For most of you, holding an EPF account with your company or investing separately in PPF could be the only retirement plan in place. This means of saving may have held water about a decade ago. But for the upcoming generation of retirees, dependence on EPF and lack of pension may mean that they are at a real risk of falling short of capital, post retirement.

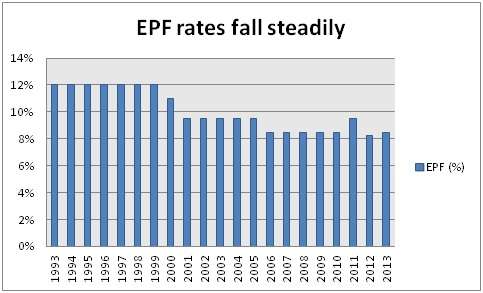

Just take a look at the kind of returns that your Employee’s Provident Fund (interest declared by the central government) was delivering about 2 decades ago and how steadily the rates have been declining. This is no different with your PPF account.

At the same time, consumer price inflation (CPI) has been on the rise, particularly in the last 5 years and has crept to an average of 10.2% in the last 5 years (taking the old CPI rates for Industrial workers, as the new CPI is available only from 2011).

That means, your net returns from your provident fund or PPF would actually be negative!

Now, if you have not built enough wealth for your retirement, chances are that you will not sustain yourself costs post retirement with just the interest income from your kitty. You will have to start spending your capital as well; reducing the corpus left to generate interest income. Now that is not a happy proposition.

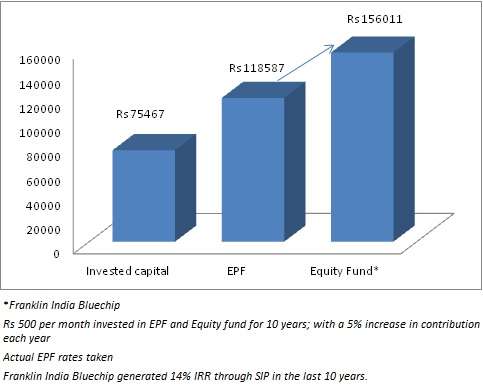

Now, just take a look at the graph below. It is a simple example, assuming Rs 500 a month contribution to EPF, with an annual increase in contribution by 5%. Similar money is invested in Franklin India Bluechip as well.

After 10 years, the differential in your corpus is 33%. It would be even higher with a longer period, as interest is compounded annually in your EPF, while equity funds undergo continuous compounding by way of remaining invested in the markets.

Elsewhere too, lower interest on traditional options has meant that people looking to save for investment scout for mutual funds.

This is why a majority of the households in countries such as the U.S. invest their retirement savings through mutual funds; so much so that retail investors’ retirement holdings alone account for 50% of the mutual fund assets in that country.

So what is preventing Indians from investing in mutual funds? Here are some of the myths that need to be busted for you to ensure you are not left grappling at the last minute:

1. Mutual funds are risky, I will lose my money

No doubt, mutual funds, especially equity funds, move with the market forces and can therefore be risky. But long-term equity fund data shows that the risks are evened out over the long term.

In fact over a 15-year period, chances of negative returns in the stock market are nil. That means, you cannot lose money if you stay invested that long. And to top it, equity funds have delivered inflation-beating returns over the long term.

2. Mutual funds will give too much exposure to equity markets

Mutual funds, for most people, mean investing in equity markets. This is not true. Mutual funds offer exposure to a wide range of low-risk to medium- risk debt instruments too.

They offer exposure to gold without holding them physically and even allow you to explore evolved international markets such as the U.S. Mutual funds also offer a combination of equity and debt, the equity part being either very low or reasonably high, depending on what risk you can assume.

A well-diversified basket provides sufficient exposure to various asset classes using a single product called mutual fund.

3. Mutual funds cannot give steady returns like deposits

Yes, mutual funds cannot guarantee you returns or provide fixed outflow of interest income like deposits. But let’s get this one straight. What is the objective behind saving for retirement?

It is to build a decent corpus until you retire. A healthy corpus can then be invested in reasonably safe investment avenues, to generate some monthly or annual income for you, to substitute the loss of salary/business income, once you retire.

