Coal India Ltd. – Fulfilling India’s Energy Needs

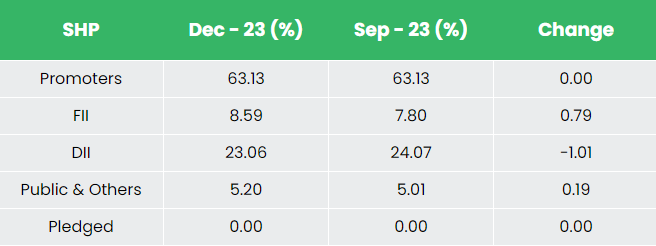

Headquartered in Kolkata, Coal India Limited (CIL), a ‘Maharatna’ company operating under the aegis of the Ministry of Coal is a prominent player in the global energy landscape. Starting with a modest coal production of 79 million tonnes (MT) in 1975, today CIL is the single largest coal producer in the world. The company functions through its subsidiaries in 83 mining areas spread over 8 states of India. As of 31st March 2023, CIL has 322 mines of which 138 are underground, 171 are opencasts, and 13 are mixed mines and a manpower of 2,39,210. It is the largest supplier of thermal coal to the power sector in India. The Government of India (GoI) remains the largest shareholder of CIL with a shareholding of 66.13% as on 31st March 2023.

Products and Services

CIL operates diverse coal mines, including open cast, underground, and mixed mines to serve the unique requirements of various industries. The company’s coal and coal-based products such as coking, semi-coking and non-coking coal, washed and beneficiated coal, middlings and rejects find application in sectors such as steelmaking, fertilisers, glass, power utilities, cement, ceramics, chemicals, paper, domestic fuel, and industrial plants.

Subsidiaries: As of FY23, the company has 11 subsidiaries, and 5 joint ventures companies.

Key Rationale

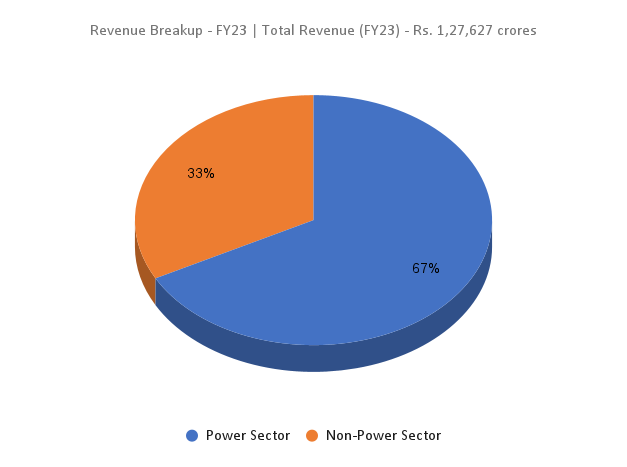

- Meeting the coal needs of India – Coal is one of the most widely used fossil fuels and is an integral commodity finding application in many key sectors such as power, steel, cement etc. With coal having a commanding prominence in the Indian energy sector, CIL leads the country’s coal production contributing to around 79% of the nation’s entire coal output for power generation. During the last five years, its production grew by 24% to 703.20 MT in FY23 from 567.37 MT in FY18. The company supplies to power sector comprised 84% of its entire despatch during FY23.

- New projects – CIL has signed a memorandum of understanding (MoU) with Haryana Power Purchase Centre (HPPC) for supplying 800 MW of electricity from Mahanadi Basin Power Ltd (MBPL). It has won bid for 300MW capacity solar power projects in Gujarat inking a power purchase agreement for a period of 25 years. The company has entered a joint venture (JV) agreement with Bharat Heavy Electricals Ltd. (BHEL) for a coals-to-chemicals project with CIL holding 51% stake in the JV. The company has also signed an MoU for 4,100 MW power projects in Rajasthan. More washeries are also getting added to the existing facilities. It recently completed and commissioned Madhuband washery with 3 more washeries under construction.

