If you started investing in equity mutual funds some time within the last 2 years, it is likely that your investments would be in the red right now. It is likely that you would have seen high returns of these funds in 2017 and early 2018, only to be disappointed after you actually invested the money.

So why have your mutual funds disappointed you? More importantly, what should you do now?

Markets go through phases

The question is not new. And the answer is nothing that you won’t find in many other places. However, in times like these, it needs to be reiterated.

It is common for equity markets to go through cycles. Equity markets are volatile. And by volatile, we mean that it doesn’t always move in one direction. While it goes up at some points, it goes down at others. This happens because of a variety of factors, including global political and economic environment, domestic economic indicators, investor expectations, etc.

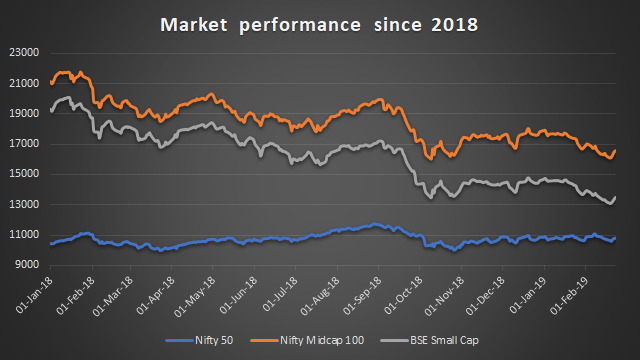

Currently, the market is on a downward cycle. This is how the market has moved over the last year

As you can see, the mid and small cap indices are down quite a bit. Both these indices hit a peak in early 2018 and have since been falling. The Nifty Midcap 100 has lost 19% since January 2018 and the BSE Smallcap has lost 26%. This isn’t the first time these segments have slipped so steeply. For the seasoned investors, this is just a phase that needs to be gone through.

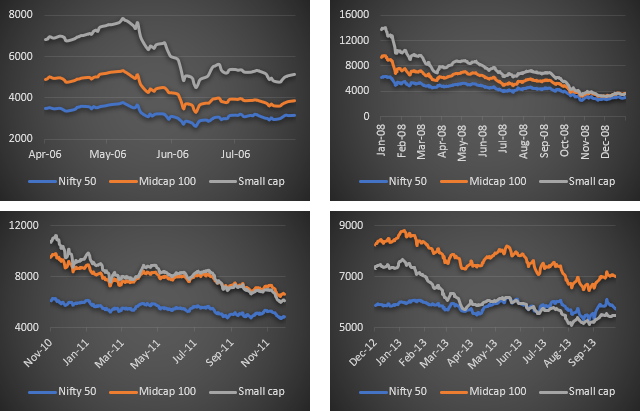

But for you newer investors who got into stock markets post 2014, this prolonged fall is new and scary. The years since 2014 saw very brief corrective phases of a 2-3 months in the midcap and smallcap space from which recovery was swift and sharp. However, the ongoing fall is just one among others. Here are a few other instances from the past 15 years

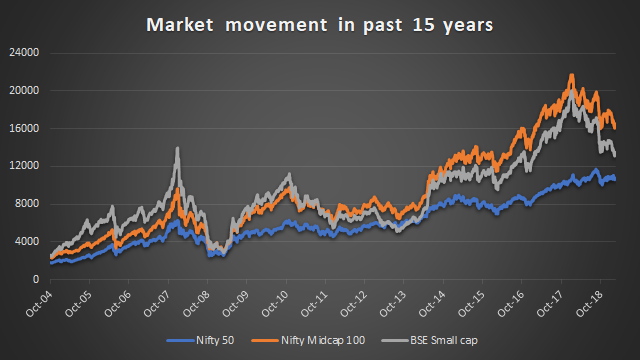

In each of these instances, markets – especially the small and midcap segment – fell by a large percentage in a span of few months. But these are specific periods of only the falls. When we put the last 15 years together in a single graph, we get this

As you can see from this graph, over a long period of time, the general trend remains upward. While the market goes through ups and downs, if you stay with the market long enough you will generate higher and inflation-beating returns. These downward phases are why we ask you to

- Have a long holding period when investing in equity. In fact, considering rolling returns of different holding periods since 2007, there were instances of markets delivering losses even on a 4 and 5-year period. Only holding 6 years and above saw nil occurrences of losses.

- Have a higher risk appetite when investing in equity. You need to be able to see the fall in your returns and not worry into exiting. Redeeming immediately after your funds have dropped is similar to buying at a high and selling at a low. You’re turning a notional loss into an actual one.

- Restrict allocations to midcap and smallcap funds no matter how attractive their 1-year or 3-year returns may look. Since these tend to fall more steeply, avoiding excessive exposure will protect your portfolio from corrections.

More opportunity

But wait, there’s more. These downturns are not something to just sit idle and wait out. What is essentially happening at this phase is that the market and your funds are trading at a discount to what it was one year ago. Which means that if you invest today, you will get a higher number of units at a lower cost.

This is why we emphasise on the importance of investing through SIP. If you invest regularly, when such falls occur, you buy more units at a lower NAV, thereby bringing down your average cost. This means that when the markets eventually recover, your investments made during the downturn will earn you higher profits.

So to answer the questions raised earlier, your mutual funds have disappointed you because that’s the nature of equity markets. Sometimes it disappoints in the short term. As for what you should do, you should keep investing and wait it out. Given sufficient times, you will once again see the returns which had lured you into investing in these funds.