egypt, Turkey, Nigeria, Nepal, and Bangladesh. The company has built a strong distribution network of over 6.9 million retail outlets with 1.3 million outlets of direct reach.

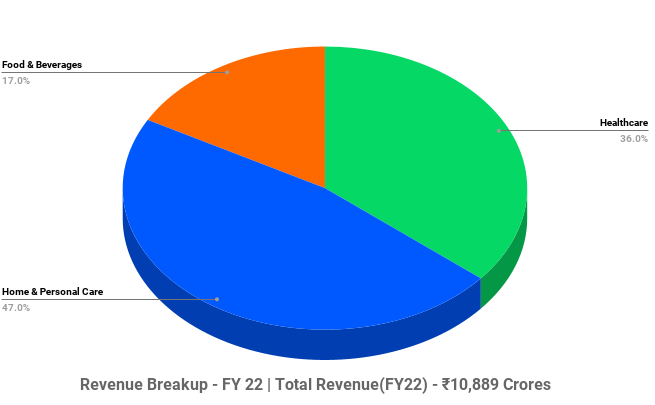

Products & Services:

The company produces several products under three main segments such as Healthcare, Home & Personal care, and Food & beverage.

Healthcare Segment (HC) – This further divide into sub segments such as Health supplements, Digestive and OTC with brands namely Dabur Honey, Dabur Chyawanprash, Dabur Lal Tail, Dabur Gilo, Dabur Nature Care, Hajmola, Dabur Glucose-D, etc.

Home & Personal care Segment (HPC) – This further divide into sub segments such as Haircare, Oralcare, skincare and Homecare with brands namely Dabur Amla, Dabur Red, Dabur Vatika, Oxylife, Odonil, Odomos, etc.

Food & beverages (F&B) – It consists of F&B brands namely Real, Real Active, Dabur Hommade, etc.

Subsidiaries: As on 31st Mar 2022, the company has a total of 26 subsidiaries and 1 Joint venture.

Key Rationale:

- Strong Market Position – The company has established brands in the natural healthcare, personal care and food products segments. In the Healthcare segment, it has a ~60% market share in the Chyawanprash brand, ~45% in honey and ~40% in Glucose D. Due to intense competition in the honey category, Dabur has premiumised the same with new offerings like Honey Tulsi, Honey Ashwagandha, Organic Honey, Honey Strawberry, Honey Chocolate. In the Home & Personal Care segment, it has a No.2 Market share of 15.8% beating HUL in the oral toothpaste and 16.2% market share in hair oils. Homecare brand Odonil doesn’t face stiff competition except the Godrej’s Aer brand. It is the market leader (~60% share) in the fruit juice segment, with its Real and Active brands. It is also the leader in herbal digestives and is one of the largest producers of ayurvedic drugs in India. The company continues to focus on its brands Dabur Amla, Red, Vatika, Real, Chyawanprash, Honey, Pudin Hara, Lal Tail and Honitus. Strong market position, diverse product offerings and healthy investments in new products will drive growth over the medium term.

- Power brands – Dabur has identified 9 ‘Power Brands’ – that account for more than 70% of its total Sales. It has also created flanker brands to support its power brands and to cater to varied consumer needs. A majority of these Power Brands fall in the Health Care space, where Dabur has the right to win. With this strategy, Dabur seeks to not just grow the categories where it is currently a market leader, but also sizably increase its presence and market share in some large categories where its brands are relatively smaller in size. Dabur Chyawanprash, Dabur Honey, Dabur PudinHara, Dabur Lal Tail and Dabur Honitus in the Healthcare space; Dabur Vatika, Dabur Amla and Dabur Red Paste in the Personal Care category; and Real in the Food & Beverages category are the nine powerful brands of Dabur.