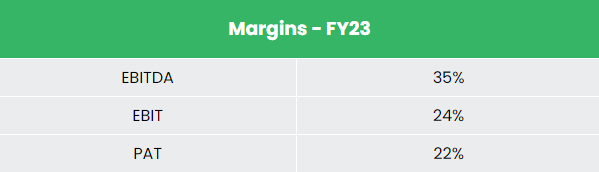

- Q3FY24 – During the quarter, revenue improved marginally by 2% to Rs.33,011 crore from Rs.32,429 crore of Q3FY23. EBITDA increased by 11% to Rs.12,325 crore compared to the Rs.11,111 crores of Q3FY23. The company reported a net profit of Rs.9,094 crore which is a growth of 18% from the corresponding period in the previous year. EBITDA and net profit margin are at a robust 37% and 28% respectively. The company recorded the highest ever 9 months coal production of 532 MT and overburden removal of 1405 MCuM (Million Cubic Meter) in 9MFY24. It also achieved the highest ever 9-month revenue from operations and profit during the period.

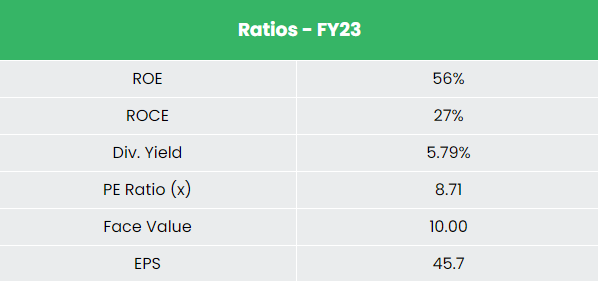

- Financial performance – The company has generated a revenue and PAT CAGR of 10% and 32% over the period of 5 years (FY18-23). Average 5-year ROE & ROCE is around 52% and 70% for FY18-23 period. The company has robust capital structure with a debt-to-equity ratio of 0.09. It has delivered a dividend yield of approximately 6%.

Industry

India is the second-largest consumer of coal behind China, with the demand primarily driven by the power sector. The nation also ranks fifth in the world, in terms of coal deposits. Electricity demand in the country has increased rapidly and is expected to rise further in the years to come. The vast resources of numerous metallic and non-metallic minerals that India is endowed with serve as a foundation for the expansion and advancement of the nation’s mining industry. The coal industry is expected to grow at 6-7% annually, reaching 1 billion tonnes by FY 25-26 and approximately 1.5 billion tonnes by 2030. Faster urbanisation and rural electrification drives are expected to boost the demand for coal in India substantially.

Growth Drivers

- To achieve 100 MT of coal gasification by 2030, the Indian Government has launched the National Coal Gasification Mission.

- Enactment of Mines and Minerals (Development and Regulation) Amendment Act, 2021 enabled captive mines owners (other than atomic minerals) to sell up to 50% of their annual mineral (including coal) production in the open market.

- The government plans to monetize assets worth Rs. 28,727 crore (US$ 3.68 billion) in the mining sector over 2022-25.

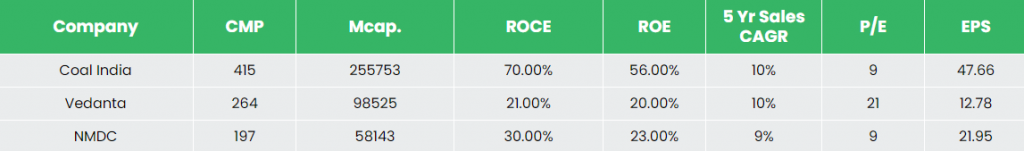

Competitors: Vedanta Ltd, NMDC Ltd etc.

Peer Analysis

Among the above competitors, CIL has higher return ratios and stable revenue growth than the other two, indicating the company’s financial stability and its efficiency to generate income and returns from the invested capital.

Outlook

India’s thermal security can be directly considered to be dependent on CIL’s performance. CIL has envisaged coal supply target of 770 MT for FY24 and 838 MT for FY25. CIL’s growth plan for the future is in synergy with the ambitious plan of the Government for 24 X 7 power supply to all homes in the country. To boost the coal evacuation infrastructure, CIL has embarked on a series of First Mile Connectivity (FMC) projects aiming to mechanize coal transportation and loading systems. Under the FMC initiatives, the company is set to invest a total of ₹27,750 crore across 4 phases with 9 projects of which 127 MTPA is already commissioned. This is expected to reduce evacuation and transportation charges and thereby contributing more to the margin. CIL achieved peak coal production of 703.2 MT in FY 2022-23 with a target to achieve 1BT by FY 2025-26.

