Investing lessons are all around us. You just need to pay enough attention to notice them. We think that ‘Game of Thrones’ – the revolutionary TV and book series that has taken the world by storm, offers some valuable lessons for the discerning investor.

Investing lessons are all around us. You just need to pay enough attention to notice them. We think that ‘Game of Thrones’ – the revolutionary TV and book series that has taken the world by storm, offers some valuable lessons for the discerning investor.

Why? Well, the worlds of Westeros and the Free Cities are as bright and vibrant, as they are dark and scary. What more, with so many armies, bandits, and would-be kings trying to best the others, it is rife with intrigue, war, and valuable lessons on life and investing too! Here are the top three investing lessons we learned from George R.R. Martin’s fantasy world:

1. Winter is coming

The words of House Stark serve as a reminder to be prepared for the worst. After all, no matter how sunny the summer, the winter and all its horrors could be right around the corner.

Investment take-away: No matter how rosy your finances are today, the winter of retirement is something you cannot escape. Plus, thanks to the insidious forces of inflation, by the time you retire, your cost of living is going to be much higher. Therefore, it is best you prepare for it by investing in products like mutual funds that will help you beat inflation, and build wealth over the long term.

2. It pays to be patient

When Daenerys was first given the dragon eggs, they seemed to be no more than pretty stones. However, some time, and a fire later, those pretty stones turned into powerful, fire-breathing dragons.

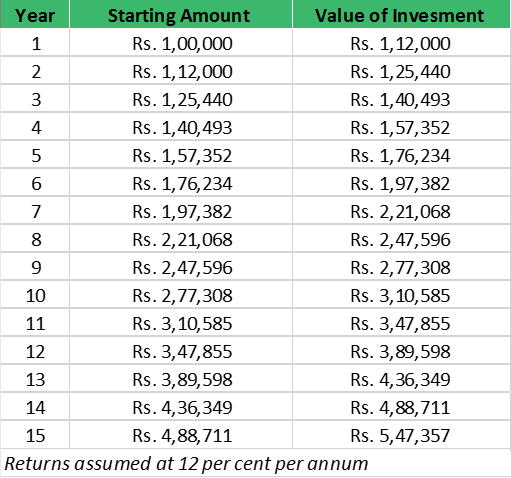

Investment take-away: Have you heard of the power of compounding? It is a magical tool in investing that allows you to earn interest on the returns you earn on your investments! That’s why it pays to be patient with investing. That’s why it pays to invest for the long-term. Just see how an investment of Rs. 1 lakh grows over 15 years thanks to compounding (with an assumed return of 12 per cent per annum).

3. Keep emotions at bay

Robb Stark’s war against the Lannisters was going rather well until he let his heart make decisions for him. Marrying Talisa Maegry (Jeyne Westerling in the books), whom he fell in love with, at the cost of his deal with House Frey, led to him losing his head and the war.

Investment take-away: Never let your emotions influence your investment decisions. If you’re investing through SIPs, don’t stop or pause them when the markets fall. Remember, each fall is followed by a rise, making ‘always’ a good time to invest more (to average out your costs).

Keep these three things in mind and you and your investments should do just fine.

Happy investing!

Interesting comparison and lessons drawn. Easy to understand.

Interesting comparison and lessons drawn. Easy to understand.