This being the objective, going for regular interest payout options do not help the purpose of building wealth because chances are that you will not diligently reinvest.

Even if the option is cumulative, you run a reinvestment risk because you may end up with lower rates (when you renew your investments after they mature) than what you received earlier. Your EPF, with varying interest rate every year, assumes this risk.

Equity funds, by way of being invested in markets all the time (and taking cash positions only if warranted), do not carry such reinvestment risk.

Rules for retirement investing using mutual funds

The first rule to follow in mutual fund investing, when you invest for retirement, is to hold reasonable exposure to equities in the early years and gradually reduce them by moving them to debt funds and other traditional saving options such as tax-free bonds and deposits.

The shifting process, if you have been investing for at least 15-20 years, can start even 5 years ahead of your retirement.

Most people burn their fingers simply because they take high exposure to equities just a few years ahead of retiring and expect equities to generate high returns in a short time. A down market, in such instances, can even wipe the capital.

The second rule is to rebalance your mutual fund portfolio, preferably every year. This involves bringing your portfolio to the original asset allocation, if the equity, debt, gold proportion in your portfolio moves out of kilter (note that this can be done in a click with FundsIndia’s Retirement Solutions).

The third rule is that your retirement portfolio can do without any theme or fancied sector funds to pep your portfolio. If you do wish to take such exposure, limit it to 10% and ensure you exit the theme at least a few years ahead of your retirement. The last thing a retirement portfolio needs is volatility from cyclical funds.

The fourth rule is that your retirement kitty should be a basket – EPF, PPF, mutual funds (equity and debt; with gold being optional) and other traditional debt options such as deposits.

The fifth rule is that if you have some exposure to mutual funds post retirement, don’t depend on them to declare dividends, if you need monthly income, use the systematic withdrawal plan (SWP) option to create your own annuity plan. SWPs are also very tax efficient, as they enjoy capital gains indexation benefit in the case of debt funds held over a year (equity funds are exempt from capital gains tax).

Following the above will likely ensure that you build a comfortable retirement corpus without burning your fingers.

Hi Vidya,

It is a very useful topic for working professionals with regular income who are planning for retirement. I am definetly inspired to plan systematically for retirement(till now it was only EPF and PPF). However i have a basic doubt about mutual funds, How do a debt fund gives you negetive return when they would primerly invest in debt instruments Eg: IDFC Dynamic Bond Fund – Regular Plan (G) has given negative return in past 6 months(-3.5%, source: money control)

Hello Arvind,

Debt instruments are also traded in the market. Hence when their price moves down (price move down when yields move up and vice versa) debt funds can fall. But such price movement is sharp only in long-term debt instruments like gilt funds or funds that have high exposure to long-term gilt. But, when yields move up, the prospects for such instruments also go up although there is near-term fall. When rates fall, typically these instruments have a high price rally. Hence, the fall is more temporary and marked to market. Therefore income/dynamic bond funds require a long-term time frame of at least 3 years. You will see that short and ultra short debt funds will not be as volatile. Hence, with debt funds, investors need to choose the right fund based on their time frame. If one chooses an income or gilt fund with a 6-month time frame in a rising interest rate scenario then chances of negative return cannot be ruled out. thanks, Vidya

Hi Vidya

I have been reading your articles in Business Line and Fundindia.com for quite sometime. They are really informative and thougprovoking. The above article is a standing example. keep going!!!!!!!!!

Thanks Srihari, for the encouragement! 🙂 vidya

where to invest the corpus at the retiring age? and do swp.

Hello Prema, Short-term debt funds can be ideal grounds to shift money closer to retirement and then do an SWP later. thanks, Vidya

you have done it again Bala.A good article that will open the eyes who can see and hear .

Hello Vidya, – A well-written article, loaded with lessons in every word. It is high time Indians started looking at equity investment as a powerful tool for long-term wealth creation. As you have rightly recorded, spicing up the retirement investment portfolio, even with a small equity component will work wonders. Let’s hope and pray that Indians turn to equity to reap long term returns, which would indirectly fuel our country’s economic growth. Please continue to enlighten us with such useful and relevant articles.