Valuation

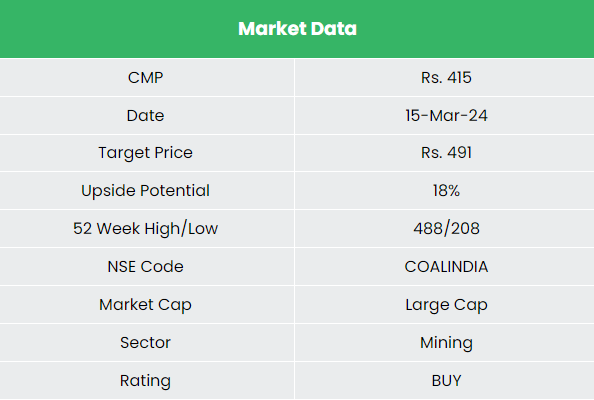

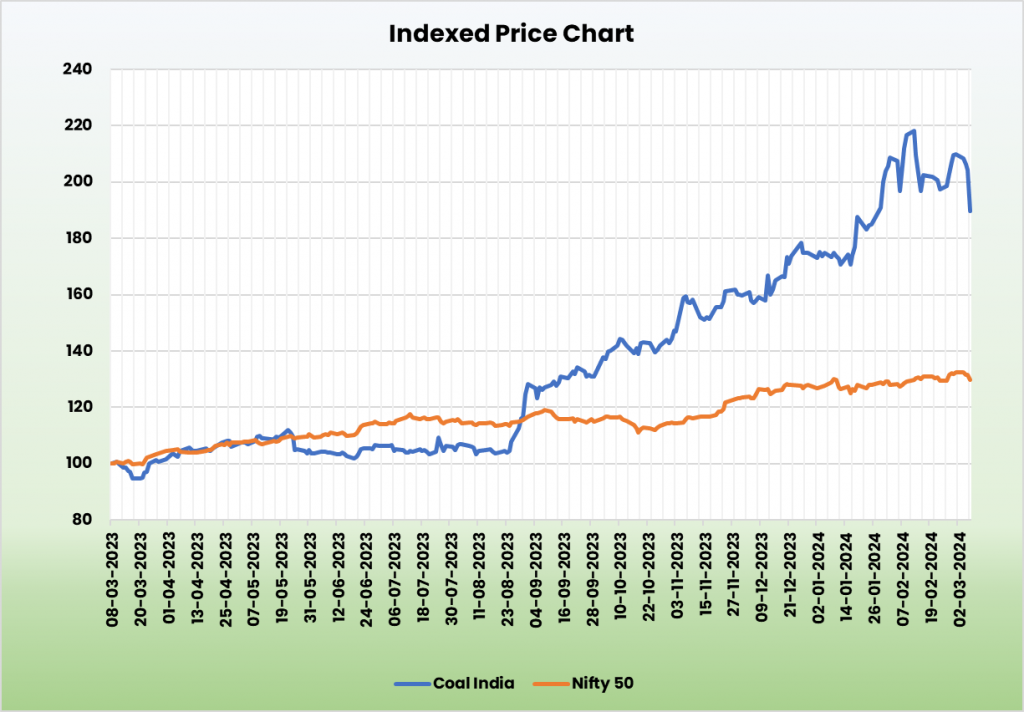

CIL’s increasing production run rate and its measures to achieve production targets is expected to grant strong growth potential for the company. We recommend a BUY rating in the stock with the target price (TP) of Rs. 491, 10x FY25E EPS.

Risks

- Environmental and social impacts – The environmental as well as social impacts of mining continues to be a major challenge for the company.

- Competition risk – Commercial mining and emphasis on renewable power generation pose a threat to the company’s market share in the energy sector. Competition from commercial mining and renewables can also lead to pricing pressure.

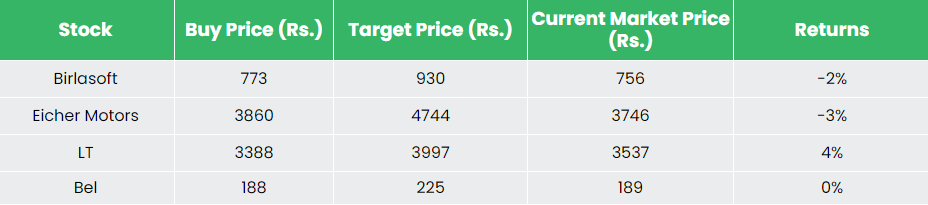

Recap of our previous recommendations (As on 15 Mar 2024)

Please click on the below links to read our previous reports: