Wondering what an NFO is? It expands to ‘New Fund Offer’. As the full form of the acronym suggests, it is a new offering proposed by a Mutual Fund house whenever a new fund is launched. Its purpose is to provide various investment opportunities for investors across the whole spectrum of Equity and Debt. It will help investors to diversify their investments.

An offer price (usually ₹10) is set for a unit of an NFO. It is thrown open to investors only for a limited period of time. During this phase, they can buy the units of the scheme.

How to invest in an NFO through FundsIndia Platform

Simply check out the latest NFOs here and start investing!

If you are an existing FundsIndia investor, here are the steps for investing in an NFO through FundsIndia platform:

- Login to www.fundsindia.com and in the left tab of your dashboard, Select Mutual Funds -> Invest -> New Investment

- Click on “Add Scheme”. A new window with a list of funds opens. In this, select the third tab named, “NFOs/FMPs”. Select the fund of your choice.

- Upon selection, you will be taken back to your dashboard. You can select as many new funds as you want.

- Enter the “amount of investment”, select the portfolio name, check the T&C checkbox, and select “Continue”.

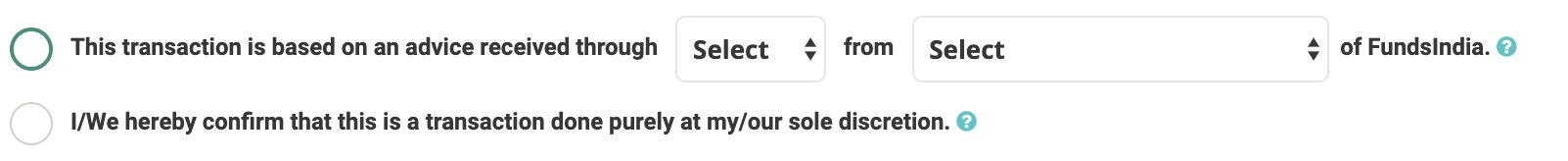

- In the next window, select the bank account that you want to use. In addition, you will be provided with two options as follows:

Select the appropriate option and select “Confirm”.

Select the appropriate option and select “Confirm”. - Make the payment and confirm to set up your investment in the NFO.

Did you notice that these simple steps for investing in an NFO through the FundsIndia platform would take you just 2 to 3 minutes? If you are not an investor, wait for nothing. Click here to open an account with FundsIndia in less than 20 minutes and start investing.

If you have second thoughts on investing in a brand new fund by yourself, fret not! Schedule an appointment with one of our expert advisors, assess your risk tolerance, get all your doubts clarified, and leverage the perks of investing in NFOs without apprehensions.