Thank you

For salaried staff, there is compulsory deduction of 12% PF contribution. Employer also contribute the similar amount i.e. 12%. Now there is option of VPF contribution wherein employees can authorise his employer to deduct PF contribution over & above 12%. People go for this method as they see compound growth. My issue is that to create wealth for my daughters education, should I continue with VPF deduction or exit and choose Equity mode. I am saving for my daughters education and the amount will be required after 5 years.

hello Ashfaque, EPF/VPF are good savings mode but whether you want to invest in equity funds would depend on your time frame and risk appetite. If you are not too worried about near term ups and downs in the market, then 5 years is a good time period to invest some amount in equities to beat inflation. Otherwise, given the rising cost of education, traditional savings such as PF and deposit may not be enough to meet higher costs. If you need help with regard to investing in equity funds through our online platform, do contact our support(mentioned in our website). thanks.

thanks Vidya. I am investing 12% compulsory PF deduction as per law. Additionally I am investing Rs.20000 yearly in my PPF a.c. My daughter is in 7th std and keeping 5 year margin for her college admission, I am investing Rs.40th in monthly SIP and the details are as follows Equity Fund (25 thousand) ICICI focussed bluechip ( 10000 ) , UTI Opportunities (Rs.10000) , ICICI Export & other services (Rs.5000) . Debt Fund (Rs.15 thousand) Birla Short Term Fund(Rs.4000) , SBI Magnum Income Fund FR Savings Plus Bond(Rs.6000) , ICICI regular saving (Rs.5000).

I am aware of the volatile market and therefore keeping next 5-6 year margin, Pl. suggest 1. if my fund selection is Ok and 2. if my portfolio is diversified.

Hello Ashfaque, Kindly route fund specific/portfolio queries through your FundsIndia account using ‘Ask Advisor’ feature. I am constrained from replying to such specific questions over blog. thanks.

Hi Vidya,

I am 28 yrs old and I do not have much idea about mutual funds. My monthly savings is Rs.9000 which I would like to invest for my retirement age. What are the best long term MF available in market considering the time frame of 10-15 Yrs. Also once I start MF do I need to constantly check the market updates?

Thanks,

Mani

Hello Manikanta,

Portfolio advice can be done through ‘advisor appointment’ if you have your FundsIndia account. it is a free feature for all our investors. If you do not have an account, I would urge you to activate it. it is free and will provide you will ongoing advisory and review services. thanks

Hi Vidya

Investing in mutual funds is fine, but how much to invest and how to calculate the amount i will require at the time of retirement?

my 2nd point is how much corpus is required, if i live for another 20-25 years after retirement.

Regards

Ritz

Hello,

Use out calculator to know what is the retirement corpus needed and how much you need to invest: http://www.fundsindia.com/content/jsp/calculators/MutulfundSipCalcAction.do?method=sipCalcHome#

thanks

Vidya

Thanks Vidya..it was helpful..the other calculators are also very useful

Hii Vidya!

Its a needed article. But before investing in a long term plan like pension should I follow online aspects or should I go for agents for assitance?

Second doubt is you said in long term plans there is no risk. Can you please explain how?

Thanks

Hello Sir, I suppose you simply mean long-term mutual fund investments (and not pension plans of insurance). Whether you should do it yourself or get an advisor would depend on your own awareness and knowledge of the product. With online platform like ours, you can use the seamless, hassle free facility to invest yourself, or pick one of our researched pre-packaged portfolios or also talk to our advisors and get your own customised portfolio. thanks, Vidya

Retirement Calculator

Rising cost of living can play havoc in your golden years. Get yourself an estimate of how much wealth you need to build to ensure you have smooth cash flows to meet your post-retirement needs.

This retirement calculator will tell you how much you need to save to build a sum that will adequately meet your monthly expenses post retirement.

