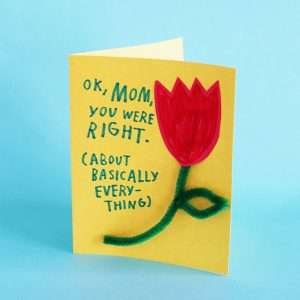

Superheroes don’t just exist in movies; they exist in our life too. Their code name? Mom. Their super hero trait? They are an endearing combination of several roles designed to help us function in life. From being our most fervid cheer-girl, to our cheapest therapist; our confidante, to our designated worrier; our solid rock of support, to the snug pillow that comforts us at the end of a hard day – moms are all of these and more. And that’s not it. Our moms are also our first financial experts from whom we pick important lessons on money.

Superheroes don’t just exist in movies; they exist in our life too. Their code name? Mom. Their super hero trait? They are an endearing combination of several roles designed to help us function in life. From being our most fervid cheer-girl, to our cheapest therapist; our confidante, to our designated worrier; our solid rock of support, to the snug pillow that comforts us at the end of a hard day – moms are all of these and more. And that’s not it. Our moms are also our first financial experts from whom we pick important lessons on money.

Here are the top five money management lessons your mom has introduced to you.

1. Money in hand does not always mean money to spend – Moms are fascinating saving buffs. Have you ever noticed how she always saves money, in spite of having many expenses to pay for during the month? It’s magical, really. At the beginning of the month, she charts out a budget, making sure money is allocated for different expenses. She keeps a part of the money aside, saving it for different goals. And then, she saves some more by spending money with such élan, without falling prey to splurging urges (a crime our generation is guilty of).

The lesson from mom: Save first, spend later. When you spend, avoid succumbing to guilty splurges. Money in hand is not always equal to money that can be spent.

2. Make hay while the sun shines – She might not have called it a ‘contingency fund’; but she most certainly kept aside some money every month to make sure it could be used at the time of an emergency. You must have seen her pool in money for this purpose by saving for it in glass jars in the kitchen, hiding it beneath an old bed sheet in the cupboard, and other non men-and-kids-trespass-able areas of the house. Once a substantial amount was accumulated, she probably invested it in a fixed deposit, restarting the save-for-a-rainy day cycle all over again.

The lesson from mom: You never know when an emergency (loss of job is one such example) may strike you. That’s why, besides saving money for different goals, make sure you keep some money aside to get you through a time of a crisis. The general thumb rule is to save a minimum of six months’ expenses for an emergency.

3. The power of ‘NO’ – Moms live what financial experts advise: distinguish between your needs and wants. Needs are the basic expenses we incur in our day-to-day lives – house rent, travel expenses, school fees, etc. Wants are those unhealthy cravings over and above our needs – that gadget in the market you must have simply because it’s the talk-of-the-town, a new designer dress this month (again?!), etc. Remember how you wanted that extra toy when you went out shopping with your mom a few years ago? Remember how you had demanded a pony that Christmas eons ago? Well, your mom put her foot down and said ‘no’ because it was the right thing to do. She kept you happy without spoiling you.

The lesson from mom: Don’t succumb to the desire to spend money on luxuries all the time. It’s okay to give in to such urges as long as they occur occasionally, and not frequently. Remember, spoiling yourself by spending on luxuries is just a short-term answer to happiness.

4. Do your homework – “Finish your homework first and then go out to play.” The importance of this line is highly under-stated. Remember the times you actually took your mom’s advice? Didn’t you feel that the joy of playing after completing your homework was phenomenally greater than otherwise?

The lesson from mom: Finish your chores first before you run off to play, or simply, save before you spend. Remember that you must do what you must first, before you do what you want. That’s the key to happiness, financial and otherwise.

5. Don’t give up – You might have scored low grades in school for certain tests / exams. You must have dreaded the idea of showing your report card / answer sheet at home. But mom, with her all-knowing eyes and ethereal wisdom, understood you. She chided you gently, simply encouraging you to do better next time. Investments are much like children. You watch them rise and fall, hoping they would deliver good returns for you. You don’t lose faith in them. You don’t give up on them.

The lesson from mom: You have little control over the outcome of the performance of your investments. But that shouldn’t dissuade you from believing in the power of saving and investments, especially if the product is a superior one like mutual funds. The key to investment success is simple – Always strive to invest in the value of a product; refrain from investing in the “face value” of a product.

A very good compilation, different way of thinking!

Reality, put perfectly in financial terms. Good articles, worth reading by children.

Reality, put perfectly in financial terms. Good articles, worth reading by children.

A very good compilation, different way of thinking!