- Q3FY23 – Dabur’s Q3FY23 revenue grew 3.4% to Rs.3043 crs with strong growth in home care (18.2%) and digestives (11.2%) category. This is for the first time the company has crossed the Rs.3000 crs mark in the quarterly revenue. The India Standalone business grew by 3.3% and international business grew by 5.1%. The EBITDA had a decline of 2.8% YoY in Q3FY23 to Rs.609 crs with a 130 bps contraction in EBITDA margin of 20%. PAT had a decline of 5.4% YoY for the same period to Rs.477 crs. Segment wise, Healthcare grew by 3% YoY in Q3FY23, followed by HPC with 2.2% and F&B with 6.4%. In Q3FY23, the company acquired a 51% stake in Badshah masala pvt. Ltd., which is engaged in the business of manufacturing, marketing and export of ground spices, blended spices and seasonings.

- Financial Performance – The company has generated a Revenue and PAT CAGR of 7% and 11% over the period of FY12-22. The company is a huge cash generating machine with an Operating Cashflow CAGR of 8% for FY17-22. The company has generated an average Free Cashflow of ~Rs.1300 crs per year over the last 5 years. The same has a CAGR growth of 14% for FY17-22. The company’s low capex helps it to avoid leverage (Net debt free) as internal accruals is more than enough. Generally, FMCGs spend on Ads and campaigns to increase the brand value rather than capacity.

Industry:

The fast-moving consumer goods (FMCG) sector is India’s fourth-largest sector and has been expanding at a healthy rate over the years as a result of rising disposable income, a rising youth population, and rising brand awareness among consumers. With household and personal care accounting for 50% of FMCG sales in India, the industry is an important contributor to India’s GDP. Indian beauty and personal care (BPC) market are the 8th largest in the world. Fragrances, Makeup and Cosmetics, and Men’s Grooming are all expected to grow at a CAGR of 12-16%. The personal hygiene market is expected to reach $15 Bn by 2023 in India. The Indian ayurvedic products market size reached Rs.626 Bn in 2022. Looking forward, IMARC Group expects the market to reach Rs.1,824 Bn by 2028, exhibiting a growth rate (CAGR) of 19.3% during 2023-2028.

Growth Drivers:

- Rural per capita consumption will grow 4.3 times by 2030, compared to 3.5 times in urban areas.

- The factors driving the growth of the ayurvedic industry in India include rising demand for authentic ayurvedic medicine range, increased consumer awareness, and growing focus on health and wellness.

- India’s retail trading sector attracted US$ 4.11 billion FDIs between April 2000-June 2022. 100% FDI in single-brand retail under the automatic route.

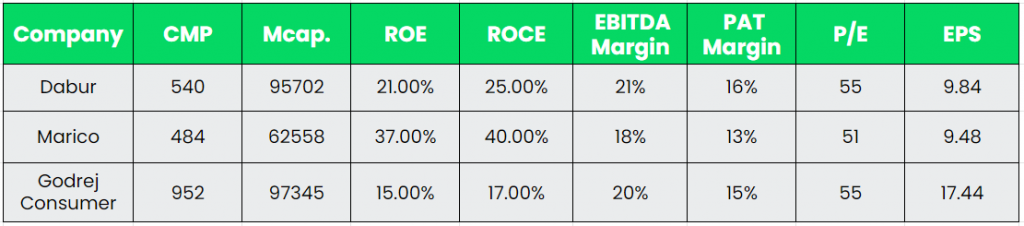

Competitors: Godrej Consumer Products, Marico, etc.

Peer Analysis:

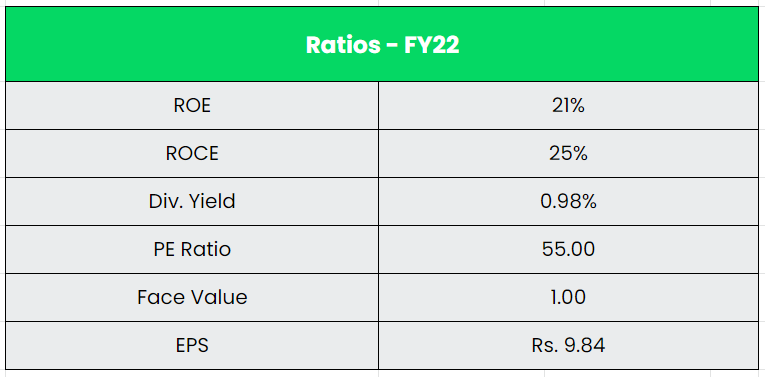

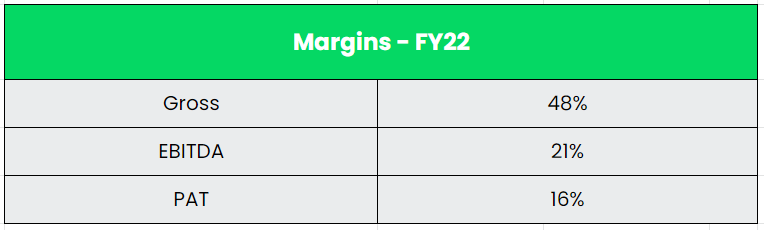

Dabur’s positioning as world leader in Ayurveda/Herbal products, renowned portfolio of brands categories and sub-categories further backed by superior distribution network makes it well placed to capture lifestyle changes-led growth in the consumer goods space, while giving it an edge over competitors. The Margin profile of Dabur is much better than the competitors which reflects the pass-on power and the cost efficiency of the Management.

Outlook:

FMCG Companies have been fighting with a decline in the rural demand for the last few quarters on account of high inflation and the recent correction in the commodity prices will improve the rural scenario going forward. The company has a presence in over 1 lakh villages which derives ~50% of the sales. With the recent acquisition of Badshah Masala, the Management is targeting a revenue of Rs.500 crs in Food business in the next 3 to 4 years from an approximate exit revenue of Rs.160 crs in FY23. The company is likely to achieve Rs.200 crs of sales for fruit drinks & Milkshake category in FY23. It would be commissioning new plant in Indore for fruit drinks category specifically for Rs.10, Rs.20 price point packs and another plant in Jammu for Aerated drinks. Dabur has been steadily increasing its market share in various segments and the demand is expected to grow as the inflation softens. The Management is confident on maintaining operating margins in the range of 20-21% despite commodity headwinds. The company’s revenue grew 9% CAGR between FY19-22 despite being hit by the Covid-19.

Valuation:

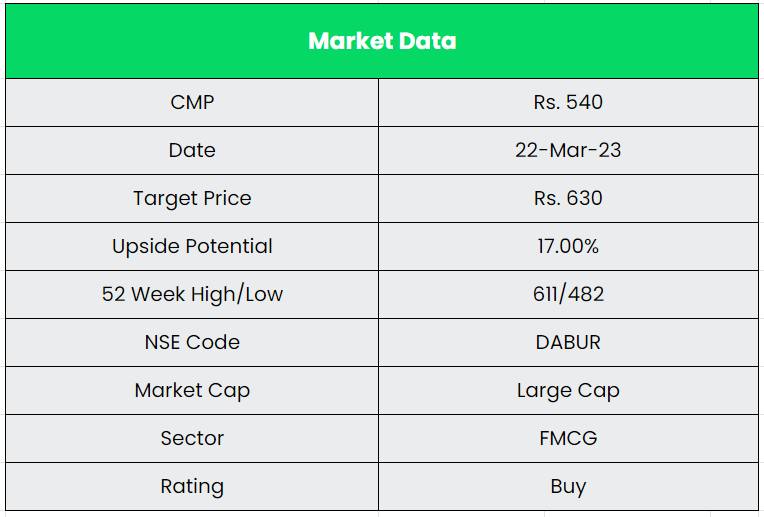

Dabur has given a consistent decent performance over the years through its strong power brands and its legacy in the Ayurvedic segment. With the inflation slowly cooling off from its peak, the margins can recover in the near to medium term. We recommend a BUY rating in the stock with the target price (TP) of Rs.630, 48x FY25E EPS.

Risks:

- Inflationary Risk – High food inflation has an adverse effect on the FMCG industry. Though companies took price hikes to pass on the prices, the margins will take time to recover.

- Competitive Risk – The domestic FMCG business continues to witness intense competition with multiple established players, including some large multinational players as well as domestic companies. Dabur being an established player with a sizeable market share had faced competitive pressure in the past and remains exposed to risks of heightened competition.

- Rural Demand Risk – Any slow pickup in the rural demand will affect the revenue of the company.