” * ” – Mandatory fields

* Current monthly expenses (Rs.):

* Current age:

* Retirement age:

* Expected life span:

Current value of existing investments (Rs.):

30000000

* Expected inflation:

* Post-retirement investment return:

* Expected return on investment:

Calculate

Monthly savings required to build retirement corpus (Rs.):

-3,86,220

Period for which monthly income is needed (years):

20

Monthly requirement first year after retirement (Rs.):

63,754

Total amount needed to generate monthly income that grows with inflation (Rs.):

1,25,11,763

Less: future value of existing investment (Rs.):

7,42,78,895

Corpus that needs to be built (Rs.):

-6,17,67,132

Period available to build retirement corpus (years):

8

Disclaimer:

the above Investment is ok for my retirement.

Hi this is Vishal, I would like to invest in mutual fund direct plan which kind of funds should be in my portfolio

My details are given below

Age 25

Investment period: 29Yrs

Investment amount 5K per month

Pls suggest me some fund

Hi Vishal,

We won’t be able to provide portfolio-specific advice on this forum. If you would like fund and investment advice, you can set up a FundsIndia account. We’ll be happy to help!

Thanks,

Bhavana

Excellent post! It’s needed article for Everyone. I really appreciate for your article, Investing in mutual funds it’s really helps.

Hii Vidya!

Its a needed article. But before investing in a long term plan like pension should I follow online aspects or should I go for agents for assitance?

Second doubt is you said in long term plans there is no risk. Can you please explain how?

Thanks

Hello Sir, I suppose you simply mean long-term mutual fund investments (and not pension plans of insurance). Whether you should do it yourself or get an advisor would depend on your own awareness and knowledge of the product. With online platform like ours, you can use the seamless, hassle free facility to invest yourself, or pick one of our researched pre-packaged portfolios or also talk to our advisors and get your own customised portfolio. thanks, Vidya

Retirement Calculator

Rising cost of living can play havoc in your golden years. Get yourself an estimate of how much wealth you need to build to ensure you have smooth cash flows to meet your post-retirement needs.

This retirement calculator will tell you how much you need to save to build a sum that will adequately meet your monthly expenses post retirement.

” * ” – Mandatory fields

* Current monthly expenses (Rs.):

* Current age:

* Retirement age:

* Expected life span:

Current value of existing investments (Rs.):

30000000

* Expected inflation:

* Post-retirement investment return:

* Expected return on investment:

Calculate

Monthly savings required to build retirement corpus (Rs.):

-3,86,220

Period for which monthly income is needed (years):

20

Monthly requirement first year after retirement (Rs.):

63,754

Total amount needed to generate monthly income that grows with inflation (Rs.):

1,25,11,763

Less: future value of existing investment (Rs.):

7,42,78,895

Corpus that needs to be built (Rs.):

-6,17,67,132

Period available to build retirement corpus (years):

8

Disclaimer:

the above Investment is ok for my retirement.

thanks Vidya. I am investing 12% compulsory PF deduction as per law. Additionally I am investing Rs.20000 yearly in my PPF a.c. My daughter is in 7th std and keeping 5 year margin for her college admission, I am investing Rs.40th in monthly SIP and the details are as follows Equity Fund (25 thousand) ICICI focussed bluechip ( 10000 ) , UTI Opportunities (Rs.10000) , ICICI Export & other services (Rs.5000) . Debt Fund (Rs.15 thousand) Birla Short Term Fund(Rs.4000) , SBI Magnum Income Fund FR Savings Plus Bond(Rs.6000) , ICICI regular saving (Rs.5000).

I am aware of the volatile market and therefore keeping next 5-6 year margin, Pl. suggest 1. if my fund selection is Ok and 2. if my portfolio is diversified.

Hello Ashfaque, Kindly route fund specific/portfolio queries through your FundsIndia account using ‘Ask Advisor’ feature. I am constrained from replying to such specific questions over blog. thanks.

Hello Vidya, – A well-written article, loaded with lessons in every word. It is high time Indians started looking at equity investment as a powerful tool for long-term wealth creation. As you have rightly recorded, spicing up the retirement investment portfolio, even with a small equity component will work wonders. Let’s hope and pray that Indians turn to equity to reap long term returns, which would indirectly fuel our country’s economic growth. Please continue to enlighten us with such useful and relevant articles.

Thank you

For salaried staff, there is compulsory deduction of 12% PF contribution. Employer also contribute the similar amount i.e. 12%. Now there is option of VPF contribution wherein employees can authorise his employer to deduct PF contribution over & above 12%. People go for this method as they see compound growth. My issue is that to create wealth for my daughters education, should I continue with VPF deduction or exit and choose Equity mode. I am saving for my daughters education and the amount will be required after 5 years.

hello Ashfaque, EPF/VPF are good savings mode but whether you want to invest in equity funds would depend on your time frame and risk appetite. If you are not too worried about near term ups and downs in the market, then 5 years is a good time period to invest some amount in equities to beat inflation. Otherwise, given the rising cost of education, traditional savings such as PF and deposit may not be enough to meet higher costs. If you need help with regard to investing in equity funds through our online platform, do contact our support(mentioned in our website). thanks.

Excellent post! It’s needed article for Everyone. I really appreciate for your article, Investing in mutual funds it’s really helps.

where to invest the corpus at the retiring age? and do swp.

Hello Prema, Short-term debt funds can be ideal grounds to shift money closer to retirement and then do an SWP later. thanks, Vidya

Thanks Vidya..it was helpful..the other calculators are also very useful

Hi this is Vishal, I would like to invest in mutual fund direct plan which kind of funds should be in my portfolio

My details are given below

Age 25

Investment period: 29Yrs

Investment amount 5K per month

Pls suggest me some fund

Hi Vishal,

We won’t be able to provide portfolio-specific advice on this forum. If you would like fund and investment advice, you can set up a FundsIndia account. We’ll be happy to help!

Thanks,

Bhavana

Hi Vidya,

I am 28 yrs old and I do not have much idea about mutual funds. My monthly savings is Rs.9000 which I would like to invest for my retirement age. What are the best long term MF available in market considering the time frame of 10-15 Yrs. Also once I start MF do I need to constantly check the market updates?

Thanks,

Mani

Hello Manikanta,

Portfolio advice can be done through ‘advisor appointment’ if you have your FundsIndia account. it is a free feature for all our investors. If you do not have an account, I would urge you to activate it. it is free and will provide you will ongoing advisory and review services. thanks

Hi Vidya

Investing in mutual funds is fine, but how much to invest and how to calculate the amount i will require at the time of retirement?

my 2nd point is how much corpus is required, if i live for another 20-25 years after retirement.

Regards

Ritz

Hello,

Use out calculator to know what is the retirement corpus needed and how much you need to invest: http://www.fundsindia.com/content/jsp/calculators/MutulfundSipCalcAction.do?method=sipCalcHome#

thanks

Vidya

you have done it again Bala.A good article that will open the eyes who can see and hear .

Hi Vidya,

It is a very useful topic for working professionals with regular income who are planning for retirement. I am definetly inspired to plan systematically for retirement(till now it was only EPF and PPF). However i have a basic doubt about mutual funds, How do a debt fund gives you negetive return when they would primerly invest in debt instruments Eg: IDFC Dynamic Bond Fund – Regular Plan (G) has given negative return in past 6 months(-3.5%, source: money control)

Hello Arvind,

Debt instruments are also traded in the market. Hence when their price moves down (price move down when yields move up and vice versa) debt funds can fall. But such price movement is sharp only in long-term debt instruments like gilt funds or funds that have high exposure to long-term gilt. But, when yields move up, the prospects for such instruments also go up although there is near-term fall. When rates fall, typically these instruments have a high price rally. Hence, the fall is more temporary and marked to market. Therefore income/dynamic bond funds require a long-term time frame of at least 3 years. You will see that short and ultra short debt funds will not be as volatile. Hence, with debt funds, investors need to choose the right fund based on their time frame. If one chooses an income or gilt fund with a 6-month time frame in a rising interest rate scenario then chances of negative return cannot be ruled out. thanks, Vidya

Hi Vidya

I have been reading your articles in Business Line and Fundindia.com for quite sometime. They are really informative and thougprovoking. The above article is a standing example. keep going!!!!!!!!!

Thanks Srihari, for the encouragement! 🙂 vidya